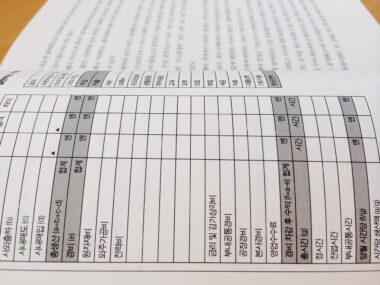

The Relationship Between Balance Sheets and Tax Reporting

Balance sheets play a crucial role in financial reporting, offering significant insights into a company’s overall financial health. They encapsulate assets, liabilities, and equity, providing stakeholders a snapshot of what the business owns and owes. This document is not only essential for internal management but is also pivotal for tax reporting. Tax authorities extensively utilize balance sheets to determine a company’s taxable income accurately. This relationship between balance sheets and tax obligations enhances transparency, ensuring that entities report their financial positions honestly. Tax reporting mostly relies on the data reflected in balance sheets, impacting the amount of tax owed. Adjustments in assets or liabilities directly affect the company’s profit metrics, which are then reported to tax authorities. Furthermore, maintaining precise balance sheet records is necessary for compliance with tax regulations, mitigating risks associated with audits. Stakeholders, including investors and creditors, are also concerned with these financial statements, making their accuracy paramount. Effective management of balance sheets involves understanding tax implications and ensuring the information is crafted meticulously for reporting purposes to avoid discrepancies during tax assessments.

An integral aspect of the balance sheet relates to assets, which include both current and non-current categories. Current assets represent resources expected to be converted to cash within a year, such as cash, inventory, and receivables. Non-current assets, on the other hand, encompass long-term holdings, including property, plant, and equipment. These classifications are critical when preparing the balance sheet and consequently influence tax calculations. Companies are often able to deduct depreciation from their taxable income, thus reducing overall tax liability. Furthermore, businesses can face tax obligations related to the disposal or sale of non-current assets. The information contained within these asset classifications is scrutinized during tax reporting and helps ensure that companies engage in fair tax practices. Liabilities on balance sheets also have tax implications, as they represent the obligations that a company must fulfill in the future. Accurate reporting of both assets and liabilities enables businesses to ascertain their net worth, thereby providing a foundation for effective management strategies that align with tax laws. Companies must remain vigilant in accurately categorizing these financial elements to maintain compliance and avoid penalties.

Equity’s Influence on Tax Reporting

Equity represents the residual interest in the assets of a company after deducting liabilities. It is vital for businesses to understand how equity is reflected in financial reporting, especially concerning tax implications. A change in equity influences the owner’s taxation level, as distributions to owners may be taxed differently than retained earnings. Companies that distribute profits, such as dividends, face specific tax obligations that differ from organizations that reinvest profits. Consequently, understanding equity is critical for both tax planning and compliance. Recognizing the different tax treatments of equity transactions can aid in informed decision-making, optimizing tax strategies. For instance, issuing new equity can have varying consequences for taxable income, affecting how future tax liabilities are calculated. Moreover, equity accounts reflect the health of a business, impacting investors’ perception and their queries on tax compliance. Therefore, businesses must uphold accurate equity reporting to assure all stakeholders about their financial dealings with tax authorities. This accuracy aligns balance sheet equity with tax disclosures, ensuring a coherent presentation of financial health to investors, regulators, and stakeholders alike, enhancing overall corporate transparency and governance.

Tax planning is often closely linked to the information presented in balance sheets, as proactive businesses leverage these documents for strategic advantage. Including accurate data in balance sheets can lead to optimizing tax positions, potentially lowering liabilities. For instance, understanding different asset valuations allows businesses to align their purchase decisions effectively and time expenses to leverage tax benefits. Tax credits and deductions can significantly influence cash flows, and effective tax planning requires lifelong attention to how these benefits interact with reported balance sheet figures. Companies facing audit triggers might find discrepancies in their balance sheet figures impacting tax calculations, necessitating careful tracking of changes. As laws and tax regulations evolve, businesses continually adapt their financial reporting to reflect compliance, adjusting balance sheets accordingly. Additionally, the relationship between financial ratios derived from the balance sheet, such as debt-to-equity, can enhance understanding of overall tax strategy. Monitoring these ratios allows a clearer view of leverage impacts on tax obligations. Regular evaluations ensure balance sheets remain compliant and beneficial for making informed financial decisions. Proper tax planning is invaluable since it enhances operational efficiency and profitability in conjunction with compliance safeguards.

