API-Driven Innovation in Digital Payments

Digital payment methods are transforming the financial landscape, facilitating seamless transactions across various sectors. As constantly evolving technologies emerge, APIs (Application Programming Interfaces) play a crucial role in shaping the future of digital payment solutions. By enabling connectivity between different systems, APIs facilitate real-time payment processing, enhancing user experience in online transactions. Businesses that adopt API-driven solutions are better positioned to innovate and meet the growing demands of their customers. From managing subscriptions to supporting e-commerce platforms, APIs allow for customization and flexibility, providing a competitive edge. Furthermore, consumers now expect instant approval for transactions, secure processing, and comprehensive services that address their unique needs. Payment service providers and fintech companies are increasingly relying on APIs to simplify integration and deployment processes. In this dynamic environment, maintaining a focus on security, ease of use, and innovative features will help businesses navigate the complexities of the digital payment ecosystem while maximizing opportunities for growth. API-driven innovation opens up new avenues for revenue generation while minimizing friction in payment processing.

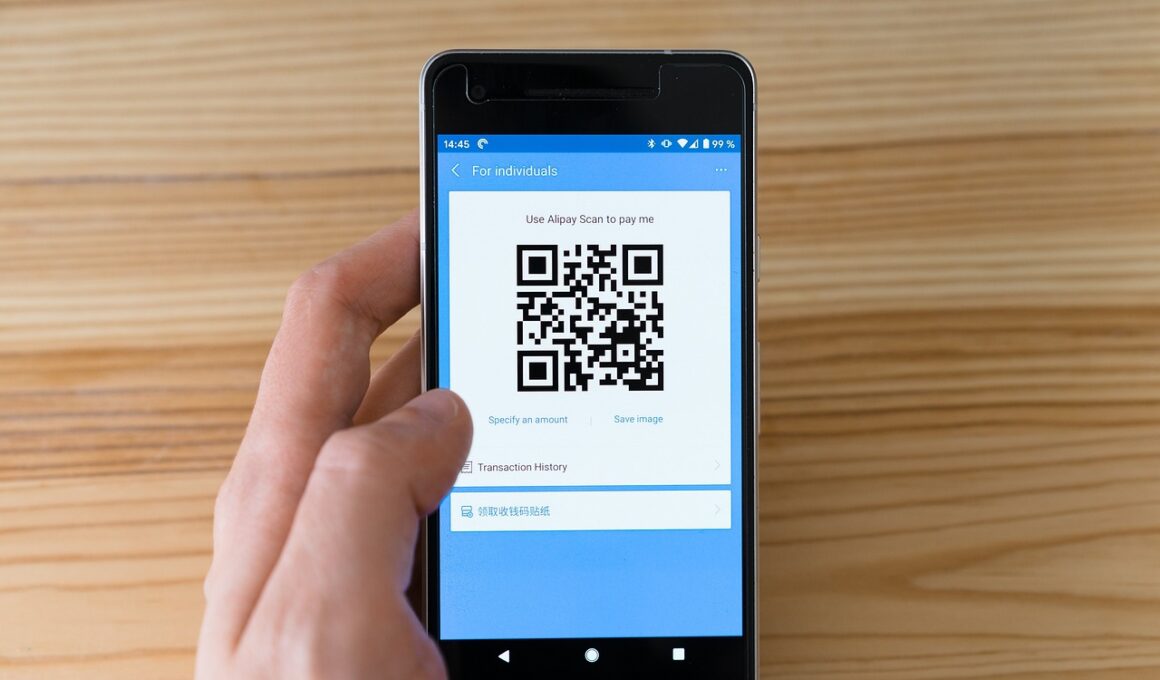

The rise of fintech has paved the way for innovative digital payment solutions driven by APIs. With numerous players in the market, competition has intensified, compelling businesses to adopt increasingly sophisticated payment APIs. These APIs provide essential functions, such as payment processing, fraud detection, and customer verification, all of which are integral to enhancing operational efficiency. Businesses can leverage the power of APIs to streamline their payment operations without requiring significant infrastructural changes. Moreover, APIs allow organizations to integrate new payment methods, such as digital wallets and cryptocurrencies, into their existing systems. This flexibility enables businesses to respond quickly to market trends and customer preferences. By utilizing APIs, merchants can also deliver personalized shopping experiences that cater to their consumers’ unique tastes. Consequently, data analytics integrated with payment APIs can drive more targeted marketing campaigns, enhancing customer loyalty. Fintech companies can facilitate partnerships with banks and payment providers to expand their reach and service offerings. In a saturated market, effectively utilizing APIs for digital payments helps companies stand out in their quest for continuous innovation and growth.

