Reverse Factoring and ESG Integration in Supply Chain Finance

Reverse factoring, also known as supply chain financing, enables suppliers to receive early payments on their invoices. This financial tool promotes liquidity and strengthens supplier relationships. In recent years, there has been a marked interest in integrating environmental, social, and governance (ESG) principles into reverse factoring. Companies are increasingly recognizing the importance of sustainable practices in their supply chains. A focus on ESG factors can enhance reputational value, facilitate better risk management, and improve overall operational efficiency. Financial institutions and companies engaged in reverse factoring are called to maintain an ethical commitment, aligning their financial practices with sustainable development goals. By promoting responsible purchasing practices and ensuring fair treatment of suppliers, companies can create a more resilient supply chain ecosystem. The collaboration and transparency within the supply chain can lead to a reduction in carbon footprints and social disparity. Additionally, organizations that prioritize ESG criteria often attract responsible investors, showcasing their dedication to sustainable practices. Companies deploying reverse factoring with an ESG lens not only improve financial stability but also contribute positively to social and environmental matters.

One of the primary benefits of integrating ESG factors into reverse factoring is the ability to attract and retain suppliers who are committed to sustainable practices. Suppliers that prioritize eco-friendly processes often enhance their operational capabilities while mitigating environmental risks. Through reverse factoring arrangements, these suppliers can gain access to quicker payments, leading to improved cash flow and financial resilience. This collaborative approach encourages suppliers to invest in sustainable and ethical practices, knowing that their financial stability will be supported through early payment initiatives. In turn, buyers benefit from having more reliable suppliers who conform to sustainable practices, further solidifying the connectivity and trust within the supply chain. Transparency introduced by this integration leads to improved supplier evaluation mechanisms as buyers analyzing potential partners can assess their commitment to ESG criteria. This practice not only results in better supplier selection but also fosters a competitive edge in the marketplace. As stakeholders, including consumers and investors, increasingly demand accountability in supply chains, companies can leverage reverse factoring solutions to demonstrate their commitment to positive social impact while maintaining financial stability.

The Role of Technology in Reverse Factoring with ESG Focus

Technological advancements, such as blockchain and data analytics, are revolutionizing the implementation of reverse factoring with an ESG focus. These technologies enhance transparency and efficiency, facilitating smoother transactions and better financial management. By leveraging blockchain, companies can ensure an accurate and tamper-proof record of all supply chain transactions, which enhances trust and accountability between buyers and suppliers. Furthermore, blockchain technology can help track the sustainability credentials of suppliers, allowing financial institutions to verify their ESG compliance. In addition to blockchain, data analytics provides valuable insights into supplier performance, enabling buyers to make informed decisions in selecting suppliers who align with their ESG goals. This data-driven approach allows companies to continuously improve their supply chains and assess their impact on the environment and society. With the proliferation of online platforms, small and medium enterprises also gain better access to reverse factoring capital, ensuring equitable growth opportunities regardless of size. As technology further advances, the integration of ESG principles in reverse factoring will become more streamlined, paving the way for a more sustainable and equitable financial landscape.

Regulatory frameworks and increased consumer awareness surrounding sustainability are driving the adoption of ESG principles in reverse factoring. Governments and regulatory bodies are setting guidelines that encourage companies to disclose their sustainability practices. As consumers become more environmentally conscious, corporations are compelled to integrate these practices into their operations, including supply chain finance solutions. Investors are increasingly evaluating companies based on their ESG performance, adding competitive pressure to adopt ethical financing practices. Companies committed to understanding and enhancing their ESG footprint stand not only to improve their brand reputation but also to secure investment opportunities. This growing emphasis on transparency and responsible sourcing impacts financial agreements, where investors may prefer companies offering favorable terms in reverse factoring arrangements. By embracing these principles, businesses enhance their creditworthiness and strengthen stakeholder relationships, making it easier to navigate potential financial challenges. The intersection between regulatory compliance and corporate responsibility represents a shift towards a more comprehensive understanding of supply chain finance, positioning companies favorably within the evolving landscape of global commerce.

