Key Components of GAAP Financial Statements

Generally Accepted Accounting Principles (GAAP) serve as the framework for financial reporting in the United States. Companies adhere to these principles to promote transparency and consistency in financial statements. One key component of GAAP is the balance sheet, which provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. This document serves to assess a company’s financial health and liquidity. Another critical element is the income statement, which presents a summary of revenues and expenses over a specific period, highlighting profitability. This allows stakeholders to evaluate performance trends over time. GAAP also emphasizes the importance of the cash flow statement, which provides insights into cash inflows and outflows within a defined period. This statement is crucial for investors and creditors assessing liquidity risks. Furthermore, adherence to GAAP principles enhances comparability among financial statements across different companies. Investors rely on this standardization for informed decision-making. Understanding these key components is vital for stakeholders engaged in the financial analysis or investment processes as they provide a comprehensive view of a company’s financial performance.

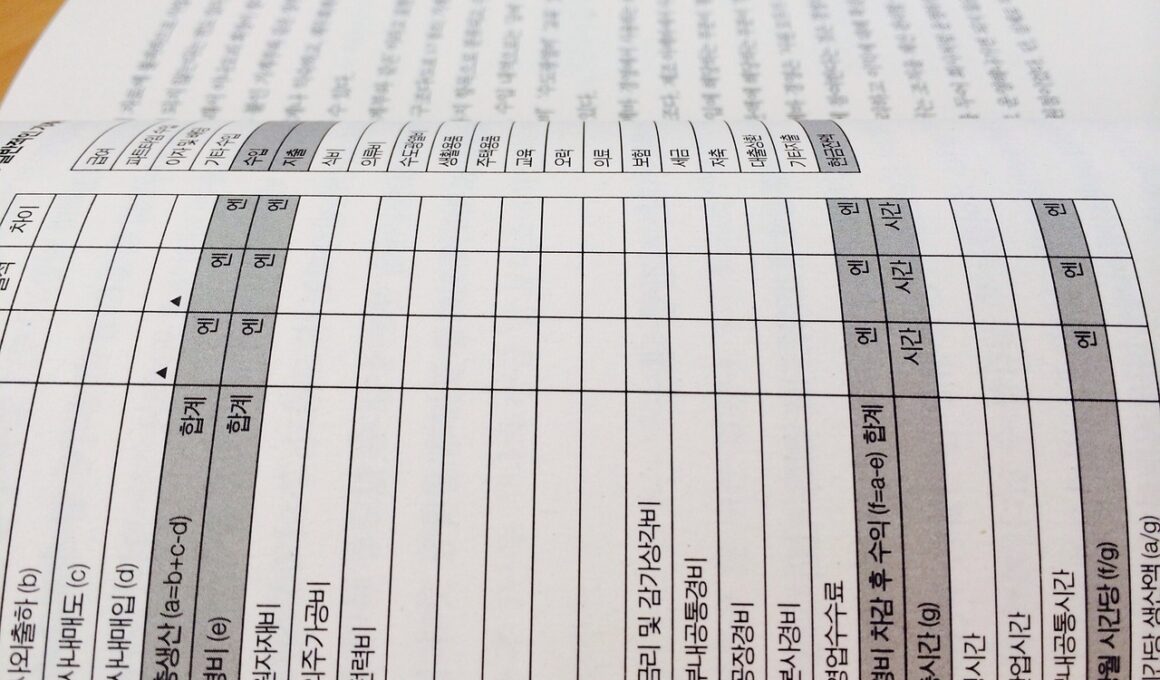

The Balance Sheet

The balance sheet is a cornerstone of a company’s financial statements under GAAP. It is formatted in a way that showcases all assets segregated into current and non-current categories. Current assets include cash, accounts receivable, and inventory expected to be converted into cash within a year. Non-current assets encompass property, plant, and intangible assets like patents. Liabilities follow, detailed into current liabilities, like accounts payable and long-term liabilities, including loans that extend beyond one year. This separation allows analysts to evaluate liquidity and long-term solvency separately. Both assets and liabilities must balance, as per the formula: Assets = Liabilities + Equity. This equation ensures that the resources owned by the company are financed either through borrowing or shareholders’ investments. Equity includes common stock, retained earnings, and additional paid-in capital. Understanding how these components interrelate helps users gauge a company’s operational efficiency and financial stability. Investors particularly focus on the working capital, which is the difference between current assets and current liabilities, as it indicates the short-term financial health of the business and its capacity to enlarge operational activities.

