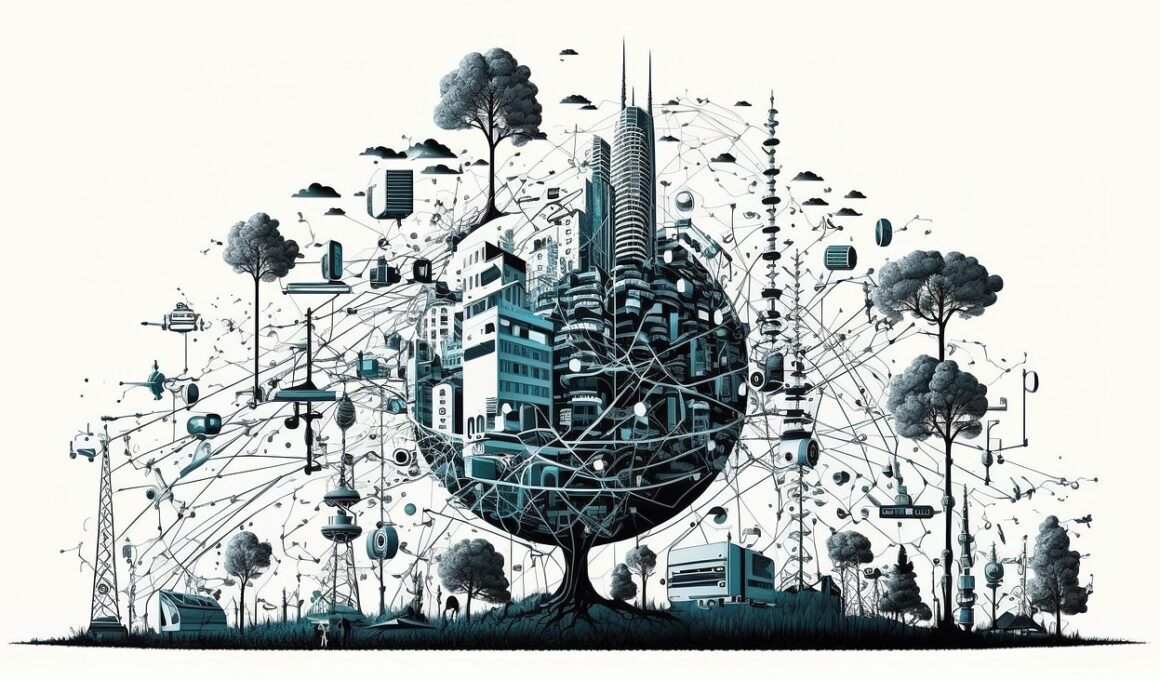

InsurTech and IoT Integration

The convergence of InsurTech and IoT (Internet of Things) devices is transforming the insurance industry. This integration enhances data collection and offers real-time insights into risk assessment. IoT devices like smart sensors, wearables, and connected vehicles provide insurers with valuable information about user behavior, environmental conditions, and operational activities. For instance, telematics in cars enables insurers to monitor driving patterns. By analyzing this data, insurance providers can tailor premium rates to individual risk profiles. Furthermore, IoT can enhance claims processing efficiency by offering real-time data during incidents. This data helps insurers reduce fraud by accurately assessing claims in real-time. With the rise of cloud computing, the storage and analysis of large volumes of data from IoT devices have become more accessible. Insurers can leverage machine learning algorithms to predict potential risks and offer preventative measures to clients. In turn, this fosters customer loyalty, as clients feel valued when they receive personalized services. Ultimately, the integration of IoT devices in InsurTech creates a more transparent, efficient, and user-friendly insurance ecosystem.

Benefits of IoT in Risk Assessment

The benefits of IoT integration in risk assessment are manifold and pivotal for the future of InsurTech. First, real-time data collection significantly improves risk evaluation accuracy. Instead of relying on historical data alone, insurers gain profound insights into current and on-the-ground situations. For instance, home insurance can utilize smart smoke detectors to monitor fire risks continuously. This proactive approach minimizes potential losses, enabling insurers to offer lower premiums for policyholders who use such devices. Additionally, better data leads to more tailored insurance products. Insurers can create specialized packages that meet specific customer needs, enhancing user experience. Transparency is another critical benefit, as policyholders receive direct insights into their risk profiles. Being aware of real-time data makes clients more cautious, thus potentially reducing insurance claims. Moreover, by encouraging safer behaviors through real-time feedback, IoT devices can showcase insurance providers’ commitment to their clients’ well-being. As the industry evolves, these practices will not only make InsurTech more resilient but also foster a culture of risk awareness among customers.