Challenges of ESG Integration in Reverse Factoring

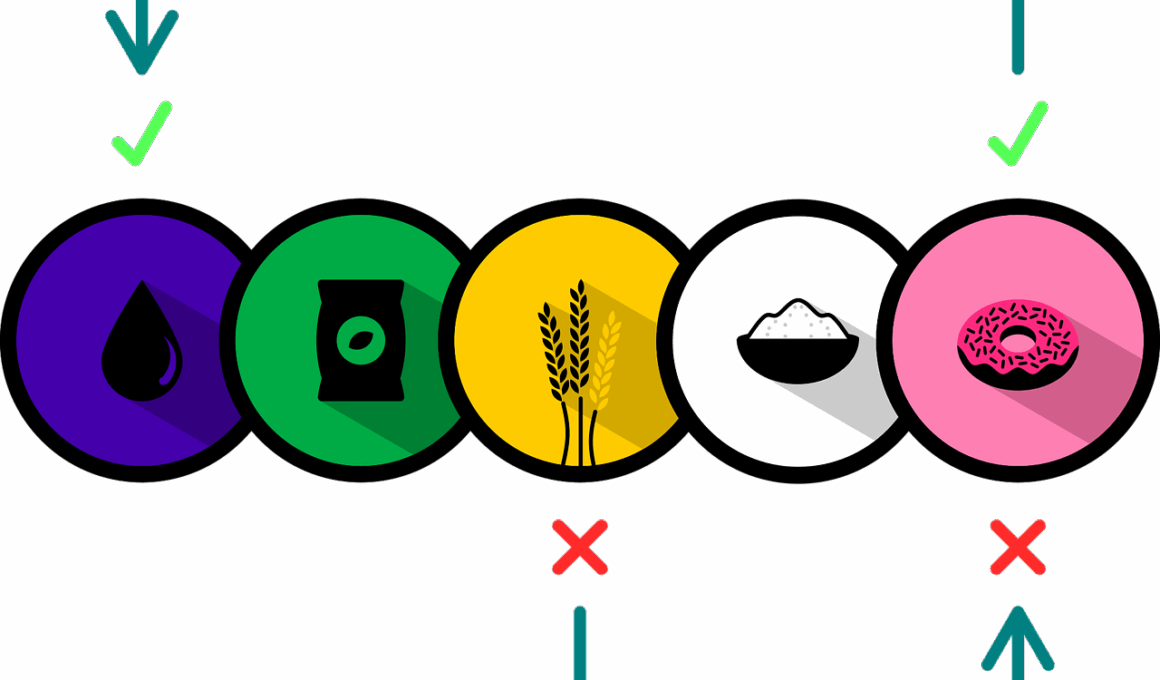

Despite the numerous benefits, integrating ESG principles into reverse factoring is not without its challenges. One key hurdle is the lack of standardized metrics for measuring ESG performance across different suppliers. The diversity of industries and regional regulations complicates the establishment of universal benchmarks. Without a consistent framework, companies may struggle to compare suppliers or assess their contributions to sustainability effectively. Additionally, the existing technological infrastructure in many organizations may not support the seamless integration of ESG data into financial processes, resulting in potential inefficiencies. Training and awareness programs for employees involved in supply chain finance are essential to ensure an understanding of the importance of sustainability. Moreover, companies must actively engage their suppliers to raise awareness about sustainable practices and incentivize participation in ESG initiatives. Overcoming these challenges requires cooperative efforts among stakeholders to facilitate a shared understanding and commitment toward responsible finance. Developing industry-wide standards could enhance transparency, enabling companies to demonstrate their ESG performance while fostering collaboration for broader societal benefits.

Ultimately, the positive impact of reverse factoring on ESG integration can lead to transformative changes within supply chains. When companies prioritize sustainable financing solutions, they inherently contribute to greater global sustainability efforts while enhancing their organizational resilience. Implementing ESG-focused reverse factoring strategies encourages suppliers to adopt greener practices and consider the broader implications of their operations. This interconnected approach shapes supply chains that not only thrive economically but also uplift communities and protect natural resources. As companies continue to pursue profitability alongside social responsibility, investing in ethical and sustainable finance will become increasingly essential. Stakeholders must prioritize transparency and accountability, measuring the impact of their initiatives on environmental and social fronts. Achieving long-term financial success requires aligning business interests with sustainable development goals, ultimately benefiting both society and the environment. As reverse factoring evolves within the landscape of supply chain finance, sustainability will remain an integral consideration. By fostering a culture of collaboration and trust, organizations can help realize meaningful impacts across the entire supply chain.

Future Trends in Reverse Factoring and ESG

Looking ahead, it is evident that the future of reverse factoring is inextricably linked to ESG considerations. Consumer preferences are rapidly shifting toward brands that are transparent in their supply chain financing and operations. This shift will force companies to rethink their financial strategies and ensure they align with responsible practices. Innovations in artificial intelligence and machine learning may unlock new horizons in managing supplier risk and monitoring ESG compliance. Companies are likely to utilize enhanced data analytics for real-time decision making, supporting efficient supply chain processes. The demand for sustainable products will encourage businesses to offer improved financing solutions, ultimately leading to a more responsible procurement process. Multi-channel engagement approaches ensure that companies remain connected to stakeholders interested in ESG achievements, showcasing their commitment to ethical practices. The emphasis on collaboration between companies, financial institutions, and technology providers will foster advancements in reverse factoring solutions. Embracing best practices and encouraging continuous learning within the industry will solidify the role of reverse factoring as a vital contributor to sustainable supply chain finance.

The evolving landscape of supply chain finance calls for organizations to reassess their financing approaches to create environmentally sustainable frameworks. By addressing ESG considerations in reverse factoring implementation, companies can unlock both financial and social value. Transparent communication and progressive policies will pave the way for enhanced stakeholder collaboration, transforming the broader industrial ecosystem towards sustainability. Companies embracing change and prioritizing ESG values will be instrumental in shaping the future of supply chains, ultimately improving resilience and adaptability in an ever-changing market landscape. As businesses implement forward-thinking approaches in reverse factoring, they will contribute significantly to reducing negative environmental impacts while enhancing financial performance. Taking significant steps in this direction will build trust with consumers, investors, and regulators. Organizations that lead the way in embedding ESG principles within their financing model will be positioned competitively. The journey toward sustainable finance is ongoing. Companies willing to innovate and adapt to new challenges within their supply chains will ensure they maintain relevance and thrive in future markets. As supply chain finance transitions further into ESG integration, the opportunities are significant for those who proactively embrace the change.