Impact of Currency Fluctuations on Cross-Border Startup Investments

In an increasingly interconnected world, cross-border startup investments are more prevalent than ever. Investors need to understand how currency fluctuations can significantly affect the profitability and sustainability of their assets. When a startup receives funding in a foreign currency, the value can change at any moment, leading to potential gains or losses for the investor. For instance, if the investor’s home currency strengthens against the foreign currency where the startup is based, the value of their investment may decrease once converted back. This can create a challenging environment for investors who are looking to maximize their returns. Currency fluctuations can also impact the startup’s operational expenses, particularly if they rely on imported goods or services. Any increase in costs at the operational level can hinder growth potential. To mitigate this risk, investors often consider hedging strategies or diversify their portfolios across various currencies. Understanding these dynamics is crucial to navigate the complex landscape of cross-border funding. As startups aim for global reach, staying abreast of currency trends is vital for securing funding viability.

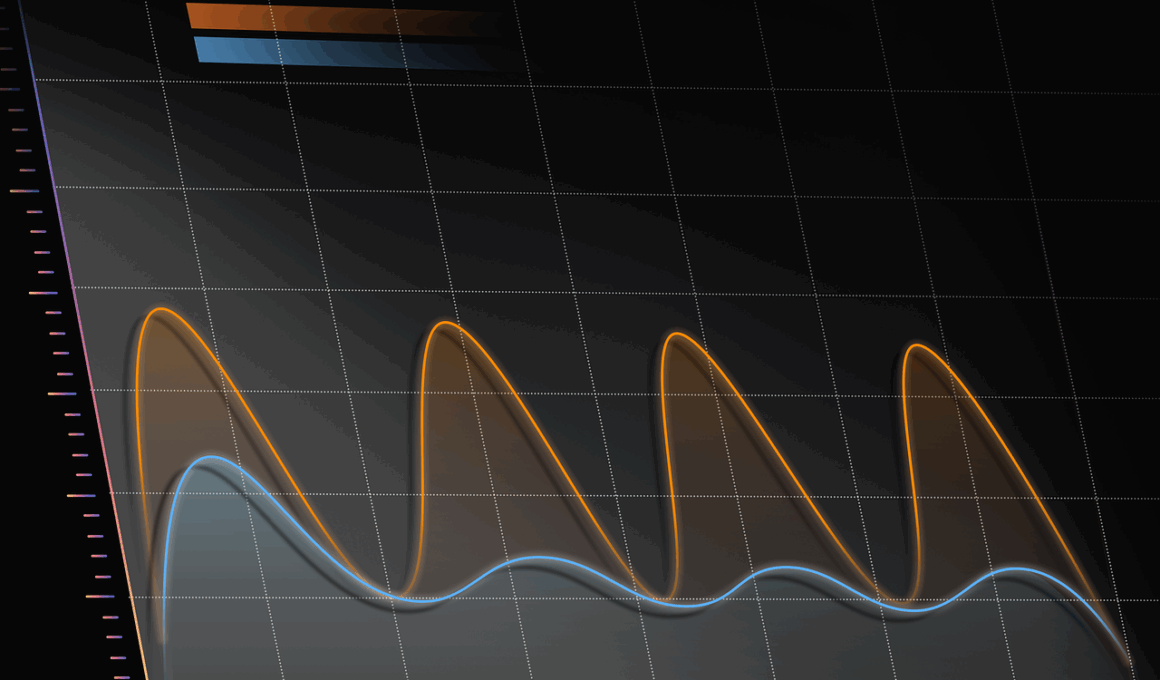

Given the volatile nature of foreign exchange markets, it is essential for startup founders and investors alike to track currency trends. Movements in exchange rates can signify macroeconomic changes that might affect business operations and profitability. For example, a weakening local currency may drive a startup to reconsider its pricing strategy, thereby impacting local sales. Conversely, a strong currency can lead to increased competition from foreign entities looking to penetrate the market. Founders must be prepared for challenges originating from fluctuations as these events can dictate whether their business thrives or merely survives. Moreover, understanding currency dynamics enables involved parties to make informed decisions regarding investment locations. International investors can capitalize on favorable exchange rates, ensuring they minimize potential losses from currency shifts. Furthermore, communication with financial advisors who specialize in foreign investments can provide deeper insights into managing risks associated with currency fluctuations. This proactive approach to currency risk management is necessary in the volatile startup ecosystem where time and operational efficiency can directly influence success or failure. Strategic financial planning centered around potential currency changes can lead to more resilient startups.

