Mobile Payment SDKs: Choosing the Right One for Your App

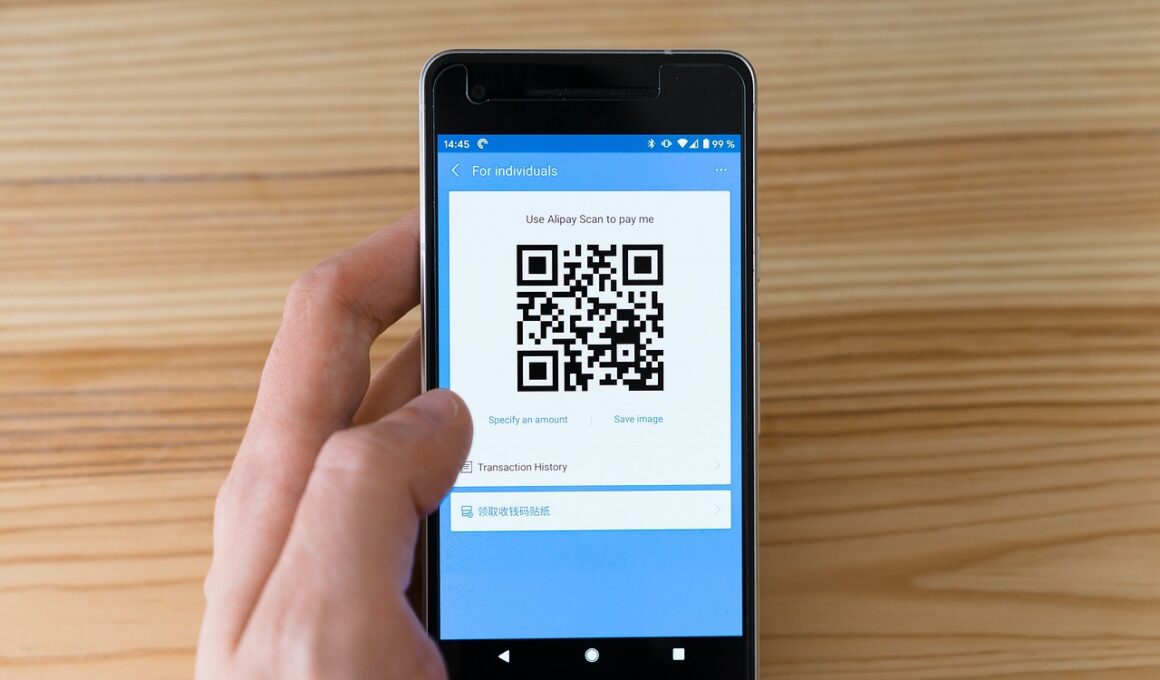

As mobile app development continues to thrive, selecting the right mobile payment SDK becomes crucial for both user satisfaction and business safety. Integrating a seamless and efficient payment solution is vital for retaining customers and boosting conversion rates. An effective mobile payment SDK must be compatible with various platforms, be secure, and provide a positive user experience. The ability to accept multiple payment methods such as credit cards, digital wallets, and cryptocurrencies enhances flexibility. Developers should prioritize an SDK that offers extensive documentation, customer support, and a user-friendly interface. Consideration of transaction fees and withdrawal limits is also essential to ensure profitability. Furthermore, proper integration of the SDK to your app can influence the overall performance, making it imperative to choose wisely. Popular SDK options include Stripe, PayPal, and Braintree, each offering unique features. Evaluating these options involves examining their pros and cons thoroughly to ensure a perfect fit for your app’s requirements and goals. Investing time in research ensures that you not only enhance your app’s functionality but also ensure user trust and satisfaction.

In-app payments have transformed how users transact, creating a necessity for developers to implement efficient solutions. The right mobile payment SDK can significantly enhance the app features and improve user engagement. Enhanced security measures such as encryption and compliance with regulations like PCI DSS ensure that users’ data is protected during transactions. Furthermore, it is vital to consider the user experience when integrating a payment SDK; complex processes can lead to cart abandonment and lower conversion rates. SDKs that allow for customizable payment interfaces can significantly enhance how users perceive the app’s value. Coupling ease of use with robust security and customer support creates a favorable environment for transactions. It’s advisable to review user testimonials regarding specific SDKs to learn about other developers’ experiences. Such insights offer practical knowledge and can guide decisions on the best SDK suited to your app’s specific needs. Developers must also evaluate the long-term implications of their payments solutions, weighing current trends against scalability. The choice of an appropriate SDK can dictate the success of an app in a competitive marketplace, making thoughtful consideration essential.

Evaluating Features and Functionality

When assessing mobile payment SDKs, evaluating their features and functionality is paramount. Consider aspects such as integration methods, fraud detection tools, and support for various currencies and payment types. A comprehensive SDK often includes APIs that enable developers to customize their payment solutions without compromising security. Moreover, transaction processing speed can make or break user experiences; customers prefer instant transactions over prolonged waits. A mobile payment SDK with real-time reporting capabilities can provide valuable insights into user behaviors and transaction trends. These features, combined with analytics, can guide future enhancements to the app. Ensure that the SDK offers efficient customer support to address technical challenges promptly, as delays can cause dissatisfaction. Security should never be an afterthought; with the rise of online fraud, SDKs must utilize advanced encryption and tokenization methods. Furthermore, understanding the fee structure associated with the SDK helps in budgeting and pricing strategies. Developers should prioritize SDKs that provide transparent information regarding potential costs, ensuring no hidden fees arise. These strategic evaluations lead to informed decisions, promoting sustainable business growth.

