AI-Powered Digital Identity Verification: Benefits and Challenges

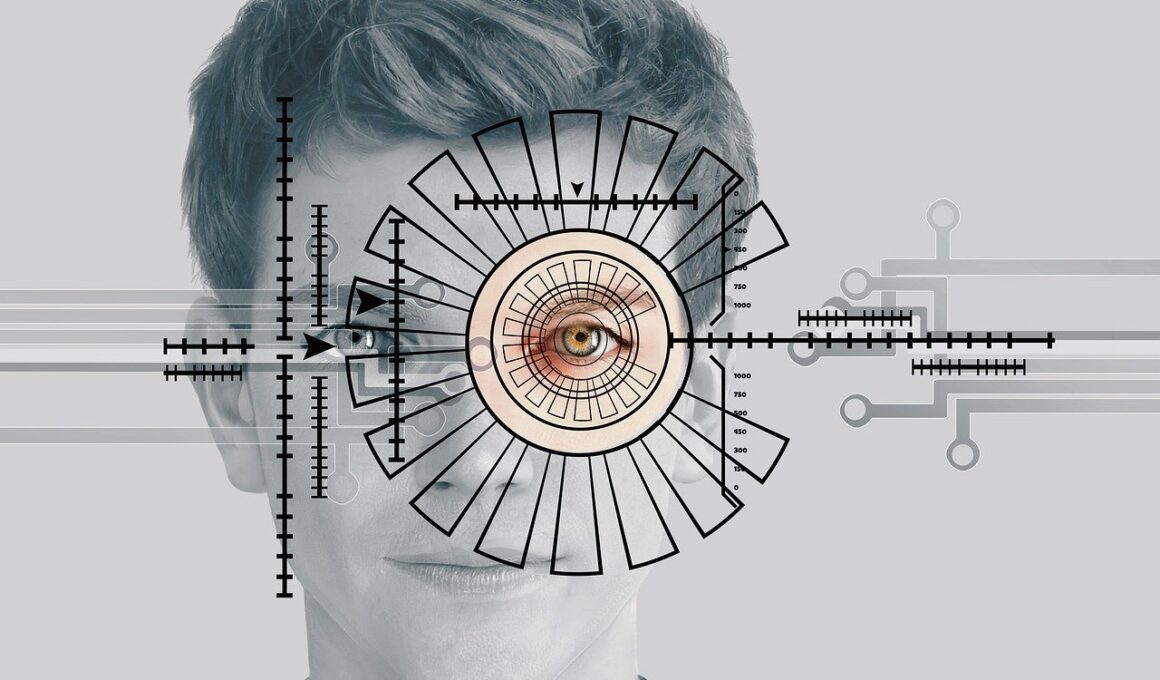

In the rapidly evolving realm of Financial Technology (FinTech), AI-powered digital identity verification systems have become pivotal. These systems utilize artificial intelligence algorithms to enhance the integrity and security of identity verification processes. They address the growing need for robust solutions to prevent identity fraud, a chronic issue that costs businesses millions annually. By employing deep learning and machine learning techniques, these systems analyze various data points, enabling accurate verification without human intervention. Furthermore, they allow for real-time processing, significantly improving user experience. Businesses can streamline their customer onboarding processes, which is essential for operational efficiency. Digital verification fosters trust and compliance with regulatory frameworks, ensuring that organizations adhere to know-your-customer (KYC) regulations. Enhanced security measures also mitigate cyber threats associated with identity theft, making transactions safer for customers. Ultimately, the integration of AI technology in identity verification signals a shift toward more sophisticated and efficient solutions, inviting a new era of customer relationships that prioritize security and safeguarding personal information.

Advantages of AI in Identity Verification

The advantages of AI in digital identity verification are multifactorial and profound. First and foremost, AI solutions can analyze vast quantities of data, including biometric information, rapidly and accurately. This capability ensures that identities are authenticated with minimal delays, a significant boon for service providers. Additionally, these systems reduce potential human error associated with manual checks. They can identify patterns and anomalies within data that humans might overlook. Furthermore, businesses utilizing AI technology enhance their defense against fraudulent activities. The predictive capabilities of AI can forecast potential threats based on historical data, allowing for preemptive actions. Such advanced analytics create a more secure environment that attracts discerning customers. Another advantage pertains to cost-effectiveness; although initial investments in AI technology may seem daunting, they yield substantial savings over time by minimizing fraud and operational inefficiencies. Companies can then divert those savings toward other areas of growth. Also, AI systems often exhibit scalability, enabling firms to adapt their verification processes as customer bases expand.

Despite its numerous benefits, the implementation of AI-powered digital identity verification also faces several challenges. Privacy concerns remain at the forefront, especially regarding data handling and storage. Consumers are increasingly wary of how organizations manage their personal information. Therefore, businesses must develop transparent protocols that engage customer trust while following GDPR and other data privacy regulations. Moreover, the accuracy of AI systems largely depends on the quality of the training data. Poorly curated datasets can propagate biases leading to erroneous verifications. Hence, a diversified dataset is crucial for ensuring fair outcomes. Additionally, the technology requisite for implementing these advanced systems can be daunting for smaller firms. They might confront barriers to entry due to high costs and technical complexities. Furthermore, organizations may require skilled professionals to manage these AI systems effectively, which is often a scarce resource. This gap can be a significant hindrance for small and mid-sized enterprises (SMEs) looking to adopt AI solutions. Thus, while the trajectory toward AI in identity verification appears promising, navigating its challenges is imperative for comprehensive adoption.

