How to Train Your Team on Expense Management Practices

Training your team on effective expense management practices is essential to maintaining the financial health of your nonprofit. Start with an orientation session where the team learns the importance of tracking expenses systematically. Provide training materials, including documents outlining best practices, processes, and tools available. Utilize engaging formats such as workshops and webinars to encourage participation. Focus on real-life scenarios to enhance understanding. Present case studies that highlight the cost of poor expense management, illustrating the benefits of adherence to established guidelines. Make sure to establish clear objectives that demonstrate how proper expense management aligns with the organization’s mission and goals. Foster an interactive learning environment by performing exercises where team members analyze mock expense reports. This hands-on approach will solidify their understanding and help identify common pitfalls. Together, brainstorm possible solutions for common issues. Additionally, emphasize the significance of transparency and accountability in financial dealings. Creating a culture where financial responsibility is shared will ultimately lead to enhanced overall performance within the organization. Encourage feedback on the training process to make necessary adjustments for future sessions.

The next step involves outlining the various tools and software that can aid in efficient expense tracking and management. Familiarize your team with tools like expense tracking software that integrates with your existing financial systems. Provide comprehensive tutorials on using these tools effectively during training sessions. This exposure will enable team members to streamline their processes and reduce documentation errors significantly. Discuss how technology can provide real-time insights into spending trends, enabling the organization to make informed financial decisions. Highlight features that automate repetitive tasks such as receipt scanning and report generation. Engaging your team in conversations about technology’s role in expense management can spark dynamic discussions. Encourage them to share experiences with different financial management applications. Create a dedicated knowledge base where team members can access helpful resources to enhance their skills continuously. Organizing periodic refresher courses or advanced training sessions on software changes will ensure the team’s competency. Collaboration is key; consider setting up a peer support system where team members can assist one another in troubleshooting or new tool adoption.

Establishing Clear Policies and Guidelines

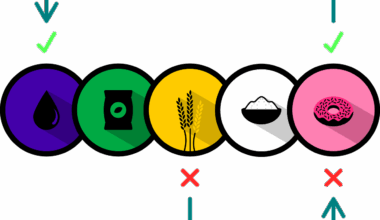

Establishing comprehensive expense management policies and guidelines is vital for team adherence and understanding. Start by creating a documented policy that encompasses spending limits, allowable expenses, and submission deadlines. Ensure every member knows the importance of following these policies thoroughly to maintain budget integrity. Hold sessions where you walk through these guidelines, encouraging team members to ask questions. Addressing their concerns head-on will contribute to a clearer understanding. Provide illustrated examples, such as specific cases outlining what is acceptable versus unacceptable expenses. Emphasizing the consequences of non-compliance will help reinforce the need for strict adherence. Regularly review these policies to keep them up-to-date with changes in financial regulations or organizational objectives. Engage your team in these reviews to allow them to suggest improvements based on their experiences. Transparency in policy communication fosters trust and helps establish a culture of accountability. Make these documents readily available on an internal portal, allowing easy access for everyone. This continuous reference will ensure that expense management remains a priority in their day-to-day operations.

Moreover, it’s essential to promote open lines of communication regarding expenses among your team members. Encourage regular discussions about financial updates and trends, helping everyone stay informed. By creating an environment where discussions on expense management are welcomed, you empower your team to address issues collaboratively. Set up channels where staff can raise inquiries or concerns about the expense process without fear of reprimand. Regular check-ins or meetings focused solely on expense management can help ensure team members feel supported. Moreover, consider creating a mentorship program where experienced staff can guide newer team members through financial management processes. Conducting feedback sessions allows the team to express their thoughts on the effectiveness of current tools and policies while identifying areas for improvement. Recognizing their contributions to financial discussions enhances team morale and ownership of their responsibilities. That’s why encouraging peer-driven solutions can lead to innovative and effective improvements in expense tracking. Establishing this dialogue can significantly improve team cohesion and operational efficiency as they work towards common financial goals together.

Implementing Regular Training Sessions

Regular training sessions are crucial to ensure that your team remains trained in expense management best practices. Consider scheduling quarterly workshops to refresh their knowledge and introduce new tools or strategies. Use these sessions to update the team on any recent changes in policies or regulations affecting expenses. Keeping your training interactive by including quizzes or group discussions fosters engagement. You can assign case studies related to common expense management challenges and seek proposed solutions. Utilizing role-playing exercises can also be beneficial in simulating conversations around expense approval or denial scenarios. Furthermore, consider inviting industry experts or guest speakers to provide additional insights and perspectives. This exposure enhances credibility and provides a stimulus for broader financial discussions within the team. Ensure that each training session incorporates feedback from the previous one to continually evolve and improve training approaches. Incorporating diverse learning modes, such as visual presentations or hands-on exercises, can cater to different learning styles. Ultimately, these regular sessions will help cultivate a financially savvy team skillfully managing organizational expenses.

Furthermore, establishing a robust expense review process helps ensure accountability within the team. Implementing a system that requires periodic review of all expenses will serve to minimize errors and enable proactive tracking. Designate a finance officer or team lead to be responsible for reviewing expense reports before final submission. This additional layer of oversight promotes responsibility and ensures compliance with your established policies. Encourage team members to double-check their documentation to assist in streamlining the review process. Consider incorporating checkpoints where team members reconvene to discuss any discrepancies or issues found within submitted expenses. It can involve collaborative discussion while ensuring proper documentation is in place. Regular discussions during these reviews can also promote a sense of collective ownership for expenses and empower participants. Ensure the final approval process maintains a balance between efficiency and thoroughness. Transparent communication during the review process fosters trust and accountability across the organization. With established checks and balances, your organization can enhance financial management significantly, ultimately enhancing trust in your team and its processes.

Monitoring and Reporting Metrics

Lastly, monitoring and reporting metrics is crucial for assessing the effectiveness of your expense management training program. Define key performance indicators (KPIs) that reflect success in expense tracking and management. For example, monitor the accuracy of expense reports, timeliness of submissions, and adherence to compliance regulations. Conduct regular assessments to evaluate the team’s performance against these KPIs. This quantifies strengths and weaknesses, allowing for actionable insights towards improvement. Develop an action plan in collaboration with your team based on these findings. Highlighting successful case studies or improvements in through reports can motivate and instill a sense of accomplishment. Transparency in sharing these metrics publicly encourages everyone on the team to strive for excellence. Consider creating a dashboard that visually represents this data, making it accessible to all. Regular updates through team meetings about the organization’s financial position will reinforce the importance of effective expense management. An ongoing commitment to scrutinizing these metrics cultivates a culture of continuous improvement, ultimately leading to better financial outcomes for your nonprofit organization.

In conclusion, investing time in training your team on effective expense management practices is vital for overall success. The combination of appropriate technology, clear policies, and ongoing support will empower your team. Reinforcing the importance of expense management ensures everyone understands their roles and responsibilities. By creating a knowledgeable and proactive team, your nonprofit can significantly enhance its financial health. Ongoing education and motivational practices will assist team members in navigating challenges efficiently. Encourage peer support and dialogue surrounding expenses, leading to collaborative solutions. Prioritize creating an engaging and informative environment. The carefully structured training will help your staff refine their expense management skills steadily. Thus, fostering a culture of accountability and shared responsibility will ultimately drive your nonprofit toward sustainability and growth.