Collaborative Financing vs Traditional Financing Models in SCF

Supply Chain Finance (SCF) has evolved significantly, especially with the rise of collaborative financing models. Traditional models often involve a straightforward lender-borrower relationship, where financing terms are rigid. In contrast, collaborative financing emphasizes strong partnerships among supply chain participants. This approach fosters better communication and enhances trust, which can lead to improved financial arrangements. By leveraging technology, businesses can now share real-time data that informs financing decisions. Traditional models, however, often lack this transparency, which can cause inefficiencies and miscommunication. Moreover, collaborative financing can lead to lower costs due to shared risks among involved parties. The flexibility in collaborative arrangements is another advantage, enabling businesses to adapt financing solutions to their specific needs. In contrast, traditional approaches often come with fixed terms that may not suit all scenarios. As businesses look to innovate and improve their supply chains, understanding the differences between these two models is crucial. By embracing collaborative financing in SCF, companies may enhance their competitiveness in today’s market. This transition demands careful consideration of all relevant factors, from technology adoption to relationship-building among stakeholders.

Traditional financing models in SCF often present challenges that can hinder efficient operations. Terms are usually rigid, binding companies to contracts that may not fit their evolving needs. This inflexibility may lead to missed opportunities or increased costs, stifling innovation and agility within businesses. Furthermore, tight payment terms and interest rates can strain relationships along the supply chain, especially between suppliers and buyers. Collaborative financing models, in contrast, allow stakeholders to negotiate terms that are beneficial for all parties involved. These adaptations can lower costs while offering better cash flow options. Enhanced transparency is a distinct advantage, allowing participants to access information that fosters collaboration. As a result, firms can adapt to market changes more effectively without renegotiating complex contracts repeatedly. Collaborative financing encourages a more fluid, responsive approach to finance, merging resources and expertise across networks. This shift leads to a sustainable framework for nurturing relationships, as companies work together towards common goals. Thus, SCF practitioners should evaluate whether transitioning to collaborative models can address the limitations posed by the traditional financing methods currently in use.

The Role of Technology in Collaborative Financing

Technology plays a crucial role in optimizing collaborative financing models in supply chain finance. By utilizing advanced systems such as blockchain, firms can enhance transparency and traceability in transactions. This heightened level of visibility helps participants to build trust, reducing the need for stringent controls typically present in traditional financing arrangements. Furthermore, financial technology innovations enable seamless data sharing, allowing stakeholders to assess real-time cash flow and payment cycles effectively. Businesses can respond promptly to financial challenges and opportunities due to this invaluable insight into their operations. The shift towards digital platforms can mitigate risks associated with traditional financing methods by encouraging better communication and collaboration. For example, e-invoicing solutions can expedite payment processes while providing accurate tracking of financial commitments across the supply chain. Additionally, automated systems reduce manual errors and administrative burdens, allowing companies to maintain focus on core activities. Hence, businesses keen on enhancing their SCF practices should embrace these technological advancements. Leveraging technology leads to an efficient financing ecosystem where trust and collaboration drive better financial outcomes for all participants involved.

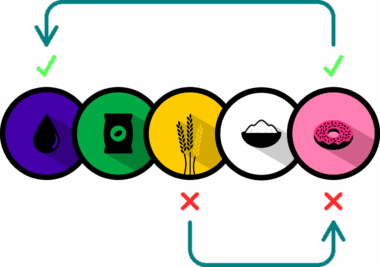

One of the primary advantages of collaborative financing models over traditional approaches is the ability to customize financing options. Traditional financing often comes with set terms, limiting the flexibility that businesses may need as they venture into new opportunities. Collaborative models enable firms to tailor their financing arrangements according to their specific requirements and objectives. This adaptability can significantly reduce costs and improve overall operational efficiency. By working together, companies can design creative financing solutions that address the unique demands of different supply chain scenarios. For instance, buyers can help finance suppliers through early payment options, garnering discounts while supporting their partners. This win-win approach strengthens relationships among collaborators and fosters mutual growth. Moreover, through the effective management of risks, these models can promote more stable and predictable cash flows, enhancing the economic resilience of all parties involved. Collaborative financing also opens pathways for innovation, inspiring stakeholders to co-create new services or products. As the competitive landscape continues to evolve, firms embracing these flexible financial arrangements can position themselves for long-term success. Understanding the balance of risk and reward remains essential in nurturing a healthy supply chain ecosystem.

