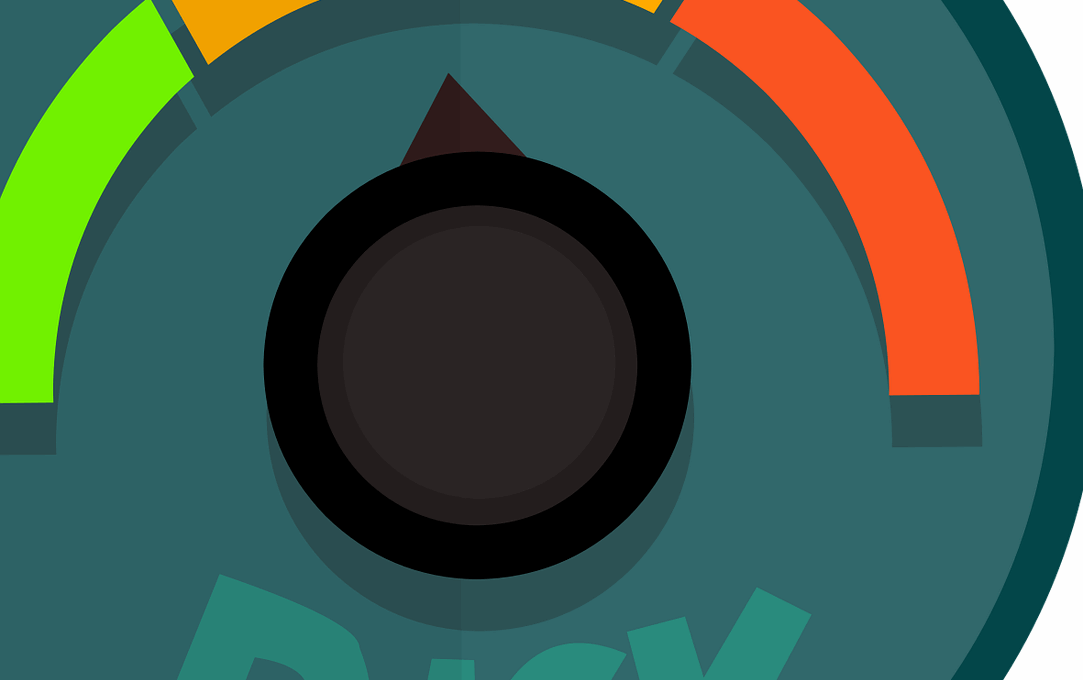

Market Risk Overview

Market risk represents potential financial losses resulting from fluctuations in market variables, including interest rates, equity prices, and foreign exchange rates. Corporations face significant challenges due to these risks, impacting their profitability, cash flow, and overall financial stability. Effectively managing market risk is critical to ensuring sustainable business operations. Companies are increasingly adopting more sophisticated financial instruments, such as derivatives, to hedge against potential market fluctuations. By using derivatives like options, futures, and swaps, corporations can mitigate their exposure to adverse movements in asset prices. This strategy allows them to stabilize cash flows, ultimately contributing to enhanced financial performance. However, while derivatives offer invaluable risk management capabilities, they also introduce new complexities and risks. As such, enterprises must develop appropriate risk management frameworks that align with their risk tolerance and financial objectives. Understanding the distinct market risks they face is the first essential step in creating a tailored risk management strategy. Therefore, companies should perform comprehensive analyses of their current exposure levels and the potential impact of market volatility, ultimately leading to informed decisions on their financial risk management practices.

The Importance of Risk Assessment

Conducting a thorough risk assessment is the cornerstone of effective financial risk management. By identifying and evaluating specific exposures, corporations can implement targeted strategies to address their vulnerabilities. Risk assessments involve analyzing various components, such as market conditions, financial instruments, and operational practices. Corporations need to quantify their exposure to market risks to gauge their potential impact. Companies often use Value at Risk (VaR) models, scenario analysis, or stress testing to estimate potential losses. These methodologies provide insights into the extent of risk exposure and prioritize the implementation of mitigation measures. Regularly updating risk assessments ensures that corporations remain responsive to changing market conditions and evolving risks. This proactivity enables businesses to adjust their hedging strategies accordingly. Corporations should also take into consideration their unique industry characteristics, regulatory requirements, and risk appetite. By adopting a holistic approach to risk assessment, organizations can enhance their financial resilience. Additionally, integrating risk management into decision-making processes fosters a culture of risk awareness within the organization. Therefore, continuous education and communication about risk management practices play a crucial role in maintaining organizational focus on market risk mitigation.

