How Supply Chain Finance Helps Small and Medium Enterprises

Supply chain finance (SCF) provides essential support to small and medium enterprises (SMEs) that face financial challenges in their operations. This financial solution enables SMEs to optimize their cash flow by facilitating early payment for their suppliers and improving overall liquidity. By implementing SCF practices, SMEs can also strengthen their relationships with suppliers, ensuring a smoother flow of goods and services. Additionally, SCF can lead to cost savings, as businesses can negotiate better payment terms and discounts. Moreover, access to easy financing options helps SMEs maintain a competitive edge in the market. Another significant advantage is that SCF enhances working capital management, allowing businesses to invest in growth opportunities as they arise. Increased efficiency in financial operations translates to faster turnaround times, which can be crucial for SMEs needing agility to respond to market demands. This financial framework can considerably reduce the reliance on traditional banking institutions. Embracing SCF leads SMEs closer to operational excellence. As they leverage these financial tools, they can ultimately enhance their sustainability in their respective industries.

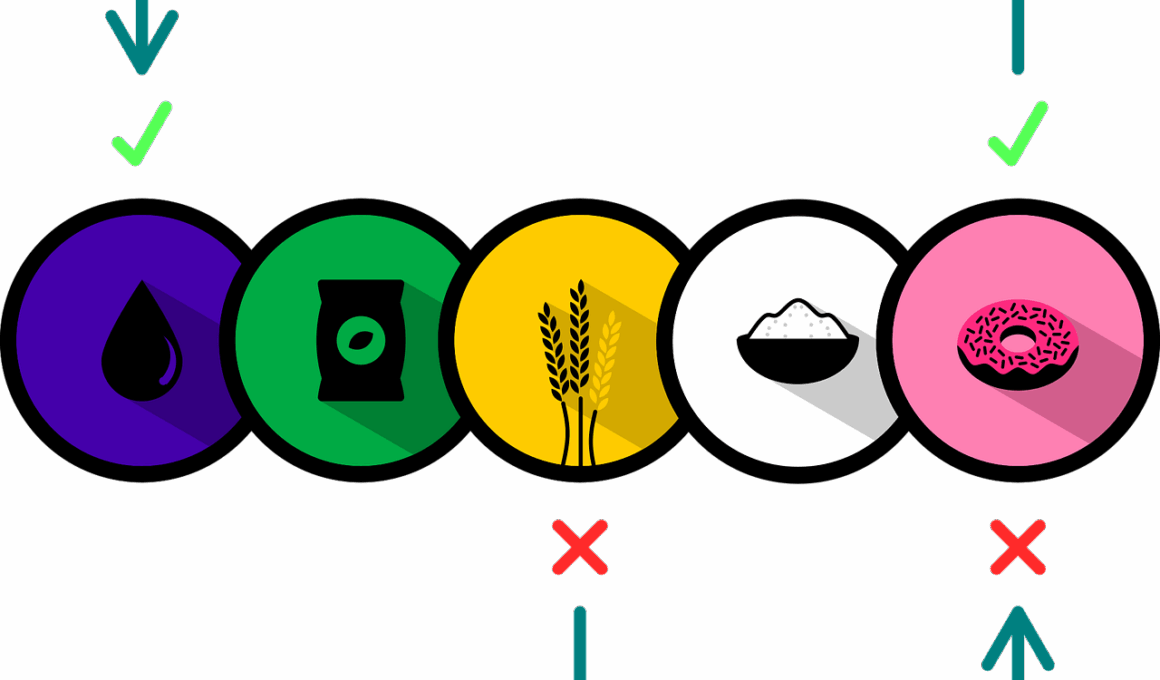

Supply chain finance encompasses various strategies that ensure an efficient flow of funds throughout the supply chain. SMEs often lack the resources and access to traditional credit options, making SCF a viable alternative. By participating in SCF, SMEs can offer favorable payment terms to suppliers, who, in turn, gain access to quicker payment cycles. This relationship is mutually beneficial; suppliers can maintain a healthy cash flow, while buyers enjoy the flexibility of extended payment periods. Moreover, SCF contributes to risk management by diversifying funding sources. As SMEs engage in SCF, they can easily manage unexpected expenses without significant disruption. Financial institutions play a pivotal role in spearheading SCF programs, developing platforms that enable transactions between buyers and sellers. With these relationships, SMEs can explore growth avenues without the burden of cash constraints. Overall, SCF frameworks include factoring, reverse factoring, and inventory financing, all tailored to meet the unique needs of SMEs. The holistic implementation of these solutions can transform traditional supplier-buyer dynamics, creating a collaborative ecosystem that fosters innovation and sustainability as key business drivers.

Through the adoption of supply chain finance, SMEs can experience a positive impact on their overall financial health. With improved cash flow, these enterprises can allocate more resources toward innovation, skill development, and technology advancements. As a result, businesses can remain relevant in a rapidly evolving market landscape and ensure competitiveness against larger counterparts. In tight market conditions, access to finance through SCF allows SMEs to respond effectively to supply chain disruptions, addressing potential risks before they escalate. Moreover, as businesses grow, their reliance on established credit lines may diminish, allowing for greater independence in financial management. SCF also promotes transparency and communication within the supply chain, leveraging technology to facilitate real-time tracking of transactions and payments. This can lead to improved financial forecasting, enabling better decision-making based on accurate data. As SCF evolves, it extends opportunities to include digital platforms that support SMEs in establishing credibility and trust with financial institutions. By enhancing these relationships, SMEs can obtain more favorable lending conditions and products, driving overall economic growth.

