Emerging Risks in Global Commodity Supply Chains

The global commodity market has faced numerous challenges in recent years, often exposing emerging risks within its supply chains. As commodities are fundamental to economic structures worldwide, understanding these risks has become paramount. Factors like geopolitical tensions, climate change, and pandemics can disrupt supply lines, leading to volatility in availability and prices. For instance, when natural disasters occur, they can affect crop yields significantly. Thus, stakeholders must monitor trends closely to mitigate potential impacts. Investors and companies alike need to adopt adaptive strategies, facilitating resilience against unforeseen disruptions. Moreover, integrating technology into supply chain logistics can provide visibility, allowing for timely adjustments and better forecasting. Adopting a proactive approach toward these emerging risks not only protects financial interests but also ensures consistent product availability for consumers globally. Organizations must cultivate relationships with local suppliers to enhance operational flexibility. Ultimately, the prioritization of a robust risk management framework will significantly contribute to sustainability and continuity in global commodity supply chains.

The increasing complexity of global commodity supply chains further exacerbates risks faced by stakeholders. Globalization has interconnected economies to unprecedented levels, leading to heightened dependency on foreign markets. Disruptions in major producing countries can lead to cascading effects felt worldwide. For instance, recent global events have demonstrated how quickly commodity prices can react to political unrest in key regions. Investors and businesses must adapt to this interconnectedness by conducting thorough due diligence on supply sources. Supply chain mapping can help identify vulnerabilities and alternative supply routes. Similarly, implementing risk assessment frameworks allows for evaluating potential impacts of various scenarios. Collaboration among industry players is vital in building resilience against these risks. Sharing data and resources can foster greater transparency in the supply chain, ultimately reducing the likelihood of disruption. Additionally, diversification strategies such as utilizing local suppliers can diminish reliance on single points of failure. By embracing these strategies, stakeholders can safeguard their positions in the market while ensuring a stable supply of commodities. Global commodity markets demand a proactive approach to risk management, ensuring preparedness for unpredictable shifts.

Climate Change Impacts

Climate change constitutes one of the most pressing risks affecting commodity supply chains globally. Increasingly erratic weather patterns pose significant challenges for producers, especially in agriculture and energy sectors. Events such as droughts, floods, and other extreme weather conditions directly impact crop outputs and energy production capabilities. As these occurrences become more frequent, supply predictability diminishes, influencing pricing mechanisms across the market. Farmers must adapt their agricultural practices to mitigate climate-related impacts. Similarly, energy producers have started investing in renewable technologies targeting sustainability. The rise of sustainable sourcing reflects the industry’s response to these climate challenges. Demand for eco-friendly commodities continues to grow, driving innovation and adaptations in the supply chain. Companies committed to sustainability can build brand loyalty, often attracting conscious consumers, contributing to overall market stability. Consequently, utilizing alternative empowerment strategies such as vertical integration or localized production can increase resilience against climate impacts. Addressing and adapting to climate change risks will increase not only market viability but also enhance global responsibility in commodity production and consumption.

Logistics and transportation issues also present emerging risks in global commodity supply chains. Commodities require efficient logistics management to transport goods from producers to consumers. However, supply chain disruptions, whether due to regulatory changes, infrastructure damage, or unforeseen events, can severely impact delivery timelines and costs. The COVID-19 pandemic highlighted vulnerabilities within this system, prompting businesses to reevaluate transportation strategies. Investing in technology solutions such as real-time tracking systems enables stakeholders to monitor shipments accurately. Moreover, enhancing logistical infrastructure by optimizing routes can significantly improve delivery efficiency. Collaborations between private and public sectors can further bolster transportation frameworks, ensuring a seamless flow of commodities. On the other hand, high fuel prices and labor shortages are influential factors in inflating operating costs. Thus, stakeholders must prepare for fluctuating market conditions by implementing cost-effective measures. Embracing innovation and logistics technologies is key to ensuring the stability of global commodity markets. Therefore, addressing transportation challenges in the supply chain fosters greater resilience and efficiency amidst a dynamically changing landscape.

