The Impact of Economic Downturns on Small Business Financial Stability

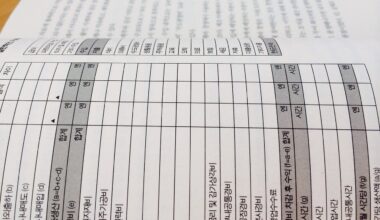

The economic environment plays a significant role in determining the financial stability of small businesses. Economic downturns often lead to reduced consumer spending, which directly affects small businesses’ revenues. This drop in sales results in a cascading effect that can jeopardize operations. Businesses may struggle to cover operational costs, which may necessitate taking on additional debt. As revenues decrease, maintaining cash flow becomes increasingly challenging, forcing many small businesses into precarious situations. The reliance on credit can further trap these businesses in a cycle of debt, making recovery difficult after an economic downturn. During these times, small businesses must be proactive, monitor their income and expenses closely, and optimize their operations for efficiency. Furthermore, understanding their financial risks becomes crucial. Adequate financial planning can help mitigate adverse effects. Building an emergency fund is a wise strategy that provides a cushion during tough times. Being aware of market trends allows small businesses to pivot strategies and adapt to changes effectively.

Despite the ability to pivot, many small businesses face external challenges during economic downturns. The uncertainty that comes with these situations can lead to increased stress for owners and employees alike. Increased supplier prices and reduced availability of goods can complicate matters. A small business’s suppliers might be struggling themselves, which could lead to increased lead times and costs. Additionally, small businesses typically have fewer resources at their disposal to navigate financial hardships. They often lack comprehensive financial strategy teams, decreasing their ability to forecast and plan effectively. For many, this limitation makes it difficult to identify risks proactively and establish responsive actions. Marketing also takes a hit, and many small businesses reduce their marketing budgets when times are tough. While this might make sense in the short term, it can harm long-term stability by reducing brand visibility and customer loyalty. The balance between cutting costs and preserving essential operations becomes delicate. Businesses must continuously communicate with customers and refine their messaging to maintain goodwill and encourage support during tough economic times.

Effective Financial Strategies

Developing effective financial strategies is key in navigating economic downturns. Small businesses should prioritize building a strong relationship with financial institutions, as this can lead to better access to credit options when needed. Establishing a robust credit score and maintaining positive relationships helps facilitate funding and lending opportunities during tough periods. Implementing budgeting techniques such as zero-based budgeting can help small businesses allocate resources more effectively. This strategy requires businesses to justify all expenses anew each period. It encourages identifying unnecessary spendings, enabling more cost-efficient operations. Regular financial reviews can help spot trends in spending and revenue, allowing timely adjustments. Small businesses can also explore various funding options, including grants or local business assistance programs. Educating staff about financial health can lead to more informed decision-making, ultimately enhancing overall financial performance. Furthermore, creating a diverse revenue stream can also mitigate risks. By exploring new markets or products, businesses can hedge against market fluctuations that impact primary revenue sources, ultimately promoting long-term growth and stability.

The emotional toll of financial instability can also affect small business owners and their decision-making. Stress and anxiety stemming from economic downturns can cloud judgment and lead to emotional decision-making rather than relying on data-driven strategies. This can contribute to a cycle of poor choices, exacerbating conditions during economic hardships. Communication within the team is essential to maintaining morale and motivation. Owners should be transparent about their financial situation and involve employees in problem-solving discussions, fostering a sense of community and resilience. Training and development during economic downturns can also empower staff, making them feel valued and part of the solution. This can include upskilling or reskilling employees, helping the business innovate and adapt. Remember that every small adjustment counts; engaging in community-building initiatives may even create partnerships that benefit all parties. Finally, reaching out for support from local business organizations can provide valuable resources during challenging times. Such connections can lead to collaborative solutions that amplify resilience against financial adversities.

Lessons from the Pandemic

The COVID-19 pandemic brought a unique set of financial challenges that weighed heavily on small businesses. Many experienced sudden closures and dramatic drops in demand, forcing them to rethink operational models. The pandemic showed that having a strong online presence is critical for survival during economic downturns. Moving services online helped many small businesses reach and retain customers. Additionally, embracing digital tools for operations and communication has become essential, promoting flexibility that withstands sudden changes in the market. Evaluating existing workflows and finding efficiencies can lead to more stable operations. Small businesses that were quick to pivot often found opportunities in unexpected areas, adapting products or services to meet changing consumer needs. This adaptability must now continue beyond the pandemic; it’s crucial for long-term success and resilience against future economic downturns. Anticipating shifts in consumer behavior and being prepared to act quickly can make the difference. Moreover, leveraging social media to enhance visibility allows small businesses to build loyal customer bases even during economic hardships, ultimately contributing to stability and growth.

Collaboration and support networks are invaluable for small business resilience. Thoroughly understanding local economic conditions and leveraging community resources can help businesses stay afloat during tough financial times. Forming alliances with other local businesses can lead to innovative solutions that benefit all involved. For instance, sharing marketing efforts or co-hosting events can amplify visibility and customer engagement while reducing costs. Participating in local chambers of commerce or business groups can also provide support and guidance during economic uncertainty. These groups can offer resources, shared knowledge, and financial assistance options that small businesses may not access independently. Building relationships in the local community fosters loyalty and strengthens the business’s position during downturns. Additionally, reaching out for assistance from financial experts or business advisors can provide tailored advice that leads to better decision-making. Understanding one’s financial condition and knowing when to seek help is vital for preventing long-term damage. The collective strength of a supportive business community can lead to innovative approaches, ensuring businesses emerge from downturns stronger and more connected than before.

Conclusion on Financial Stability

Ultimately, economic downturns pose significant threats to small businesses, affecting financial stability and long-term viability. However, with strategic planning, effective communication, and community support, these businesses can navigate challenges and thrive. Understanding financial risks, maintaining accurate records, and being adaptable remain essential components. Establishing diverse revenue streams and keeping an eye on market trends contributes to building a strong foundation for stability. Anticipating economic shifts will empower small business owners to stay ahead of potential challenges. Continued education and support can foster resilience, allowing businesses to bounce back stronger than before. Setting up long-term financial goals and maintaining an agile approach to operations can lead to increased resilience. Investing in staff and community ties creates a network of support that will help withstand future adversities. The lessons learned from previous economic downturns can guide future decisions and strategies. Embracing change, seizing opportunities, and cooperating with others can establish a sustainable business environment. In embracing these strategies, small businesses can emerge from downturns not just surviving but thriving, enriching their communities and economies.