How Panic Selling Affects Market Stability

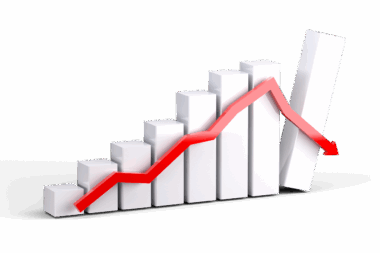

Panic selling is a phenomenon that can ripple through financial markets, creating instability. When investors fear significant losses, they often rush to sell their assets to prevent further damage to their portfolios. This behavior is psychologically driven, rooted in emotional reactions rather than rational analyses. As more investors succumb to panic, the volume of sell orders increases, leading to a plummet in stock prices. Market sentiment, heavily influenced by news and social media, plays a crucial role during these periods. When people observe others selling, they may feel compelled to do the same, resulting in a herd mentality that exacerbates market declines. Understanding this pattern is critical as it highlights the vulnerability of markets to psychological factors. Effective risk management strategies must account for these emotional behaviors to maintain market balance. Additionally, financial professionals often need to devise responses to restore investor confidence. Education about market psychology and its impact on decision-making can mitigate panic selling and sustain more stable market environments in the future. Developing a robust understanding of these dynamics can empower investors to act cautiously during volatile periods.

Aside from the immediate impact on prices, panic selling has long-term consequences for market stability. When markets experience sharp declines, the fallout can lead to increased volatility and prolonged bearish trends. These consequences can generate a lack of investor confidence, causing individuals to withdraw from investing altogether. The unpredictability arising from panic-induced sell-offs challenges the overall functionality and effectiveness of financial markets. Furthermore, this phenomenon can create an illusory perception of risk, prompting asset mispricing on a broader scale. During periods of panic, even fundamentally sound companies may witness their stocks plunge unfairly. Investors who engage in thoughtful analysis can uncover these opportunities if they remain undeterred by market fluctuations. However, widespread panic can cloud judgment, discouraging rational decision-making and compelling investors to lock in losses. Educating market participants about the effects of panic selling plays a vital role in fostering resilience against irrational behavior. By promoting awareness of psychological factors, investors can better navigate their emotional responses during uncertain periods. Understanding these underlying challenges is essential for maintaining a balanced market atmosphere conducive to informed trading and investment practices.

The Role of Media in Panic Selling

The media contributes significantly to shaping market expectations and can significantly exacerbate panic selling. Sensational headlines and news coverage can trigger emotional responses among investors and fuel fear of losing money. The role of social media cannot be overlooked, as it allows information to spread rapidly, often amplifying panic. False or exaggerated reports can lead to hasty decisions and further exacerbate market declines. Investors must critically evaluate the sources they rely on for information to mitigate panic-induced reactions. Maintaining awareness of the impacts of media narratives can help default to more rational decision-making rather than emotional responses. Responsible reporting and balanced coverage are essential in curtailing panic selling situations. Financial literacy campaigns can also counter these adverse media effects by equipping investors with skills to differentiate between credible information and sensationalist noise. This preparedness empowers individuals to stay informed, reducing the likelihood of being swayed by volatile narratives. Moreover, fostering a culture of thoughtful engagement with market data can lead to better overall market health. Education rooted in practical applications can strengthen investor resilience amid fluctuating market sentiments, ultimately contributing to greater stability.

Institutional investors play a crucial role during panic selling episodes. Their actions can either help stabilize the market or further contribute to the chaos. If large institutions decide to sell off assets, it can lead to significant market drops, amplifying panic. However, when these entities take a more measured approach, they can help restore confidence. Buying opportunities during panic sells often arise when valuations of fundamentally strong companies fall below their intrinsic worth. Institutional investors are often better positioned to capitalize on these opportunities due to their capacity for long-term strategic thinking. However, they must also be cautious not to exacerbate spiraling situations with rapid sell-offs. Collaborative approaches among institutional investors can lead to moderate market behavior, aiding recovery. This collaborative spirit can restore investor confidence and create an environment for market healing. Active participation in market stabilization is not only responsible but can also lead to favorable outcomes for all participants. The balance of power between institutional and individual investors remains paramount in fostering healthy market dynamics. Engaging in responsible trading practices can contribute to a more resilient market climate even during challenging times.

