The Rise of Mobile Payment Processing Technologies

The rise of mobile payment processing technologies has transformed the landscape of commerce remarkably over the past decade. Consumers now prefer the convenience of utilizing their smartphones for transactions rather than carrying physical cash or cards. This shift is primarily driven by advancements in technology, increased smartphone penetration, and heightened consumer expectations for seamless payment experiences. Mobile payment solutions such as Apple Pay, Google Wallet, and Samsung Pay have gained significant popularity, allowing users to complete transactions with just a tap or swipe. Merchant adoption of these solutions has also surged, incentivized by the demand for faster and more efficient payment methods. Businesses can now provide an enhanced customer experience and shorten the checkout time, which is crucial for maintaining competitiveness. Security features such as encryption and tokenization, which protect users’ financial information, further encourage widespread adoption. Additionally, integration with loyalty programs offers customers extra incentives. As mobile payment processing technologies continue evolving, the future holds even more innovative solutions tailored to satisfying changing consumer needs and preferences. Continuous advancements are paving the path for more robust digital payment ecosystems.

The increasing reliance on mobile devices has also significantly impacted consumer behavior, resulting in a shift towards contactless transactions. Consumers appreciate speed and convenience, which mobile payment processing technologies provide, especially during high-traffic shopping periods. Card skimming and other fraud threats have further motivated users to move towards encrypted mobile payment solutions. Various studies reveal that mobile payments are not just a trend, but the future of financial transactions. These technologies rapidly expand beyond retail, making their way into marketplaces, restaurants, and even personal finance management. Mobile payment systems foster greater customer loyalty, offering rewards for repeat customers through easy-to-use applications. Tech giants recognized this potential and have heavily invested in their mobile payment infrastructures. Companies enabling secure payments through third-party apps are becoming essential players in the market. Furthermore, partnerships between technology providers and financial institutions promote the widespread use of such technologies. As merchants progressively realize the benefits of adopting mobile payment processing technologies, it can be anticipated that further innovations will continue to enhance user experience while ensuring security and privacy.

Integration of Advanced Technologies

A notable aspect of the rise of mobile payment processing technologies is the integration of advanced technologies such as AI and blockchain. These innovations significantly enhance the overall payment experience for both consumers and merchants alike. Artificial intelligence enables better fraud detection and risk management, providing higher security for users. Many mobile payment platforms employ machine learning algorithms to analyze transaction data and identify patterns, enabling quick detection of suspicious activities. Blockchain technology enables secure, transparent, and tamper-proof transactions between parties without intermediaries. This allows for lower transaction fees and quicker processing times, enticing more merchants to adopt the technology. Additionally, various sectors like health care and hospitality are integrating mobile payments to streamline operations. The ease of mobile payments can lead to improved customer satisfaction, driving repeat business. Furthermore, the combined use of biometric authentication, such as fingerprint and facial recognition, adds an extra layer of security. As these technologies and integrations evolve, they will continue revolutionizing mobile payment systems, ensuring they remain both secure and user-friendly for a vast array of customers.

The current landscape of mobile payment processing technologies demonstrates the importance of adaptability, especially as consumer preferences change. Merchants and businesses increasingly recognize that maintaining competitive advantages hinges upon offering flexible payment options. Offering various payment methods, including mobile wallets and options like PayPal, ensures businesses can cater to diverse audiences. By doing so, they increase customer satisfaction and loyalty, essential for long-term success. Additionally, the emergence of payment apps specifically designed for Millennials and Gen Z further illustrates the necessity of catering to the evolving market. These generations prioritize convenience, speed, and security, which mobile payments provide. Furthermore, promotional campaigns and partnerships with other tech companies can enhance the visibility of payment processing technologies. Businesses must actively engage customers through dual functionalities of mobile payments and social media platforms, creating a synchronized customer experience. The power of review and feedback for ongoing improvements remains significant. Recognizing which features customers value turns into actionable insights for future developments. Ultimately, businesses that remain attuned to these trends are likely to succeed in the rapidly evolving digital landscape.

Regulatory Framework and Security

The rise of mobile payment processing technologies and their widespread adoption bring inherent challenges, particularly concerning regulatory frameworks and security. Governments across the globe are still grappling with creating rules and regulations to safeguard consumer data and ensure transaction security. Compliance with these guidelines is a significant concern for companies engaged in the digital payments sector. Striking a balance between innovation and adhering to regulations is paramount for businesses. Thus far, many global jurisdictions have enacted laws that require enhanced security measures for fiscal documents and accountability. Organizations need to understand and implement these regulations to operate without legal complications. As cybercrime evolves, businesses must take proactive steps to heighten cybersecurity measures, safeguarding customer data against potential breaches. Regular updates and personnel training on security protocols are essential in mitigating risks. Moreover, customers must be educated about secure mobile payment practices and the importance of using strong password protection. As awareness regarding privacy issues increases, companies adopting resilient security standards stand to build trust and loyalty among users. In doing so, they will ultimately foster a safe mobile payment ecosystem.

