Tax Implications of Leveraged Buyouts

Leveraged buyouts (LBOs) present unique tax structures that significantly influence the financial landscape of the acquired companies. In an LBO, a company is purchased using a combination of debt and equity, with the target’s assets often serving as collateral. One of the main tax implications of LBOs is the ability to deduct the interest expenses associated with the debt financing, thus reducing the taxable income. This can lead to substantial tax savings compared to all-equity transactions. However, depending on the local tax laws, there may be limits on the amount of interest that can be deducted, which could change the attractiveness of the LBO structure for investors. Additionally, the choice of financing can trigger unexpected tax liabilities. For instance, if the borrowing leads to an increase in the company’s net interest expense, it could risk reaching detrimental tax thresholds that affect future cash flows. To mitigate these risks, it is essential for businesses to conduct thorough tax planning and consider potential changes in corporate tax rates that could impact the overall profitability of LBO transactions in the long run.

Understanding the assessment of tax benefits in LBOs requires a closer look at both corporate and personal tax implications. The tax treatment for gains involved in LBOs refers primarily to the gains realized during the sell-off of investments or through dividends received after a sale. Often, the tax treatment allows for long-term capital gains rates on these realized gains. Depending on the structure of the LBO, returns for individual private equity investors might be taxed at a lower rate than ordinary income, given that equity holdings may appreciate significantly over time. It’s crucial for stakeholders to understand how different structures, such as partnerships or corporations, affect individual tax obligations. Companies might also face alternative minimum tax (AMT) issues based on tax benefits. Tax rules can also change, so it’s vital for investors to remain informed about potential legislative changes that could impact the attractiveness of LBOs. Furthermore, tax credits or incentives could offset LBO-related expenses, thus affecting the overall cost-benefit analysis of acquiring a business through leveraged buyouts. Proper guidance from tax professionals can lead to optimized structures that effectively maximize post-transaction profits.

Interest Deductibility in LBOs

One distinguishing feature of LBOs is the treatment of interest expenses associated with the debt used for the acquisition. Companies acquiring targets through leveraged buyouts typically incur high levels of debt, resulting in substantial interest payments. Tax legislation, particularly in jurisdictions like the United States, allows these interest payments to be deducted from taxable income, thereby lowering the overall tax burden. This tax shield can significantly enhance the cash flows available for reinvestment or distribution to equity holders. Nevertheless, specific rules often govern the deductibility of interest in such structures. For example, if interest expenses exceed a certain threshold or ratio compared to earnings before interest, taxes, depreciation, and amortization (EBITDA), companies may face limitations that restrict their ability to deduct these expenses. Moreover, changes in tax laws may further complicate deductions. Therefore, it becomes imperative for companies to monitor their debt levels carefully and assess the sustainability and implications of financing their acquisitions through debt in an LBO context. Failure to optimize this aspect can lead to unforeseen tax liabilities that may hinder overall financial performance.

Another critical consideration in the tax implications of LBOs relates to tax attributes, particularly net operating losses (NOLs). In instances where a target company possesses NOLs on its balance sheet, these can often be valuable to the acquirer post-transaction. Utilizing these NOLs can significantly alleviate future taxable income, thus lowering overall tax liabilities. However, the continuity of business operations can be crucial in keeping such tax attributes intact; making substantial changes to the acquired company could risk losing these benefits under various tax regulations. The implementation of Section 382 in the U.S. tax code, designed to limit the use of NOLs after ownership changes, imposes further restrictions based on changes in stock ownership. As such, it is critical for investors in leveraged buyouts to consider the implications of corporate restructurings and how they can impact these tax attributes. When planning LBO transactions, assessing the longevity and usability of NOLs must factor into the overall financial strategy to maximize potential savings over time. Strategies might include specific planning around the timing and structure of the LBO transaction.

