Behavioral Economics vs. Traditional Finance: Key Differences

Behavioral economics and traditional finance represent two distinct approaches to understanding financial markets. Traditional finance operates on the assumption that investors act rationally, seeking to maximize utility and make decisions based purely on available information. This perspective relies heavily on models that incorporate mathematical formulas and statistical methods to forecast price movements. Traditional finance upholds that any anomalies in market behavior can be explained by fundamental analysis, which is strictly rational in its framework. This has led to established practices like efficient market hypothesis, which posits that assets are always fairly priced based on known information. Behavioral economics, on the other hand, introduces psychological factors that influence investors’ decisions, often irrationally. It explores how emotions, cognitive biases, and social influences can lead to systematic deviations from the predictions made by traditional finance models. Behavioral failures such as overconfidence or fear can distort market behavior, leading to phenomena like bubbles and crashes. To comprehend the complexities of the financial world, understanding these differences offers a deeper insight into how psychological and emotional factors affect investment choices.

Core Concepts of Traditional Finance

Traditional finance is grounded in core principles and theories that revolve around rational decision-making and efficient markets. Central to this school of thought is the efficient market hypothesis, which asserts that all relevant information is available to investors, thus making it impossible to consistently achieve higher returns than the overall market. This means that stock prices reflect all known information, leaving little room for mispricing. Financial theorists emphasize the importance of risk-return trade-offs, advocating that investors should only expect higher returns from investments that come with higher risks. Key models such as the Capital Asset Pricing Model (CAPM) highlight this relationship, providing investors with a way to determine the expected return based on market risk. Additionally, traditional finance uses tools like diversification and asset allocation strategies to mitigate risk. Analysts often make decisions based on quantitative data and market trends, relying on structured methods to guide their strategies. In contrast, behavioral economics suggests that human emotions and biases can disrupt these rational processes, challenging the basic assumptions of traditional finance.

The exploration of market anomalies reveals significant intersections between behavioral finance and traditional finance. Anomalies such as the January effect, momentum trading, or the value effect demonstrate instances where market behavior contradicts traditional financial predictions. These discrepancies arise when investors exhibit irrational tendencies that traditional models fail to account for. Behavioral finance posits that cognitive biases, such as loss aversion or herd behavior, significantly influence how investors react to market information. Loss aversion, for example, explains why individuals might hold losing investments too long, or conversely, sell winning ones too soon. This behavior directly contradicts the rational investor model and its assumption that individuals consistently act to maximize profits without emotional interference. Additionally, the concept of overreacting or underreacting to market news challenges the efficient market hypothesis. While traditional finance seeks to normalize market behavior through structured analysis, behavioral finance delves into the psychological undercurrents that shape investment choices, ultimately suggesting that a more nuanced understanding of human behavior is crucial for more accurate financial modeling.

Psychological Factors at Play

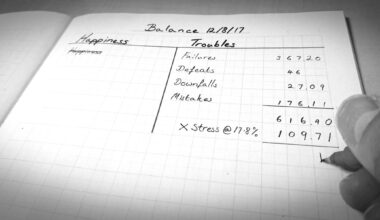

Behavioral finance emphasizes the significant role of psychological factors in influencing financial decisions. Investors are not solely driven by logical analysis; rather, psychological biases often govern their actions. One prominent factor is overconfidence, where individuals believe they can predict market movements accurately, leading them to take larger risks than justified. This can result in trading more frequently than optimal, often causing losses that would have been avoided with a more tempered approach. Another important bias is anchoring, where investors fixate on the initial information they receive, such as the purchase price of an asset, which then distorts their future decision-making. This can cause them to overlook new information that contradicts their initial beliefs. Furthermore, mental accounting refers to individuals categorizing their money in irrational ways, leading to poor financial decisions that disregard overall wealth. Behavioral finance aims to identify these psychological patterns and improve investor sentiment, reminding them that emotions deeply influence choices. By acknowledging these biases, investors might mitigate their adverse effects and achieve better outcomes in their financial strategies.

