How to Plan Charitable Gifts to Maximize Tax Efficiency Over Time

Planning charitable giving is essential for maximizing tax efficiency. When considering charitable donations, one should evaluate the impact of these gifts on overall tax liability. Timing is vital; making donations during high-income years can yield a more significant tax deduction. One of the best ways to plan is by utilizing donor-advised funds, which allow individuals to contribute assets and receive an immediate tax break while recommending grants over time. Coupled with a strategic assessment of personal finances, this ensures that charitable giving aligns with long-term financial goals. Furthermore, maintaining records of donations is critical for tax reporting. Engaging a financial advisor can also provide tailored strategies that suit unique financial situations. Moreover, make sure to understand the specific tax laws surrounding charitable giving, as regulations can differ from state to state, affecting total deductibility. Investigating various charitable organizations is also advisable to ensure funds go to reputable causes, thereby maximizing both impact and tax benefits. Finally, reviewing and adjusting your charitable strategy annually can ensure you stay on track with your financial goals and philanthropic desires.

Prioritizing tax-efficient charitable giving also involves utilizing appreciated assets. Donating appreciated assets such as stocks or real estate can enable individuals to avoid capital gains tax while enjoying an income tax deduction for the full market value of the asset. This strategy not only provides higher deductions but also supports valuable charities. To implement this, donors need to be aware of the rules regarding valuation and ensure they provide proper documentation. Donor-Advised Funds (DAFs) continue to be a popular tool for this purpose, as they can hold both cash and appreciated assets, providing flexibility in how and when funds will be distributed. Additionally, understanding the limits placed on charitable contributions is crucial. For instance, individuals can typically deduct contributions of 50% of their adjusted gross income (AGI) for cash gifts, while the limit may be lower for other types of donations. Thus, spreading charitable contributions over multiple years might be more beneficial. As a result, integrating your tax strategy with your philanthropic vision can significantly impact both tax savings and community support.

Using Estate Planning for Charitable Contributions

Integrating charitable giving into estate planning is a vital strategy for maximizing tax efficiency. Individuals can reduce their estate tax burden by incorporating charitable gifts into their wills or trusts. By allocating a portion of the estate to charity, individuals can claim an estate tax deduction, benefiting both the charity and themselves. Specifically, using charitable bequests can bypass the tax implications that typically accompany inheritance, benefiting heirs. Additionally, charitable remainder trusts allow donors to enjoy income from an asset during their lifetime while transferring the remainder to a charity after death. This not only creates immediate tax deductions during the donor’s life but also satisfies philanthropic desires. It is essential to establish clear terms and ensure beneficiaries understand how it aligns with their financial plans. Working closely with an attorney experienced in tax and estate planning can facilitate this process, ensuring compliance with laws and regulations. Engaging professional financial advisors can also yield strategies to earmark funds or assets for charity while maintaining financial stability. Hence, charitable giving must also be thoughtfully integrated into overall estate planning.

Ensuring that the chosen charity aligns with personal values is equally important. It is advisable to research potential charities thoroughly, examining their impact, efficiency, and financial health. Tools and resources like Charity Navigator or Guidestar can provide assessments of charitable organizations, helping donors make informed decisions. Understanding a charity’s mission and how funds will be utilized strengthens the connections between donors and recipients. Additionally, considering supporting local charities can yield tangible community benefits while fulfilling personal charitable goals. Being aware of the charitable needs within one’s community allows for more personalized giving. Furthermore, incorporating volunteer work can enhance one’s philanthropic experience, creating a personal connection to the cause. Engaging with charities through volunteering also provides insight into their operations, ensuring that contributions genuinely support their mission. Moreover, storytelling from charities about how funds are used can inspire further support, showing the impact of generosity. Ultimately, the goal of charitable giving should align both with tax efficiency and a heartfelt desire to support meaningful causes.

