Using Biometrics for Stronger Digital Identity in Finance

In the financial sector, securing digital identities has become increasingly critical. With rising instances of cybercrime, organizations are turning to biometrics as a reliable solution. Biometrics utilizes unique physical characteristics such as fingerprints, facial recognition, and iris scans. These traits are difficult to replicate, offering a higher level of security compared to traditional methods like passwords. As cyber threats continue to evolve, financial institutions seek innovative strategies to enhance their security measures. By leveraging biometric technologies, businesses can ensure secure access to sensitive financial data while maintaining a seamless user experience. Additionally, integrating biometrics can significantly reduce the risk of identity theft, a prevalent issue in today’s digital landscape. Financial providers have begun implementing these technologies to verify identities during account openings and transactions. Moreover, biometric systems can streamline customer interactions by reducing the time spent on authentication. The adoption of biometrics represents a pivotal shift in identity management that could reshape the finance industry.

The Benefits of Biometrics in Finance

There are numerous benefits associated with implementing biometric systems within the finance sector. Firstly, biometrics enhances security by providing multi-factor authentication that is more difficult to compromise. Financial institutions can utilize various biometric factors to validate users effectively, such as using both fingerprint and facial recognition. This method not only enhances security but also improves user convenience. Customers can access their accounts swiftly without remembering complex passwords. Simultaneously, financial institutions can benefit from reduced costs associated with managing lost or stolen credentials. Another significant advantage is the improvement in customer trust. Clients feel more secure knowing their sensitive data is safeguarded by sophisticated biometric technology. Moreover, in an age where data breaches are rampant, organizations can demonstrate their commitment to protecting client information. As a result, customers might be more likely to choose a financial provider that employs robust identity management solutions. In this way, biometrics can also provide a competitive edge in the market. Spurring innovation, organizations that adopt biometric technology can foster positive relationships with their customer base.

However, the implementation of biometric technology comes with its own set of challenges that must be addressed. One major concern is privacy. Consumers often harbor fears regarding the misuse of their biometric data. Ensuring that organizations handle this information responsibly is crucial. Regulators also play a significant role in defining the legal framework surrounding biometric data usage. Financial institutions must comply with strict regulations to protect sensitive information. Poorly implemented biometric systems can lead to security vulnerabilities and customer mistrust. Educating customers about how their data is used and protected will mitigate their concerns. Moreover, businesses must invest in secure storage and processing technology to ensure the safe handling of biometric data. Biometric authentication systems depend on advanced algorithms and user acceptance, as consumers need time to adapt to new methods of identity verification. The transition towards a biometric future requires ongoing conversations with stakeholders, and addressing concerns will be necessary for successful integration. Organizations need to demonstrate ethical practices related to privacy in order for consumers to embrace these advanced systems.

