Key Software Tools Supporting Supply Chain Finance Best Practices

In today’s rapidly changing market environment, efficient supply chain finance can make a significant difference. Various software tools can help optimize processes, improve cash flow, and streamline operations. One of the key components of successful supply chain finance management is visibility throughout the supply chain. By utilizing software tools that improve transparency, businesses can make timely decisions, mitigate risks, and enhance collaboration among various stakeholders. These tools typically come with features for real-time tracking, data integration, and analytics. Among the most essential tools are those providing cash management and forecasting capabilities. These tools enable financial teams to predict cash flow more accurately, allowing organizations to maintain healthy liquidity levels. Furthermore, integrating these solutions with existing ERP systems can create a cohesive view across departments and functions, enabling more informed decisions. As businesses increasingly embrace digital transformation, investing in the right software tools is crucial for maintaining competitiveness in the supply chain landscape.

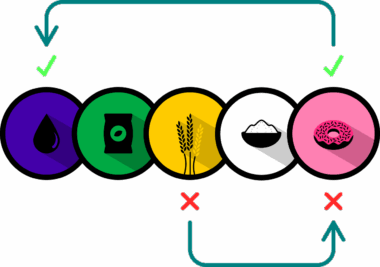

The implementation of effective software tools can significantly enhance supply chain finance practices. One critical area where they contribute is risk management. Modern tools provide advanced analytics that helps identify potential breakpoints in the supply chain. By predicting these risks through data-driven insights, businesses can take proactive measures to minimize disruptions. Some renowned software options include supply chain visibility platforms, which provide real-time data on inventory levels and trends. This information empowers financial teams to allocate resources strategically and adjust financing options based on real-time supply chain conditions. Moreover, inventory finance tools can bridge the gap between suppliers and buyers, offering flexible payment solutions and financing options that enhance cash flow. When properly utilized, these tools are not just about funding; they drive efficiencies that lower operational costs. Therefore, selecting software tools that cater specifically to supply chain finance needs can lead to improved profitability and sustainability in the long run. By leveraging technology, organizations can stay ahead of their competition, adapting to changes in consumer demand and evolving market conditions.

Collaboration and Communication Tools

Another significant factor in achieving best practices in supply chain finance is effective collaboration. Software solutions that facilitate communication among supply chain partners are essential for maintaining fluid operations. Tools such as collaborative platforms help various stakeholders work together seamlessly, sharing data and insights effectively. Additionally, these platforms can minimize misunderstandings that may arise due to geographical distances or different language requirements. Other notable tools employ cloud-based technologies, allowing easy access to data from anywhere in the world. This grants supply chain stakeholders flexibility and promotes quick responsiveness to market changes. Integrating various partners into a shared platform enhances trust among supply chain entities, fostering long-term relationships. Moreover, automated workflows within these tools can significantly reduce administrative burdens. This can improve time management and reduce errors associated with manual processes. Consequently, investing in collaboration and communication tools assures stakeholders can respond to operational challenges dynamically. These tools not only empower businesses to work effectively but also enrich overall supply chain practices, ensuring that all partners remain aligned toward common financial objectives.

Data analytics tools are further critical components in supporting supply chain finance best practices. Such tools enable organizations to leverage data for insightful decision-making, significantly enhancing forecasting accuracy. Companies can analyze historical trends to identify patterns in cash flow, which can inform future financing strategies. These tools typically employ algorithms and predictive analytics, providing customizable dashboards that highlight key performance indicators. As financial teams analyze these insights, they can optimize working capital and improve cash conversion cycles. Incorporating machine learning capabilities within data analytics software can also provide an added edge, helping companies adapt to changing conditions more effectively. Moreover, businesses can monitor the financial health of supply chain partners through analytics. This enables more strategic partnerships as organizations can understand the risks and opportunities existing within their supply chain. Properly analyzing and leveraging this data facilitates ongoing improvements, driving supply chain efficiencies while ensuring robust financial structures. Ultimately, investing in advanced data analytics is critical in navigating an increasingly complex supply chain finance landscape.

Automation in Supply Chain Finance

Automation represents another key software tool that allows businesses to streamline their supply chain finance practices effectively. Automating processes such as invoice generation, payment approvals, and reconciliations can enhance accuracy and reduce time spent on manual tasks. By utilizing automation, companies can ensure that transactions are processed promptly, enhancing cash flow and preventing bottlenecks. Another benefit is improved compliance, as automated systems often come with built-in checks and balances that secure adherence to regulations. This is vital in a complex financial environment where compliance risks are ever-present. With fewer human errors, organizations can also foster better relationships with suppliers as payments become more predictable and reliable. Additionally, automating certain finance decisions can free resources that can be directed toward strategic initiatives. Companies can focus more on developing relationships with partners and customers, leading to increased collaboration. The implementation of automation tools aids businesses in their quest to evolve constantly and remain competitive while ensuring that finance practices align with broader supply chain goals.

Incorporating fintech solutions is an emerging trend in enhancing supply chain finance best practices. These innovative solutions often cater to specific supply chain needs, enabling organizations to address unique financial challenges. Fintech tools can showcase innovative financing options, such as dynamic discounting, for suppliers to gain quicker access to cash. Furthermore, they allow businesses to optimize their payment terms and strategies, ultimately benefiting both buyers and suppliers. The growing prominence of blockchain technology within the fintech space also adds an opportunity for increased transparency and efficiency. Blockchain helps to track transactions in real-time, providing verifiable proof of financing arrangements. Utilizing these technologies enables organizations to implement cost-efficient financial practices while aligning with sustainability initiatives. These solutions are instrumental in creating a more resilient supply chain finance ecosystem where all stakeholders benefit from seamless interactions. As the fintech landscape continues to evolve, businesses must stay informed about new developments in the industry to leverage them effectively. Prioritizing investment in the right fintech tools ensures improved relationships among partners within the supply chain.

Continuous Improvement and Evaluation

The importance of continuous improvement in software tools used for supply chain finance cannot be overstated. Regular evaluations help organizations stay agile and adapt to ever-changing market conditions. It’s essential to review existing software tools periodically, assessing their effectiveness and determining if they align with current business goals. Additionally, gathering feedback from users provides valuable insights into areas that require enhancement or additional features. Companies should also keep tabs on emerging technologies in the supply chain finance space to determine if switching might promote enhanced efficiency. These improvements can include user experience upgrades, integrating new features, or replacing outdated tools with cutting-edge alternatives. Requesting training sessions for staff ensures they can fully utilize the tools available effectively. Continuous improvement goes beyond just software; it’s an organizational mindset. Fostering a culture of innovation and adaptability leads to better financial practices in supply chain management. Companies embracing this principle position themselves better within their industries, ensuring sustainable growth and profitability.

In conclusion, leveraging the right software tools is fundamental to enhancing supply chain finance best practices. Each of these tools plays a pivotal role, from improving visibility and collaboration to data analytics and automation. Understanding that integrating these tools with existing processes creates synergies that enhance overall performance is crucial. By continuously evaluating and adapting to advancements in technology, businesses can fully harness their potential, resulting in more streamlined operations and effective partner relationships. As supply chain finance continues to evolve, companies must remain proactive in adopting innovations that foster agility and competitiveness. Ultimately, investing in robust software solutions will provide organizations with the tools needed to navigate complex financial landscapes successfully. This not only supports the organization’s financial health but also contributes to a more resilient and sustainable supply chain strategy. By prioritizing software tools that align with best practices, businesses can position themselves favorably in an increasingly competitive environment. Making informed decisions will lead to long-term growth, ensuring that they can effectively respond to market demands and fluctuations.