Understanding the Tax Implications of Charitable Giving

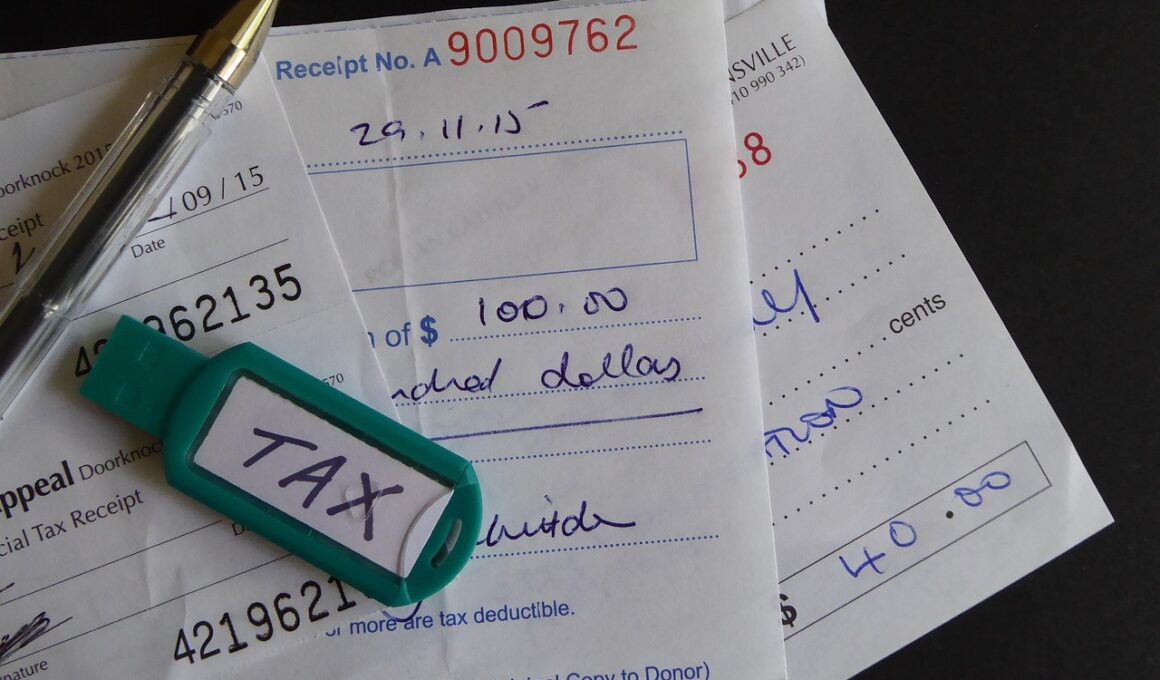

Furthermore, it’s crucial to understand the tax implications and reporting requirements associated with charitable donations. Keeping thorough records of all donations and their valuations is vital for substantiating claims on tax returns. The IRS requires specific documentation for contributions, depending on the donation amount; cash donations over $250 must be substantiated with a written acknowledgment from the charity. Familiarizing oneself with these rules can prevent potential issues during tax filing and ensure compliance. Additionally, tax benefits can potentially vary based on the type of donation made, such as cash, property, or services. Donors should also be mindful of the importance of timing. Maximizing the tax deduction generally requires contributions to be made by December 31st of the tax year. Therefore, planning gifts earlier in the year can ease this process and avoid last-minute contributions that may disrupt record-keeping. Engaging a tax advisor can provide assistance in strategizing around charitable contributions triggered by specific life events such as retirement or inheritance. Situations like these present ideal moments for planning larger donations and capitalizing on unique tax opportunities.

In addition, syncing charitable giving plans with retirement accounts can enhance tax efficiency. Charitable rollovers from retirement accounts, like IRAs, allow taxpayers over 70½ to transfer funds directly to charities, avoiding income tax. This strategy benefits both individuals and charitable organizations, enabling large tax-free contributions. Furthermore, it’s essential to consider the overall giving strategy, including planned giving. Donation strategies such as installment gifts or lump-sum donations can yield different tax benefits and should be assessed based on personal circumstances. It’s necessary to determine how these contributions affect Adjusted Gross Income (AGI), as fluctuations in AGI can influence the deductibility of future donations. To maximize tax efficiency, engaging in discussions with tax professionals about optimizing donation strategies aligns well with personal financial goals. This cooperative approach ensures that charitable giving continues to fulfill both philanthropic and financial objectives. Overall, managing charitable donations efficiently will require balancing tax strategies with genuine support for the chosen causes, aiding in long-term financial and social goals.

Conclusion: A Holistic Approach to Charitable Giving

In conclusion, planning charitable gifts requires a holistic approach that integrates tax efficiency, personal values, and financial strategy. The process should start with a set of clear goals, evaluating what types of support matter most personally and to the community. Through strategies like donor-advised funds, appreciated assets, and estate planning, one can significantly lower tax burdens while making impactful contributions. Consistently reviewing and adapting this plan ensures alignment with changing financial landscapes or personal circumstances. Additionally, staying informed comprehensively about the rules and regulations surrounding charitable contributions can facilitate smoother donation processes and avert potential tax pitfalls. Engaging charitable organizations through research and volunteer activities fosters a deeper understanding of their mission and operational integrity. Balancing financial efficacy with social purpose creates a rich philanthropic experience, driving support for meaningful causes over time. Therefore, by optimizing every aspect of charitable giving, individuals can ensure their contributions reflect both tax-smart strategies and heartfelt generosity. Maximizing the potential benefits from charitable giving enriches the donor’s life and significantly impacts society at large.

The journey towards maximizing tax efficiency while making charitable gifts is ongoing. Donors must remain vigilant and adaptable in their approach. Economic changes, shifts in tax laws, and evolving charitable needs necessitate a flexible mindset. By taking an informed, strategic, and values-driven approach to charitable giving, individuals can navigate through complexities and achieve their philanthropic goals effectively. Ultimately, the powerful fusion of careful planning and motivated giving can lead to transformative effects on individuals and communities alike. Whether it’s supporting education, health, welfare, or any field, charitable gifts can create a legacy that lasts. Continuous education about the tax landscape will empower donors, ensuring they remain equipped to make informed decisions. Fund management and strategy must undergo regular evaluation to align both with changing tax codes and charitable missions. This way, individuals can ensure enduring impact while fostering a culture of giving. Each contribution, shaped by responsible planning and an intention to give back, contributes to societal betterment and individual satisfaction. Therefore, embracing this comprehensive approach will pave the way for rewarding charitable engagement and valuable tax outcomes.