Types of Biometric Technologies Used in Finance

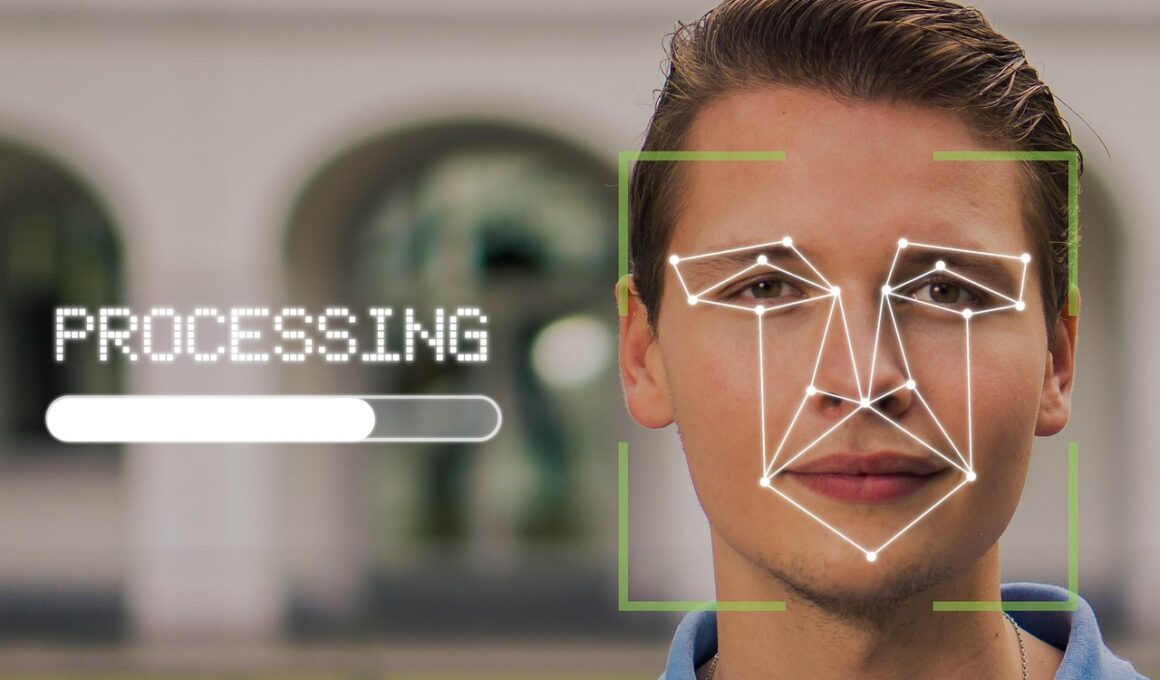

Various technologies have emerged in the biometric landscape that financial institutions can adopt. One of the most common types is fingerprint recognition. Easily integrated into mobile devices and ATMs, this technology allows quick user verification. Another popular option is facial recognition, which utilizes advanced algorithms to identify individuals based on unique facial features. This technology can be utilized for secure access in various financial applications. Iris scanning is also gaining traction, given the high level of accuracy it offers. With groups investing in this technology, it may soon become more accessible in the near future. Voice recognition is another method used in contact centers, where clients can be authenticated based on their vocal patterns. Additionally, behavioral biometrics analyzes users’ actions, such as typing rhythm and mouse movements, to ensure a secure and personalized experience. This technology enables real-time fraud detection, making it a valuable asset for financial institutions. By combining multiple biometric technologies, organizations can create a comprehensive security framework that adapts to emerging cyber threats, ensuring a robust defense.

Moreover, the integration of biometrics into financial workflows can yield numerous operational advantages beyond security enhancement. Implementing biometric authentication can significantly speed up the onboarding process for new clients, reducing the time taken for identity verification. This improved efficiency earns customer loyalty, leading to repeat business. Further advantages include streamlined compliance procedures with regulatory requirements. By adopting biometric technologies, organizations can keep detailed records of user interactions, ensuring transparency and accountability. These systems can help automate and record identity verification processes, which enables organizations to focus on other operational aspects. Moreover, unified biometric systems enable seamless transactions across various touchpoints, enhancing customer experience. This seamless experience promotes positive customer interactions and satisfaction levels, ultimately impacting an organization’s bottom line positively. On the other hand, organizations can leverage this technology to analyze customer behavior. With a comprehensive understanding of client preferences, businesses can offer personalized services and products tailored to user needs. Consequently, organizations become more equipped to address evolving market demands, driving innovation and growth in the financial sector.

Challenges and Considerations for Implementation

Despite its numerous advantages, implementing biometric technology in finance requires careful consideration of several factors. Organizations must evaluate the costs associated with deploying biometric systems, as these can vary significantly based on the chosen technology. Financial institutions need to invest in high-quality equipment, software, and staff training, which can require considerable upfront capital. Additionally, ongoing maintenance and system updates may also incur further expenses. Organizations must also consider the potential risk of biometric data breaches. Should such data be compromised, the ramifications could be severe, leading to legal repercussions and reputational damage. Developing a holistic strategy for data protection is imperative. Solutions must include end-to-end encryption methods and secure storage systems to safeguard sensitive information. Another important aspect is ensuring system compatibility with existing infrastructure. Financial institutions need to perform thorough assessments before adopting biometric technologies to ensure they can integrate seamlessly into current operations. Finally, including customer feedback in the decision-making process will provide insights that help to enhance implementation and promote user acceptance of these technologies.

Additionally, the growing trend of remote banking has further heightened the necessity of robust digital identity solutions. As customers increasingly conduct financial transactions online, ensuring secure user authentication becomes critically important. Remote banking and the rise of mobile applications are changing the way customers interact with their financial providers. Biometrics can simplify the onboarding process for new clients, eliminating the need for physical visits to branches. Moreover, incorporating biometric methods allows remote verification, which is essential in reducing user friction during transactions. However, organizations must also address the potential for increased fraud in online settings. Cybercriminals continuously develop new techniques to bypass security measures, which makes it imperative that financial institutions stay ahead of these evolving threats. Implementing biometric systems helps to mitigate such risks while enhancing customer trust and satisfaction. Moreover, businesses can leverage biometric technology to analyze and adapt to user behavior, offering personalized experiences for remote users. By creating an environment where security and convenience coexist, organizations can foster innovative growth in this rapidly changing landscape.

The Future of Biometrics in Finance

Looking ahead, the role of biometrics in the finance sector is likely to expand even further. Advancements in technology will facilitate the development of more sophisticated biometric solutions. This evolution means increased accuracy, reduced costs, and wider adoption among various institutions. For instance, artificial intelligence could be integrated into biometric systems, allowing for real-time security enhancements. As machine learning algorithms improve, financial providers may develop predictive models to identify abnormal behavior, further strengthening security measures. The combination of AI and biometrics will likely revolutionize personal identification procedures, creating ways to preemptively address potential threats. Furthermore, as finance becomes more interconnected with technology, regulatory bodies will adapt to develop new frameworks to govern biometric data usage. This evolution will provide clarity on the best practices financial organizations should adopt, fostering a secure environment for consumers. Consequently, a collaborative effort between financial institutions, technology vendors, and regulators will stimulate the growth of biometrics. Building a transparent dialogue will increase consumer confidence, making biometrics a leading facet of identity management in finance.