Digital Payment Marketplace Growth in Asia-Pacific Region

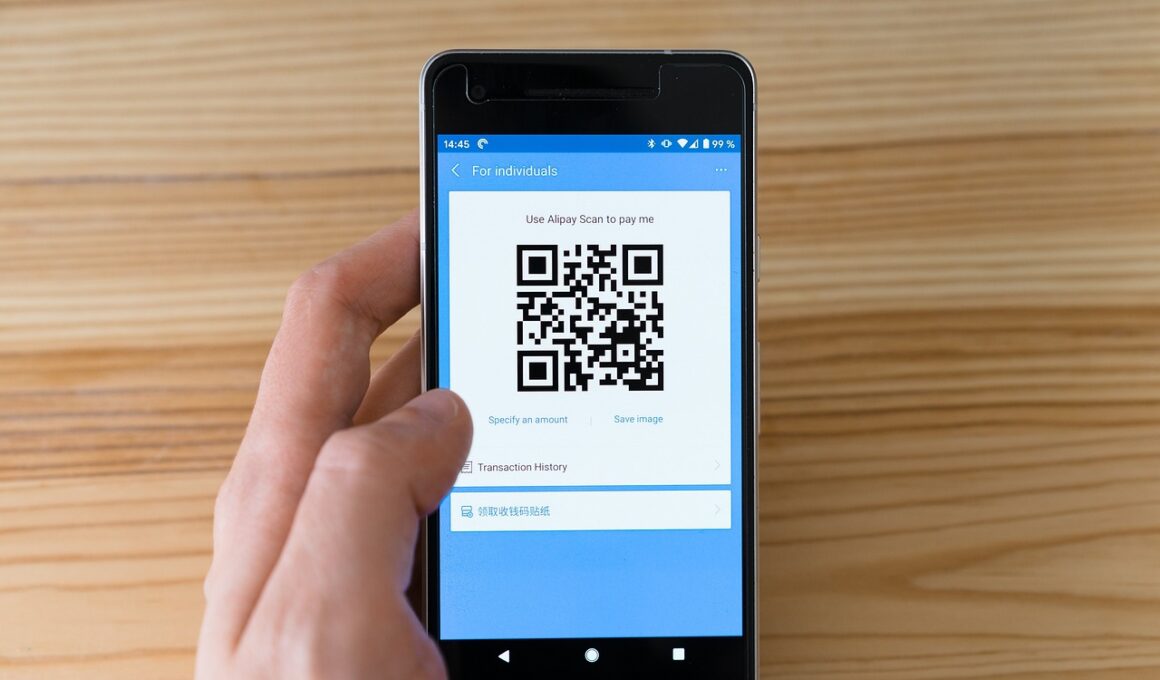

The Asia-Pacific region is witnessing remarkable growth in the digital payment marketplace, driven by increased smartphone penetration and consumer acceptance. The landscape is quickly changing, influenced by both regional innovations and global trends. Payment methods like mobile wallets and contactless technologies are surging in popularity, as financial institutions and fintech companies adapt to meet consumer needs. The rise of e-commerce coupled with the demand for seamless transactions is inspiring new payment solutions. Factors such as rapid urbanization and a young population are proving beneficial. Moreover, the pandemic accelerated the shift to digital payments, prompting businesses to adopt these solutions for survival. Disruptive technologies, including blockchain and artificial intelligence, are enhancing security and efficiency. The region also shows diversity in payment preferences, varying by country, suggesting localized strategies are essential. Organizations need to remain agile, as competition intensifies. As digital payment technology evolves, it lowers barriers, increases accessibility, and encourages financial inclusion. Global partnerships and technological alliances are increasingly vital, ensuring players can build strong ecosystems that promote innovation, choice, and customer-centric solutions. The future, driven by continuous advancements, promises unprecedented growth.

As the digital payment landscape in Asia-Pacific expands, various challenges lie ahead. Consumer trust remains a significant barrier; many users are apprehensive about the safety and security of online transactions. Fraud and cyber threats continue to evolve, heightening concerns among users about sharing personal information. To counteract these issues, companies are investing in cutting-edge security measures including biometrics and encryption. Striking a balance between convenience and security is paramount for encouraging wider adoption. Moreover, regulatory frameworks across the diverse markets in the region can create complexities for businesses. Companies are tasked with navigating these regulations, ensuring compliance while remaining competitive. This adds layers of complexity when developing integrated payment solutions. Additionally, infrastructure disparities among countries create uneven playing fields. Regions with better digital infrastructure tend to experience accelerated growth, whereas underdeveloped areas lag behind. Despite these challenges, the increased focus on financial inclusion can turn obstacles into opportunities. Consumers demand choices that cater to different needs and preferences. Many start-ups are sprouting in response to this demand, with innovative solutions aimed at addressing gaps in the marketplace. In conclusion, addressing these challenges is crucial for sustainable growth.

The Role of Startups in the Digital Payment Ecosystem

Startups have emerged as vital players in the Asia-Pacific digital payment ecosystem, driving innovation and competition. Their agility allows them to respond quickly to changing consumer demands and market trends. Many have developed niche products catering to specific demographic groups, such as millennials or small businesses, enhancing the inclusiveness of digital payments. These startups often leverage technology to simplify financial transactions, making them more user-friendly and accessible. In addition, they empower underserved communities and populations, providing them with affordable payment solutions that can stimulate economic activities. Investment in these startups is growing, supported by venture capital and private equity funding, aiming to support their growth. Many traditional financial institutions are also collaborating with these innovative enterprises to integrate and enhance their service offerings. Furthermore, regional incubators and accelerators are fostering an environment for sustainable growth. Established businesses recognize the potential of partnering with startups to explore new avenues within the rapidly evolving landscape. Moreover, regulatory support in many countries encourages innovation, enabling startups to thrive. This vibrant ecosystem is expected to drive substantial improvements in the digital payment marketplace across the region.

