Introduction to Balance Sheet Modeling in Finance

Balance sheet modeling is a critical aspect of financial analysis, providing insights that are essential for informed decision-making. It involves creating a structured representation of a company’s financial position at a specific point in time. Through effective modeling, analysts can assess assets, liabilities, and equity, which provides a snapshot of a corporation’s financial health. This exercise aids in understanding how well a company can fulfil its short-term and long-term obligations. Furthermore, by analyzing trends in the balance sheet over time, stakeholders can identify financial patterns that may indicate future performance. A thorough grasp of balance sheet modeling equips investors with the necessary tools to evaluate the overall viability of a business. Moreover, improved communication of financial information to shareholders can lead to greater confidence in the organization. Using software like Excel, financial professionals can streamline their modeling processes, making it easier to incorporate scenarios and sensitivity analysis. Balance sheet modeling enables firms to strategize effectively for growth and mitigate potential financial risks. As such, it plays a significant role in corporate finance, investment analysis, and financial reporting. Continuously improving skills in this area is essential for finance practitioners.

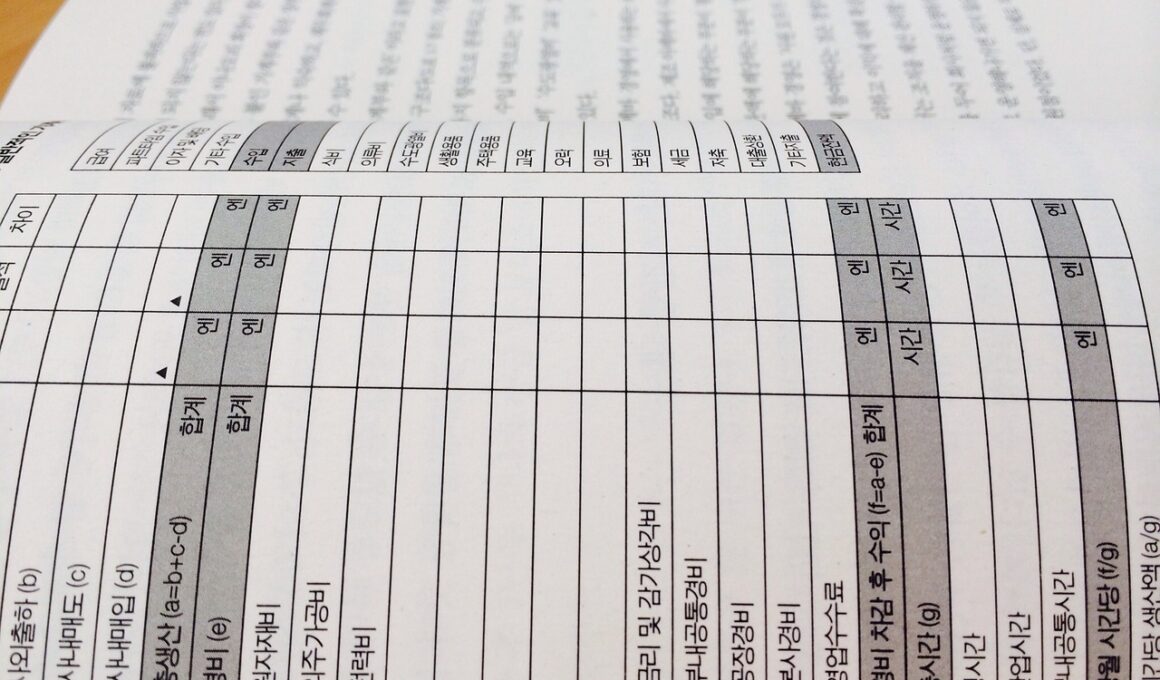

Typically, a balance sheet consists of three main categories: assets, liabilities, and shareholders’ equity. Understanding the distinctions between these categories is vital for anyone involved in finance. Assets refer to items of economic value owned by a company, including cash, inventory, and real estate. Liabilities, on the other hand, represent the debts and obligations a company owes to outside parties, such as loans or accounts payable. Lastly, shareholders’ equity is the difference between total assets and total liabilities, representing the ownership interest in the assets of the company. A well-structured balance sheet provides useful indicators for assessing liquidity and solvency. For example, the current ratio, derived from current assets divided by current liabilities, indicates whether an organization can meet its short-term obligations. Similarly, the debt-to-equity ratio assesses financial leverage by comparing total liabilities with shareholders’ equity. A balance sheet is essential for investors who rely on this information for making financial decisions. Furthermore, banks and other lenders frequently examine balance sheets during the loan application process to determine the viability of a potential borrower.

The Importance of Accurate Balance Sheet Modeling

Accurate balance sheet modeling goes beyond simple calculations; it requires a deep understanding of accounting principles and financial reporting standards. Errors in the representation of financial data can lead to misinformed decisions, which may have severe implications for a corporation’s strategy. By maintaining precise balance sheets, companies can foster transparency and trust among stakeholders. Investors, creditors, and management rely on reliable financial reports for evaluating operational performance and financial stability. Resultantly, sound balance sheet modeling practices play a key role in compliance with regulatory requirements and accounting standards. International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) impose strict regulations concerning financial transparency. Adhering to these standards through accurate modeling reduces the risk of discrepancies that can lead to audits or trust deficits among investors. In today’s financial landscape, the credibility offered by precise data in financial modeling is an asset. As the industry evolves and financial data becomes more complex, continuous education in balance sheet analysis and modeling is indispensable. By aligning modeling techniques with industry standards, professionals can provide invaluable insights and drive better financial outcomes for their organizations.

