How to Read Financial Statements Like a Pro

Understanding financial statements is crucial for entrepreneurs and small business owners. These documents provide insight into the company’s financial health, helping to make informed decisions. The three main types of financial statements include the income statement, balance sheet, and cash flow statement. Each serves a unique purpose and is essential for comprehensive analysis. Familiarity with these statements allows business owners to assess profitability, financial position, and cash liquidity. Many find reading these documents daunting, yet it becomes easier with practice. It is vital to know the various components that make up each statement, including revenue, expenses, assets, liabilities, and equity. By dissecting these elements, one can glean useful information to drive growth. Analyzing trends over time can also reveal critical patterns that could affect future operations. In addition, competent management of these finances directly affects strategic planning. A clear understanding aids in securing funding or investment, which often depends on these documents. By mastering financial statements, entrepreneurs empower themselves to steer their businesses towards success.

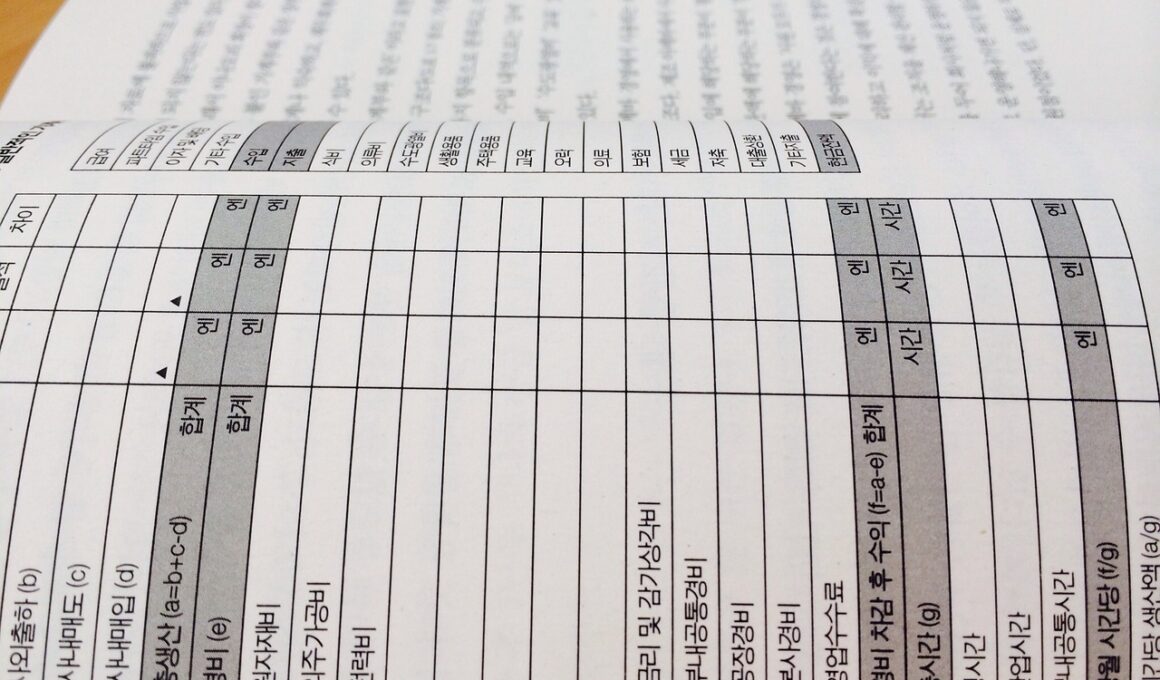

The income statement, also known as the profit and loss statement, summarizes the revenues and expenses over a specific time period. This statement indicates how much profit or loss the company has experienced. Entrepreneurs should focus on key metrics such as gross profit margin, operating income, and net income. Comparisons against industry benchmarks provide further insight into performance. Revenue figures present the top line, while expenses detail costs associated with generating that revenue. By subtracting total expenses from total revenue, business owners derive net profit. Furthermore, it is crucial to understand various expense categories, including fixed and variable expenses, and their implications on cash flow. Analyzing gross margins helps identify efficiency in production or service delivery. A consistent review of the income statement enables businesses to take corrective actions quickly if they fall short of their revenue goals. Professionals suggest maintaining a close watch on month-over-month and year-over-year changes to track growth and expenses effectively. Therefore, mastering the income statement sets a foundation for a comprehensive understanding of the financial landscape. Examining this statement reveals opportunities to optimize performance and drive business success.

The Balance Sheet Essentials

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It consists of three main components: assets, liabilities, and shareholders’ equity. Assets represent what the company owns, while liabilities depict what it owes others. Shareholders’ equity signifies the owners’ claims on the business’s assets after liabilities are subtracted. Understanding the relationship between these elements is vital for analyzing overall financial health. Key ratios, such as the current ratio and debt-to-equity ratio, help evaluate liquidity and financial stability. A current ratio above 1.0 indicates the company can cover its short-term obligations. However, too high a ratio might suggest inefficient use of assets. The debt-to-equity ratio, on the other hand, informs how much leverage the business employs. A lower ratio typically suggests a more stable company, while a high ratio can indicate financial risk. Monitoring changes in the balance sheet over time helps detect trends and shifts in operational efficiency. In this way, reading the balance sheet like a pro is invaluable for sustaining and growing your business. Regular evaluations spur strategic adjustments to enhance performance.