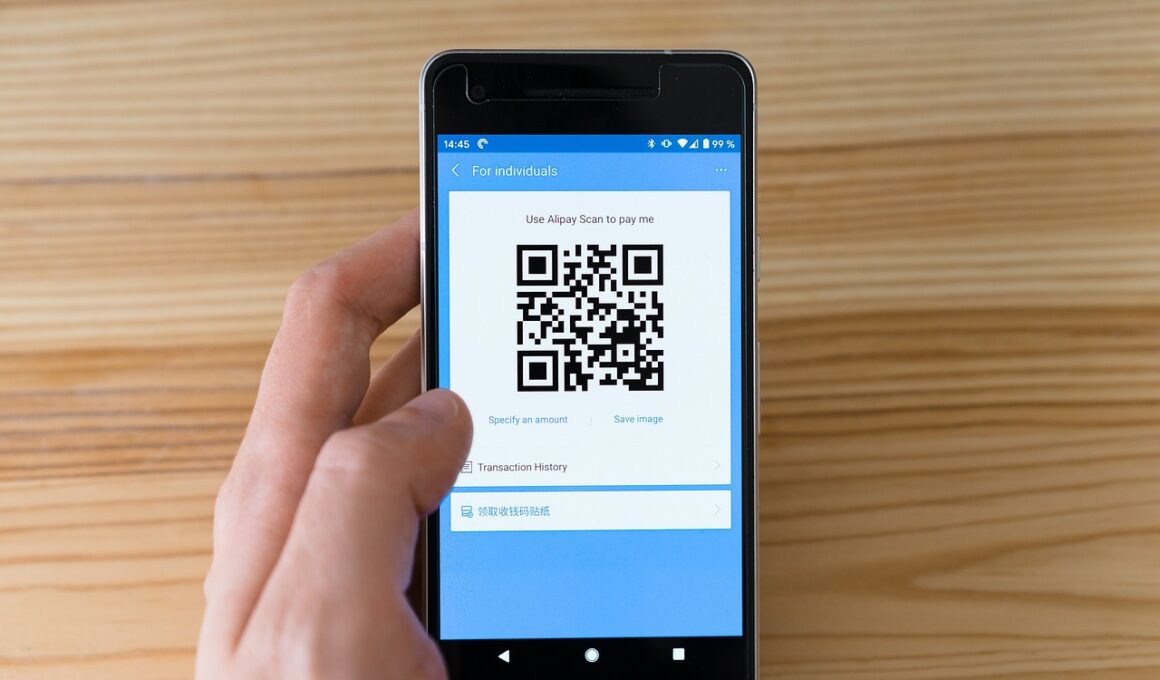

Looking ahead, the future of mobile payment processing technologies appears bright, driven by continuous advancements and increased user adoption. Innovations such as near-field communication (NFC) technology and QR code payments will continue to improve mobile transaction convenience. They enable secure transfers through simple actions, eliminating the need for physical interaction altogether. As the technology matures, we will likely witness even more integrations with other sectors, creating seamless experiences across various platforms. The merging of personal finance tools with payment systems will allow individuals to effortlessly track their spending while making purchases. This all-in-one approach could further demystify financial management for consumers, especially digital natives. Additionally, proactive infrastructure investments by telecom companies will greatly enhance mobile connectivity, making mobile payments even more accessible in emerging economies. Regulatory standards will also evolve, ensuring global interoperability as regions implement their frameworks. Businesses that stay informed and adapt to these developments will thrive in an increasingly competitive market. As mobile payment processing technologies reshape the financial landscape, both consumers and merchants stand to benefit immensely from the efficiencies they bring.

Conclusion

In conclusion, the rise of mobile payment processing technologies exemplifies the notable changes occurring in the world of commerce and finance. Along with increasing consumer demand for convenience and security, businesses that prioritize the implementation of these technologies will find themselves at the forefront of the industry. The expansiveness of mobile payments, augmented by integrations of AI, machine learning, and blockchain, showcases a robust future where traditional payment methods gradually become obsolete. With shifting consumer demographics towards tech-savvy generations, organizations must innovate continuously to meet their diverse preferences. Emphasizing security and regulatory cooperation will be essential for fostering trust and loyalty in this digital era. Effective customer engagement strategies and enhanced learning about mobile payment protocols to instill user confidence are critical steps in adopting these technologies successfully. The collaborative efforts between merchants, financial institutions, and technology providers will prove vital for nurturing the growth of mobile payment ecosystems. As we navigate this evolving landscape, the potential it holds will create opportunities for businesses and invigorate commerce in previously unimaginable ways.