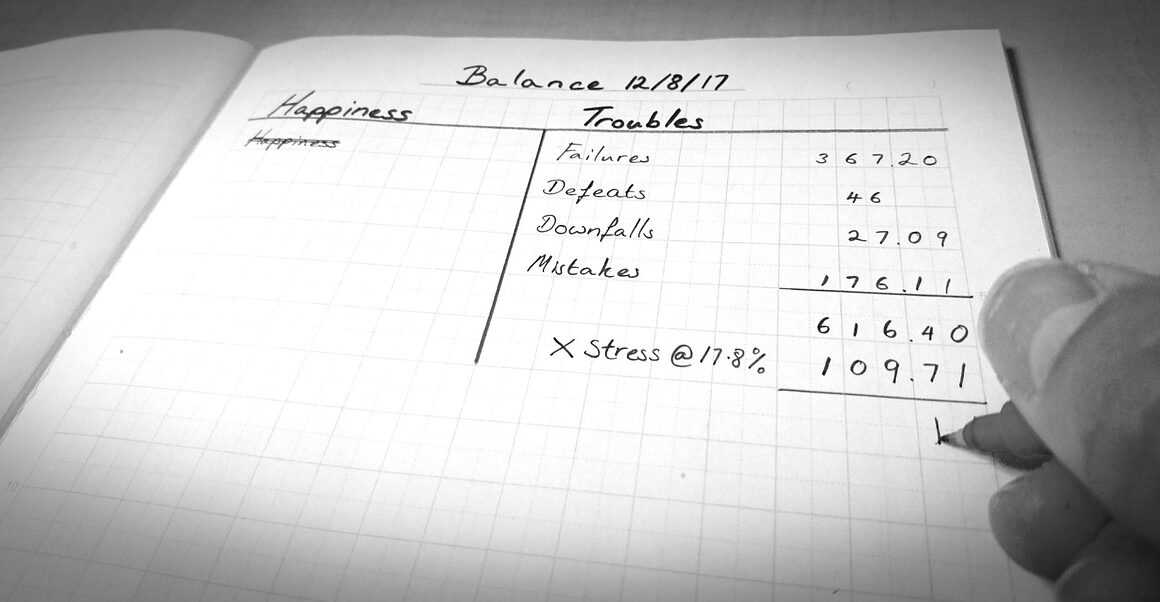

Understanding Tangible vs Intangible Assets on the Balance Sheet

Tangible and intangible assets play critical roles in accounting and financial reporting. Tangible assets can be physically touched, such as machinery, buildings, and equipment. Investing in tangible assets often reflects a company’s physical presence in its market. Hence, understanding their valuation is essential for financial analysts. Conversely, intangible assets include non-physical things like patents, copyrights, and goodwill. These assets can be more challenging to appraise because their value is often derived from future economic benefits rather than a current market price. As a result, navigating this difference is crucial for accurate balance sheet representation. The distinctions between these two types of assets influence both decision-making and regulatory compliance. Businesses must recognize the importance of each category in maintaining a balanced financial outlook. Since tangible assets depreciate over time, tracking their value is vital for accurate reporting. Yet, intangible assets may appreciate, adding a layer of complexity to the balance sheet. Therefore, understanding how to report and manage both assets is paramount for a business’s long-term financial health.

Tangible assets are characterized by their physical existence and are often easily quantifiable on a company’s balance sheet. An understanding of these assets is vital for various stakeholders, as they are often seen as a form of collateral against loans and other financial obligations. For example, real estate and equipment are examples of tangible assets that can contribute to a company’s ability to generate revenue. Their depreciation over time must be adequately monitored, as it directly affects the overall value of the assets. The straight-line method is often applied to calculate depreciation, providing a systematic approach to reduce asset value over time while maintaining transparency. Meanwhile, intangible assets, though lacking physical presence, can significantly enhance a company’s competitive advantage. Intellectual property rights or brand recognition, for instance, can augment market value. Thus, accurate assessment for these non-physical assets is equally important. Companies often need to prioritize strategies to protect their intangible assets. Conducting regular assessments allows businesses to gauge their management effectiveness, ensuring both tangible and intangible assets contribute optimally to their financial strategies.

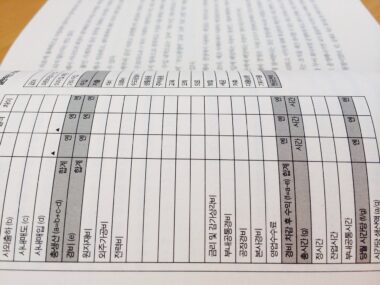

The Importance of Asset Classification

Maintaining distinct classifications for tangible and intangible assets on the balance sheet fosters transparency and enhances financial analysis. This classification provides stakeholders, including investors and creditors, with clarity regarding the financial health of an organization. Moreover, segmenting these assets assists in evaluating performance metrics, thus supporting informed decision-making. In addition, the classification aids compliance with financial reporting standards, ensuring that companies adhere to regulatory requirements. Understanding the distinction is paramount when conducting audits or reviews. Accountants can ascertain the reliability of financial data significantly through asset classification. Furthermore, investors often analyze balance sheets to determine the risk associated with assets. Tangible assets provide a degree of safety, particularly during economic downturns, as they are less volatile. In contrast, intangible assets may be subject to fluctuations in market dynamics, thereby requiring diligent risk assessment. Much depends on how these assets are managed. Effective management strategies extending over both asset types can significantly enhance profitability and ensure sustainable growth. Therefore, diligent classification practices are central to comprehensive financial reporting.

