Supplier Bankruptcy: Assessment and Mitigation Strategies in SCF

In the realm of Supply Chain Finance (SCF), assessing supplier bankruptcy risk is crucial for maintaining operational stability and financial health. Companies engage in SCF to optimize their cash flow while providing suppliers with the necessary liquidity. Supplier bankruptcy, however, poses a significant threat, potentially disrupting supplier relationships and supply chain operations. To effectively assess this risk, organizations must employ a multifaceted approach that incorporates financial metrics, market indicators, and qualitative assessments. Early detection of potential issues can provide ample time for mitigation strategies to be developed and implemented. Businesses should consider utilizing analytics tools to monitor financial health indicators such as profitability, debt levels, and cash flow trends. It’s equally important to engage suppliers regarding their business performance and stability through open channels of communication. By fostering these relationships, companies can gain insights into potential risks and establish proactive measures to address any looming issues. Within this framework, employing insightful supplier scorecards can offer a visual overview of risk factors, enabling easy monitoring and assessment over time, ultimately bolstering SCF strategies.

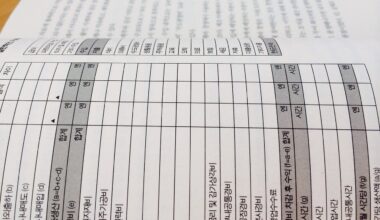

To further enhance supplier risk assessment, companies should adopt a structured framework that combines quantitative and qualitative evaluation methods. Quantitative assessments typically involve analyzing financial statements, credit scores, and payment histories. Key financial metrics, such as current ratio, quick ratio, and profitability margins, can provide vital insights into a supplier’s financial health. On the qualitative side, factors such as management stability, governance structures, and industry reputation must also be considered. Engaging with industry analysts and rating agencies can aid in gathering qualitative data to support your assessment. Additionally, conducting regular audits of suppliers ensures that any pertinent changes in their operations are identified promptly. Another fundamental aspect of this assessment involves examining the robustness of a supplier’s business model and their ability to adapt to market changes. Understanding lessons from past supplier bankruptcies, including identifiable signals and patterns, can help develop more resilient strategies. Ultimately, a proactive, holistic approach to supplier risk assessment can mitigate the impact of potential bankruptcies on your supply chain financing process, thus preserving operational efficiency.

Mitigation Strategies for Supplier Bankruptcy

Once potential bankruptcy risks have been identified through thorough assessments, developing robust mitigation strategies becomes essential. One effective approach is diversifying the supplier base. Relying heavily on a single supplier increases vulnerability; thus, ensuring multiple suppliers are sourced can safeguard against disruptions caused by bankruptcy. Additionally, establishing long-term relationships with suppliers can foster collaboration and transparency, which leads to early identification of potential financial issues. Leveraging technology, particularly predictive analytics, can allow firms to foresee trends or changes in supplier financial health, facilitating timely interventions. Further, firms should consider implementing letters of credit or insurance products to provide an additional layer of security. This ensures that even in the event of a bankruptcy, the financial risks are minimized. It’s also prudent to negotiate contracts that include clauses for performance guarantees and credit insurance. Regular training for procurement and finance teams on recognizing early signs of supplier distress is vital to enable quick action as needed. These strategies collectively create a safety net that protects firms from the adverse effects of supplier bankruptcies, ensuring steady cash flow and supply chain continuity.

Effective communication is crucial for successful mitigation of supplier bankruptcy risks. Companies must maintain open lines of dialogue with their suppliers to foster transparency and trust. Regular check-ins and meetings to discuss financial responsibilities and performance can help identify potential issues before they escalate. Establishing a Supplier Relationship Management (SRM) system can aid in streamlining communication and collaboration, ensuring that stakeholders have access to meaningful data and analysis. This system can enable the real-time monitoring of supplier performance against established metrics. In addition to gathering insights from suppliers, businesses should seek feedback from their counterparts in the industry regarding market conditions and supplier behavior. Engaging in networks or forums dedicated to supply chain finance can also provide valuable, collective insights that enhance understanding of potential risks. Furthermore, educating stakeholders on macroeconomic conditions and their potential impact on supply chain partners is vital for informed decision-making and contingency planning. By incorporating a comprehensive communication strategy into risk management practices, firms can enhance their ability to prepare for and respond to supplier bankruptcy risks effectively.

