Comparing Actively Managed ETFs vs. Passive ETFs

Exchange-Traded Funds, often known as ETFs, have gained incredible popularity in recent years. They provide an accessible way for investors to diversify their portfolios. Within the realm of ETFs, there are two distinct categories: actively managed ETFs and passive ETFs. Active ETFs employ a management team to select investments based on in-depth analysis and market conditions. They aim to outperform benchmark indices. In contrast, passive ETFs track a specific market index, seeking to replicate its performance instead of actively selecting securities. This fundamental distinction highlights the varying investment philosophies between these strategies. Investors must consider their risk tolerance, investment goals, and market outlook when choosing between actively managed and passive ETFs. Understanding the nuances of both types is crucial when constructing a portfolio that aligns with one’s financial objectives. Low costs, liquidity, and tax efficiency make ETFs an appealing choice overall. However, which type ultimately yields the best results? This article delves into the key differences to help investors make informed decisions that cater to their individual needs and expectations.

Understanding Active ETFs

Actively managed ETFs possess unique characteristics that set them apart from passive options. These ETFs often come with higher expense ratios due to the management fees associated with skilled investment teams. This selection process involves continuous research, analysis, and potential adjustments to the portfolio as market conditions change. Investors might gravitate towards these ETFs when they believe that active management can generate better returns than market averages. However, it’s essential to note that not all active managers outperform the market consistently. Hence, investors must perform due diligence on the track record of these funds before investing. Factors to consider include the strategy employed, historical performance, management experience, and fees. Some actively managed ETFs also offer flexibility in investment choices, allowing managers to respond quickly to market cues. This flexibility might appeal to those interested in capitalizing on specific market trends or sectors. Ultimately, investors aiming for returns above index performance may find actively managed ETFs worth considering, yet they must weigh the costs and risks associated with this approach. The potential for higher returns often comes with a trade-off in terms of expenses.

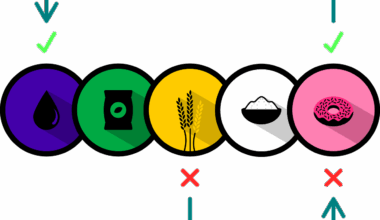

Passive ETFs, on the other hand, have gained a significant following due to their cost-effectiveness and simplicity. These funds aim to mirror the performance of a specific index without attempting to outperform it. By offering a broad market exposure, passive ETFs can effectively lower risks associated with individual securities. The low expense ratios attributed to passive management are appealing, as decreased costs often translate to more substantial long-term gains. Furthermore, passive ETFs are generally less prone to dramatic fluctuations, providing investors with a sense of stability. Investors who prefer a buy-and-hold strategy might find passive ETFs especially appealing. They can build wealth over time by taking advantage of market growth. Moreover, passive ETFs are often more tax-efficient because they typically have lower turnover compared to actively managed funds. This efficiency can lead to minimized capital gains distributions, thus offering potential tax advantages for investors. In essence, passive ETFs serve as a straightforward solution for those looking to invest in the market without the complexities of active management, making them an attractive choice for various investors.

Comparative Performance Analysis

When comparing actively managed and passive ETFs, performance is a crucial element of consideration. Typically, investors seek funds that not only perform well in various market conditions but also minimize risks. Active ETFs operate with the goal of beating a benchmark index, which could potentially lead to higher rewards. However, data from numerous studies have shown that many actively managed funds fail to consistently outperform their benchmarks over extended periods. Conversely, passive ETFs consistently deliver performance that aligns closely with their underlying indices. The efficient market hypothesis suggests that it’s challenging to gain an edge through active management consistently. Consequently, many investors might find that passive ETFs offer better long-term value due to their predictable performance and lower fees. Nevertheless, there may be periods when actively managed ETFs outperform, especially in volatile markets or sectors where skilled managers can navigate risks and capitalize on opportunities more effectively. Ultimately, the choice between these two ETF types may depend on individual market outlooks and investment strategies.

Fees play a vital role in the decision-making process for ETF investors. Actively managed ETFs generally incur higher expenses because of their active investment strategies. Costs can include manager salaries, research expenses, and trading fees associated with the constantly changing portfolios. In contrast, passive ETFs typically boast lower management fees since they require less oversight. Lower costs can have a significant impact on investment returns over time, particularly when compounding is considered in long-term holdings. For many investors, minimizing expenses is a top priority, which is why passive ETFs may seem more attractive. Evaluating fees brings about crucial insights into total portfolio costs and potential returns. While some actively managed ETFs might justify their higher fees with superior performance, the majority of passive options have consistently outperformed when cost is factored in. Therefore, it’s not only essential to consider past performance but also how these fees impact long-term investment growth. This evaluation will likely lead many investors to lean towards passive options due to their more straightforward, cost-efficient investment strategies.

Investment Strategy and Goals

When deciding between actively managed and passive ETFs, investors must clearly define their investment strategy and goals. Active ETFs are often suited for those seeking specific market exposure and willing to undertake higher risks to chase potential higher returns. These investors might believe in the value of skilled management and are ready to embrace the associated costs. Alternatively, passive ETFs may be ideal for those preferring a more hands-off approach. A buy-and-hold strategy focusing on broad market exposure can be effective with passive ETFs, providing stable growth over time without frequent trading concerns. Depending on market conditions, investors may adjust their strategies to include both options. Some may employ a core-satellite strategy, where passive portfolios serve as a core holding and active approaches offer additional potential upside. This diversified strategy can balance the benefits and risks between active and passive investments. Whether an investor is focused on capital growth, income generation, or preservation of capital, articulating precise goals will help guide the decision-making process and ultimately influence how one navigates the ETF landscape.

In conclusion, both actively managed ETFs and passive ETFs present compelling advantages and considerations for investors. The choice between the two ultimately hinges on individual preferences, investment strategies, and market perspectives. Investors who prioritize active management and believe in the ability to outperform may gravitate towards actively managed ETFs, accepting the accompanying risks and fees. Alternatively, those who value simplicity, lower costs, and a long-term wealth-building approach may opt for passive ETFs. Assessing factors such as performance history, fees, market conditions, and investment goals helps investors craft a strategy that aligns with their financial objectives. It’s essential to remain mindful that market trends can evolve, influencing the relative merits of each strategy. Continuous education and staying informed about changing market conditions are critical components for success in ETF investing. By evaluating personal financial situations and objectives, investors can navigate the complexities of ETF investments. Ultimately, the path to building a robust investment portfolio lies in understanding the differences between actively managed and passive ETFs and knowing when to employ each to best serve individual financial aspirations.