Technological Innovations Driving AI Verification

The evolution of technological innovations has played a critical role in advancing AI-driven identity verification frameworks. One notable advancement is the introduction of biometrics, which includes facial recognition and fingerprint scanning technologies. These innovations elevate the security measures inherent in identity verification, allowing users to interact without traditional passwords. Additionally, AI systems are continually being improved through innovations in natural language processing (NLP), enhancing their capacity to process textual information efficiently. This evolution allows systems to verify identity through text messaging or voice recognition, catering to diverse consumer preferences. Moreover, cloud computing has emerged as a catalyst for scalability in AI applications, enabling businesses to harness vast computational resources without significant upfront investments. Another exciting development in the field is blockchain technology, which introduces decentralized verification methods that further enhance security and transparency. By leveraging these technologies, organizations can provide secure and fast verification services that align with today’s digital expectations. As they permeate the FinTech landscape, constant research and innovation will ensure that AI-powered identity verification remains dynamic and highly effective.

Security concerns in digital identity verification are a pivotal aspect that must be addressed diligently. Cybersecurity threats significantly undermine the confidence consumers have in online services. Identity verification technologies must evolve continuously to remain resilient against evolving threats such as hacking, phishing, and data breaches. Consequently, AI systems can be enhanced with adaptive learning mechanisms, allowing them to counter real-time threats. With continuous input and updates, these systems can learn from new cybersecurity challenges, adjusting their defenses accordingly. Moreover, fostering collaboration among industry stakeholders is crucial for developing universal protocols to mitigate risks. Sharing threat intelligence and best practices will allow organizations to stay one step ahead of potential vulnerabilities. Simultaneously, regulatory bodies should play an integral role in enforcing robust security norms across the industry. By establishing standardized security procedures, companies can create a cohesive framework that improves consumer confidence. Consequently, developing a culture of proactive security will empower users to engage with digital identity solutions and encourage their adoption across various sectors, ultimately contributing to a safer digital ecosystem. Many organizations are already initiating collaborative efforts to navigate these challenges effectively.

The Future of AI in Digital Identity Verification

Looking ahead, the future of AI in digital identity verification appears exceedingly promising due to technological advancements and increasing demand. As organizations strive to enhance user experiences, AI systems will likely integrate seamlessly with various platforms and applications. Proactive engagement with customers will become commonplace, making the verification process transparent and user-friendly. Moreover, diversity in verification methods will expand, as technologies like behavioral biometric analysis gain traction. This could encompass evaluating user behavior patterns, adding another layer of verification that relies less on traditional identity documents. Furthermore, advancements in AI algorithms will lead to improved accuracy and reduced bias, making identity verification accessible to a broader audience, including marginalized communities. Consequently, markets around the globe can benefit from comprehensive digital services that foster economic growth. As global regulations continue to evolve, adherence to various compliance requirements will ensure a balance between innovation and privacy. In addition, a shift toward ethically-aligned AI practices will foster trust and public confidence. Overall, the integration of AI technologies will revolutionize digital identity verification, making it more efficient, secure, and inclusive.

In conclusion, AI-powered digital identity verification systems represent a transformative evolution within the Financial Technology sector. With a plethora of benefits ranging from enhanced security and efficiency to significant operational cost savings, adopting AI solutions can propel businesses toward growth and innovation. However, the challenges cannot be overlooked; privacy and security concerns must be top priorities for companies seeking to embrace AI technology responsibly. As businesses navigate complexities, continuous advancements in technology and collaborative efforts across sectors will be imperative to realizing the full potential of AI in identity verification. Building consumer trust will require firms to prioritize transparency and ethical data handling practices consistently. Furthermore, fostering a culture of continuous learning and adaptation will counter the ever-evolving cybersecurity threats effectively. With this approach, organizations can ensure that technology remains a beneficial asset and can foster a safer digital environment. Ultimately, the momentum of AI integration into identity verification indicates a future that welcomes a more secure, inclusive, and efficient financial ecosystem. The implementation of comprehensive strategies addressing both benefits and challenges will lay the groundwork for equitable digital interactions throughout society.

In summary, the ongoing dialogue about AI’s role in digital identity verification signals a pivotal juncture within the FinTech world. Shifting consumer expectations alongside fast-paced technological changes necessitate innovation and responsible implementation of AI capabilities. With the potential to redefine how identities are validated online, stakeholders must prioritize human-centric approaches. Considering ethical implications, inclusive access, and unwavering security measures will be crucial as society advances into a digital-first era. By addressing these concerns, organizations can reap the multifaceted rewards of AI technologies while building sustained trust with their customers.