Unlocking Growth: How SMEs Benefit from Supply Chain Finance Solutions

Small and medium enterprises (SMEs) play a vital role in the global economy, contributing significantly to job creation and innovation. However, they often face challenges in accessing financing for their operations. Supply chain finance (SCF) solutions offer a way for SMEs to unlock growth by providing essential funding tailored to their needs. These solutions, which bridge the gap between suppliers and buyers, enable SMEs to optimize their cash flow, improve working capital, and ultimately enhance their competitiveness. In recent years, SCF has gained traction, as many SMEs recognize its potential to facilitate growth and streamline their financial operations. Utilizing SCF allows SMEs to gain access to funds efficiently, helping them maintain liquidity and invest in new opportunities. Furthermore, SCF solutions can provide SMEs with better payment terms from suppliers, ensuring that they can manage their finances more effectively. For SMEs looking to thrive, SCF represents a powerful opportunity to tap into financing resources that can propel their operations forward while mitigating risks associated with traditional financing methods. As the financial landscape evolves, embracing innovative SCF strategies is crucial for sustainable growth.

The Importance of Cash Flow Management

For SMEs, managing cash flow is paramount. Effective cash flow management ensures that businesses can meet their obligations, invest in growth, and navigate unforeseen challenges. Supply chain financing enhances cash flow by enabling SMEs to convert future receivables into immediate liquidity. This means that businesses can access funds before invoice payment periods come to an end, helping them tackle short-term financial needs without resorting to costly debt. Moreover, SCF can significantly reduce the waiting time for payment against invoices, thereby providing SMEs with a steady and predictable cash flow. By leveraging the strengths of SCF, SMEs can arrange their finances more efficiently, ensuring that they have the necessary resources for operational costs, payroll, and investments. Additionally, improved cash flow management through SCF can lead to better relationships with suppliers, as timely payments can foster loyalty and collaboration. Consequently, SMEs engaging in SCF should prioritize cash flow management strategies to maximize the benefits of these solutions and underpin their long-term growth possibilities while adhering to financial discipline and transparency.

One of the most appealing aspects of supply chain finance is its flexibility. SMEs can access financing options that align with their unique operational needs and cash flow cycles. SCF solutions are designed to accommodate varying needs, allowing businesses to choose the most suitable financial terms and conditions. This is particularly beneficial for seasonal businesses that may experience fluctuations in demand and cash flow throughout the year. By utilizing SCF, these enterprises can adjust their financing as needed, ensuring that they have the necessary resources available to support their growth. Moreover, the adaptability of SCF products allows SMEs to scale their operations without encountering financial roadblocks. As businesses expand into new markets or introduce new product lines, tailored financing solutions can support their ambitions. The seamless integration of SCF into existing supply chains helps SMEs maintain operational efficiency and capitalize on growth opportunities, further establishing their competitive position. Ultimately, the flexibility that supply chain finance provides can be a game-changer, empowering SMEs to navigate financial challenges, seize opportunities, and secure a prosperous future in dynamic markets.

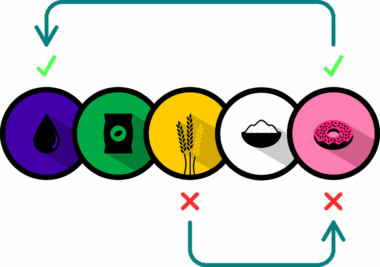

Enhancing Supplier Relationships

Building strong relationships with suppliers is crucial for the success of SMEs. Supply chain finance facilitates smoother interactions by guaranteeing quicker payments, thereby improving trust. When SMEs can ensure timely payments through SCF solutions, suppliers are incentivized to foster collaboration and may even offer better terms or discounts. This leads to enhanced negotiation leverage for SMEs, allowing them to secure advantageous pricing, terms, and conditions. Consequently, improved supplier relationships can strengthen the stability of the supply chain, minimize risks, and contribute to overall operational efficiency. With a solid supplier base, SMEs can have reliable access to the resources they need, ensuring that production and service delivery remain uninterrupted. Moreover, these enduring partnerships can lead to shared innovations, where suppliers collaborate with SMEs on product developments or cost-saving measures. In a rapidly changing business environment, having dependable supplier relationships is a strategic asset that can enable SMEs to respond effectively to market demands and challenges. Thus, by engaging in supply chain finance strategies, SMEs can significantly enhance their supplier relationships and position themselves for sustained success.

