The Importance of APIs in Digital Payment Infrastructure Development

In the rapidly evolving landscape of digital payments, APIs play a crucial role in developing and maintaining effective payment infrastructures. APIs or Application Programming Interfaces are essential tools that enable distinct software systems to communicate with each other seamlessly. Their primary function is to make it easier for developers to integrate various payment features into applications without extensive coding. This level of simplification makes API utilization vital for modern businesses looking to expand their digital payment offerings. In particular, organizations can utilize APIs to create safe and efficient transaction channels, ensuring adherence to regulatory requirements while protecting user data. Financial institutions, e-commerce platforms, and fintech startups all benefit significantly from implementing robust API frameworks within their payment infrastructures. Furthermore, APIs foster innovation by allowing multiple solutions to interact, thus enabling diverse payment options such as digital wallets and cryptocurrency. As a result, businesses that effectively harness the power of APIs can enhance user experiences, streamline transactions and respond adeptly to market shifts, ultimately gaining a competitive edge in the digital payments landscape.

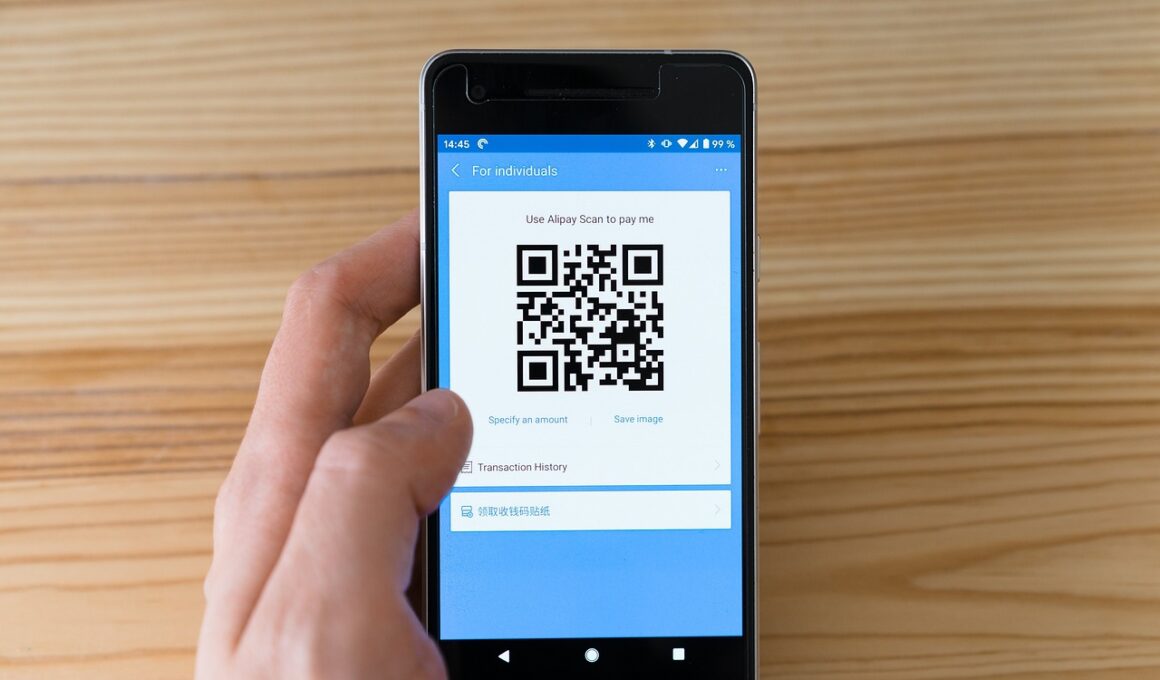

APIs are integral to simplifying the onboarding process for merchants and payment providers. Traditionally, integrating new payment systems required significant time and manual effort from both merchants and service providers. However, APIs reduce these burdens by offering straightforward integration points, allowing merchants to quickly start accepting a variety of payment methods. This shift not only saves time and resources but also reduces barriers to entry for small businesses. By allowing them to easily adopt new payment technologies, APIs enhance overall market competitiveness. Moreover, these interfaces facilitate clear communication between backend systems while providing merchants with the flexibility to expand their payment options. As a result, businesses can tailor their offerings to meet the specific needs and preferences of their target audience. Integration can also quickly adapt to emerging payment trends, such as contactless payments and mobile wallets. This adaptability is crucial in keeping pace with ever-changing consumer preferences and technology advancements. In summary, APIs play a vital role in ensuring merchants have the resources they need to stay competitive and responsive in the fast-paced environment of digital payments.

Enhancing Security with APIs

Security remains a critical concern for consumers and businesses engaging in digital payment systems. APIs contribute significantly to implementing robust security measures that protect sensitive information during transactions. By utilizing industry standards and protocols, APIs can encrypt data, apply risk management strategies, and incorporate multi-factor authentication while processing payments. This creates a more secure transaction environment, safeguarding both merchants and customers from potential fraud and security breaches. Additionally, API management platforms often provide built-in monitoring capabilities that help identify threats and vulnerabilities. As security regulations continue evolving, businesses that leverage secure APIs not only comply with legal requirements but also build trust with their customers. Trust is vital in the digital payments space where users are increasingly wary of sharing their financial data. Therefore, businesses adopting secure, reliable APIs can create a solid foundation of goodwill with their users. Security isn’t just a regulatory necessity; it’s a competitive advantage that can differentiate successful companies from those that lag in their cybersecurity measures, ensuring that customer data remains safe and confidential.