The Importance of Accurate Financial Reporting

Accurate financial reporting, including the integrity of balance sheets, is foundational to establishing a company’s credibility. Providing stakeholders with consistent and reliable information ensures that tax reporting reflects the true nature of a business’s financial situation. This accuracy serves to maintain stakeholder trust and confidence, which is invaluable for both current operations and future expansions. Inaccurate balance sheets can lead to tax miscalculations, resulting in fines or additional interest penalties imposed by tax authorities. Regulatory compliance codes require accurate record-keeping; thus, agents must ensure all figures are meticulously documented and verified. Regular audits and reconciliations can uncover discrepancies in balance sheets that may otherwise complicate tax submissions. Companies that maintain high transparency through accurate reporting are also well-positioned to negotiate favorable terms with creditors. Effective financial reporting positively influences the organization’s cash flow and ultimately affects tax strategies. Well-managed balance sheets signal to the market that a business practices responsibility and sound fiscal management, which can also boost investor and stakeholder confidence. Enhanced transparency lays the groundwork for robust corporate governance, reinforcing the bond between accurate reporting, stakeholder trust, and sound financial management.

In summary, the relationship between balance sheets and tax reporting is multi-faceted and deeply interconnected. Companies must navigate the complexities of reporting accurately to fulfill both financial and tax obligations. A well-prepared balance sheet provides a reliable foundation for calculating applicable taxes, ensuring compliance and integrity in financial practices. Understanding how balance sheets influence tax reporting requires a comprehensive view of assets, liabilities, and equity. Furthermore, tax strategies should be informed by the financial data reflected in these statements, emphasizing the importance of accuracy and transparency. Businesses that prioritize the accuracy of their balance sheets equip themselves to adapt to ever-changing tax laws and regulations. As such, enhancing financial reporting mechanisms has far-reaching implications for a company’s success, not just in meeting compliance requirements but also in cultivating a positive relationship with stakeholders. Addressing these aspects enhances operational efficiency, fostering long-term value. Maintaining precise balance sheet records combined with awareness of tax impact enables better planning and decision-making. The ongoing evaluation of financial positions based on balance sheets is critical for continual improvement and adaptation to external tax environments.

Conclusion

In conclusion, an understanding of the interrelation between balance sheets and tax reporting is essential for every business. Accurate balance sheets not only facilitate tax compliance but also strengthen a company’s financial strategies. Implementing best practices in financial reporting can result in decreased tax liabilities, providing significant advantages. Companies adept at managing their financial statements are better positioned to respond to audits and face tax reporting requirements. Equally, a strategic approach when preparing balance sheets contributes to informed financial decision-making, aiding business resilience. Challenges in aligning tax reporting with balance sheet data must be addressed proactively through ongoing training and education for finance teams. Establishing a culture that prioritizes accuracy reflects an organization’s commitment to financial integrity, thereby enhancing its overall credibility. Stakeholders, including investors, creditors, and regulators, place considerable weight on accurate balance sheets, viewing them as essential indicators of business health. Thus, ensuring the alignment of these financial statements with tax reporting fosters a culture of transparency and trust. Ultimately, successful navigation of this relationship supports sustained growth through operational excellence and tax optimization strategies.

The cohesive relationship between balance sheets and tax reporting emphasizes the importance of diligent financial practices. Equipping organizations to understand this dynamic fosters resilience, allowing businesses to thrive under regulatory scrutiny.