Another critical aspect to consider is compatibility across different devices and operating systems. A versatile mobile payment SDK should function seamlessly on both iOS and Android platforms, adapting to various screen sizes and resolutions. User interfaces must also be intuitive, guiding users through the payment process efficiently. Rigorous testing across devices ensures that potential bugs and inconsistencies are identified and rectified before launch. Additionally, the payment paths provided by the SDK need to be clear and concise, as lengthy processes can frustrate users. Aiming for a smooth transaction process contributes significantly to positive app reviews and consistent user engagement. Highlighting various payment methods, including mobile wallets like Apple Pay or Google Pay, expands user options and can cater to diverse audiences. Moreover, consider the integrated marketing tools provided by some SDKs, enabling promotional offers and rewards. Such features can incentivize users to complete transactions, increasing sales opportunities. Gaining insights through user feedback on the payment experience can further foster iterative development, enhancing satisfaction and loyalty.

Cost Comparison and Budgeting

Budgeting for a mobile payment SDK is essential for financial planning within the development process. Different SDKs present varying fee structures, including transaction fees and monthly subscription costs. A thorough cost-benefit analysis can aid developers in understanding the long-term financial implications of their choices. This evaluation should also consider scalability, as businesses often grow, demanding more robust payment solutions. Startups might prefer cost-effective solutions that offer essential features without overwhelming expenditures. However, established businesses may require feature-rich SDKs capable of handling high volumes of transactions effortlessly. Keeping abreast of changing market conditions and competition can also influence pricing strategies. Additionally, evaluating the return on investment (ROI) is crucial; the right SDK should not only save costs in the long run but also enhance operational efficiency. Gathering user data through the payment process can provide insights that help in making informed budgeting decisions. Therefore, staying informed about market trends enables businesses to adapt to changes in demand and pricing, ensuring competitiveness and profitability.

Adopting a payment SDK may also compel developers to maintain compliance with relevant regulations. Understanding various compliance frameworks is essential to avoid legal issues and maintain customer trust. Payment processing regulations can vary significantly between regions, necessitating a sound knowledge of local laws. The SDK selection process should include consideration of how well a provider conforms to these standards. Well-established SDK providers often offer resources or guidelines to assist developers with the compliance process. Implementing systems that audit compliance and security measures within your app can ensure ongoing adherence to regulations. Moreover, finding an SDK with strong industry reputation reduces risks associated with payment processing. Developers should be able to count on their provider for not just technological support, but also for insight on regulatory compliance updates. Staying ahead of legal complexities can safeguard a business from costly penalties and enhance its credibility in the eyes of users. Therefore, compliance is not merely a consideration but a foundational aspect that positively impacts user relationships.

Future Trends in Mobile Payments

Keeping an eye on future trends in mobile payments can inform your SDK choice as well. Emerging technologies such as artificial intelligence and machine learning are increasingly becoming integral to payment solutions. These innovations allow for personalized user experiences and enhanced fraud detection mechanisms. Developers should consider SDKs that are flexible enough to incorporate these cutting-edge technologies. Moreover, the rise of blockchain technology offers innovative payment options that enhance security and transparency. While traditional methods remain prevalent, users are progressively adapting to these advanced solutions. An SDK that supports various payment forms, including cryptocurrency, positions an app to meet evolving consumer preferences. Additionally, mobile payment solutions are increasingly interlinked with loyalty programs and rewards mechanisms to foster user retention. Frequent updates to the SDK enable developers to address changing needs promptly while maintaining cutting-edge functionality. Lastly, as consumers become more digitally savvy, their expectations for seamlessness and efficiency in payment solutions also heighten. Consequently, choosing the right SDK now will ensure your app remains relevant and competitive through adapting to future advancements.

To summarize, selecting the right mobile payment SDK is a critical process influencing your app’s success and user satisfaction. Assessing different SDKs based on features, compatibility, security, and transaction fees will guide you towards an informed decision. Additionally, aligning your payment solution with future trends while considering compliance requirements keeps your app ahead in an ever-changing digital landscape. With enhanced focus on user experience and financial planning, developers have ample opportunity to create apps that resonate with users effectively. The integration of an efficient payment SDK fosters valuable relationships with your customers, promoting loyalty and long-term engagement. Meticulously researching options ensures the selection aligns with business goals, enhancing productivity and profitability. Furthermore, the ability to innovate while retaining a strong emphasis on user security will distinguish successful apps from their competition. By maintaining adaptability, your app can flourish in a fast-paced environment rich with opportunity. As digital payments continue to evolve, embracing the right tools becomes paramount to your app’s long-term innovation and user satisfaction.