Understanding Pre-Seed Funding: The First Step for Startups

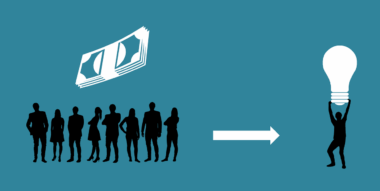

Pre-seed funding is often the very first capital that a startup receives. This funding stage occurs before the startup launches or develops its first product. Typically, the money is sourced from founders, family, friends, or angel investors. Pre-seed capital is utilized to cover initial expenses such as market research, product development, and creating prototypes. It is crucial for startups to generate a base concept and begin building their businesses. The amount of pre-seed funding varies by market and industry but is generally modest. While the exact figures can fluctuate, founders should expect initial investments anywhere between $10,000 to $250,000. The funding can be sought through personal networks, local investor groups, or online platforms. However, building a compelling pitch is essential in convincing potential investors of the startup’s vision and potential for success. Founders must clearly communicate their business ideas, targeted markets, and long-term goals. Ultimately, a strong pre-seed funding strategy sets the stage for future growth and further investment rounds. Understanding these foundational aspects can catalyze a startup’s success.

Once a startup secures pre-seed funding, it can focus on several key areas. One of these areas is product development. This phase involves creating a minimum viable product (MVP), which enables testing and validation of ideas with actual users. Startups must leverage this funding efficiently to refine their offerings based on feedback. Another crucial element is market research. Conducting effective market research helps founders understand their target audience. It is important for determining market size, customer needs, and competitive landscape. By tapping into pre-seed funds for research, startups eliminate uncertainties. Additionally, this funding stage allows startups to establish a brand presence in the industry. This can be achieved through marketing initiatives, outreach efforts, and building a digital footprint. Startups need to prioritize activities that will lay the groundwork for future funding rounds. This is the phase where connections are often made and partnerships formed. These relationships can lead to further opportunities. However, founders should always be ready to pivot based on market dynamics and insights gained through these early efforts.

Challenges During Pre-Seed Funding

Securing pre-seed funding can be challenging for many entrepreneurs. A common hurdle is the lack of an established track record. Many investors are hesitant to invest in founders who do not have prior experience or successes. Building credibility is crucial for overcoming this obstacle. Entrepreneurs need to clearly outline their skills and showcase previous relevant experiences. Another significant challenge is effectively communicating their business idea. It’s essential for founders to articulate their vision, value proposition, and unique selling points clearly. Emphasizing why their solution is necessary can help engage investors. Often, pre-seed startups may also face difficulties in differentiating themselves from competitors. Their uniqueness should be highlighted in presentations. Furthermore, managing initial expenses within limited funds can be quite daunting. Startups need to make budgetary decisions wisely that focus on essential projects and immediate objectives. This requires astute financial planning and prioritization of spending. Educating oneself on personal and business finance principles can substantially improve management of pre-seed funds.

Investor participation is crucial in pre-seed funding. Various types of investors play a role in this stage, including angel investors and venture capitalists. Angel investors often provide individual funding based on personal interests, while venture capitalists operate in firms that manage funds from multiple investors. Understanding each type’s motives, expectations, and preferences facilitates better alignment between founders and investors. Startups may also consider crowdfunding platforms. This approach democratizes the funding process, enabling contributions from many individuals who believe in the business’s potential. By utilizing social media and digital marketing, entrepreneurs can effectively reach potential funders. Entrepreneurs should also be prepared for investor due diligence. Investors will likely seek clarity on business plans, financials, and growth strategies. Therefore, having all necessary documents organized is paramount. Additionally, founders need to remain open to feedback and criticism during this phase. Engaging investors in dialogue often leads to valuable insights that can refine strategy. Ultimately, building sustainable relationships with investors can open doors to subsequent funding rounds as the startup matures.

Importance of a Strong Business Plan

A comprehensive business plan is vital for startups seeking pre-seed funding. This document outlines the startup’s vision, mission, target markets, financial forecasts, and operational strategies. Investors typically refer to these plans while deciding on funding. A well-structured business plan not only provides clarity but also demonstrates the founders’ commitment. Additionally, it outlines a clear path to success. Founders should ensure their business plan outlines potential revenue streams, costs, and growth metrics. Defining these elements signals to investors that the startup is both organized and serious about achieving objectives. Furthermore, it enhances the startup’s credibility. Establishing measurable milestones in the business plan can guide the startup’s progress during the early stages. Investors often look for evidence that the startup is tracking goals closely. Revisiting and updating the business plan regularly also keeps innovation alive. Agility in decision-making can lead to better performance. As a result, having a solid business plan not only supports securing funds but also establishes a foundation for a sustainable business model.

Networking is incredibly important during pre-seed funding stages. Founders should actively reach out to mentors, industry experts, and fellow entrepreneurs to build connections. These relationships can provide valuable insights and strategic advice. Participating in local startup events and incubators helps to expand one’s network. Meeting people who have navigated the process can be incredibly beneficial. Additionally, establishing a solid online presence through social media platforms can attract potential investors. Transparent communication about startup goals and achievements helps to generate interest. Founders should engage consistently with their audience, providing updates and insights into their journey. Furthermore, joining online entrepreneurial communities fosters collaboration and knowledge-sharing. Interacting within these circles often yields referrals, investor pitches, and partnership opportunities. Another tactic includes leveraging alumni networks or associations. Former schoolmates can provide support and funding possibilities. Maintaining genuine relationships and offering value in networking keep doors open for future opportunities. In the world of startups, networking should be approached as an enduring strategy, fostering connections that can have lasting impacts on growth.

Conclusion: Nurturing Your Startup’s Future

In conclusion, pre-seed funding is an essential phase in the life of any startup. It serves as the foundation upon which all future growth is built. Startups must navigate this stage with a clear understanding of their objectives and strategies. Engaging with potential investors effectively, showcasing innovation, and refining business propositions are crucial. Building a robust network aids in accessing knowledgeable mentors and financial supporters. A well-structured business plan ensures the startup remains agile, addressing market needs and investor expectations. As they transition beyond the pre-seed phase, ongoing adaptability and communication will be driving forces behind success. Many successful startups have originated from humble beginnings during pre-seed funding. Founders must constantly seek growth opportunities and remain resilient through challenges, ready to pivot when necessary. By embracing these elements with dedication and strategic focus, startups can effectively nurture their journeys. Ultimately, understanding pre-seed funding translates to gaining a competitive edge as they seek subsequent investments. With perseverance, clarity, and sound practices, entrepreneurs can turn their dreams into thriving realities that can disrupt industries worldwide.

Startups that navigate pre-seed funding effectively establish a strong foundation for their future. This initial funding stage builds credibility, attracts investors, and forms the basis for sustainable growth. Those who embrace the challenges of this stage can foster innovation and ultimately create impactful solutions to real-world problems. Given the competitive nature of the startup ecosystem, founders must continuously adapt to market dynamics and investor expectations. The journey may be challenging, but the potential rewards make it worthwhile. Moreover, engaging with stakeholders and fostering meaningful relationships can greatly enhance a startup’s trajectory. Entrepreneurs should maintain a learning mentality, remain agile, and pivot as needed. By doing so, they can uncover untapped opportunities and trend-setting ideas. Ultimately, the art of securing pre-seed funding is about much more than just money; it is about building a compelling narrative and vision that others can rally around. The future of any startup begins with a strong foundation, fostering growth and setting the stage for even greater achievements.