Customizing Payment Solutions Using Digital Payment APIs

Digital Payment APIs have revolutionized the way businesses handle transactions online. This innovation allows companies to customize payment solutions that cater to specific needs and preferences. By integrating these APIs, businesses can streamline their payment processes, thus enhancing user experience. A customizable payment solution means that businesses can choose the currency, payment methods, and security features that align with their goals. Additionally, APIs offer flexibility in terms of user interface which can be tailored to match existing platforms. This crucial step ensures consistency across the digital experience. Moreover, by leveraging existing APIs, organizations can save valuable time and resources. They eliminate the need to build payment systems from scratch, allowing teams to focus on core business functions. Furthermore, Digital Payment APIs are designed with scalability in mind. As businesses grow, they can easily adapt their payment solutions without significant overhauls. As a result, many companies are now prioritizing API integration into their payment gateways. Ultimately, custom payment solutions foster trust, encourage customer loyalty, and positively impact revenue streams through enhanced transaction security and efficiency.

One significant advantage of using Digital Payment APIs lies in the enhanced security features they provide. When businesses process payments, safeguarding customer data is paramount. APIs from reputable providers utilize state-of-the-art technologies, such as encryption and tokenization, to protect sensitive information. By implementing these APIs, companies significantly reduce the risk of data breaches, which are costly and damaging to reputations. Additionally, incorporating two-factor authentication can further bolster transaction safety. As cyber threats evolve, embracing technological advancements in security becomes non-negotiable. Customers are growing increasingly cautious about sharing personal information. Thus, businesses must prioritize security to foster trust. Another vital feature offered by these APIs encompasses fraud detection systems. These integrated systems analyze transactions in real-time, identifying anomalies that might indicate fraudulent activity. Businesses benefit from immediate alerts and can act promptly to mitigate risks. Furthermore, tracking user behavior through these systems provides insights into spending patterns and preferences. Understanding customer behaviors helps in tailoring marketing strategies and improving service offerings. With these advancements, businesses can confidently offer seamless transaction experiences. The rise of Digital Payment APIs has undeniably transformed how security is approached in online transactions.

Enhancing User Experience

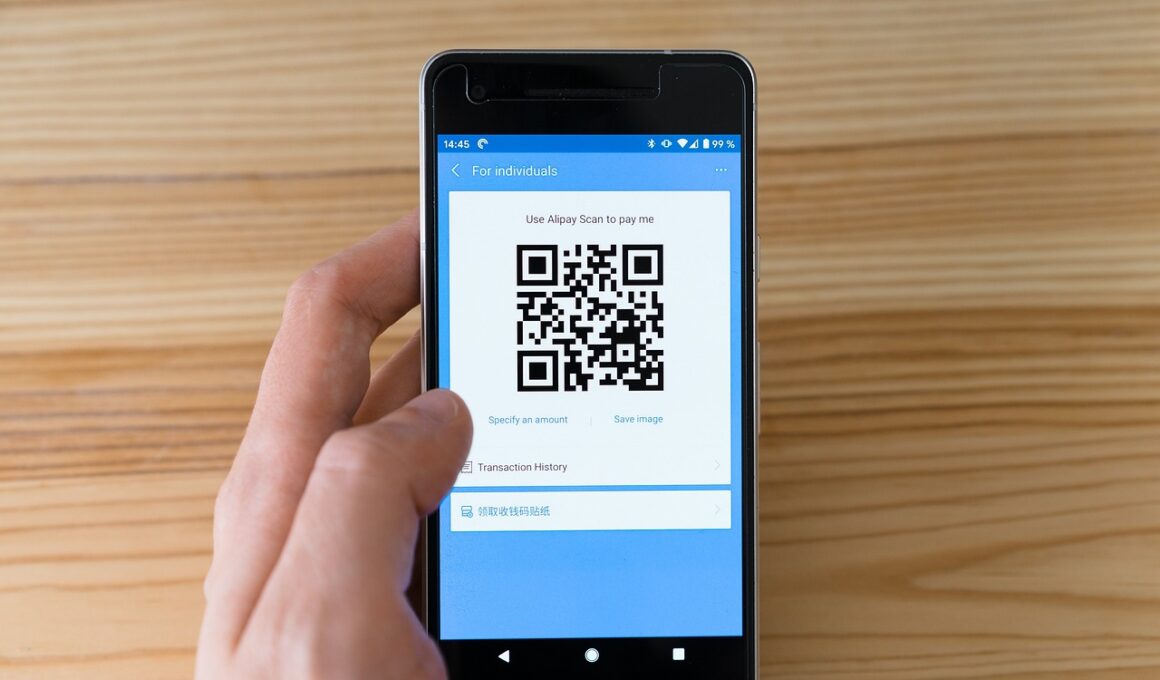

Enhancing user experience is at the core of digital payment solutions. Digital Payment APIs enable businesses to implement seamless checkout experiences that minimize friction for users. When payment processes are quick and intuitive, customers are more likely to complete transactions. An array of payment options such as credit cards, e-wallets, and alternative methods should be provided. This variety caters to the diverse preferences of users and empowers them to choose their preferred payment method. Furthermore, incorporating features like guest checkout can eliminate the need for users to create accounts, expediting the purchase process. Simplifying the checkout experience not only aids in boosting conversion rates but also encourages repeat business. Feedback mechanisms can also be integrated using APIs, enabling companies to gather insights directly from users about their transaction experiences. This information is invaluable for continuous improvement. Moreover, offering localized payment options based on geographical locations can enhance user satisfaction. Recognizing various currencies and payment preferences boosts engagement and can elevate brand loyalty. The importance of user experience cannot be overstated; it plays a critical role in shaping customer perceptions and influencing long-term brand loyalty.

