Crowdfunding vs. Venture Capital: Which Funding Option is Right for You?

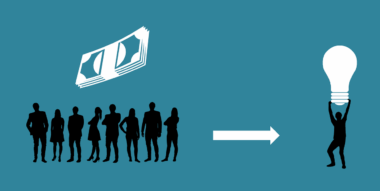

Crowdfunding and venture capital are both essential funding sources for startups and small businesses. Entrepreneurs often find themselves at a crossroads, trying to decide which option suits their needs best. Crowdfunding primarily involves raising small amounts of money from a large number of people, typically via online platforms. This approach enables entrepreneurs to maintain control over their businesses while showcasing their ideas to potential backers. On the other hand, venture capital involves investing larger sums of money in return for equity ownership within the company. Venture capitalists not only provide funding but also valuable mentorship and connections that can drive growth. While crowdfunding helps generate community support, venture capitalists often require a proven track record before investing. Thus, potential candidates must weigh these differences to make an informed decision. Overall, each funding source has its benefits and drawbacks depending on the entrepreneur’s goals and business model. Understanding the nuances of these funding options will ultimately empower individuals to choose the right path for their ventures.

Understanding Crowdfunding

Crowdfunding is a popular method for raising money, leveraging the power of the internet and social media. It allows entrepreneurs to present their ideas through platforms like Kickstarter and Indiegogo. In these platforms, individuals can contribute small amounts of cash to support projects they find appealing. One major advantage of crowdfunding is the ability to test market interest prior to fully launching a product or service. If a project fails to gain traction, entrepreneurs can pivot or adjust their ideas before investing significantly in production costs. Moreover, crowdfunding fosters a sense of community, as backers can feel more involved in the creation process. Funding options in this domain include rewards-based, equity-based, and donation-based models. In rewards-based crowdfunding, backers receive incentives like early product access or exclusive merchandise. In equity crowdfunding, contributors gain a small ownership stake in the business. In donation-based crowdfunding, donors contribute without expecting anything in return. Understanding these models equips entrepreneurs to select the best strategy for their fundraising endeavors.

However, crowdfunding is not without its challenges. The first challenge is standing out in a crowded marketplace. Many projects vie for attention during campaigns, making it critical for entrepreneurs to articulate their vision clearly. It is essential to create engaging marketing materials, including captivating videos, compelling visuals, and persuasive copy that drive interest. Additionally, entrepreneurs must invest time in nurturing relationships with their backers, providing regular updates, and maintaining open communication. To maximize success, creators might consider offering value-added experiences, such as exclusive access to events or milestones met during their project. Furthermore, entrepreneurs should be prepared for potential legal hurdles when collecting funds from numerous investors, ensuring compliance with regulations specific to crowdfunding in their jurisdiction. Another consideration is that while crowdfunding can provide immediate financial assistance, it does not guarantee sustained support over time. Once funds are raised, entrepreneurs will still need to execute their plans efficiently to fulfill the expectations of their backers. Thus, diligence and adaptability are crucial for success in the crowdfunding arena.

The Dynamics of Venture Capital

Venture capital (VC) serves as a significant funding source for startups aiming for rapid growth. Unlike crowdfunding, venture capitalists typically invest substantial sums in exchange for equity in the business. This investment often comes with the expectation that the business will scale quickly and yield profitable returns. A defining feature of the VC model is the lifeline it provides for startups, allowing access to not only funds but also industry knowledge and mentorship from seasoned investors. Many venture capital firms specialize in specific sectors, enabling them to offer strategic guidance. One challenge entrepreneurs face when seeking VC funding is the rigorous selection process. VCs conduct in-depth assessments of businesses, including evaluating the founding team’s experience, market potential, competitive advantage, and financial projections. Additionally, entrepreneurs may have to relinquish some control over company decisions as VCs often seek a say in strategy. While this can empower the business with expert insight, it can also lead to conflicting interests. Thus, entrepreneurs must consider whether the advantages outweigh the sacrifices when pursuing venture capital.

Another essential aspect of venture capital is its focus on scalability. For businesses aiming to grow exponentially, venture capital can provide the necessary fuel for expansion, allowing for new hires, product development, and market penetration. Venture capital investments often come with a timeline, usually around 5 to 10 years, by which investors expect returns. This pressure can motivate startups to achieve aggressive growth targets. However, the expected growth trajectory may not match every entrepreneur’s vision; some businesses may prefer a slower, sustainable growth path. Entrepreneurs must be cautious in choosing the right partners, ensuring alignment with their long-term goals and vision. Investors may request board seats or advisory roles to influence company strategy, impacting the ownership structure. Entrepreneurs should be prepared to navigate these dynamics and be open to compromise while ensuring that their foundational values remain intact. Additionally, potential entrepreneurs should take the time to research various venture capital firms, ensuring they align with their industry focus and values. Finding the right investor partnership can be instrumental in a startup’s success.

Comparing the Two Options

When comparing crowdfunding and venture capital, the choice often depends on various factors including business model, personal preferences, and growth objectives. Crowdfunding is suitable for projects with niche markets or consumer-facing products, as it allows for direct engagement with potential buyers. Conversely, venture capital might be the better option for businesses seeking substantial funding to scale operations rapidly. Entrepreneurs should weigh the benefits of maintaining autonomy in crowdfunding against the insights and networks that venture capitalists bring to the table. Another consideration is the funding timeline; crowdfunding campaigns usually have fixed durations, whereas venture capital investments may occur in multiple rounds over a longer time frame. However, VCs generally expect faster timelines for business growth and profitability. Furthermore, startups should reflect on their long-term ambitions; those aiming for significant market presence might prioritize venture capital, while those favoring community support could opt for crowdfunding. Ultimately, the decision should align with the entrepreneur’s vision for their venture while considering the implications and expectations each funding source entails.

Ultimately, the right choice between crowdfunding and venture capital lies in the specific needs and ambitions of the entrepreneur. Those looking for a grassroots effort, coupled with community support, may find crowdfunding to be an excellent fit. However, businesses aiming for accelerated growth and willing to share equity and control might lean towards venture capital. The landscape of funding is continuously evolving, with emerging options such as hybrid models combining aspects of both methods. Furthermore, entrepreneurs must be aware of changing market conditions and technological advancements influencing funding routes. As new platforms emerge and regulatory systems shift, the dynamics between these two funding avenues may also transform. Furthermore, tapping into expert advice from mentors and industry leaders can provide additional layers of clarity in the decision-making process. Engaging with local entrepreneurial communities can yield insights into successful funding strategies adopted by peers. In conclusion, evaluating personal objectives along with the nuances of crowdfunding and venture capital will help entrepreneurs effectively navigate their funding options while fostering successful growth.

In summary, crowdfunding and venture capital each present unique advantages and challenges for entrepreneurs seeking funding. Crowdfunding empowers creators with market validation and customer engagement while retaining control over their ventures. In contrast, venture capital offers financial support and mentorship, albeit sometimes at the cost of autonomy. Entrepreneurs must carefully consider their options, focusing on business goals, growth strategies, and willingness to concede control. Successful fundraising strategies hinge on understanding the qualities of potential funding sources and developing transparent communication with backers or investors. As today’s startup ecosystem evolves, leveraging both funding methods could open new avenues for growth while enabling diversified investment opportunities. Entrepreneurs who remain adaptable and informed can navigate these choices more adeptly, positioning their businesses for sustainable success in a competitive landscape.