How to Prepare Accurate Revenue Reports for Your Business

Revenue reports are crucial for any business, providing a clear view of the income generated within a specific period. They help assess performance, set strategic goals, and analyze trends. Accurate revenue reporting requires meticulous attention to detail and adherence to the appropriate accounting standards. First, establish a coherent revenue recognition policy that aligns with the applicable accounting frameworks. This can often include principles set by GAAP or IFRS, depending on your location. Next, ensure that all business units consistently record transactions in the same manner. This prevents discrepancies that could lead to inaccurate results. It is also vital to use reliable accounting software or tools that offer precision and can automate repetitive tasks. Regular internal audits and reconciliations of accounts can also help identify potential issues early. Additionally, training staff involved in financial reporting ensures they are well-versed in procedures and compliance requirements. An overview of these foundational steps aids in streamlining your reporting process and ensuring that accuracy is maintained throughout. Accurate revenue reports not only reflect your financial standing but also enhance your ability to make informed business decisions.

The process of drafting revenue reports begins with gathering all relevant financial data across various business units. This involves collating receipts, invoices, and contracts that substantiate the income figures. It is best practice to establish a standardized format for reporting to ensure clarity and consistency across all departments. All data gathered should be cross-verified for accuracy. Any discrepancies need to be addressed promptly as they can distort overall financial health if left unchecked. Once the figures are compiled, it’s essential to categorize the revenue into distinct streams, such as product sales, services rendered, or recurring revenue. This categorization allows stakeholders to analyze which segments are performing favorably and which may need enhancement or reevaluation. Utilizing effective accounting software can significantly facilitate this categorization process. Analyzing the revenue by period, such as monthly or quarterly, can yield insights into seasonal patterns or fluctuations in demand. This helps in predicting future income and planning for seasonal changes or economic shifts. Overall, thorough data gathering and categorization set the stage for producing accurate and insightful revenue reports.

Methods for Ensuring Accuracy

To ensure precision in revenue reporting, performing regular reconciliations is imperative. A reconciliation involves comparing internal records with those reported by third parties such as banks and vendors. This process reveals any inconsistencies that must be rectified before finalizing the revenue report. Equally important is the implementation of internal controls throughout the reporting process. This includes assigning duties to various personnel, which helps reduce the likelihood of errors or fraudulent activities. Furthermore, developing comprehensive checklists can standardize the reporting procedure and prompt users to verify each aspect meticulously. Another method includes periodic training sessions for the accounting team to cover updates in financial regulations or software. This commitment to training ensures staff are prepared to keep the reports accurate. Moreover, employing an independent auditor can provide an objective overview of the reporting process. They can offer recommendations for improvement and ensure compliance with regulatory standards. By adopting these methods rigorously, businesses can confidently produce revenue reports that reflect true financial performance and integrity.