Utilizing Financial Derivatives

Financial derivatives serve as a powerful tool for mitigating market risk, allowing corporations to hedge their exposure effectively. Companies can employ various types of derivatives, including options, futures, and swaps, depending on their specific needs and market conditions. Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price. Futures contracts enable corporations to lock in prices for future transactions, thus providing price certainty. Swaps facilitate the exchange of cash flows between parties, allowing organizations to manage their interest rate and currency exposures. Utilizing these financial instruments effectively can enhance a corporation’s ability to navigate volatile market environments. However, it is crucial to understand the risks associated with these instruments. Derivatives can amplify losses if not managed correctly or used in excess. Implementing strict risk management policies and maintaining clear guidelines on derivative usage are necessary to ensure responsible practices. Regular monitoring of derivative positions allows corporations to adjust strategies based on market conditions. Moreover, seeking expert advice when dealing with complex derivatives can greatly improve a corporation’s risk management outcomes and safeguard their financial well-being.

Establishing a Risk Management Framework

Creating a robust risk management framework is essential for any corporation, particularly regarding market risk management. Such a framework provides clear guidelines and processes that encompass identifying, assessing, and mitigating risks. A well-structured framework begins with defining the organization’s risk appetite, which sets the threshold for acceptable risk levels. It is crucial to integrate risk management into the organization’s overall strategic planning processes to ensure alignment with business goals. Furthermore, establishing policies and procedures for ongoing risk monitoring allows for continual assessment of market conditions and exposure. An effective risk management framework should also prioritize communication and accountability among key stakeholders. This encourages collaboration across departments, ensuring that all relevant areas of the business contribute to risk management initiatives. Regular training and resources should be provided to employees, enhancing their understanding of risk management principles. Corporate governance plays a pivotal role as the board of directors and senior management need to champion risk management initiatives. By embedding risk management into the corporate culture, organizations can promote a proactive approach to managing market risk and ultimately safeguard their financial interests.

Developing Strategic Hedging Policies

Organizations must develop strategic hedging policies as part of their overarching risk management framework. Hedging serves to offset potential losses from market fluctuations and stabilize financial performance. A sound hedging policy outlines the specific goals and objectives of hedging activities, ensuring corporate alignment with risk management strategies. Companies must regularly assess their risk exposure to determine appropriate hedging instruments and techniques. For instance, a corporation heavily impacted by currency fluctuations may opt for forward contracts, while others might choose options to hedge against interest rate movements. Moreover, organizations should establish clear guidelines on the proportion of risk exposure to hedge. This prevents over-hedging or under-hedging and further enhances financial stability. Documentation and transparency should be prioritized in the hedging process, allowing for thorough oversight and audit trails. Evaluation of hedging effectiveness is crucial; companies should regularly review their hedging strategies’ performance against intended outcomes. Additionally, it can be beneficial to maintain flexibility in hedging programs, adapting to changing market conditions and emerging opportunities. By continually refining hedging policies, corporations can ensure their risk management practices remain effective and responsive to market dynamics.

Monitoring Market Conditions

Constantly monitoring market conditions is essential for effective financial risk management. Organizations should implement systems and processes to track market developments, including economic indicators, industry trends, and regulatory changes. Timely information allows companies to make informed decisions about their risk exposure and hedging strategies. Employing advanced technology and analytics can enhance monitoring capabilities, enabling corporations to process vast amounts of market-related data efficiently. Monitoring tools can provide real-time insights that assist in identifying potential risks before they escalate. Regularly assessing market volatility enables organizations to adjust their exposure and implement protective measures proactively. Furthermore, companies should engage in ongoing dialogue with industry experts, analysts, and financial institutions to stay updated on best practices and emerging trends. Establishing relationships with market players can provide invaluable insights and networking opportunities. Additionally, corporations should leverage benchmarking against peers to gauge their market position and assess the adequacy of their risk management strategies. This proactive approach promotes constant vigilance and adaptability, positioning organizations to respond effectively to market challenges and seize opportunities for growth.

Final Thoughts on Market Risk Management

In conclusion, effectively managing market risk is essential for corporations striving to maintain financial stability and improve their bottom line. By adopting a comprehensive approach that includes rigorous risk assessments, strategic use of financial derivatives, and well-defined hedging policies, organizations can significantly mitigate their exposure to unfavorable market conditions. Establishing a robust risk management framework ensures a structured response to potential threats and facilitates ongoing monitoring of market trends. Furthermore, fostering a culture of risk awareness within the organization enables employees to recognize and act upon market risks proactively. Continuous education and collaboration across departments are key components of successful risk management efforts. Looking ahead, companies must remain adaptable to the ever-changing market landscape and continuously refine their risk management practices. By doing so, organizations will position themselves not only to protect against market downturns but also to capitalize on opportunities that arise in a volatile market environment. Ultimately, a strong focus on market risk management will contribute to long-term resilience and success for corporations navigating the complexities of the financial landscape.