Game Theory in Financial Decisions: Theory and Practice

Game theory offers important insights for understanding decision-making in finance, enabling better modeling of strategic interactions among various agents. Financial transactions are inherently competitive and collaborative, which makes evaluating opponents’ strategies crucial. By assessing how other market players behave, investors can more accurately predict future trends and adjust their own behaviors in response. This interplay of choices amongst market participants conveys broader economic implications. For example, when a financial organization decides to lower interest rates, its competitors may respond similarly, affecting overall market conditions. Hence, decisions are not made in isolation; rather, they are responses to the broader equilibrium where multiple players operate. Additionally, game theory helps in assessing risks, determining optimal investment strategies, and navigating complex scenarios such as mergers and market entry. By understanding the underlying game-theoretic principles involved in finance, stakeholders can improve negotiating outcomes while minimizing potential losses. As finance continues evolving, incorporating game theory will enhance strategic thinking and risk management. Overall, this intersection not only enriches academic discourse but also increases practical applications in areas like portfolio management and corporate governance.

Key Concepts of Game Theory

At its core, game theory revolves around strategic decision-making that occurs when multiple players are involved. This theory identifies two primary types of games: cooperative and non-cooperative games. Cooperative games focus on forming coalitions between players to achieve mutually beneficial results, while non-cooperative games emphasize individual strategies and outcomes. Understanding these concepts helps financial analysts develop models to predict behavior in financial markets effectively. Another critical concept in game theory is Nash Equilibrium, a state where no player can benefit from changing their strategy if others maintain theirs. This concept illustrates stability within competitive environments and enhances forecasting methods used in finance. Furthermore, mixed strategies come into play when players randomize their decisions to keep competitors uncertain, effectively preventing predictability. In financial economics, players include investors, corporations, and regulatory institutions, each making decisions considering the actions of others. Analyzing these interactions reveals insights that can propel better financial decisions. Additionally, identifying strategies through scenario analysis aids in pre-empting competitors’ movements. Thus, incorporating these fundamental game theory traits into financial strategies fosters improved outcomes and reinforces investment performance.

Financial markets exemplify environments where game theory provides valuable insights for strategic behavior. One notable instance of game theory application is in options trading, where market fluctuations significantly impact pricing strategies. Investors respond tactically to not just their expectations but also the anticipated strategies of their competitors. As players in these markets hold asymmetric information, they may engage in bluffing or signaling to mislead others about their true intentions. The use of call and put options illustrates these strategic maneuvers, with each choice reflecting a player’s assessment of underlying asset behavior. By employing game theory rigorously, investors can better comprehend and predict price movements and trading volumes. The incorporation of psychological behaviors further solidifies understanding, as emotions such as fear and greed influence decision processes. Consequently, the convergence of financial analysis with game-theoretic principles enhances the accuracy of predictions, thereby improving competitiveness in markets. As these mechanisms evolve, consistently leveraging game theory remains essential in adapting to dynamic market conditions. In summary, game theory’s relevance to financial economics continues to grow, necessitating its integration for optimal decision-making.

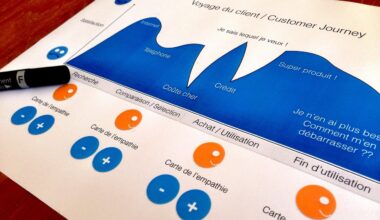

Real-World Applications

The real-world applications of game theory in finance extend across various disciplines, demonstrating its practical significance. One crucial application is in competitive bidding situations, such as auctions, where participants must carefully formulate strategies while considering potential actions of other bidders. Game theory elucidates optimal bidding strategies that maximize individualized outcomes while navigating the uncertainties of competitor behavior. Additionally, understanding pricing strategies becomes vital when firms adjust their product prices in response to competitors. As price wars unfold, understanding competitors’ reactions can significantly influence market positioning. Moreover, game theory finds relevance in the context of financial regulation and government policy, where policymakers strategically design rules to foster competition and mitigate market failures. Regulatory bodies observe how firms adapt to these policies, guiding future adjustments. Furthermore, mergers and acquisitions also reflect game-theoretic principles, as companies weigh the potential competitive advantages against the risks involved with consolidating pathways. By evaluating these scenarios through a game-theoretic lens, financial professionals wield broader insight in navigating negotiations. The versatility of game theory makes it a powerful tool in addressing financial complexities across varying contexts, aiding practitioners in cultivating robust decision-making frameworks.

Understanding behavioral finance in conjunction with game theory presents fascinating opportunities to redefine investment strategies effectively. Recognizing that human behavior can deviate from rational decision-making trends has immense implications for financial analysts. Psychological biases often distort perceptions of risk and reward, leading investors to make suboptimal choices. Game theory complements these insights, providing a structured framework through which analysts can explore how emotions influence market dynamics. By identifying common biases, such as overconfidence and anchoring, professionals can mitigate their impacts on investment practices. Game-theoretic concepts illustrate how these biases manifest in competitive scenarios, leading to unintended consequences. For example, when multiple investors succumb to herd behavior, financial markets experience heightened volatility and irrational price spikes. Consequently, leveraging both behavioral finance and game theory can develop risk-averse strategies by allowing investors to capitalize on market inefficiencies stemming from collective psychological trends. This valuable integration equips analysts with the tools necessary to predict and understand irrational behaviors within financial markets effectively. Hence, advocating for a multifaceted approach relying on both disciplines results in better-informed decisions that adapt efficiently to market fluctuations.

Challenges and Limitations

Despite the advantages of integrating game theory into financial decision-making, certain challenges and limitations persist. One significant challenge lies in the complexity of accurately modeling financial situations, as unpredictable variables often arise in the ever-evolving landscape. While theoretical frameworks assist in outlining foundational strategies, real-world applications can suffer from intricacies that complicate outcomes. Additionally, simplifying assumptions made in game-theoretic models may overlook critical factors affecting decision-making, resulting in subpar predictions. Financial phenomena are influenced by both rational and irrational behaviors, which may not always align with traditional game-theoretic assumptions. Another limitation emerges from the dynamic nature of financial markets, where rapid technological advancements and regulatory shifts constantly alter the playing field. Stakeholders must remain agile and adaptive to incorporate these shifts into their strategies. Moreover, relying solely on game theory may lead to an overestimation of predictability within competitive arenas and excessive trust in predefined strategies. A balanced approach, combining qualitative judgment and game-theoretic analysis, can offer a more accurate reflection of market dynamics. Acknowledging these challenges ensures thoughtful integration of game theory into practical financial applications, fostering better decision-making.

Looking ahead, the future of game theory in financial economics holds immense promise as technological advancements reshape the landscape. The integration of artificial intelligence and machine learning methodologies enhances the capabilities of game-theoretic applications in finance. These technologies generate sophisticated algorithms that provide real-time data analysis, enabling practitioners to implement dynamic strategies adaptively. Furthermore, blockchain technology creates new avenues for modeling strategic interactions, shifting traditional paradigms towards decentralized finance. Consequently, as financial markets experience transformative changes, incorporating advanced computational techniques presents exciting opportunities for game theory’s continued evolution. Professionals must focus on developing robust predictive models capable of capturing the nuances of evolving behaviors. Enhanced collaboration between data scientists and financial experts fosters the creation of innovative solutions leveraging game-theoretic principles to address modern challenges. Additionally, as globalization influences markets, the need for understanding cross-border financial dynamics emerges, giving relevancy to collaborative game theory frameworks. Ultimately, the ongoing exploration of game theory in finance serves as a critical juncture for practitioners, promoting sophisticated decision-making strategies that navigate through the complexities of contemporary financial ecosystems.