The income statement is another vital component of GAAP financial statements. It represents a detailed rundown of revenues generated and expenses incurred over a particular time frame, typically a quarter or a fiscal year. Revenues, often referred to as the top line, show the total income from sales of goods or services. Following this, expenses are subtracted to determine net income, often known as the bottom line. This net profit (or loss) showcases how effectively a company has managed its resources during the reporting period. Key metrics derived from the income statement include gross profit, operating income, and net income. Analysts and investors look at trends in these figures to evaluate growth potential and operational efficiency. Furthermore, operating expenses detail costs that are necessary for conducting business, while non-operating expenses include interest and taxes. Understanding the distinction between operating and non-operating components aids investors in assessing core operations separately from ancillary activities. This analysis enables stakeholders to make informed assessments regarding company performance and investment viability, highlighting areas where management can improve profitability.

The Cash Flow Statement

Another critical element of GAAP financial statements is the cash flow statement, which offers insights into the cash inflows and outflows of a business. This statement segments cash activities into three sections: operating, investing, and financing. Operating activities detail cash flows generated from core business operations, including receipts from customers and payments to suppliers. Investing activities include cash spent on acquiring or selling long-term assets, such as property and equipment. This section is crucial for assessing a company’s future growth potential. Finally, financing activities outline cash flows related to borrowing and equity financing. These include dividends paid to shareholders and cash received from issuing stocks or bonds. A clear understanding of each category enables investors to interpret how effectively a company manages its liquidity. A positive cash flow indicates a company can settle its short-term debts and fund operations, while negative cash flow may signal potential liquidity issues. Thus, analyzing the cash flow statement is essential for various stakeholders, including investors and creditors, as it indicates the sustainability of a company’s financial position and operational effectiveness.

Notes to financial statements provide essential supplemental information to GAAP financial statements. These notes clarify the accounting principles, policies, and methodologies implemented by the company in preparing its financial documents. These disclosures enhance transparency and ensure that users comprehend the underlying assumptions behind the reported figures. Key areas often highlighted include significant accounting policies, contingencies, and commitments. Notes also disclose potential risks that may significantly impact financial results, guiding stakeholders in their decision-making processes. For instance, if a company uses different methods for inventory valuation, this is explicitly stated in the notes, informing users about how this may affect profitability. Furthermore, these disclosures may often include segment reporting, providing deeper insights into the performance of individual business lines or geographical areas. In many cases, future projections or guidance on capital expenditures are included, helping investors gauge the company’s growth strategy. By dissecting the notes accompanying financial statements, stakeholders are empowered to make informed decisions concerning potential investments and anticipated returns. As such, this supplementary information plays a pivotal role in the comprehensive understanding of a company’s financial health.

Importance of Compliance with GAAP

Compliance with GAAP is vital for maintaining credibility and trust in the financial reporting process. Adhering to these principles ensures that financial statements are consistent, comparable, and understandable to all users. This standardization increases the reliability of financial reporting, which is crucial for investors, regulators, and other stakeholders. It fosters a level playing field allowing different entities to be compared without confusion. Moreover, publicly traded companies are required by law to follow GAAP, providing a safeguard against fraudulent or misleading reporting. Non-compliance may lead to severe financial and legal repercussions, including litigation or penalties by regulatory bodies. Furthermore, financially sound organizations utilize GAAP as a framework to avoid misrepresentation of their financial activities. Companies that consistently comply with GAAP realize benefits that extend beyond legal compliance; they enhance investor confidence, improve relationships with creditors, and foster a culture of transparency within the organization. Emphasizing ethics and integrity in financial reporting reinforces stakeholder trust and bolsters the company’s reputation and credibility in the marketplace. Such alignment with GAAP is not just prudent; it is essential for sustainable business growth.

In conclusion, the key components of GAAP financial statements play an immense role in shaping the financial landscape of organizations. The balance sheet, income statement, cash flow statement, notes, and compliance with GAAP form the bedrock of credible financial reporting. Each element offers valuable insights that empower stakeholders to analyze company performance, assess profitability, and evaluate financial health. By understanding these components, investors and analysts can navigate the complexities of financial statements with confidence. GAAP not only ensures consistency and comparability across reports but also safeguards against the misrepresentation of financial outcomes, which may lead to catastrophic consequences should inaccuracies emerge. For stakeholders, the significance of robust financial information cannot be overstated, as it influences strategic decisions and investment choices. As businesses continue to grow and evolve within their respective markets, adhering to GAAP principles remains indispensable for driving transparency and fostering trust in the business world. Ultimately, GAAP serves as a vital toolkit enabling each stakeholder to make informed decisions, ensuring that they fully comprehend the financial realities depicted within these crucial statements.