Another benefit associated with Digital Payment APIs is the ability to facilitate international transactions with ease. In an increasingly globalized marketplace, businesses are reaching audiences beyond local borders. Digital Payment APIs simplify the complexities associated with currency conversion and cross-border transactions. By supporting multiple currencies, businesses can cater to international customers effortlessly. Furthermore, these APIs often include features that handle taxes and tariffs, ensuring compliance with local regulations. This not only reduces the burden on finance departments but also enhances trust with customers. Transparency in pricing becomes possible through these integrations, leading to improved customer relationships. When customers are informed of any additional charges upfront, it promotes a positive transaction experience. Additionally, APIs have the capability to adapt to changing regulations across different regions. This eliminates the need for businesses to constantly update their systems manually. Automated compliance ensures that transactions remain within legal frameworks, thus mitigating risks associated with regulatory fines. Embracing international capabilities through Digital Payment APIs ultimately allows businesses to expand their customer base without significant overhead investments.

Innovation Through Analytics

Digital Payment APIs also pave the way for innovation through analytics. By collecting and analyzing transaction data, businesses gain valuable insights into customer behaviors and preferences. This information can drive strategic decision-making, allowing companies to optimize their offerings effectively. Understanding transaction patterns helps businesses identify peak buying times, preferred payment methods, and even geographical trends in sales. Using this information, targeted marketing campaigns can be created to convert potential customers. Additionally, the availability of real-time analytics enables companies to monitor their transactions continuously. This empowers them to react promptly to fluctuations in transaction volumes or irregular activities. Businesses can also personalize the shopping experience by offering tailored promotions based on previous customer interactions. Customizing messaging to targeted users significantly enhances engagement rates. Moreover, the development of new products and services can be guided by the insights garnered through transaction data. Businesses can identify gaps in their offerings and innovate accordingly. By harnessing analytics provided by payment APIs, companies can stay ahead of competitors and make informed decisions centered around customer satisfaction and market demands.

Integration of social payment functionalities is another important feature that sets Digital Payment APIs apart. Many consumers are turning to social platforms to make purchases or share expenses directly. By integrating these functionalities, businesses can tap into an emerging market trend that appeals to younger consumers. Offering features such as ‘pay your friend’ options or social sharing of purchases elevates the user experience to a whole new level. This not only fosters deeper connections between brands and consumers but also encourages virality. Moreover, these functionalities can seamlessly integrate into e-commerce websites or apps, creating an all-in-one platform for transactions. The rise of social commerce provides a unique opportunity for businesses looking to expand their reach and engage their audience. Additionally, analytics from social payment trends can be captured through APIs, offering insights into which features resonate with users. Taking action based on these insights can enhance user satisfaction significantly. As social payments continue to grow in popularity, businesses that leverage Digital Payment APIs will be well positioned to capitalize on this evolving landscape. Adaptability is key in maintaining relevance in the fast-paced world of digital commerce.

The Role of Customer Support

The importance of customer support cannot be overlooked when implementing Digital Payment APIs. A seamless payment experience hinges not only on technology but also on the level of support provided to users. Ensuring that customers can easily navigate payment issues is essential for maintaining trust and satisfaction. By offering comprehensive support channels such as live chat, email, and phone assistance, businesses can address concerns in real-time. This builds confidence among users, knowing that help is readily available. Additionally, establishing a robust FAQ section can help users troubleshoot common issues independently. By incorporating resources like video tutorials and step-by-step guides, companies can further empower customers to resolve challenges on their own. When users find help proactively, it enhances their overall transaction experience. Monitoring customer feedback about the payment processes is also crucial. Companies should actively solicit input through surveys after transactions, enabling them to identify possible pain points. Continual improvement based on customer experiences will lead to better satisfaction and retention rates. Ultimately, investing in customer support, alongside Digital Payment APIs, creates a holistic approach that boosts service quality and overall user trust.

In conclusion, customizing payment solutions using Digital Payment APIs is essential for businesses seeking efficiency, flexibility, and enhanced user experience. With features such as security enhancements, analytics, international transaction capabilities, and user experience improvements, these APIs offer businesses the tools necessary for success in a rapidly evolving digital landscape. Adopting these innovative solutions not only streamlines operational processes but also enhances customer trust and satisfaction. Each implementation aspect can significantly affect consumer behaviors, encouraging repeat purchases and fostering brand loyalty. As digital commerce continues to grow, having customizable payment solutions will provide a competitive edge. The landscape of payments is constantly evolving, and staying abreast of the latest trends and technologies is vital. By committing to integrating Digital Payment APIs, businesses can navigate this transformative environment effectively. Indeed, success lies in adaptation and innovation. Companies that embrace these advancements will not only improve transaction experiences but will also position themselves successfully for the future. Ultimately, organizations ready to prioritize payment customization through API adoption will thrive in the digital economy.