Another key element of balance sheet modeling is the forecasting of future financial positions. Accurate projections require a combination of historical data analysis and market research. By evaluating past performance trends and understanding current market dynamics, financial analysts can create reliable forecasts for the balance sheet. These projections assist in identifying potential funding needs or investment opportunities that may arise in the future. Implementing different scenarios and understanding their implications on the balance sheet is crucial for robust financial planning. In this context, sensitivity analysis allows analysts to assess how changes in certain variables, such as interest rates or sales volume, impact the balance sheet. This technique helps management in understanding the financial risks associated with various business strategies. Beyond forecasting, balance sheet modeling supports capital budgeting by determining how investments affect long-term financial health. Incorporating forecasts directly into models also provides essential insights into resource allocation, enabling better decision-making. Consistent evaluation and adjustment of these models using updated information ensures adaptability to market conditions, ultimately enhancing strategic planning. Embracing such methodologies enables organizations to remain competitive amid volatility in the financial market.

Utilizing Technology in Balance Sheet Modeling

The integration of technology into balance sheet modeling has transformed financial analysis and report generation processes. Financial modeling software packages streamline the establishment and updating of balance sheets, allowing for real-time data analysis. This efficiency enables analysts and stakeholders to quickly access required information and address any discrepancies in real time. Tools such as Excel and specialized financial modeling software facilitate creating intricate models with functions that minimize human error. Additionally, automated data gathering reduces the time spent on manual data entry, promoting accuracy throughout the process. Financial institutions are increasingly adopting cloud-based solutions for balance sheet modeling, which support collaboration among teams across geographical boundaries. Enhanced communication results in quicker decision-making and facilitates a comprehensive understanding of any financial alterations. Moreover, the automation tools allow for scenario analysis as well as predictive modeling to be performed effortlessly. As technology continues to progress, incorporating advanced analytics, Artificial Intelligence (AI), and machine learning will lead to even stronger financial insights. Finance professionals can harness these innovations for improved strategic planning and financial forecasting, thus bringing more value to their organizations.

The presentation of balance sheet data is also crucial for varied stakeholders. Crafting clear and accessible balance sheets ensures that all relevant parties can understand the financial health of the organization. Visual aids such as graphs and charts can be integrated, enhancing comprehension of complex financial positions. This is especially important for non-financial stakeholders who may not possess advanced financial knowledge but need to make informed decisions. Constructing visually appealing models can be achieved through various data visualization tools available in the market. Stakeholders, including investors, board members, and creditors, benefit significantly from seeing financial data in a clear format. By effectively communicating financial information, companies build credibility and maintain trust among their financial stakeholders. As transparency remains vital in business operations, well-articulated financial data encourages collaboration across departments. The cross-departmental synergy fosters innovative ideas for financial improvement, which aligns with broader organizational goals. Ultimately, the emphasis on appropriate presentation in balance sheet modeling plays a significant role in driving business success and enhancing relationships with key stakeholders. Hence, organizations must invest in effective reporting practices to facilitate higher engagement and trust.

Conclusion and Future Outlook

In conclusion, balance sheet modeling is a foundational component of financial management, playing an essential role in assessing and conveying the financial standing of a company. As financial landscapes evolve, so too must the methodologies applied to balance sheet modeling. The shift towards technology-driven solutions is enabling more efficient analysis, enhancing the capabilities of finance professionals. Continuous education and embracing modern tools and techniques will ensure organizations remain ahead in delivering accurate financial insights. Future advancements in technology, such as AI and predictive analytics, are poised to revolutionize the practice of financial modeling further. Organizations should prioritize investment in training and infrastructure that supports these developments. As the business environment continues to change, balance sheet modeling will serve as a vital resource for gaining insights and strategic positioning. Recognizing its importance in a larger financial strategy can empower stakeholders to make informed decisions and navigate challenges more effectively. By fostering a culture of knowledge and adaptability in financial modeling, firms can thrive despite uncertainties in the market. Finance professionals must embrace these ongoing changes to facilitate sustainable growth and success for their organizations in the years ahead.

Understanding balance sheet modeling is not merely an academic exercise; it is a practice that empowers financial analysts, business owners, and investors alike. By comprehensively grasping balance sheet dynamics, practitioners can harness analytical insights to navigate their financial futures more efficiently. The significance of robust balance sheet modeling transcends the confines of individual businesses; it impacts entire economies. As organizations prioritize transparency and accuracy in their financial communications, stronger economic foundations can be established globally. This interconnectedness highlights the importance of continual learning within the field of finance. As regulations and standards evolve alongside market demands, stakeholders must adapt accordingly. The evolving financial landscape presents both challenges and opportunities. Continuous investment in the development of balance sheet modeling capabilities can aid organizations in seizing these opportunities while mitigating risks. Fostering dialogue within organizations about the principles of balance sheet modeling cultivates a deeper understanding and encourages collaboration among diverse teams. By embracing a proactive approach to financial planning, firms can drive innovation, enhance profitability, and contribute positively to the economy at large. Ultimately, finance professionals equipped with advanced balance sheet modeling skills will be better positioned to lead their organizations toward sustained success in an ever-changing marketplace.