How to Adjust Expense Categories Over Time

Managing your finances requires understanding and organizing your spending habits. One crucial aspect involves effectively tracking expenses, which can help you identify trends and adjust your spending accordingly. To start, outline your primary expenses: housing, food, transportation, utilities, and entertainment. List these categories, and ensure you include less frequent or seasonal expenses like holidays and vacations. This way, you can paint a complete picture of where your money goes. A flexible expense tracking system will enable you to adapt to changes over time. As your life circumstances shift—such as a new job, relocation, or family changes—your expense categories may need adjustments. Regularly reviewing your expenditures will provide insights into potential savings and highlight areas requiring more attention. You should utilize various tools for tracking, such as budgeting apps, spreadsheets, or even pen and paper. The following steps can guide you in adjusting those categories effectively. First, analyze past spending, categorize it, and identify trends, which will help you understand your financial behavior better in the coming months. These adjustments will empower you to manage finances more effectively.

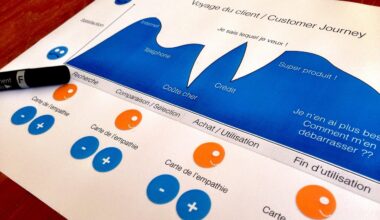

After analyzing your spending habits, it’s essential to categorize them accurately to follow your financial goals. As you adjust your expense categories, consider creating subcategories for more detailed tracking. For example, include subcategories like groceries, dining out, and coffee under food expenses. This additional layer of detail can provide greater insights into discretionary spending habits. Utilizing a visual element such as charts or graphs can help you visualize your spending patterns and make more informed decisions. Consistently updating these categories will keep them relevant and beneficial. Generally, it is also helpful to establish a budget based on your most recent spending analysis. By setting limits within these categories, you can gain better control over your financial situation. Allocating percentage-based budgets can ensure you spend wisely while saving adequately. Setting aside a monthly allowance for each category can help you avoid overspending while motivating you to adhere to your financial goals. Remember, you can adjust this allowance as needed based on your changing circumstances. Incremental changes may lead to significant financial improvements over time, so reassessing your budget periodically is crucial to maintain financial health.

Regular Review and Adjustment

Performing regular reviews of your expense categories is vital for ongoing financial success. Schedule monthly or quarterly evaluations to analyze your spending patterns and adjust your categories to reflect any shifts in your lifestyle or priorities. This process can involve discussions with your family or household about collective financial responsibilities, making changes based on group needs. One effective way to conduct these reviews is by comparing actual spending against your budgeted amounts, looking for any discrepancies that might indicate overspending or areas to cut back. Visual tools can assist in this analysis—graphs showing your spending categories can highlight significant expenses that might require adjustment. Furthermore, you should consider environmental factors like inflation or lifestyle changes while reviewing your categories. For instance, if you’ve started a family, you might find that your categories for childcare or education become critical on your expense list. Be sure to document these reviews systematically to track progress and changes over time. This practice not only keeps you accountable but can also provide helpful insights moving forward into future budgeting and planning.

As life evolves, so do your financial priorities. Adjusting expense categories should reflect changes, whether due to a promotion, relocation, or even a lifestyle switch. This shift may require adding new categories, eliminating irrelevant ones, or redistributing your budget. For example, consider creating specific categories for work-related expenses if you’ve taken on additional duties requiring travel or materials. Maintaining an open line of communication about finances with your partner or family is essential. Establishing shared goals will help everyone understand the significance of each category. Remember, it’s okay to prioritize certain spending at different times. Periodic reassessment allows you to modify your financial strategy effectively. You might consider increasing funds for health and wellness if personal well-being becomes a focus. It’s crucial to remain flexible and open to change while tracking expenses. Utilize tools that allow for easy category adjustments, such as mobile apps and spreadsheets, which can simplify the process. Continuously educating yourself about personal finance and expense management strategies can also enhance your ability to make sound financial decisions.

The Importance of Categories

Expense categories serve as the backbone of effective money management, allowing you to understand your financial behaviors. By organizing expenses into meaningful categories, you can easily identify where your cash flow is going each month. This allocation provides insight into essential versus discretionary spending habits. Furthermore, it allows for more precise budget adjustments when necessary. Another vital aspect is the emotional impact associated with categorizing expenses. It can help you cultivate a healthier relationship with money, fostering mindfulness around spending choices. For those on fixed incomes, adequate categorization can mean the difference between meeting financial obligations and facing shortages. Understanding which categories are fixed costs versus variable expenses can lead to informed decision-making. For example, you can prioritize essentials like housing while finding ways to easily manage variable costs like entertainment. Furthermore, utilizing the 50/30/20 rule can aid in budget assignment, directing 50% to needs, 30% to wants, and 20% towards savings. This categorization promotes balance, ensuring healthy saving habits alongside responsible spending behaviors. Over time, you can refine your financial strategies based on experiences and insights gained from tracking your expenses.

As you adjust your expense categories and practice diligent tracking, consider integrating technology to streamline the process. Many applications and software are available, making it simple to categorize and analyze spending without excessive manual effort. Explore options such as budgeting apps which allow automatic sync with bank accounts, automatically categorizing transactions for you. This feature can save you valuable time and provide real-time insights into your financial situation. Additionally, many tools offer budgeting suggestions and visual graphs to highlight spending trends, allowing for well-informed decisions. Popular apps include Mint, YNAB, and Personal Capital, each offering unique features that suit different tracking needs. Furthermore, backed-up data enhances your financial journey, providing you with the credibility necessary for potential loans or credit applications. Over time, as you familiarize yourself with these tools, adjusting expense categories becomes a seamless task. Take the time to explore various options to find the one that resonates with your financial habits. A well-integrated financial management tool can turn what once felt like a chore into an empowering ritual, making adjustments more manageable and insightful.

Conclusion

In summary, regularly adapting your expense categories is a fundamental practice in personal finance management. As your lifestyle and financial goals change, so too should the categories you use to track your expenses. Embrace the transformative journey of improving your financial literacy and making investments in your future. By understanding the importance of these categories and diligently reviewing them, you can cultivate better money habits and behavior patterns. Each monthly or quarterly review can pinpoint where adjustments are needed and identify categories that require more focus. Utilizing modern technology will ease the process while providing insightful data to substantively inform decisions. Whether you’re aiming to eliminate debt or build savings, thoughtful categorization can guide your path. Remember to communicate with family or partners about changes to ensure you’re all aligned. Set realistic financial goals that reflect both progress and challenges you face along the way. Ultimately, maintaining a flexible approach will help ensure your expense tracking remains effective and relevant long-term. Commit today to make these adjustments and watch your financial management skills evolve over time.