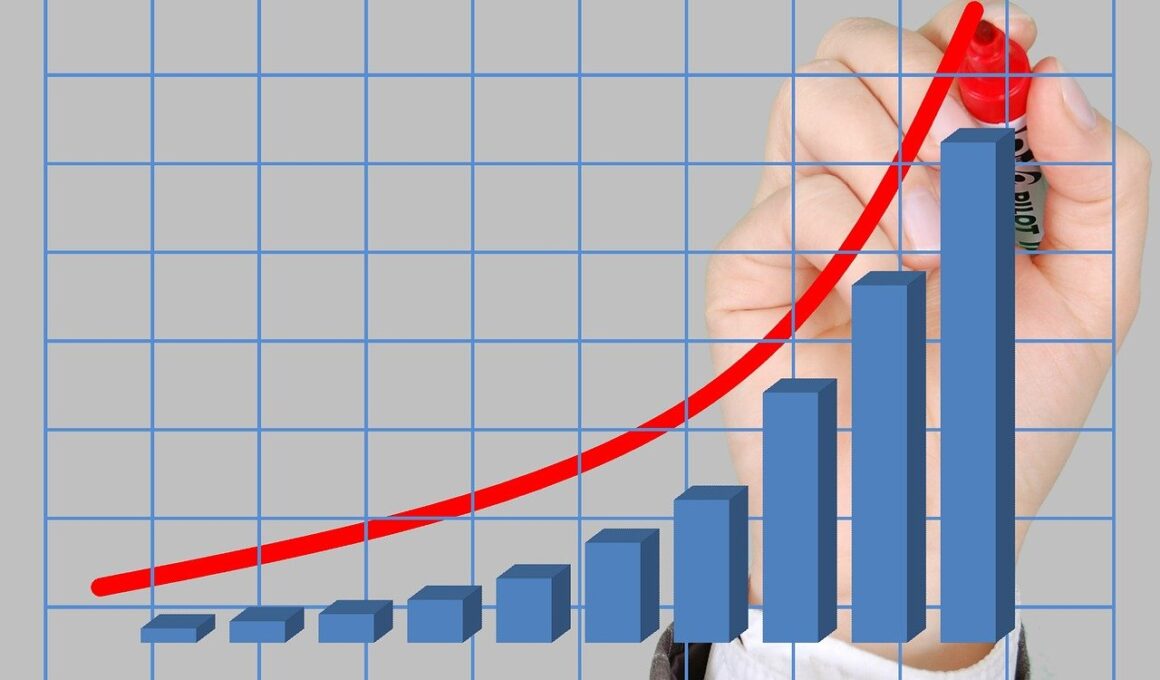

After the data collection and analysis, drafting the actual revenue report comes into play. A revenue report should provide a comprehensive overview without overwhelming the reader with excessive details. Start by presenting key metrics at the top, such as total revenue, comparison to previous periods, and percentage growth. Following this summary, delve into a more detailed breakdown, highlighting individual revenue streams. Utilize charts or graphs to visually represent data, as they can enhance understanding significantly compared to written explanations alone. Ensure that the language employed is clear and free of jargon to make it accessible to all stakeholders, including those who may not have a financial background. Including notes or commentaries on unusual variations may provide context for the data. Furthermore, it is beneficial to project future revenue based on historical data and upcoming trends. Such insights can assist in strategic planning sessions. Finally, one should ensure that the report is formatted well, professional looking, and free from typographical errors to maintain credibility and clarity.

Review and Approval Process

Before disseminating a revenue report, it undergoes several layers of review and approval. This step is critical, especially in larger organizations with multiple stakeholders involved. Initially, the report should be reviewed for accuracy by the finance team. They must verify figures and assertions made in the report. This is typically followed by a secondary review from a department head or senior manager, providing oversight and confirming compliance with legal and regulatory standards. Establishing a clear protocol for these reviews ensures accountability and enhances the report’s quality. Once the report passes scrutiny, it should be approved by a designated executive, such as the CFO. This final sign-off confirms that all aspects of the report are complete and accurate before it is shared with external parties, such as investors or regulatory agencies. Additionally, having a set timeline for the review process can help streamline operations, ensuring timely delivery of the revenue report. Effective communication during the review phase preserves the integrity and utility of the report while fostering buy-in from all stakeholders.

After the revenue report is finalized, communication with stakeholders becomes paramount. The report’s distribution should be strategic, targeting individuals most impacted by the findings. This could include the executive team, departmental managers, and potentially external stakeholders like investors or lending institutions. Accompanying the revenue report with a summary presentation or a meeting to discuss key points can enhance comprehension and allow for dialogue around financial performance. Open channels for feedback can prompt discussion and lead to actionable insights. Encouraging stakeholders to ask questions regarding the report can also clarify any ambiguities. Furthermore, organizations should consider creating a regular schedule for reporting to establish consistency, such as quarterly reports coupled with annual reviews. This will help maintain stakeholder engagement and keep the financial performance at the forefront of strategic planning. Digital tools can also facilitate the distribution of the reports, allowing for easier access and tracking of who has received and reviewed the documents. Effective communication regarding revenue reports connects the financial health of the business to overall strategic goals and fosters a proactive approach to financial management.

Conclusion and Continuous Improvement

In preparing accurate revenue reports, continuous improvement should always be a priority. Since the landscape of financial reporting is always changing, remaining adaptable and receptive to new frameworks and technologies can enhance reporting efforts. Businesses must regularly seek feedback from users of the report, using this intelligence to refine and streamline the process further. Additionally, periodically reassessing accounting software for new features or better integration can improve efficiency and accuracy. Establishing performance metrics to gauge the effectiveness of the reporting process can lay the foundation for ongoing improvements. This includes tracking error rates, time taken for report generation, and stakeholder satisfaction. As teams grow more familiar with the process, they should document best practices to cultivate a standardized approach that serves as a guide for future reporting. The overall goal is to foster a culture of diligence and accountability surrounding revenue reporting. Accurate, transparent, and insightful revenue reports will ultimately fortify decision-making, ensuring the business advances toward its goals efficiently and effectively.

Ultimately, accurate revenue reporting is not just about the figures but also about the narrative they tell concerning the business’s health. These reports can identify strengths and weaknesses, and they are essential for guiding strategic decisions. Developing a reliable reporting procedure incorporates building an analytical foundation that predicts future performance. By consistently applying best practices, engaging in regular training, and embracing feedback mechanisms, businesses can enhance their reporting capabilities. Fine-tuning the process creates a roadmap for achieving ongoing accuracy in revenue reporting. In conclusion, viewing financial reports as living documents that require regular oversight ensures that they remain relevant and useful tools in business management. The commitment to accuracy will reflect positively in stakeholder confidence and overall business credibility. Companies that master this facet of financial management may position themselves for sustainable growth and success. Good revenue reporting practices not only aid in complying with financial standards but also empower executives to pursue strategic opportunities. They will ultimately lead to stronger financial standing and pave the way for future prosperity.