The Role of Technology in Risk Assessment

The integration of technology plays a pivotal role in supplier risk assessment and mitigation strategies within SCF. Advanced technologies such as artificial intelligence (AI) and machine learning (ML) can be leveraged to analyze vast amounts of data quickly and efficiently. These technologies can assist businesses in recognizing patterns and trends that indicate potential supplier instability. For instance, AI-driven platforms can analyze credit ratings, news articles, and social media chatter to proactively identify suppliers at risk of bankruptcy. Blockchain technology also significantly enhances supply chain transparency, enabling companies to trace the origin of products and verify supplier data in real-time. This can foster trust and streamline communications between buyers and suppliers, reducing the chances of misinformation and misjudgment. Moreover, adopting robust risk management software that consolidates supplier data and assessments can facilitate better decision-making processes. Such systems can offer user-friendly dashboards that present key metrics and alerts regarding supplier performance, ensuring firms stay informed. Overall, embracing technology not only augments traditional risk assessment methodologies but also empowers businesses to navigate the complexities of supplier bankruptcy dynamics effectively.

In conclusion, the threats posed by supplier bankruptcies necessitate a strategic and proactive approach in the context of Supply Chain Finance. Companies must recognize the importance of early risk assessment to mitigate adverse effects on operations and cash flow. By employing a combination of financial analysis, qualitative assessments, and engagement strategies, firms can identify vulnerabilities within their supply chain ecosystem. Mitigation strategies such as diversifying suppliers, fostering strong relationships, and leveraging technological advancements significantly enhance resilience. In addition, establishing effective communication channels ensures that stakeholders remain informed and responsive to any changes. Moreover, embracing technology and incorporating AI or machine learning expands the depth and accuracy of risk predictions. As the business landscape continues to evolve, organizations must remain agile and adaptive in their risk management approaches. By fostering a comprehensive risk assessment culture within the organization, firms can not only avert potential losses but also strengthen their overall supply chain robustness. Ultimately, understanding and preparing for supplier bankruptcy risks is integral to sustaining long-term success in Supply Chain Finance. Empowering teams with the right tools and knowledge can result in a resilient SCF strategy.

Future Trends in Supplier Risk Management

As the dynamics of supply chains evolve, the future of supplier risk management is also likely to change. Companies are increasingly realizing that traditional methods of evaluation may not suffice in today’s rapidly changing environment. The embracing of innovative technologies is on the rise, reshaping the landscape of supplier assessments. Big data analytics will continue to play a critical role in synthesizing information from various sources, enabling organizations to produce real-time insights about potential supplier risks. Furthermore, the implementation of more stringent regulations across industries will compel businesses to adhere to compliance, which indirectly promotes better supplier practices. Companies should also be prepared to adapt their strategies to align with emerging trends, such as sustainability and social responsibility, which are becoming critical in supplier assessments. More organizations will prioritize working with suppliers who demonstrate ethical practices, as stakeholders demand accountability. The integration of sustainability metrics into risk management practices will aid in uncovering potential vulnerabilities related to environmental and social compliance. By staying ahead of these future trends, companies can enhance their supplier risk management frameworks, ensuring robustness and resilience in their supply chains.

In summary, effective supplier bankruptcy risk assessment is an essential aspect of sustainable Supply Chain Finance practices. By adopting a comprehensive, multi-faceted approach that encompasses both quantitative and qualitative evaluations, organizations can effectively identify potential vulnerabilities. Implementing robust mitigation strategies, engaging actively with suppliers, integrating transparent communication structures, and leveraging technology will further strengthen risk management initiatives. As businesses face a rapidly evolving landscape, those that prioritize supplier risk assessment and mitigation will likely enjoy improved operational efficiency and financial stability. Understanding emerging trends is essential, as they will shape the future of risk management practices. Companies must continually refine their approaches to remain resilient, adaptive, and competitive within the market. The integration of sustainability factors and compliance requirements will play an integral role in the assessment frameworks of the future. With a strategic focus on supplier risk assessment, organizations can safeguard against potential bankruptcies and provide a solid foundation for growth within their supply chain infrastructures. Continuous monitoring, reassessing strategies, and deploying innovative solutions will ensure that firms maintain advantageous positions in today’s complex supply chain environment.