A major advantage of implementing APIs in digital payment infrastructures is the facilitation of real-time transactions and data sharing. These capabilities ensure that businesses can process transactions quickly and efficiently, which is critical for customer satisfaction. In an era where consumers expect instant gratification, long transaction times can lead to cart abandonment and lost revenue. By employing APIs, businesses can eliminate bottlenecks, ensuring smooth payment processing. Benefits also extend to data analytics, allowing organizations to gain valuable insights into consumer behavior. Real-time data sharing enables businesses to track sales trends and customer preferences, empowering them to make informed decisions. This data-driven approach can enhance marketing strategies, enabling targeted campaigns and promotions that resonate with users’ interests. Consequently, companies can optimize their offerings and personalize experiences for consumers. This information can also facilitate timely responses to market changes, attributed primarily to the agility enabled by APIs. Ultimately, the ability to execute transactions in real-time, paired with actionable insights gleaned from data, positions businesses competitively in the dynamic world of digital payments.

Improving Collaboration Between Stakeholders

APIs can significantly enhance collaboration between various stakeholders in the digital payment ecosystem. The digital payments space is diverse, involving banks, payment processors, e-commerce businesses, and software providers, all of which must cooperate to create seamless transaction experiences. APIs act as a bridge, streamlining communication among these parties and allowing them to collaborate effectively. For example, banks can communicate efficiently with payment platforms, providing essential functionality like fraud detection and credit checks during transactions. This collaborative approach fosters innovation within the industry, leading to the development of new solutions and services. Collaboration also drives cost efficiencies, as stakeholders can share resources, reducing development and operational expenses. Additionally, by enabling access to shared APIs, organizations can take advantage of collective insights and technologies, ultimately promoting industry advancement. Stakeholders can also gain valuable information on transaction trends and customer behavior, which further enhances their offerings. This improved collaboration leads to a more user-friendly payment experience, helping businesses seamlessly interact with their customers and fulfilling their evolving needs effectively.

Scalability is another essential benefit of utilizing APIs in digital payment infrastructure. As businesses grow, their payment processing systems must also seamlessly expand. APIs provide the flexibility needed for such scalability, allowing organizations to integrate additional payment methods and functionalities without significant overhaul or system changes. In situations of heightened demand, such as during seasonal sales or promotional events, APIs enable organizations to adjust their systems effortlessly, ensuring uninterrupted service. This adaptability is crucial for maintaining customer trust and loyalty when transactions occur smoothly. Furthermore, APIs allow businesses to quickly align their payment infrastructure with external technologies and services, maximizing their ability to respond to industry changes or consumer demands rapidly. As technological advancements occur, organizations can swiftly incorporate new payment methods, ensuring they don’t fall behind competitors. Scalability becomes more critical as the number of users grows in the digital landscape, emphasizing the importance of APIs in maintaining an agile and responsive payment infrastructure. Overall, the scalability offered by APIs empowers organizations to optimize their payment systems as they expand.

Future Opportunities with APIs

Looking ahead, APIs in digital payment infrastructure will continue to unveil exciting opportunities. With the growth of new technologies, such as artificial intelligence and blockchain, the potential for innovation in payment systems is vast. APIs will serve as mechanisms to deploy these technologies into existing payment frameworks effectively and efficiently. For example, integrating AI algorithms can enhance fraud detection and customer engagement through advanced data analysis. Similarly, blockchain technology can facilitate secure, transparent transactions while reducing associated costs. As the digital payments landscape continues evolving, APIs will be pivotal in enabling swift adaptation to changes while fostering innovation among stakeholders. Moreover, as regulatory landscapes shift, APIs will help ensure compliance while accommodating new policies concerning digital transactions. Businesses that adopt forward-thinking strategies will be better equipped to navigate the complexities of these changes. They will leverage APIs to remain competitive while continuously improving customer experiences. The future will undoubtedly depend on API evolution and integration, making their development an integral part of the digital payment landscape.

In conclusion, APIs are essential for enhancing digital payment infrastructure, enabling innovation, security, collaboration, and scalability. Their importance cannot be overstated as businesses navigate an increasingly crowded and competitive landscape. By embracing APIs, organizations can offer robust, responsive, and user-friendly payment options that cater to their customers’ needs effectively. The future of digital payments hinges on the ability to adapt and thrive within this dynamic environment, with APIs at the heart of it all. Companies that prioritize API development and integration will undoubtedly emerge as leaders, setting new standards in the industry. This foundation will empower businesses to maintain competitive advantages and provide exceptional customer experiences, ultimately ensuring sustained growth and success. The continued evolution of APIs, alongside technological advancements, will extend their capabilities, creating exciting new opportunities within the digital payments sphere. Organizations that recognize this potential will be well-prepared to face the challenges of tomorrow while capitalizing on emerging trends. Thus, investing in the development of a solid API ecosystem is not just a strategy; it’s essential for future success in the digital payments domain.