Instant Payments and Financial Analytics

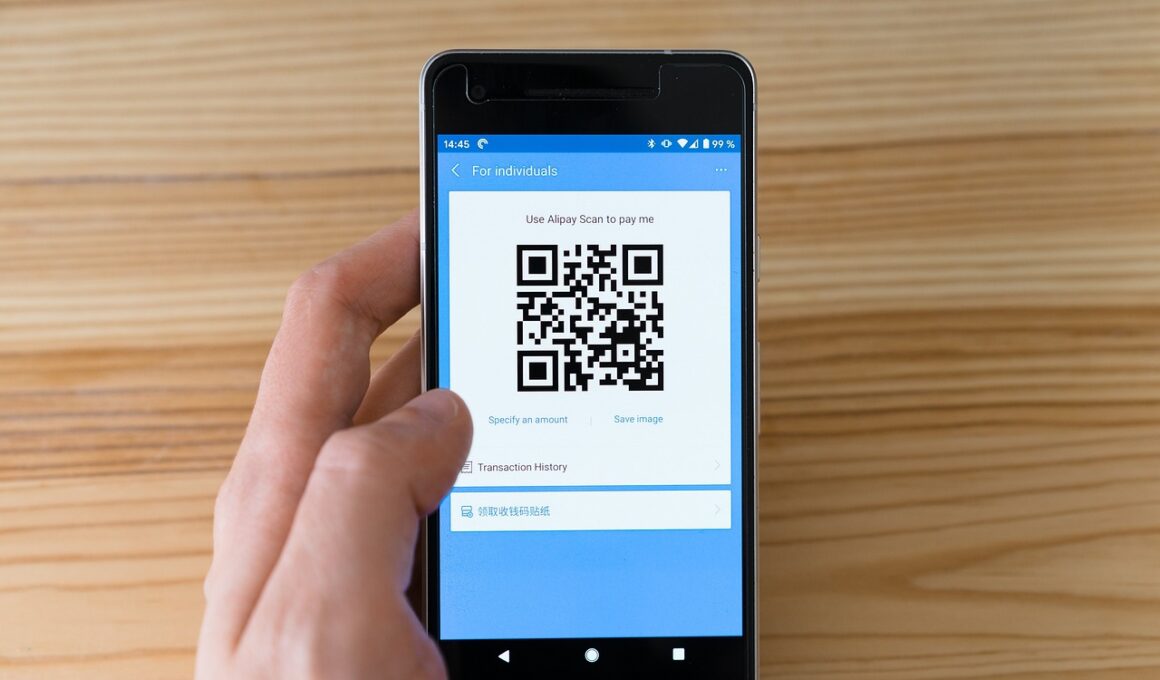

In the rapidly evolving landscape of finance, the concept of instant payments has emerged as a game-changer. Instant payments enable consumers and businesses to transfer funds in real-time, eliminating the delays typical of traditional banking. In this context, financial analytics becomes crucial for stakeholders to navigate this new territory. Advanced analytics tools can assess transaction data, helping financial institutions understand consumer behavior and payment trends. Additionally, employing predictive analytics allows organizations to forecast future payment demands, ensuring they meet customer expectations. Moreover, insights derived from financial analytics can assist in identifying potential fraud and enhancing security protocols. With real-time data at their fingertips, businesses can adapt swiftly to changes, offering products and services that resonate with their customer base. Notably, the integration of machine learning technologies within financial analytics further amplifies accuracy and efficiency. As the demand for seamless transaction experiences grows, organizations utilizing instant payments alongside robust analytics gain a competitive advantage in the digital landscape. By leveraging technology, the financial sector is not only catering to evolving consumer needs but also optimizing operations through data-driven insights.

Instant payments represent a technological evolution that dramatically enhances financial transaction speed. In conventional systems, delays in payment processing can lead to operational inefficiencies and customer dissatisfaction. Instant payments alleviate these concerns by ensuring that funds are available immediately after transaction initiation. This immediacy has significant aspirations for various sectors, including e-commerce, real estate, and international trade. Enabled by pioneering technologies like blockchain and digital wallets, these systems ensure transaction security and transparency. Financial analysts approaching this landscape must employ sophisticated methods to gauge the effectiveness of their instant payment solutions. Coupled with analytics, these measurements can inform strategies that boost user engagement and improve conversion rates. Many organizations have observed enhanced customer loyalty due to the seamless experience offered by instant payments. Additionally, financial reporting becomes more accurate with real-time data analytics, helping firms minimize discrepancies in their reporting. As a result, companies that successfully integrate instant payments and financial analytics position themselves for sustainable growth. The synergy of these elements underscores the importance of innovation in driving the financial industry’s future, setting a robust foundation for a dynamic digital economy.

The Role of Data in Instant Payments

The role of data in instant payments cannot be understated. As transactions occur in real-time, the volume of data generated increases exponentially. Financial institutions must capture and analyze this data to make informed decisions. Data analytics supports operations such as risk management and compliance. By assessing transaction patterns, organizations can identify anomalies indicative of fraudulent activity, thus enhancing security protocols. Furthermore, understanding customer preferences through collected data allows businesses to tailor their services effectively. Real-time analytics also equip firms with insights into market trends, influencing strategic decisions related to product offerings. The ability to visualize real-time data helps organizations make swift adjustments during peak transaction times, ultimately improving customer satisfaction. Therefore, investing in advanced data processing technologies is essential for all firms operating within the instant payments realm. Techniques including machine learning and artificial intelligence can be harnessed to gain further insights. The seamless interplay between data collection, analysis, and action is paramount in staying competitive. Consequently, organizations that prioritize data-driven approaches are more likely to thrive within an ever-evolving financial landscape.

