The Future of Startup Funding: Trends to Watch

As we navigate the ever-evolving landscape of startup funding, several trends are emerging that potential entrepreneurs and investors should closely monitor. One significant trend is the increasing use of alternative funding sources such as crowdfunding platforms and peer-to-peer lending. These avenues provide startups with diverse options beyond traditional venture capitalists and angel investors. In addition, with the rise of digital currencies and blockchain technologies, Initial Coin Offerings (ICOs) have become a viable financing option for tech startups. These ICOs allow companies to bypass traditional fundraising mechanisms and engage with their audience directly. Moreover, a noteworthy trend involves the rise of impact investing, where investors seek not only financial returns but also social and environmental impacts. This shift in priorities is indeed transforming how startups pitch their ideas. Furthermore, we are witnessing a significant increase in corporate venture capital, as established companies recognize the value in investing in startups that align with their strategic objectives. Given these dynamics, today’s entrepreneurs must stay informed and adapt their funding strategies accordingly.

Following the trends in funding sources, there is also a continued emphasis on sustainability in the startup ecosystem. Investors are increasingly considering environmental and social governance (ESG) factors when making decisions. This change is driven by the growing awareness of climate issues and the demand for responsible investments. Founders focusing on eco-friendly practices and sustainable business models often find it easier to attract investors who are committed to fostering positive societal changes. Another trend worth noting is the rise of micro-investing, which allows individuals to invest small amounts in startups, thus democratizing investment opportunities. Platforms such as SeedInvest and Wefunder create space for everyday investors to support companies. This newfound accessibility has the potential to reshape the startup landscape by providing vital capital. Moreover, traditional venture capital firms are increasingly evolving their approaches to deal sourcing, leveraging data analytics and artificial intelligence to identify promising investment opportunities and streamline their processes. Finally, the recent global pandemic has also shifted priorities in funding, leading to opportunities in telehealth, e-commerce, and remote technologies. Each of these trends presents unique challenges and advantages in the funding landscape.

Technology’s Role in Startup Funding

Technology continues to drive innovation in the funding landscape for startups, enhancing the efficiency and transparency of financing processes. Fintech companies are revolutionizing how startups access capital by simplifying lending requirements and cutting through bureaucratic red tape. For example, advancements in artificial intelligence are enabling lenders to evaluate creditworthiness through alternative data sources, making it easier for underrepresented entrepreneurs to receive funding. Additionally, blockchain technology is streamlining investment administration by ensuring secure transactions and real-time auditing. This innovation minimizes risks associated with fraud and increases investor confidence. Crowdfunding platforms are also leveraging technology to connect innovators directly with backers, leading to a more inclusive and participatory funding environment. Furthermore, the integration of smart contracts has the potential to automate agreement execution, ensuring parties fulfill their obligations efficiently. In a world increasingly powered by technology, startups that harness these advancements can optimize their funding strategies. As startups adapt to these changes, they are likely to gain a competitive advantage and foster innovative solutions in alignment with today’s digital-first environment.

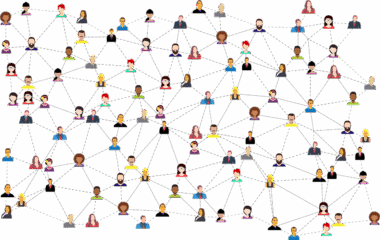

Amidst the technological transformations, the investor landscape is also evolving. Notably, there is a growing trend towards specialization, with venture capital firms focusing on specific industries, technologies, or stages of investments. This specialization enables investors to leverage their expertise, ultimately leading to better investment decisions and targeted support for startups. Additionally, we are witnessing a shift towards more collaborative investments, where multiple investors join forces to support a startup. This approach lowers individual risk and brings diverse expertise to the supported company. Moreover, angel networks and syndicates are gaining traction as they allow individual investors to pool resources and share insights when funding new ventures. As this landscape shifts, entrepreneurs who seek to secure funding can benefit from creating strategic partnerships while effectively communicating their value propositions. Lastly, companies seeking investment must be prepared to demonstrate strong traction, proven business models, and adaptability in the face of unforeseen challenges. In an increasingly competitive fundraising environment, displaying these qualities can be decisive in attracting potential backers.

