Cross-border Inflation Comparisons: Challenges and Insights

Understanding inflation on a global scale is essential for investors, central banks, and policymakers. It involves analyzing varied metrics and indicators that reveal how prices change across different economies. Cross-border inflation comparisons can provide unique insights into global trends, enabling better investment decisions and fostering economic cooperation. However, this also poses significant challenges linked to the complexity of exchange rates, local policies, and different statistical methods adopted by countries. These factors can lead to misleading interpretations and difficulty in making direct comparisons. Moreover, inflation data is requested by various entities, from governments to international organizations. These differences complicate obtaining consistent and reliable data that supports fair evaluations. For example, the adoption of diverse methods of data collection can further complicate comparisons. A deeper understanding of these elements can facilitate investment strategies more geared towards the global outlook. Analysts need to navigate political implications and economic environments, which often have different effects on inflation trends. Therefore, achieving reliable comparisons necessitates a nuanced approach that considers local contexts while aiming for a comprehensive understanding of global inflation dynamics.

The disparate economic conditions lead to varying inflation rates across regions, making cross-border comparisons vital in understanding implications for trade and investment. Different countries exhibit distinctive inflationary pressures driven by unique factors, including supply chain disruptions, energy prices, and monetary policy decisions. Consequently, international trade agreements can be influenced by disparities in inflation. For instance, countries experiencing higher inflation may see their exports become more competitive, while others might struggle with economic stability. These dynamics suggest that assessing inflation trends requires not only quantitative metrics, but also qualitative analyses that capture the local economic climate. The influence of global events, such as pandemics and geopolitical tensions, must also be considered in any comparison. Furthermore, inflation data often lag, complicating timely responses from policymakers. This creates a scenario where understanding comparative inflation metrics becomes essential for global economic forecasting. Proper interpretation of cross-border data can provide crucial insights into how inflation impacts purchasing power and economic competitiveness. Thus, a collaborative approach between nations may enhance the accuracy of inflation assessments, ensuring that both local and global perspectives are integrated effectively in inflation-related discussions.

The Role of Statistical Methods

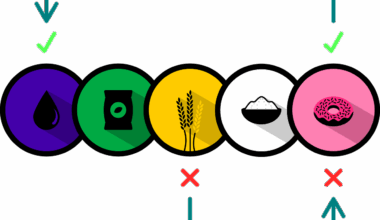

Statistical methods play a crucial role in analyzing and comparing inflation across countries. Different methodologies used by national statistical agencies can lead to significant variations in reported inflation rates. Countries may choose different basket items regarding Consumer Price Index (CPI) calculations, introducing discrepancies in results. Some nations might apply seasonal adjustments while others prefer raw data, thus altering figures profoundly. Understanding these methodologies can help analysts interpret data correctly and avoid pitfalls. Additionally, discrepancies in data frequency can affect how quickly governments respond to inflationary pressures. A country reporting monthly data compared to another’s quarterly can result in differing assessments of inflation trends, impacting economic strategies. Using consistent methodologies is critical for making cross-border comparisons reliable. Analysts must consider how international standards suggested by institutions such as the International Monetary Fund (IMF) overlap with local practices. It might be prudent to establish more standardized reporting practices, ensuring that all countries follow similar guidelines for inflation reporting. Thus, adopting a unified methodology can enhance the clarity of cross-border inflation comparisons and foster productive discussions between nations regarding economic conditions.

Another challenge in cross-border inflation comparisons is the impact of currency fluctuations on economic stability. Exchange rate volatility can distort inflation measurements, particularly for countries relying heavily on imports or exports. For instance, a depreciating currency may result in imported goods becoming significantly more expensive. Analysts must account for these changes when assessing inflationary impacts across countries. Additionally, the conversion of local currencies into a common denominator can introduce bias, affecting the interpretation of price changes. Countries employing different monetary policies can further exacerbate these issues as varying levels of interest rates can lead to different inflation trajectories. Thus, observers need to contextualize findings within the framework of the regional economic landscape. Analysts may adopt various adjustments to account for currency fluctuations, enhancing the transparency of their comparisons. Acquiring a deeper understanding of how local economic events and currency movements influence inflation can facilitate better investment decisions. Collaboration amongst central banks can also lead to more informed interpretations of inflation data, resulting in balanced reactions amidst global economic uncertainties. Such cooperative efforts can provide more stable conditions necessary for effectively managing inflation concerns.