Safety and security are integral components of instant payments and their corresponding financial analytics. As transactions become instantaneous, the threat landscape evolves, demanding robust security measures. Cybersecurity threats can undermine consumer trust, deterring them from utilizing digital payment solutions. Consequently, financial institutions must leverage analytics to protect sensitive customer data during transactions. Implementing fraud detection algorithms enables institutions to recognize suspicious activities in real-time, averting potential losses. Furthermore, adherence to regulatory frameworks surrounding data privacy is critical for compliance. Organizations are expected to implement adequate measures that safeguard user information effectively. Advancements in encryption and tokenization technologies play a crucial role in securing payments. Additional initiatives such as consumer education about safe transaction practices are vital for awareness. By integrating education into payment systems, organizations can foster an informed user base that knows how to protect their data. As we advance further into digital finance, maintaining robust security will remain a priority for financial institutions focused on providing instant payments. This commitment will ensure a trustworthy environment encouraging broader adoption of instant payment solutions.

Challenges in Implementing Instant Payments

Despite the numerous advantages of instant payments, various challenges exist that hinder widespread adoption. Technical infrastructure can pose significant obstacles; organizations must invest in modern technology to facilitate seamless transactions. Many legacy systems are incompatible with instantaneous payment solutions, requiring substantial upgrades or overhauls. Furthermore, regulatory compliance remains a critical concern, with diverse regulations varying across jurisdictions. Financial institutions must navigate complex regulatory landscapes to integrate instant payment systems while ensuring they meet legal standards. Customer adoption also presents a challenge; some users may resist transitioning to digital payment methods due to familiarity with traditional banking practices. To counteract this hesitance, educating consumers about the benefits and security measures in place is essential. Market competition may also become a hurdle as various institutions roll out similar offerings, leading to dilution of brand value. Organizations need to innovate consistently, providing unique features that attract and retain customers. By acknowledging these challenges and actively seeking solutions, financial institutions can strategically position themselves for successful implementation of instant payment frameworks that meet current demands.

Future trends in digital payments are intimately tied to the evolution of instant payments. As technology continues to advance, we foresee more integrated solutions enhancing user experience. Innovations such as contactless payments and mobile wallets are gaining momentum, leading to increased usage of instant payment services. Additionally, the emergence of cryptocurrencies presents new avenues for instant transactions while affecting traditional payment structures. Financial analytics will evolve alongside these trends, offering sharper insights into customer behavior and preferences. Organizations must remain agile, adapting their strategies as new technologies arise. Furthermore, sustainability is becoming a key consideration; efficient energy consumption in processing transactions merits attention. Companies targeting sustainable practices won’t only enhance their brand reputation but may also attract eco-conscious consumers. Collaborations between fintech firms and traditional banking institutions will likely become more common, combining strengths to better serve consumers. As digital payment ecosystems converge towards a common goal of convenience and efficiency, analyzing trends will become increasingly critical. Financial stakeholders who can foresee shifts in consumer preferences will enable their organizations to thrive amidst rapidly changing landscapes.

Conclusion

In summary, instant payments are transforming the financial landscape, making transaction processes faster and more efficient. By employing financial analytics, organizations can navigate this evolving environment effectively. The integration of real-time data analytics not only assists in understanding user behavior but also bolsters security measures against potential fraud. As challenges persist in implementing these systems, organizations must also look to compliance regulations and infrastructure upgrades to fully capitalize on benefits. The continued growth of digital payments necessitates an ongoing commitment to innovation and customer-centric approaches. Moreover, a future-focused perspective will ensure that firms remain competitive by adapting in a dynamic marketplace. The synergy between instant payments and financial analytics exemplifies the overall direction of the financial industry, pushing stakeholders to prioritize agility, security, and user experience. Embracing these concepts will shape financial institutions’ success as they strive to meet modern consumer demands. Hence, those embracing these technological shifts will emerge as leaders, defining the future of digital finance effectively. In essence, the interplay between instant payment solutions and robust analytics frameworks signifies a bright future for the financial sector.

The impact of instant payments on global economies is profound, with potential ramifications on liquidity and spending habits. As financial systems modernize to offer instantaneous transaction capabilities, the flow of capital becomes more fluid, encouraging economic activities across various sectors. Companies can settle payments swiftly, thereby increasing operational efficiency, and allowing for improved cash flow management. Furthermore, instant payments can enhance cross-border transactions, facilitating international trade relationships. As barriers are reduced, businesses can enter new markets with ease, ultimately contributing to global economic growth. Financial analytics will play an essential part in monitoring these developments—offering insights that can help predict market trends and consumer behaviors. Companies leveraging both tools will be better equipped to make strategic decisions based on data, thereby enhancing business intelligence. The interplay between instant payments and analytics signifies a movement towards a more interconnected financial ecosystem where real-time insights drive innovation. As barriers continue to diminish, institutions that prioritize instant payment solutions while employing advanced analytics are poised to benefit significantly from evolving consumer preferences. The future of finance is undeniably leaning toward instant payments, powered by insights gleaned from robust financial analytics.