The cash flow statement is essential for understanding how cash enters and exits a business. It is divided into three primary sections: operating, investing, and financing activities. The operating section shows cash generated from daily business operations, which is crucial for maintaining liquidity. Positive cash flow from operations indicates healthy business activities while negative cash flow may raise concerns. The investing section reflects cash spent on or received from investments in assets, such as property or equipment. Understanding this helps gauge growth initiatives. Lastly, the financing section reveals cash transactions related to borrowing and equity financing. Analyzing cash flow ensures that the business can sustain operations without cash shortfalls. Monitoring net cash flow over consecutive periods is essential for spotting patterns that could impact strategic decisions. Using cash flow projections enhances financial planning, enabling businesses to prepare for future expenditures or investments. Without sound cash flow management, a business can quickly face financial difficulties, regardless of profitability. Hence, mastering the cash flow statement is vital for maintaining a thriving enterprise.

Key Financial Ratios

Financial ratios derived from financial statements provide invaluable insights into a business’s performance. These ratios assess profitability, efficiency, and solvency, aiding informed decision-making. Common ratios include the return on equity (ROE), return on assets (ROA), and the current ratio. ROE measures how effectively a company utilizes shareholders’ equity to generate profit, providing a valuable perspective for investors. Meanwhile, ROA indicates how efficiently a company uses its assets to produce earnings, crucial for operational analysis. The current ratio assesses a firm’s ability to cover short-term liabilities with short-term assets, essential for evaluating liquidity risk. Moreover, the gross profit margin can signal pricing strategy effectiveness and operational efficiency. Businesses should benchmark these ratios against industry standards to highlight strengths and weaknesses relative to competitors. Consistent monitoring aids in trend analysis, revealing underlying operational improvements or declines. Utilizing financial ratios empowers companies to make informed adjustments in strategy and resource allocation. Understanding these indicators fosters proactive management and enhances business resilience. Thus, cultivating a solid grasp of key financial ratios significantly contributes to sustainable growth.

To enhance proficiency in reading financial statements, continuous education and practical experience are crucial. Engaging with professional development resources, such as courses or workshops, can solidify understanding and build confidence. Financial literacy is a pivotal skill for entrepreneurs, impacting day-to-day decision-making. Networking with financial experts or consulting with accountants can also yield valuable insights into best practices. Online platforms and forums provide access to a wealth of educational materials, thus making learning accessible and convenient. Additionally, case studies highlighting real-world applications deepen comprehension by illustrating challenges and solutions faced by businesses. Encouraging interaction with financial software tools further enables streamlined analysis and reporting. Surveys show that many entrepreneurs find software solutions significantly ease the understanding of complex data. By practicing these skills, small business owners can cultivate a richer understanding of their finances, leading to better strategic decisions. Furthermore, analyzing frequently and implementing practices like monthly reconciliations are instrumental in reinforcing this knowledge. In conclusion, becoming proficient at reading financial statements is a journey toward greater business success and stability.

Conclusion

In summary, mastering the art of reading financial statements is essential for any small business owner. These statements serve as vital tools for assessing business health, profitability, and sustainability. By understanding the income statement, balance sheet, and cash flow statement, entrepreneurs can gain a comprehensive view of their ventures. Moreover, leveraging key financial ratios enhances decision-making capabilities, ultimately driving growth. Regular practice and engagement with educational resources optimize understanding and application. Entrepreneurs must prioritize monitoring and analyzing these documents to inform their strategies. Seeking assistance from professionals enhances comprehension, guiding toward informed financial decisions. Creating a routine for reviewing statements ensures that business owners stay flanked by their financial status. This proactive approach facilitates early identification of potential issues. Developing financial literacy fosters greater confidence and empowers entrepreneurs to navigate their business landscape effectively. Lastly, as financial statements evolve, ongoing learning is critical for sustained success. By refining skills in financial statement analysis, small business owners can ensure they are well-equipped to face challenges and seize opportunities. Therefore, the ability to read financial statements like a pro significantly contributes to long-term business growth and stability.

Becoming adept at financial statements requires diligence and a commitment to understanding the fundamentals. By breaking down each component of these reports, business owners can unveil their financial narratives. Utilizing resources such as webinars, books, and courses can provide deeper insights. Additionally, collaboration with peers and financial professionals can pave the way for greater understanding. Keeping abreast of changes in accounting standards and practices is also advantageous. Today, many online tools and applications exist to assist with financial statement analysis and interpretation. When used effectively, these tools can help streamline the process of understanding complex financial data. Consistent practice combined with ongoing education will yield the best outcomes. Embracing a proactive approach toward financial management ultimately enriches decision-making processes, enabling better business outcomes. Ultimately, knowledge is a powerful tool that allows entrepreneurs to navigate their financial landscape confidently. As they hone their skills in reading financial statements, they become empowered to drive their business towards success. The investment in time and resources pays off, leading to a brighter financial future. Thus, embarking on this journey toward financial literacy is a crucial endeavor for any entrepreneur striving for success.