The Benefits of Digital Payment APIs

Integrating digital payment APIs presents numerous advantages for businesses looking to streamline their payment processes. One significant benefit is the enhanced security these APIs provide. Payment systems integrated with robust APIs can offer features such as tokenization and encryption, ensuring that sensitive customer information remains protected during transactions. This level of security builds consumer confidence, encouraging more users to embrace digital payments. Additionally, APIs facilitate faster payment processing, reducing the time it takes for funds to transfer between parties. Quick processing times significantly enhance the user experience, especially for e-commerce businesses that rely heavily on seamless transactions. API integration also allows for easier updates and maintenance, bringing new functionalities without requiring extensive system overhauls. By adopting these APIs, businesses remain agile and capable of navigating the ever-changing payment landscape effectively. Furthermore, the scalability of API-driven solutions enables companies to grow their payment infrastructure as they expand. Developing partnerships with payment service providers through API integration fosters innovation, enabling companies to remain competitive in a crowded marketplace.

Incorporating digital payment APIs simplifies the overall user experience when making transactions. Consumers today prioritize convenience; thus, it is crucial for businesses to offer multiple payment options. APIs enable seamless integration of various payment types, ensuring that customers can swiftly complete their purchases. This variety not only meets different consumer demands but enhances customer satisfaction and retention rates. Moreover, businesses leveraging APIs can offer innovative features such as one-click payments and secure recurring payments for subscriptions, which are essential in capturing consumer interest. An efficient digital payment system managed through APIs minimizes friction, allowing customers to focus on their shopping experience rather than worry about payment hassles. Additionally, digital wallets and contactless payments have gained traction, particularly amid the pandemic. As more businesses adapt to the rise of digital and mobile payments, leveraging APIs ensures they keep pace with consumer expectations. Ultimately, focusing on enhancing the user experience through digital payment options can significantly impact overall sales and customer loyalty, driving growth in the long term.

The Future of Digital Payment APIs

The landscape of digital payment APIs is continuously evolving, driven by technological advancements and changing consumer behaviors. Key trends shaping the future include the integration of artificial intelligence and machine learning capabilities into payment systems. These innovations enhance fraud detection measures and improve personalization, leading to tailored payment solutions for businesses and consumers alike. Additionally, as the Internet of Things (IoT) becomes increasingly prevalent, payment APIs will adapt to facilitate transactions through various interconnected devices. This evolution will enable seamless payment experiences, even in environments like smart homes and smart cities. APIs will also become more focused on streamlined compliance with regulatory frameworks concerning data protection, such as GDPR and PSD2. Service providers in the digital payments sector must prioritize transparent practices and data privacy to maintain consumer trust. Furthermore, the adoption of blockchain technology promises to revolutionize transaction speed and security, pushing digital payment APIs into new territories. As the digital payment landscape continues to expand, focusing on innovation and adaptability will be essential for all stakeholders in the ecosystem.

Collaboration between financial institutions and fintech companies will be paramount to driving innovation within the digital payment API space. Strategic partnerships allow both parties to leverage their strengths; banks bring credibility and established customer bases, while fintech firms offer agility and cutting-edge technological solutions. This collaboration fosters an environment where innovative payment solutions can flourish, leading to better services for consumers. Moreover, integrating APIs into traditional banking systems enables banks to remain relevant in a digital-first world. As money transfers and online payments are increasingly done through mobile devices, banks must adapt to meet consumer expectations. Furthermore, shared knowledge and resources between these entities will spur significant advancements in technology that enhance payment security. Collaborative efforts can focus on creating universally accepted standards that make digital transactions safer worldwide. Simplifying interoperability among systems ensures a smooth customer experience, regardless of the user’s chosen platform. Such partnerships will significantly impact not only the efficiency of digital payments but also their acceptance and growth on a global scale.

Conclusion

API-driven innovation in digital payments presents limitless opportunities for businesses and consumers alike. By harnessing the power of APIs, organizations can substantially enhance the efficiency and security of their payment solutions. The flexibility that APIs offer allows businesses to keep pace with evolving market demands while managing costs effectively. Furthermore, the ability to integrate new payment methods ensures that businesses remain competitive in an increasingly digital world. As technology continues to advance, companies will need to embrace API solutions that not only provide operational efficiencies but also improve customer experiences. At the same time, addressing security and compliance requirements will be essential to maintaining consumer trust. The collaboration between fintechs and financial institutions can lead to the creation of innovative solutions that cater to diverse consumer needs. Ultimately, as consumers increasingly embrace digital payments for their convenience, it is critical for businesses to adapt accordingly. The future of digital payments will be characterized by seamless, secure, and tailored experiences, driven by API innovations that reshape the financial landscape.

In the quest to maintain relevance, the integration of digital payment APIs into business operations is not just a trend; it’s a necessity. As online transactions become commonplace, businesses can no longer ignore the imperative of streamlining their payment processes. By shifting towards API-driven solutions, organizations position themselves to ensure customer satisfaction while enhancing operational efficiency. With speed, security, and user experience at the forefront, the implementation of APIs becomes a strategic advantage. Consequently, industry players who invest in these innovative solutions today will reap benefits in the future, driving growth through improved customer interactions and loyalty. Traditional payment methods may still have a place; however, the future will belong to those companies that harness the transformative potential of digital payment APIs. The significant improvements in user experience lead to higher conversion rates, allowing businesses to maximize their revenues. In conclusion, successful navigation of the digital payment landscape necessitates an understanding of API advancements and a commitment to prioritize innovation, security, and customer experience.