In contrast, traditional finance’s reliance on mathematical models can sometimes overlook critical behavioral insights that affect market dynamics. While traditional models focus purely on numbers and quantitative data, they may miss the subtleties of human behavior. Consequently, understanding when traditional theories might falter becomes essential for investors and analysts alike. Some investors who strictly adhere to these models may face challenges, especially during turbulent market conditions when behavioral factors play a larger role. The rigid frameworks of traditional finance can potentially lead to blind spots, yielding discrepancies in asset valuations. For instance, during financial crises, cognitive biases can exacerbate panic and irrational decisions, further distancing actual market behavior from theoretical models. This highlights the need for a hybrid approach, integrating both behavioral finance insights with traditional methods. Acknowledging psychological factors alongside traditional finance can lead to more holistic investment strategies that account for human emotion and behavior. Enhanced decision-making can result from a comprehensive understanding of both irrational biases and rational analysis in financial markets.

Applications in Real Life

Both behavioral economics and traditional finance have valuable applications in the real world. Understanding the strengths and weaknesses of each approach can provide investors with a more robust framework for decision-making. Financial advisors increasingly incorporate behavioral insights into their practice, guiding clients to recognize cognitive biases that may impact their investing behavior. By doing so, clients can become more aware and conscious of their decisions, leading to better long-term investment choices. Financial education programs often emphasize the importance of recognizing Emotional triggers, improving investors’ ability to manage their responses during market fluctuations. Moreover, businesses have begun employing behavioral finance principles in marketing strategies to predict consumer behavior effectively. Companies utilize insights from behavioral economics to fine-tune their pricing strategies and product offerings to align with human psychology. By adjusting marketing efforts based on an understanding of consumer behavior, businesses can boost sales and build stronger customer relationships. Ultimately, the integration of both approaches can empower investors and businesses to act more prudently and strategically in a constantly evolving financial landscape.

Future research in both behavioral finance and traditional finance will undoubtedly continue to shape our understanding of how markets operate. As technology and data analysis techniques evolve, opportunities to merge these two fields increase substantially. Comprehensive studies into investor behavior will unveil deeper insights, guiding practices and policies within the finance industry. The development of behavioral finance reflects an ongoing evolution in recognizing the importance of human emotions and cognition in investment practices. More professionals in the investment world are seeking to enhance their skills by embracing behavioral understanding during day-to-day operations. Likewise, organizations are enhancing their predictive analytics, aiming to better forecast market trends with the integration of behavioral insights. Investors can benefit from expecting fluctuations in emotions and biases within market behavior, ultimately leading to strategies that adapt to human irrationalities. Both schools of thought will play an essential role in supporting individuals and organizations towards sustainable growth and financial success. By harmonizing the quantitative focus of traditional finance with behavioral insights, stakeholders can foster a more comprehensive understanding of the markets.

In summary, the interplay between behavioral economics and traditional finance brings forth unique insights that can enhance our understanding of financial markets. Traditional finance bases its principles on rational decision-making, providing structured methodologies that guide investment strategies. However, the incorporation of behavioral finance reveals the complexities of human behavior, illustrating how psychological factors significantly influence market dynamics. Investors must recognize the vital distinctions between both approaches to navigate the financial landscape effectively. By appreciating the role of cognitive biases and emotional influences, individuals can make better financial decisions, ultimately leading to improved investment outcomes. As industries evolve, the relevance of integrating behavioral finance into traditional models cannot be overstated. This combination promotes a more nuanced approach that addresses both rational and emotional aspects of investing. The insights gained can serve investors in refining their strategies and mitigating risks connected with behavioral biases. Ultimately, embracing both perspectives equips financial professionals with the tools needed to adapt to market changes more efficiently. As we continue to examine and understand these dynamics, the prospects for more resilient and adaptive investment approaches grow brighter.