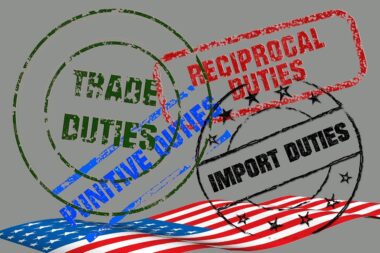

Geopolitical Risks

Geopolitical tensions have profound implications on global commodity markets. Conflicts, sanctions, and political instabilities can lead to drastic fluctuations in commodity prices. For example, oil-producing regions are often affected by unstable political climates, causing disruptions to supply chains and impacting the market globally. High-reliance on specific regions for key commodities raises significant concerns among stakeholders. Implementing geopolitical risk assessments allows businesses to identify potential disruptions and adjust strategies accordingly. By diversifying supply sources across multiple regions, companies can build resilience. Additionally, fostering diplomatic relations can help mitigate risks associated with geopolitical conflicts, assuring stability in commodity availability. Trade agreements also play a vital role, as they can lower tariffs and bolster trade flows between countries. Ultimately, stakeholders must remain vigilant and proactive in their approach to geopolitical risks. Monitoring developments and maintaining flexibility in operations will enable businesses to navigate complex commodity markets successfully. A thorough understanding of geopolitical dynamics provides a competitive edge, safeguarding interests amid turbulence and uncertainty in the global landscape.

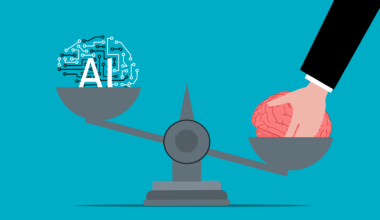

Technological advancements are rapidly reshaping the landscape of global commodity supply chains, introducing both opportunities and new risks. Automation, machine learning, and artificial intelligence have streamlined processes, facilitating enhanced productivity and efficiency. However, reliance on technology also presents cybersecurity threats. Compromised data can lead to significant financial losses and disrupt supply chains. Therefore, investment in robust cybersecurity measures is critical for protecting sensitive information and maintaining operational continuity. Organizations must prioritize training staff on cybersecurity best practices and routinely audit their systems for vulnerabilities. Furthermore, embracing blockchain technology can enhance transparency and traceability within supply chains. By providing a secure and immutable ledger, blockchain mitigates the risk of fraud while improving accountability. Moreover, continuous innovation fosters adaptability in response to rapidly changing market conditions. Companies exploring technological integration should also assess the potential environmental impacts to ensure sustainability across operations. Balancing technological advancements with comprehensive risk management strategies is essential. By doing so, stakeholders can harness innovation while safeguarding against emerging risks, fostering a resilient and robust commodity supply chain.

Future Considerations

Looking ahead, addressing emerging risks in global commodity supply chains requires collaboration, innovation, and adaptability. Stakeholders must engage in active dialogue within the industry to share best practices and solutions. Developing adaptive strategies that consider robust risk management frameworks can enhance resilience against unpredictable market dynamics. Employing diversified sourcing strategies can help buffer against supply disruptions. For instance, companies seeking clarity in their supply chains should prioritize sustainability while remaining abreast of changing consumer demands. Furthermore, aligning with technological advancements and sustainability goals will optimize operations while minimizing risks. Engaging with local commodities and fostering relationships can ensure steady supply lines. Both public and private sectors must commit to strengthening their logistical frameworks to support smooth commodity flow throughout trade routes. Greater emphasis on education regarding geopolitical, environmental, and technological risks will prepare businesses for future challenges. Ultimately, building a resilient global commodity market hinges on understanding these emerging risks and proactively addressing them while positioning organizations favorably against uncertainty in the global economy.

Collectively, understanding and addressing emerging risks is essential for sustainability and profitability in global commodity supply chains. As the landscape evolves, stakeholders must remain agile and proactive to thrive in the face of uncertainty.