Using Supply Chain Finance Software to Enhance Financial Visibility

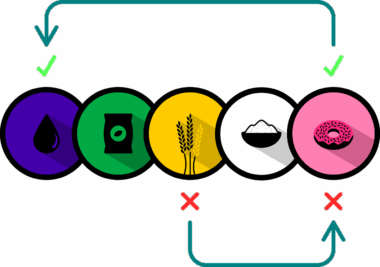

In today’s fast-paced business environment, supply chain finance software solutions are increasingly seen as vital tools for enhancing financial visibility. Such tools streamline the movement of goods and capital, creating seamless interactions between various supply chain partners. By integrating these software systems, organizations can gain real-time insights into payment processes and cash flows. These insights empower businesses to manage working capital more effectively, reducing costs and increasing operational efficiency.

One of the most significant benefits of supply chain finance software is its ability to facilitate better forecasting. Official quotes from experts indicate that improved data analytics can lead to substantial increases in accuracy when predicting cash flows. When businesses are armed with precise forecasting data, they can make informed decisions regarding inventory management and procurement. Consequently, visibility is enhanced not just for internal teams but also for external partners, leading to stronger collaboration. Overall, these solutions contribute to a transparent financial ecosystem.

Moreover, the platform provides a space for all stakeholders to access financial information easily. This accessibility helps mitigate disputes over payments and delivery, which can be crucial in maintaining strong business relationships. Furthermore, by automating many of the administrative tasks associated with invoice management, supply chain finance software allows the finance team to focus on more strategic initiatives. Thus, the organization benefits from elevated efficiency and can also foster innovation within its processes.

Improved Cash Flow Management

Effective cash flow management is another area where supply chain finance software excels. It enables businesses to optimize their working capital by ensuring that finance flows seamlessly across the supply chain. By using advanced algorithms, these systems help organizations identify bottlenecks and inefficiencies in cash cycles. Through real-time tracking and reporting, companies can respond promptly to changes, thus enhancing their financial planning and risk management strategies. This increased agility can help mitigate risks associated with late payments and other uncertainties in supply dynamics.

In addition, integrating supply chain finance software improves credit management by providing lenders with accurate information to assess risks associated with different partners. Accurate risk assessment allows for tailored financing solutions that fit the unique requirements of each relationship. Such collaboration becomes key as firms negotiate better terms based on their financial credibility, which is enhanced through transparency offered by the software. With a more reliable financing framework, companies can also afford to be more competitive in their market.

Furthermore, these technology-driven solutions promote sustainability within the supply chain. By offering insights that highlight the efficiency of capital use, organizations can identify areas for improvement that can reduce waste. Notably, sustainable finance positions companies as socially responsible entities, which can enhance brand equity. Stakeholders increasingly expect businesses to operate ethically, and leveraging supply chain finance software can help fulfill these expectations economically.

Challenges and Considerations

Despite the many advantages, the implementation of supply chain finance software comes with challenges that businesses must consider. One primary concern is data security due to the sensitive nature of financial information exchanged between partners. Organizations need to ensure robust security protocols are in place to protect their data. Additionally, employee training is critical since the technology may be complex. Investing in proper training will enhance user adoption and ensure that the software’s benefits are maximized.

In conclusion, supply chain finance software solutions are indispensable tools for enhancing financial visibility in modern business operations. They enable improved cash flow management, better forecasting, and encourage sustainable practices throughout the supply chain. However, companies must also be vigilant regarding data security and invest in staff training to fully leverage these solutions. As financial landscapes continue to evolve, businesses that adopt effective supply chain finance solutions will likely find themselves at a distinct competitive advantage moving forward.