Technological advancements play a crucial role in shaping the digital payment industry, with several key trends emerging across Asia-Pacific. The increasing use of artificial intelligence and machine learning is revolutionizing transaction processes, enhancing personalization, security, and efficiency. These technologies allow businesses to analyze consumer behavior and tailor payment experiences to meet specific needs. Additionally, blockchain technology is gaining traction for its ability to provide transparency and security in transactions. As trust remains a concern, blockchain offers a decentralized approach that appeals to consumers wary of conventional payment methods. Another significant trend is the rise of social commerce, where social media platforms integrate payment solutions into their ecosystems. This creates opportunities for businesses to reach consumers directly within social networks, streamlining the purchasing process. Moreover, augmented reality and virtual reality technologies are facilitating immersive shopping experiences that integrate seamless payment options. As these trends evolve, they not only enhance convenience for consumers but also create significant opportunities for businesses. Companies that adapt and innovate using these technologies will be well-positioned to succeed in the competitive digital payment marketplace.

Consumer Behavior and Preferences

Understanding consumer behavior is essential for businesses operating in the digital payment marketplace, as preferences shift rapidly across demographics. Research reveals that convenience is one of the primary drivers for consumers opting for digital payments. Users favor solutions that are fast and easy to navigate, eliminating unnecessary complexities. Moreover, there is a growing preference for payment methods that provide rewards and incentives, such as cash back or points systems. This trend encourages consumer loyalty and enhances the perceived value of using specific payment platforms. In addition to convenience and rewards, security continues to weigh heavily on user decisions. Consumers prioritize platforms that offer robust fraud protection and privacy measures, seeking reassurance that their data is secure. Regional cultural differences also influence preferences; for instance, some markets favor mobile wallets, while others lean towards card payments. Accessibility and ease in payment setup can dictate choice, as individuals seek streamlined solutions to integrate into their daily lives. Businesses must invest in understanding these dynamic behaviors to tailor their offerings and improve user experiences effectively. Fostering consumer trust and engagement is central to establishing a strong foothold in the competitive marketplace.

Partnerships and collaborations are increasingly vital for driving growth within the Asia-Pacific digital payments sector. Companies recognize the importance of working together to create ecosystems that enhance user experiences and provide complementary services. For example, fintech companies often team up with traditional banks to leverage their established customer bases while offering innovative digital payment solutions. This synergy not only accelerates the adoption of digital payments but also mitigates risks associated with regulatory compliance. Furthermore, partnerships with tech firms can lead to the development of advanced payment technologies, ensuring businesses remain competitive. Additionally, consumer goods companies are beginning to collaborate with payment providers to integrate their services, offering seamless transactions at points of sale. These collaborations enhance customer engagement and streamline the purchasing process, driving overall acceptance. As competition intensifies, organizations that embrace partnerships will be better positioned for success in this fast-paced industry landscape. Moreover, enhancing service offerings through partnerships can result in better customer insights, ultimately guiding businesses in tailoring their strategies. In summary, forming strategic alliances will be a pivotal factor in shaping the future of digital payments in the region.

The Future of Digital Payments in Asia-Pacific

Looking ahead, the future of the digital payment landscape in Asia-Pacific appears promising and dynamic, fueled by ongoing technological advancements and changing consumer preferences. Predictions indicate significant growth in mobile payments as the smartphone penetration continues to rise. Companies that invest in user-friendly applications and seamless payment solutions will likely thrive in this evolving marketplace. Moreover, the increasing focus on financial inclusion suggests that digital payment platforms will expand their reach, catering to underbanked populations, thereby opening new market opportunities. Sustainability is an emerging theme, as more users express interest in eco-friendly payment options. Businesses that adapt to these preferences by integrating green technologies may capture a more conscientious consumer base. Furthermore, the rise of decentralized finance (DeFi) could transform the landscape by offering alternatives to traditional financial systems, allowing users more control over their transactions and data. This shift towards greater autonomy is likely to appeal to younger consumers, pushing more businesses to adopt such innovations. Ultimately, continuous adaptation and commitment to understanding market dynamics will drive success in the ever-evolving digital payment ecosystem within the region.

In essence, the growth of the digital payment marketplace in the Asia-Pacific region is a multifaceted phenomenon characterized by rapid technology adoption, shifting consumer behaviors, and complex challenges. As the sector expands, innovation and collaboration will remain at its core. Businesses must navigate the evolving regulatory frameworks, ensure security, and cultivate consumer trust to succeed in this dynamic environment. The role of startups, technology advancements, and partnerships will be instrumental in shaping the future of digital payments. Organizations that embrace change and focus on customer-centric solutions will position themselves to harness significant growth opportunities. Continuous investment in research, development, and understanding market trends is imperative for staying ahead in this competitive landscape. Furthermore, the ongoing pursuit of financial inclusion and accessibility will guide strategies and product offerings in the coming years. Stakeholders must remain vigilant, proactive, and responsive to changing dynamics to drive sustainable growth. As the future unfolds, the Asia-Pacific digital payment marketplace promises to be a hotbed of innovation and opportunity, benefiting businesses and consumers alike. This narrative creates a vibrant landscape wherein digital payments can thrive.