The shift towards digitalization in finance presents further advantages for SMEs utilizing supply chain finance solutions. The proliferation of fintech platforms and digital tools enables seamless transaction processing, creating a more efficient funding environment. These advancements allow SMEs to initiate financing requests, track transactions, and manage their cash flows from anywhere in the world. Digital platforms streamline the SCF process by reducing paperwork, expediting approvals, and ensuring transparency throughout the transaction lifecycle. Consequently, SMEs can allocate more time and resources toward their core business operations rather than spending excessive time on financial management tasks. Furthermore, digital SCF solutions often provide data analytics and insights, equipping SMEs with valuable information to make informed decisions regarding their financing needs. This data-driven approach enhances financial literacy and empowers SMEs to take charge of their financial futures. As the demand for digital SCF solutions continues to grow, SMEs should seize the opportunity to enhance their financial capabilities and embrace these technological advancements. The combination of SCF and digitalization can transform the way SMEs manage their finances, unlocking new paths to growth.

Financial Stability and Resilience

In uncertain economic times, financial stability is critical for SMEs. Supply chain finance contributes to building financial resilience by providing a safety net during challenging periods. With SCF solutions in place, SMEs are better prepared to withstand unexpected fluctuations in market conditions, supply chain disruptions, or changes in customer demand. The access to quick liquidity provided by SCF enables SMEs to absorb shocks and implement necessary adjustments without compromising their operations. By retaining financial flexibility, SMEs can proactively respond to threats and explore opportunities that arise in turbulent times. Additionally, SCF can help SMEs maintain a more stable credit profile, which is particularly valuable in securing loans or lines of credit from traditional financial institutions. Lenders often favor businesses with stable cash flow due to their reduced risk exposure. Consequently, SMEs engaged in SCF can improve their financial profiles and gain easier access to capital when needed. Emphasizing financial stability through supply chain finance can increase SMEs’ resilience and equip them to navigate the complexities of today’s market landscape.

Ultimately, supply chain finance serves as a powerful growth engine for SMEs looking to enhance their operational efficiency and financial strength. By optimizing cash flow management, improving supplier relationships, embracing digitalization, and fostering financial resilience, SMEs can reap the numerous benefits that SCF solutions offer. These approaches empower businesses to take a proactive stance in addressing their financing needs, driving growth, and achieving long-term success. As SMEs continue to face challenges that require innovative solutions, SCF stands out as an effective strategy to unlock growth potential. For aspiring entrepreneurs and established business owners alike, understanding and leveraging supply chain finance can significantly shape their financial futures. The path to success is paved with opportunities that can be fully realized through tailored supply chain finance solutions. By adopting SCF strategically, SMEs can not only survive but thrive in competitive marketplaces. As they harness the power of SCF, SMEs will find themselves well-equipped to face the evolving demands of their industries and emerge as leaders in their respective sectors.

Conclusion

In conclusion, SMEs are uniquely positioned to benefit from supply chain finance solutions that enhance their operational and financial outcomes. As the landscape continues to change, embracing SCF can lead to profound improvements in cash flow, supplier relationships, and overall financial health. With the right strategies in place, SMEs can harness the power of supply chain finance to drive growth, innovation, and sustainability. The potential for unlocking new markets and expanding business horizons is significant, as SMEs leverage these financing solutions to cultivate a more prosperous future. As they navigate the complexities of modern business environments, SMEs should prioritize integrating SCF into their strategies to ensure resilience and success. By implementing SCF solutions, SMEs can not only address their immediate financial needs but also position themselves for long-term growth and competitiveness. In a world that increasingly values agility and adaptability, supply chain finance emerges as a vital tool for SMEs aiming to thrive in a challenging economic landscape. Investing in SCF today will lead to a stronger, more vibrant tomorrow for SMEs across various sectors.