Benefits of Supply Chain Finance for SMEs

The benefits of supply chain finance for small and medium enterprises (SMEs) extend beyond improved cash flow. Enhanced collaboration between partners can lead to reductions in operational costs, allowing SMEs to focus on core business activities. SCF provides a structured framework that enables businesses to access funding swiftly, promoting overall operational efficiency. Additionally, improved liquidity helps SMEs to take advantage of early payment discounts, positively impacting their bottom line. By engaging in SCF, small and medium enterprises can strengthen their negotiating power when dealing with suppliers, establishing long-lasting relationships built on mutual benefit. This powerful mix can lead to better market position, securing essential resources at competitive pricing. Furthermore, consistent cash flow provided by SCF allows SMEs to invest in marketing initiatives, boost customer outreach, and innovate product development. As a result, SMEs can adapt to consumer needs faster than ever before. Establishing a robust SCF strategy aligns financial goals with operational objectives, transforming SMEs into agile competitors in their industries. By prioritizing SCF practices, SMEs pave the way for sustainable growth that enhances their economic contributions.

The key to successful implementation of supply chain finance lies in the collaboration between all stakeholders within the supply chain. SMEs must establish clear communication channels with suppliers and financial institutions to foster an environment of trust and transparency. This involves sharing relevant data to make informed decisions and optimize financial strategies. By embracing collaboration, businesses can create a more resilient supply chain capable of withstanding market fluctuations. Financial technology has revolutionized SCF strategies, enabling real-time monitoring of transactions and cash flow changes. These advancements provide SMEs with the tools they need to enhance operational efficiency and streamline their processes. As digital solutions become commonplace, SMEs can access valuable insights into market trends and fluctuations, allowing for more strategic decision-making. Adopting such technologies can place SMEs ahead of competitors who may still rely on traditional methods. Furthermore, the impact of the COVID-19 pandemic has highlighted the importance of a robust supply chain finance framework. Many SMEs have leveraged SCF to weather the storm and maintain business continuity, showcasing the necessity of adaptability in these challenging times.

Challenges to Consider

Despite the benefits of supply chain finance for SMEs, certain challenges must be considered for successful implementation. One primary concern is the ability to integrate SCF solutions within existing business operations. SMEs often lack the necessary resources or expertise, which can hinder the adoption process. Additionally, some suppliers may be hesitant to participate in SCF programs due to concerns over fees or risks associated with financial partnerships. Educating stakeholders about the advantages and long-term benefits of SCF is crucial to overcoming these hurdles. SMEs should work closely with financial institutions to develop tailored SCF solutions that address specific needs and concerns. Another challenge lies in maintaining sufficient data security while dealing with sensitive transaction information. Trust must be established among all stakeholders to ensure they feel confident sharing vital information. To address these challenges, SMEs should invest in training programs that enhance the understanding of supply chain finance. This promotes an entrepreneurial mindset, enabling SMEs to leverage SCF effectively for growth. Aligning SCF strategies with industry trends can also aid SMEs in navigating complexities while achieving sustainable results.

As supply chain finance continues to evolve, it presents valuable opportunities for small and medium enterprises to enhance their financial health and competitiveness. The importance of fostering strong relationships between SMEs, suppliers, and financial institutions cannot be overstated. Building trust among stakeholders leads to better collaboration, setting the stage for successful SCF implementation. As more businesses recognize the potential of SCF, they contribute to reshaping the landscape for SMEs. Governments and industry organizations can play a pivotal role in facilitating access to SCF programs through supportive policies and initiatives. Encouraging partnerships between financial institutions and SMEs can lead to innovative financing solutions that drive growth. Additionally, as technology improves, so do analytics capabilities, allowing SMEs to make better-informed decisions regarding their supply chain strategies. Through strategic investments in SCF and adopting technology-driven approaches, SMEs can not only thrive but also chart a path toward long-term success. Ultimately, embracing supply chain finance fosters a thriving ecosystem, enabling small and medium enterprises to contribute significantly to economic growth and stability across various sectors.

The Future of Supply Chain Finance

Looking ahead, the future of supply chain finance is bright for small and medium enterprises. With advancements in technology and data analytics, SCF solutions will become increasingly tailored to meet the unique needs of businesses. Innovations such as blockchain technology offer enhanced transparency and security within transactions, ensuring timely payments and reducing the risk of fraud. This technological evolution will also allow SMEs to engage in more effective credit assessments, improving their likelihood of accessing favorable financial terms. As sustainability becomes a critical focus for many industries, SCF can integrate environmental, social, and governance (ESG) factors to promote ethical practices in supply chains. SMEs can benefit from adopting solutions supporting sustainability initiatives while enhancing their market appeal. Moreover, as the awareness of SCF continues to grow, various stakeholders will recognize its significance in fostering resilient supply chains capable of adapting to global challenges. The role that supply chain finance plays in shaping the future of commerce cannot be underestimated. Supply chain finance will ultimately empower small and medium enterprises to excel and adapt in an ever-changing business environment.