Navigating Regulatory Landscapes

A crucial factor influencing startup funding is the regulatory environment that governs investment activities. Policymakers across the globe are acknowledging the need to adapt regulations to reflect the growing presence of technology in the fundraising ecosystem. For instance, many countries are reevaluating securities laws to accommodate emerging funding methods, such as equity crowdfunding and ICOs. These adjustments aim to mitigate risks for investors while allowing startups to benefit from innovative financial avenues. Furthermore, as more startups engage in cross-border funding activities, understanding international regulations becomes vital for founders. Non-compliance can lead to severe penalties or damaged reputations, hindering a startup’s growth. Consequently, entrepreneurs need to collaborate with legal professionals who possess expertise in securities laws and international finance. Additionally, growing focus on investor protection is shaping the regulatory landscape, leading to tighter regulations around disclosures and compliance. As the environment continues to evolve, staying informed and adapting to changes will be critical for startups seeking to attract and retain funding. The balance of regulation and innovation is essential for fostering a vibrant startup ecosystem.

In conclusion, the future of startup funding is witnessing a transformation marked by several compelling trends that entrepreneurs and investors cannot afford to ignore. From the rise of alternative financing sources and impact investing to technological advancements reshaping funding processes, the landscape is dynamic and full of opportunities. As startup founders navigate this changing environment, they must prioritize sustainable business practices and foster collaboration within their networks. Embracing specialization and adapting to regulations will provide startups with a competitive advantage. Investors, meanwhile, should recognize the value of engaging with diverse startups that align with their interests. By understanding the evolving landscape and its complexities, both entrepreneurs and investors can better position themselves for success. In an increasingly interconnected world, the funding trends that emerge in this era will indeed mold the future of entrepreneurship. As we progress into this new frontier, adaptability and proactivity will be crucial for all parties involved. Ultimately, the goal should be to create an ecosystem that fosters innovation and supports the growth of groundbreaking ideas while prioritizing sustainability and ethical responsibility.

Ultimately, as we look towards the future of startup funding, the trends emerging today will dictate the opportunities available tomorrow. By harnessing these opportunities and staying aware of the various developments, both startups and investors can create a synergy that fuels entrepreneurial spirit and innovative thinking. Keeping a keen eye on industry shifts, technological advancements, and regulatory changes is fundamental. The real challenge lies in integrating these varying factors into cohesive strategies that maximize potential. Entrepreneurs must cultivate relationships with supportive investors and proactively engage with their communities to secure resources. By fostering a strong support network, startups can better weather market fluctuations and pursue ambitious goals. Meanwhile, investors should stand ready to adapt their strategies, leveraging their expertise to support promising startups while remaining mindful of emerging risks. In summary, the future of startup funding presents a landscape rich with potential; capitalizing on it requires a forward-thinking approach from both ends. As this era unfolds, the ability to navigate these changes wisely will dramatically impact the success of new ventures and investments alike.

A brighter future awaits startups when they are attuned to the ongoing evolution of funding trends. Collaboration among stakeholders, open communication, and innovative thinking will define success in this space. As economic landscapes continue to change, fostering resilience in startup ecosystems will be crucial. With the rapid pace of change in technology and investor expectations, startups should prioritize adaptability. Opportunities abound for those willing to embrace new methods of funding and collaboration. The positive impacts of these shifts can yield lasting benefits for both startups and the investors who champion them. Now is the time for entrepreneurs to forge their paths by leveraging new insights and partnerships to achieve sustainable growth. Engaging with the latest trends and understanding the dynamics of funding sources will equip startups for future success. Investor confidence will be bolstered when startups reflect potential for scalability and sound business practices. Moving forward, the entrepreneurial landscape can thrive through synergies that prioritize innovation alongside sustainability. This commitment not only sets the stage for financial success but also contributes meaningfully to society’s broader goals.