Influence of Geopolitical Factors

Geopolitical factors significantly impact inflation, often making cross-border comparisons intricate due to the political climate. Political unrest can lead to abrupt changes in supply chains, causing inflation spikes in affected regions. Countries may also impose tariffs or trade restrictions, consequently affecting the pricing dynamics between nations. These events often lead to heightened uncertainty regarding future inflation, necessitating a comprehensive analysis of global events when interpreting inflation data. Moreover, countries with significant political instability may implement policies distorting economic indicators. In such cases, relying solely on statistics may not provide a full picture, as qualitative factors must also be considered. Analysts should be cautious of drawing conclusions without thoroughly examining the political context shaping inflation trends. One region’s inflation might not correlate with another’s due to these complex interdependencies. Consequently, observers need to incorporate geopolitical analyses that explain underlying causes of price changes when comparing inflation. Recognizing how political factors intertwine with economic fluctuations can help form a more complete understanding of inflation across borders. Establishing a clearer dialogue on geopolitical implications may pave the way for better cooperative economic strategies among nations.

Consumer expectations also significantly influence inflation trends, making it imperative to account for them in cross-border comparisons. When consumers expect prices to rise, their spending behaviors can accelerate demand, ultimately leading to an actual increase in inflation. This aspect emphasizes the importance of psychological factors in economic assessments, which can vary markedly across cultures and societies. Consequently, understanding how consumer sentiment shifts in different regions can shed light on inflation dynamics. Tracking consumer confidence can provide analysts with insights to gauge potential inflationary pressures. Countries with strong economic fundamentals may display differing inflation expectations compared to potentially weak states, leading to contrasting outcomes. Thus, monitoring these expectations is crucial in forming accurate comparisons. Regulating bodies play a vital role in managing expectations through appropriate communication and monetary policy measures, shaping consumer behavior over time. This interrelation between baseline consumer expectations and inflation underscores the importance of analyzing qualitative insights alongside quantitative data. By incorporating these elements, assessments of cross-border inflation comparisons will become more robust and reliable, ultimately aiding investments on a global scale.

Towards Improved Data Collection

Improving data collection methods can enhance the accuracy of cross-border inflation comparisons. Adopting technology allows for more efficient gathering and processing of inflation data. Digital surveillance tools and big data analytics provide real-time insights, essential in rapidly changing economic climates. Collaborations between countries can also facilitate better practices for data sharing, creating a network of reliable information sources. Standardizing inflation measurement frameworks will allow for further consolidation of data, leading to meaningful comparisons over time. Furthermore, training programs for statisticians and data analysts can improve the quality of inflation metrics collected by various nations, enhancing their relevance. Prioritizing transparency in data reporting can help re-establish trust in inflation metrics, encouraging better interpretation. Analysts should advocate for comprehensive approaches that consider diverse aspects of consumer spending while grasping national particularities. Addressing variations in statistical methodologies can bolster mutual understanding between countries. Educational initiatives can strengthen the collaborations necessary to ensure consistent data collection practices across borders. Ultimately, a unified approach towards data collection will facilitate enhanced and more reliable inflation comparisons, supporting stable economic strategies worldwide.

In conclusion, while cross-border inflation comparisons present their fair share of complexities and challenges, a focused approach can yield significant insights. By addressing the importance of statistical methods, geopolitical influences, consumer expectations, and improved data collection, countries can enhance their understanding of global inflation dynamics. Investments made with these insights will be informed and potentially more profitable. Bidirectional communication among nations regarding inflation will facilitate shared learning and allow for better cooperative securities in the future. Progress in harmonizing methodologies will create a more transparent landscape for inter-country inflation comparisons. Awareness and adaptation to local contexts will strengthen the credibility of analyses conducted. As globalization expands, so does the necessity for reliable information that transcends borders to inform policymakers and investors alike. Tackling each of these challenges will lead to better-informed decisions that consider both local and global landscapes, creating a more connected economic future. The road ahead may be challenging, yet embracing collaboration can lead to an invaluable understanding of inflation worldwide.