The Role of Economic Indicators

Economic indicators play a crucial role in understanding currency fluctuations and their impact on startup investments. Key indicators such as inflation rights, interest rates, and employment levels can herald changes in currency strength. For instance, high unemployment rates may lead to a central bank lowering interest rates, often resulting in a weaker currency. Investors must pay close attention to these indicators when considering changes in investments. When evaluating cross-border funding opportunities, both startup founders and investors should not only look at past performance but also future economic forecasts. Indicators can help predict whether a currency will strengthen or weaken, giving essential insights for investment decisions. An appreciation of domestic and foreign economic conditions is paramount. Founders should also factor in domestic demand trends when evaluating exchange rate impacts. Awareness of shifts can enable better pricing strategies, helping startups remain competitive. Additionally, cross-border investors should synchronize their investment strategy with currency outlooks, allowing them to maximize returns. Leveraging data analytics tools or consulting with professionals can facilitate informed investment decisions, thereby addressing potential currency fluctuations more effectively.

Hedging Strategies and Financial Instruments

Many investors utilize hedging strategies to protect against currency risks associated with cross-border startup investments. Hedging provides a safety net by reducing exposure to unfavorable currency fluctuations. Several financial instruments are available to assist in this endeavor, including forward contracts, options, and swaps. These tools can lock in exchange rates or set boundaries for potential losses, allowing investors to navigate currency volatility more effectively. By employing hedging techniques, investors can mitigate risks, thus ensuring a more stable return on investment. For startup founders, utilizing these financial strategies can also be instrumental in providing clarity when raising capital internationally. Investors may be more inclined to support a venture if they see that the startup has measures in place to handle currency risks. Moreover, integrating market analysis with hedging strategies can enable start-ups to operate on a foundation of confidence. Understanding the relationship between hedging and cross-border funding is vital for long-term success. Consultations with financial advisors or banking institutions specialized in international transactions can yield a range of hedging options tailored to specific needs.

In addition to hedging, diversification of investments across multiple currencies can also play a vital role in mitigating risks tied to currency fluctuations. By investing in various currencies rather than concentrating on a single foreign currency, investors can reduce the overall impact of adverse currency movements. This means if one currency weakens, others may still perform well, thus balancing the portfolio. For startup founders, this approach can facilitate better negotiation power when sourcing funds from international investors. It showcases a well-rounded strategy that underscores an understanding of global markets. Furthermore, cross-border collaborations can foster stability; startups can engage with partners in various countries. These partners can provide insights into local market conditions and currency forecasts. Additionally, startups that operate in multiple regions may find it easier to manage currency risks through local transactions. A practical approach combines these diversification strategies with proactive monitoring of currency dynamics. Emphasizing the importance of tailored financial forecasting can set the groundwork for a resilient startup, enabling it to weather the fluctuations in currency markets directly. Staying agile and informed is key to navigating cross-border funding successfully.

Impact of Geopolitical Events

Geopolitical events can significantly influence currency fluctuations and, consequently, the landscape of cross-border startup investments. Political instability, trade wars, and diplomatic tensions can create an environment of uncertainty that affects investor sentiment. When such events unfold, investors may withdraw from markets perceived as risky, leading to depreciation of the local currency. Startup founders must remain vigilant, as these fluctuations can impact their funding rounds. Investors may request additional safeguards or demand more equity in cases of increased political risk. Additionally, understanding the geopolitical landscape can aid in making informed decisions regarding market entry or expansion plans. Startups looking to attract cross-border funding must also consider how local political sentiments might affect their operational viability. In this context, extensive market research becomes essential. Analysis of potential political risks should be integrated into overall business strategy to enhance preparedness. This proactive approach allows startups to address potential funding challenges attributable to geopolitical factors. Continuous engagement with global events and expert analysis is critical to fostering resilience in cross-border investments amidst changing political climates.

In summary, currency fluctuations present both challenges and opportunities for startups seeking cross-border funding. Understanding these dynamics is vital for minimizing risks and maximizing returns. Investors should continuously analyze economic indicators and geopolitical landscapes to craft strategies that benefit their ventures. As the startup ecosystem evolves, businesses increasingly rely on robust financial planning to navigate this complexity. Hedging strategies, combined with diversification and real-time market analysis, will remain fundamental in managing currency risks associated with international investments. Furthermore, effective communication between founders and investors regarding currency concerns can foster a more collaborative approach to risk management. Startups must remain informed of trends while developing agile financial strategies. By employing these solutions, startups can enhance their chances of securing funding while mitigating the adverse impacts of currency fluctuations. As globalization continues to shape the business environment, awareness and adaptability will be essential for success in cross-border startup investments. Future trends will likely evolve, requiring ongoing assessments of currency risk within funding narratives. Embracing these practices will ultimately contribute to a resilient foundation for startups amidst the intricacies of cross-border funding.

As cross-border funding becomes a prominent strategy for startups, rigorous attention to currency fluctuations remains essential. By implementing thoughtful strategies, startups can maximize growth potential while minimizing inherent risks. Key takeaways include utilizing effective hedging instruments, proactive communication with investors, and staying informed of geopolitical and economic developments. These practices collectively position startups for successful navigation of cross-border funding landscapes, contributing to sustained growth and innovation.