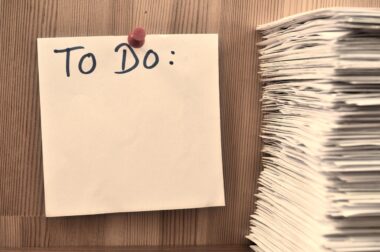

Potential Tax Risks in LBO Transactions

While structured effectively, leveraged buyouts do not come without risks. The tax implications of LBOs can vary, leading to potential pitfalls that could diminish the anticipated advantages of high leverage. Regulatory environments can shift, and tax codes may evolve, altering the base assumptions on deductibility and interest rates, ultimately influencing the value proposition of an LBO. Moreover, high levels of leverage raise the risk of default, and in the event of bankruptcy, the associated tax implications can be severe for both the target and the acquirer. For instance, companies could find themselves facing altitudes of non-deductible expenses coupled with penalties due to unpaid taxes. Moreover, the tax treatment after a sale, including any capital gains tax owed on appreciation realized, can complicate the exit strategy for private equity investors. An unexpected tax liability at the exit could lead to significant reductions in overall returns. Planning carefully in consideration of these risks can enhance long-term viability and the strategic return potential of leveraged buyouts, enabling more informed decisions and a better approach to asset management during the exit process.

The global landscape for corporate tax rates greatly impacts the appeal of LBO transactions across different jurisdictions. In countries where corporate tax rates are comparatively lower, the tax shield benefits derived from interest expense deductions can be more favorable towards LBOs. Conversely, regions with higher taxes may offer limited benefits, particularly if local rules restrict interest deductibility. For multinational corporations involved in LBOs, navigating local compliance becomes essential to avoid pitfalls that arise from international tax regulations and cross-border transactions. Engaging with tax advisors familiar with local intricacies helps avoid unexpected liabilities. Additionally, features like tax treaties and incentives may play a significant role in mitigating tax burdens in cross-border LBOs. The implications of local tax laws on the overall structure of LBOs can be critical to maximizing returns. Strategic planning and location assessments contribute to understanding where the most advantageous tax positions might arise. Ultimately, effective tax strategies across jurisdictions may serve as competitive advantages, influencing decisions on acquisition targets and exiting strategies while ensuring compliance with varying regulations and local practices.

Strategic Tax Management in LBOs

Tax management is instrumental in ensuring the success of leveraged buyouts; thus, companies involved often engage strategies to optimize tax outcomes. One common approach involves structuring financing arrangements creatively, such as through specific tranches of debt or equity mixtures that appeal to eager investors while maintaining tax efficiency. Additionally, some firms utilize special purpose vehicles (SPVs) to isolate tax risks and maximize tax benefits during the life of the investment. Maintaining ongoing dialogue with tax advisors helps to inform acquisitions or divestitures, as these conversations may lead to discovering invaluable tax breaks or incentives that significantly enhance net returns. Moreover, assessing ongoing legislative changes will allow firms to pivot their strategies to adapt to evolving tax legislation, ensuring optimal performance. It is also vital for management to implement robust reporting systems to monitor tax positions and compliance continually. All stakeholders involved should be aware of their obligations to avoid unintentional tax-related issues or audits. Ultimately, integrating tax strategy closely with financial planning can lead to the successful navigation of leveraged buyouts while safeguarding returns and maintaining compliance.

The future of leveraged buyouts may increasingly be impacted by technological advancements that allow for better tax planning and risk assessment. With the advent of big data analytics, firms can analyze vast amounts of financial and tax data to identify opportunities for tax savings in their acquisition strategies. Furthermore, technology facilitates more efficient compliance with varying tax regulations across different jurisdictions, reducing the risk of documentation errors and unintended violations. Artificial intelligence systems can assist in predicting how changes in tax law may impact leveraged buyout structures, allowing businesses to adapt proactively. These innovations will change how private equity firms approach transactions and the assessment of financial liabilities involved. Tax assessments could become more precise and streamlined, benefiting both buyers and sellers during negotiations. However, the potential for cybersecurity threats related to the digitalization of sensitive financial data represents a challenge that firms must navigate importantly. As technology becomes more integrated into finance, the necessity for keeping data secure while digitally managing tax implications will be vital. Ultimately, embracing these technological advancements may enable private equity firms to achieve further efficiencies and successfully navigate the complicated terrain of LBOs for years to come.