Financial Stress Among Different Demographics: A Behavioral Perspective

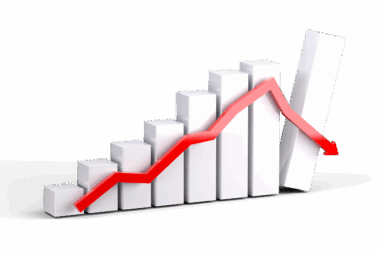

Financial stress significantly affects individuals across various demographic groups, manifesting in diverse coping mechanisms. In understanding this stress, we recognize that factors such as age, gender, and economic background play vital roles. Young adults often experience heightened pressure due to educational loans, job insecurity, and the impact of social media on their financial expectations. Conversely, older adults may grapple with retirement savings, healthcare costs, and the fear of financial instability as they age. Studies indicate that women are more likely than men to experience financial anxiety, attributed to wage gaps and career interruptions for caregiving roles. This demographic insight emphasizes the necessity of tailored interventions that consider these differences in experiences and coping styles. Effective coping strategies can vary widely, from seeking support to employing financial planning resources. Understanding the behavioral tendencies in financial stress across demographics allows for better-targeted solutions, fostering resilience and empowerment. Therefore, awareness around these variations is crucial for developing effective programs that help manage financial stress universally, leading to healthier financial behaviors and improved well-being, ultimately enhancing quality of life for individuals facing financial challenges in their respective demographic contexts.

Demographic variations in financial stress are evident through multiple studies highlighting distinct coping mechanisms. Among younger groups, impulsivity in spending often leads to a cycle of stress. They may prioritize short-term gratification despite long-term consequences. This demographic frequently resorts to social media for validation, leading to increasing financial pressure when they compare themselves with their peers. In contrast, older adults often take a more conservative approach, focusing on risk aversion and long-term financial security. They tend to engage in thorough financial planning, actively seeking to understand their economic limitations. Moreover, cultural factors can significantly influence coping styles; individuals from collectivist cultures might rely more on family support, while those from individualistic backgrounds may encourage personal financial responsibility. Financial literacy also varies by demographic, shaping how individuals understand and tackle their financial situations. Programs aimed at increasing financial literacy are vital, especially among demographics most vulnerable to financial stress. By promoting bilateral understanding of financial literacy and its implications on behavior, we can better assist individuals in effectively managing their financial stressors and enhance their overall financial health, contributing positively to their emotional and psychological well-being.

Exploring Coping Mechanisms

Coping mechanisms for managing financial stress differ widely across demographic lines. Many respond through emotional coping strategies, which can include denial, avoidance, or seeking social support. Younger individuals are more prone to denial, often ignoring their financial situations until they become urgent. This can lead to feelings of hopelessness and anxiety, perpetuating the stress cycle. On the other end, older adults frequently employ problem-focused strategies, such as budgeting and financial planning, allowing them to confront difficulties head-on. They may consult financial advisors or rely on established family practices to navigate uncertainties. Moreover, the role of education cannot be understated; higher levels of financial education correlate with more adaptive coping strategies. Individuals with better financial knowledge tend to analyze their situations calmly, utilizing systematic problem-solving techniques. In this regard, community resources play an essential role, offering workshops and tools to bolster financial literacy. Targeted programs can help bridge educational gaps, empowering various demographics to create sustainable coping mechanisms. Addressing financial stress through supportive community measures not only mitigates anxiety but also fosters a culture of healthy financial habits and proactive approaches in managing personal finances across all demographics.

The psychological toll of financial stress cannot be overstated, impacting not only one’s financial decisions but also mental health. Studies have shown that prolonged financial strain can lead to anxiety, depression, and overall decreased quality of life. Individuals struggling with financial stress often exhibit difficulties in focusing, affecting work performance and personal relationships. Younger people are particularly vulnerable, as their formative years are marked by experiences like student loan debt and job insecurity. Their coping methods, which often involve temporary relief through spending or escapism, can lead to deeper issues over time. Older adults, however, face financial pressures intensified by retirement concerns and chronic health conditions. They may feel isolated due to the stigma around financial struggles, hiding their issues, which can worsen their mental state. Addressing these psychological consequences requires holistic approaches that integrate mental health support within financial planning. Solutions like counseling and peer support groups can help mitigate these stressors. By combining financial education with mental health resources, individuals across different demographics can develop stronger coping strategies, enhancing resilience and fostering healthier, more proactive approaches to managing financial stressors and improving overall well-being.