Tactics to Mitigate Panic Selling

Mitigating panic selling involves adopting specific strategies that promote a healthier trading psychology. One crucial tactic is developing a well-defined investment plan that outlines short-term and long-term goals. This proactive approach can provide investors with a sense of direction, reducing emotional decision-making in times of stress. Furthermore, setting stop-loss orders can serve as an effective risk management tool, limiting potential losses and preventing hasty sell-offs. Regularly reviewing and adjusting portfolios can also help maintain stability, ensuring that investments align with recent market conditions and individual risk tolerance. Education about market history and cycles can bolster investor discipline, reinforcing the understanding that declines are often temporary. Seeking expert advice or using financial advisors may also help investors gain an objective perspective during emotional market periods. By cultivating emotional awareness, traders can develop healthier coping mechanisms and resist herd mentality. Moreover, participating in community forums focused on trading can foster sharing experiences and empathy among investors facing similar challenges. Building a supportive network can reinforce positive behaviors that promote resilient investment practices during turbulent market conditions.

Ultimately, understanding and addressing panic selling requires an extensive focus on behavioral finance principles. Investors must confront their biases and learn mechanisms to manage emotional responses effectively. Training in cognitive behavioral techniques can increase awareness of when emotions influence financial decisions, aiding individuals in making rational choices. Developing a mindset that embraces volatility can lead to enhanced resilience, enabling investors to view declines as opportunities for growth rather than threats. Market education and workshops centered on cognitive biases need to become more mainstream to alter perceptions effectively. Financial literacy efforts can emphasize the importance of patience and informed decision-making, especially during periods of elevated emotions. By comprehensively addressing market psychology, participants can gain confidence in their ability to withstand market fluctuations. A healthy perspective towards investing is fundamental for long-term success. Ultimately, more informed investors contribute to a stable marketplace, disrupting the cycle of fear and panic. Building a nurturing investment environment can only be achieved by empowering individual traders with the tools and knowledge needed to navigate emotional challenges confidently.

Conclusion: Building Resilience Against Panic Selling

In conclusion, panic selling profoundly affects market stability, driven by emotional and psychological factors. The impact of rapid sell-offs extends beyond immediate pricing effects, influencing long-term investor confidence and market functionality. Addressing this phenomenon involves understanding the role of media, institutional investors, and individual psychological responses. Implementing specific strategies to mitigate panic selling can foster a healthier financial ecosystem. By promoting education and awareness about market psychology, investors can make more informed decisions amid volatility. The emphasis on emotional management and fostering supportive networks is essential for building resilience in financial markets. Investment strategies that prioritize discipline and rationality can significantly contribute to enhanced market stability, ensuring that participants engage effectively even in turbulent times. The collective shift towards mindful trading practices will create an environment conducive to sustained financial growth. As we embrace these principles, we pave the way for a more resilient and balanced market landscape, one where panic selling becomes less frequent and impulsive actions are curtailed. Investors must commit to fostering a long-term perspective and embracing rational frameworks tailored for enduring success during evolving market conditions.

Understanding and addressing panic selling as a part of market psychology is crucial for the sustainable health of our financial system. Effective strategies need to be communicated and developed to withstand the pressures of emotional decision-making in trading. The interplay between market factors and psychological influences creates an exciting yet challenging landscape for investors. By committing to building emotional intelligence and resilience against panic selling, we provide ourselves with the tools and knowledge to navigate complexities. This proactive approach will ultimately lead to greater stability and improved outcomes for all market participants, reinforcing a cooperative spirit that invigorates our financial ecosystem. Recognizing that panic selling is not just a failure of rational thought, but a symptom of larger emotional triggers, can enhance our comprehension. Engaging with practical strategies to counteract these emotional impulses will lead to an overall more informed investing community. The future of our financial markets relies on our ability to act judiciously amidst the noise. Ultimately, fostering a culture of patience, responsibility, and discipline is essential for sustainability. With these principles in mind, investors can lay the groundwork for a secure and profitable bridge towards lasting financial success.