Moreover, the role of IoT in risk assessment can facilitate enhanced community safety. By leveraging data from multiple users within a locality, insurance companies can identify emerging risks and collaborate with local governments to devise mitigation strategies. For example, data from weather sensors can alert residents about potential flooding or extreme conditions, fostering a proactive approach towards safety. This data-sharing model can lead to community-based insurance initiatives, such as lower premiums for neighborhoods that consistently engage in risk-reducing measures. Furthermore, InsurTech can create platforms where clients share experiences and insights gathered from IoT devices. Sharing knowledge fosters a cooperative environment among users, allowing them to learn from one another and adopt best practices. Collaboration among clients can drive innovation, prompting insurers to adapt their offerings to meet evolving customer needs. Clients become more engaged when they actively participate in the process, feeling empowered and informed. Consequently, mutual trust builds between clients and providers, leading to long-term relationships. The community-oriented aspect of InsurTech innovation will be crucial as society becomes increasingly interconnected.

Challenges in Implementing IoT Solutions

Despite the promising benefits, challenges persist in implementing IoT solutions within InsurTech. One of the primary hurdles is data privacy and security. With increasing connectivity of devices, data breaches are a growing concern that can jeopardize client trust and operational continuity. Insurers must employ stringent data protection measures to safeguard sensitive information from cyber threats. Compliance with regulations such as GDPR complicates data handling practices. Insurers must navigate complex legal landscapes to ensure they collect and process data correctly. Moreover, IoT devices can produce immense volumes of data, leading to challenges in data management. Companies often struggle to derive actionable insights from this data, encountering information overload. This issue can hinder timely decision-making processes that rely on real-time analytics. Another challenge is the initial investment cost associated with deploying IoT devices and associated technology. Insurers may hesitate to adapt their business models due to these costs, especially smaller organizations lacking resources. Balancing the long-term benefits against immediate financial burdens remains vital for ensuring successful integration of IoT into their operations.

Furthermore, interoperability among different IoT devices presents a significant challenge. The insurance industry comprises multiple players, each utilizing different technology and protocols. Ensuring seamless communication between various IoT systems requires standardized frameworks that often do not exist. This lack of interoperability can limit the effectiveness of risk assessment efforts, as data may remain siloed and unusable across platforms. Consequently, insurers miss out on valuable insights that could be leveraged through collaborative data-sharing initiatives. Suppliers and insurers must work diligently to develop these interoperability standards to amplify the potential of IoT integration. Additionally, educating stakeholders, including employees and customers, about these technologies is crucial for maximizing their benefits. Many individuals may be unfamiliar with how IoT devices function or their potential advantages in risk assessment. Offering training programs and resources focused on IoT use fosters a culture of understanding and adaptability. Insurers must be proactive in promoting IoT device adoption and usage, ensuring that clients see their value clearly. Emphasizing the positive implications will result in increased engagement and further integration of IoT into InsurTech solutions.

Future Prospects of InsurTech and IoT

The future of InsurTech and IoT devices is promising, heralding transformative changes within the insurance sector. As technology evolves, data analytics capabilities will become more sophisticated, empowering insurers to make more accurate predictions regarding risks. Predictive analysis harnessed from IoT data will lead to personalized policy recommendations tailored to individual user needs. Insurers will focus on providing preventative services, thereby reducing claims and improving profitability. Greater integration of AI with IoT data will enable real-time risk assessments, allowing for dynamic pricing strategies. Policies will shift from being static documents to adaptable arrangements that evolve in tandem with customer behavior and risk profiles. Furthermore, as client expectations transform towards more personalized service, InsurTech innovators will prioritize user experience, developing intuitive interfaces and user-friendly applications. Offering seamless engagement through mobile platforms will enhance customer satisfaction and retention. The emergence of blockchain technology will also play a vital role in insurance, providing secure and transparent transactions. Consequently, smart contracts can streamline claims processes and reduce fraud, ultimately fostering a more secure insurance ecosystem. The integration of technological advancements within InsurTech and IoT will revolutionize the industry’s future.

By fostering collaboration among industry leaders, consumers, and technology providers, the InsurTech landscape will continue evolving. Initiatives focused on partnerships and research will yield innovative solutions that address existing challenges. Increased investment and venture capital funding for InsurTech startups with IoT integration capabilities will drive further advancements. This collaborative approach will spur innovations that enhance risk assessment and customer experience. Moreover, educational efforts highlighting the importance of IoT adoption will empower clients and insurers alike to leverage available technologies effectively. As clients demand more personalized services, insurers will gather invaluable insights through the adoption of IoT devices. Continuous improvement and adaptability will be essential in navigating a rapidly changing landscape. Companies must remain agile, embracing new technologies and methodologies that support enhanced decision-making. By employing best practices and keeping pace with trends, InsurTech can establish itself as a front-runner in risk management. With every advancement, both customers and insurers will benefit from a more responsive and proactive approach to insurance. The road ahead is exciting, and the promise of blended innovations will shape the future of InsurTech sustainably.