Community Support and Resources

Community support plays a crucial role in alleviating financial stress across different demographics. Initiatives that promote financial literacy empower individuals with knowledge and skills essential for sound financial management. Local workshops and online resources tailored to diverse community needs help impart essential budgeting strategies and saving techniques. Moreover, peer support groups can offer vital emotional backing, encouraging individuals to share their experiences and solutions. Diverse demographic groups benefit from these community-driven efforts, fostering connections that enhance coping mechanisms. For instance, young adults can engage in mentorship programs led by financial professionals who provide guidance tailored to their specific challenges. In contrast, older adults often access community centers offering resources for estate planning and retirement savings. These connections enable individuals to feel less isolated, creating a support network that mitigates feelings of shame or inadequacy. Developing community-based outreach programs specifically aimed at addressing financial stress is crucial for fostering resilience and empowerment. As individuals stabilize their financial situations, they not only experience decreased stress but also contribute positively to their communities. Therefore, investing in community resources can uplift entire demographics, leading to healthier financial cultures and improved overall well-being for all.

Financial stress presents distinct challenges but can also lead to personal growth and resilience. Implementing effective coping mechanisms requires a combination of community involvement and personal initiative. Younger individuals can find solace in learning from older generations, who have weathered similar storms. This intergenerational dialogue is vital, promoting shared wisdom and skills that foster adaptive coping strategies. Financial education initiatives should emphasize real-life skills such as budgeting, credit management, and savings techniques. A focus on experiential learning can equip younger individuals with practical tools alongside theoretical knowledge, bridging the gap between understanding and application. Additionally, addressing mental and emotional aspects of financial strain can encourage more holistic approaches to coping. For example, promoting mindfulness practices can help foster emotional health and better stress management related to finances. By incorporating psychological support alongside financial education programs, we create comprehensive systems that address both the emotional and practical dimensions of financial stress. This dual approach also encourages individuals to seek help proactively rather than reactively, reducing stigma associated with financial struggles. Ultimately, fostering resilience through education and support networks paves the way for healthier approaches to managing finances across demographics.

Future Directions in Behavioral Finance

The future of behavioral finance offers promising avenues for understanding and addressing financial stress among different demographics. As research continues to evolve, a greater emphasis on data analytics and behavioral insights can shape how we approach financial education. Tailored interventions based on demographic needs can improve resilience and coping strategies. Technology plays an increasingly essential role, as innovative digital platforms provide easy access to financial resources and guidance. For instance, apps designed for budgeting can be fine-tuned to appeal to young adults, while retirement planning tools can serve older populations. Furthermore, ongoing collaboration between psychologists and financial experts can amplify our understanding of the emotional dimensions linked to financial decision-making. Personalized financial coaching offers direct support that accounts for unique demographics. Evaluating the impact of various strategies on different groups will help create more inclusive financial environments. This collaborative approach underscores the significance of understanding behavioral context when developing solutions for financial stress. Ultimately, advancing behavioral finance with a focus on individual experiences fosters a culture of financial empowerment, better preparing individuals for the complexities of modern financial landscapes as they navigate their personal and collective financial futures.

In conclusion, understanding financial stress through a behavioral finance lens reveals the complexity of individual experiences influenced by demographics. Various groups face unique challenges that shape their coping mechanisms and stress responses. The role of community support and financial education is vital in helping individuals develop their skills, enhancing resilience. As we advance in our efforts to mitigate financial stress, it is essential to consider mental health alongside financial education, forming a holistic framework for managing stress. The future of behavioral finance holds promise through innovative technologies and collaborative strategies that empower diverse populations. By striving for increased financial literacy and tailored programs, we can build healthier financial habits across demographics. Closing the gaps in financial understanding and support within our communities fosters not only individual resilience but strengthens the societal fabric as well. Encouraging open discussions about financial struggles can help reduce stigma and foster a culture of solidarity. Therefore, investing in these resources and approaches is crucial for enhancing the well-being of individuals and communities. By proactively addressing these issues, we contribute to a more educated and financially resilient society ready to tackle the challenges of the modern world.