Valuation methods for tangible and intangible assets vary considerably, reflecting the distinct nature of these asset types. For tangible assets, principles such as cost approach and market approach are prevalent. The cost approach determines asset value based on the expenses incurred in asset creation or acquisition—an essential method particularly relevant for physical goods like machinery. On the other hand, the market approach assesses value through comparable sales, which helps in determining fair market prices. Conversely, for intangible assets, future income potential often dictates valuation. The income approach estimates value based on projected revenues attributable to the asset. However, challenges arise due to volatility in markets and shifting consumer behaviour patterns affecting those projections. Thus, accurate forecasting becomes essential. Furthermore, the lack of a standardized valuation method complicates how intangible assets appear on balance sheets, thereby leading to potential discrepancies in asset representations. To mitigate these issues, regular re-evaluation and consistency in reporting practices are crucial. By continuously assessing these asset valuations, companies can maintain financial accuracy and transparency.

The Role of Amortization and Depreciation

In managing tangible assets, depreciation plays a pivotal role in measuring both financial performance and asset value over time. Depreciation helps allocate the cost of a tangible asset over its useful life, providing an accurate picture of financial standing on balance sheets. Generally accepted accounting principles (GAAP) offer guidelines, including methods like straight-line or declining balance. Companies employ these strategies to reflect the gradual wear and tear on physical assets such as vehicles and machinery. Accurate depreciation reporting assists in portraying a company’s profitability during financial assessments. Conversely, for intangible assets, amortization serves a very similar function. It recognizes the consumable nature of these non-physical assets over time. Amortization generally follows the straight-line method, where costs are evenly allocated for the specific useful life of an intangible asset, such as a patent. Understanding these processes is crucial for stakeholders globally, as they can influence corporate decision-making and investment strategies significantly. Consequently, balancing both amortization and depreciation strategies is essential for providing integrity to the financial reporting framework.

Valuing both tangible and intangible assets has substantial implications for business operations. Investors and financial analysts closely scrutinize these values to inform their decisions and assess risk. Tangible assets are often seen as more straightforward due to their physical nature, which lends a certain reliability. In contrast, intangible assets can add unpredictability, influenced by factors like innovation, market shifts, and consumer trends. Companies must navigate these complexities as they strive to maintain balanced reports on their balance sheets. In practice, the management of intangible assets is increasingly becoming a strategic priority. Many firms invest in robust intellectual property portfolios, as strong intangible assets can lead to competitive advantages. Furthermore, successful marketing strategies also enhance brand value—a key intangible asset. An organization recognizing the importance of both asset types is better positioned to drive sustainable growth. Effective management ensures that both tangible assets are adequately protected and that intangible assets are leveraged effectively. Hence, financial practices must emphasize the importance of both tangible and intangible asset management for a comprehensive approach to business success.

Conclusion: The Bigger Picture

In concluding the examination of tangible versus intangible assets, it becomes evident that both categories play essential roles in a company’s financial landscape. Each type contributes uniquely to the overall strength and viability of business operations. Tangible assets offer stability and security, ensuring lenders and investors feel comfortable regarding capital allocation. Meanwhile, intangible assets, though more elusive, can drive innovation and enhance valuation, creating competitive edges in the market. Managing both categorically requires nuanced strategies that encompass accurate valuation, effective reporting, and prudent operational practices. Given the evolving business environment, companies must constantly re-evaluate their asset management strategies. Firms with a well-rounded approach to understanding their asset composition are more likely to thrive amidst fluctuating economic conditions. Thus, recognizing the value of both tangible and intangible assets is imperative for strategic planning and financial foresight. Companies that succeed in measuring the comprehensive worth of their assets are equipped to make informed decisions. Embracing both sides of the balance sheet provides a solid foundation for sustainable growth, effectively blending short-term profitability with long-term vision.

As we close this discussion regarding tangible and intangible assets, integrating these aspects yields valuable insights into the balance sheet’s significance. Companies should focus on leveraging both asset types to establish a robust financial position. A deep understanding enables effective resource management, supporting informed financial choices that directly contribute to organizational success. Monitoring both tangible and intangible assets assists in delineating strategies that align with long-term objectives while ensuring compliance with relevant regulations. Furthermore, businesses can cultivate resilience by prioritizing continual assessments and establishing fluid asset management systems. By embracing dynamic evaluation practices, companies can adapt to market shifts more effectively. Additionally, stakeholder engagement is crucial in navigating the complexities of asset valuation. Regular communication will enhance understanding while refining investments based on the assessed value. This multifaceted approach will bolster a company’s overall financial health, allowing rapid adaptation to changing conditions. Tangible assets will provide a secure foundation, while intangible assets can unlock new avenues for growth. Emphasizing holistic asset management strategies creates aligned priorities across teams, fostering continuous improvement and sustained success. As such, the balance sheet does more than list assets; it reinforces a company’s economic narrative.