Building Trust Among Supply Chain Participants

Trust is a cornerstone of successful collaborative financing models in the supply chain ecosystem. Unlike traditional financing arrangements, where relationships may feel transactional, collaborative finance fosters a spirit of partnership. For companies to thrive in this model, stakeholders must work together, sharing insights and financial data transparently. Creating a culture of trust enhances communication and promotes empathy, allowing for genuine dialogue between participants. This trust-building dynamic is further reinforced by leveraging technology tools that offer transparency and improved tracking. Collaborative financing participants can make informed decisions about payment terms and financing options because of their access to real-time data. Such cooperation not only reduces misunderstandings but also translates into better overall financing terms for all parties involved. Establishing trust leads to a willingness among stakeholders to share risks, ultimately fostering a healthier relationship. For companies to effectively transition from traditional to collaborative financing, investing time in relationship-building is essential, paving the way for a more prosperous supply chain environment. This shared understanding forms the basis for effective collaboration, illustrating the importance of trust in maximizing the benefits of collaborative financing.

In addition to trust, transparent communication is vital for the success of collaborative financing models. As businesses undertake collaborative efforts, they should ensure all stakeholders understand their roles and responsibilities clearly. This clarity minimizes misunderstandings and helps maintain a healthy flow of information. Conversely, traditional financing models can inadvertently promote uncertainty due to unclear terms or expectations. With a collaborative approach, participants can discuss their financial needs from the outset, enabling them to tailor solutions as per each party’s expectations. Moreover, this two-way communication fosters innovation, allowing firms to explore new ways of financing or restructuring their operations. Transparent dialogue can reveal potential bottlenecks and allows for timely interventions, which can improve overall operational efficiency. Regular check-ins and updates contribute to maintaining alignment among stakeholders. Furthermore, by creating open channels for feedback, collaborative financing models can adapt and evolve in line with market dynamics. In contrast, traditional financing models, marred by rigidity, often fail to keep pace with changing business environments. Organizations must nurture these essential communication practices to maximize collaborative financing’s potential benefits.

Conclusion on Collaborative Financing

Collaborative financing models present numerous advantages over traditional financing techniques, helping organizations navigate the complexities of modern supply chains. By prioritizing relationships and fostering trust, these models create an environment where businesses can thrive together. Enhanced communication, customization of financing arrangements, and the utilization of technology serve as foundational elements that drive positive outcomes for all stakeholders involved. As firms explore their options in SCF, they must evaluate the benefits of adopting collaborative financing in place of conventional methods. With the growing demand for agility and innovation in business operations, embracing these models may provide a strategic edge. Moving forward, organizations should remain aware of their financial landscape and seek collaborative opportunities that enhance their supply chain capabilities. Ultimately, by working together, supply chain participants can unlock new potential for growth, efficiency, and sustainability. The journey towards collaborative financing requires open dialogue, commitment, and a willingness to adapt. Success in this venture will empower organizations to create a resilient, agile, and thriving supply chain ecosystem that benefits all involved. As such, stakeholder engagement is essential for unlocking the transformative power of collaborative financing.

In summary, the shift from traditional to collaborative financing models represents a paradigm change in supply chain finance. This transition is fueled by technological advancements, greater emphasis on relationships, and a commitment to shared success among business partners. Organizations adopting a collaborative approach are poised to achieve improved financial performance and enhanced operational resilience. In contrast, traditional financing methods may limit flexibility and responsiveness to the evolving market demands. The collaborative financing model addresses these challenges by enabling stakeholders to craft tailored solutions that meet their specific needs. Additionally, a focus on trust and transparent communication creates a more collaborative environment, fortifying relationships and fostering innovation. Companies that successfully navigate this shift will find themselves better positioned to adapt to changes in the economic landscape. Ultimately, understanding the implications and benefits of collaborative financing can empower organizations to transform their supply chain finance practices. As the industry continues to evolve, firms must remain vigilant and adaptive, utilizing every opportunity to leverage collaboration. Embracing this transformative approach will allow supply chains to thrive amid the challenges of today’s interconnected global economy.