Early Retirement: Planning and Preparing Financially

Planning for early retirement involves careful considerations, ensuring you have sufficient funds to cover living expenses for potentially decades. Start by determining your desired retirement age. Aim for clarity on how much you need to save by estimating your future expenses in retirement, which includes housing, healthcare, travel, and leisure activities. Creating a comprehensive budget will help you identify areas where you can cut expenses now. Consider potential inflation and unexpected costs that could arise during retirement. Your income sources post-retirement must be diversified. Potential income might come from pensions, Social Security, investments, or part-time work. Each source should be evaluated for its reliability and longevity. Building a robust retirement account is vital; max out contributions to tax-advantaged accounts like IRAs or 401(k)s. Don’t forget to take advantage of employer matches if available. Consulting with a financial advisor can be beneficial in crafting an effective plan tailored to your needs. They can guide you on asset allocation and investment strategies that align with your risk tolerance. The earlier you start planning, the more options you’ll have to achieve the financial freedom that comes with early retirement.

Assessing Your Financial Health

Understanding your current financial health is crucial as you contemplate early retirement. Start by calculating your net worth, which includes assets such as real estate, savings, and investments, minus your liabilities like debts and mortgages. A thorough assessment allows you to identify areas for improvement. Budgeting plays a pivotal role in this phase. Use your current income and expenditure to establish a realistic budget that outlines necessary expenses and discretionary spending. Identify opportunities to increase savings. Prioritize high-interest debt repayment to increase your ability to save. The next step includes analyzing the sustainability of your savings rate; how aggressively you need to save to meet retirement goals is essential. This could mean adjusting lifestyle choices—consideration for smaller homes or cutting back on luxury items may be necessary. Monitor your progress by conducting quarterly reviews. It’s essential to remain adaptable, adjusting your plan based on your changing circumstances. Staying informed about economic trends can also help you make better investment choices to maximize your savings over time. With a solid understanding of your finances, you will feel more empowered to approach early retirement with confidence.

Research indicates that many people grossly underestimate the amount necessary for retirement. To mitigate this risk, consider employing the 85% rule, which suggests you should aim for an income that replaces 85% of your pre-retirement income. This approach provides a broader financial cushion, allowing for lifestyle consistency after retirement. Another important factor is healthcare; costs can rise significantly as you age. Research various health insurance options and Medicare, as these will significantly impact your financial situation. Create an emergency fund to cover unforeseen expenses, aiming for at least six months’ worth of expenses readily accessible. This fund should be separate from retirement savings to ensure its integrity. Next, take advantage of capital gains from investments to grow your nest egg. Understanding investment vehicles is essential; consider stocks, bonds, and mutual funds that correspond with your risk profile. A diversified investment strategy usually yields better returns over time. Make contributions regularly, adhering to the saying that “time in the market beats timing the market.” Through a disciplined and calculated approach to saving and investing, the probability of success in achieving early retirement greatly enhances your financial position.

Understanding Retirement Accounts

Retirement accounts play a pivotal role in the planning strategy for anyone considering early retirement. Familiarize yourself with various accounts: 401(k)s, IRAs, and Roth IRAs. These accounts offer tax advantages that can greatly enhance your savings. Note that traditional 401(k) and IRA contributions are often tax-deductible but tax payments will occur upon withdrawal. In contrast, Roth accounts allow for tax-free withdrawals after meeting specific conditions, which can be beneficial in minimizing taxes during retirement. Limitations exist concerning early withdrawals from retirement accounts to consider. Most accounts impose penalties for withdrawing funds before the age of 59½, adding additional complexity to your planning. Exploring alternative investment strategies, such as brokerage accounts, offers flexibility, albeit without the same tax breaks. The amount contributed annually to these accounts is subject to caps, necessitating strategic allocations to maximize savings. Keep abreast of changing legislation regarding contribution limits. Staying informed will ensure you’re making the most of available opportunities, optimizing your saving strategy while avoiding penalties. A disciplined approach to maximizing these accounts can significantly impact your ability to retire early on secure financial foundations.

Additionally, cultivating a disciplined saving habit is fundamental to achieving early retirement. This doesn’t simply entail saving what is left over at the end of the month; rather, it requires a proactive approach. Set explicit savings goals and automate contributions to retirement accounts. Automating savings helps to instill a consistent habit—out of sight, out of mind! Utilize every available opportunity to bolster your savings. This can mean funneling bonuses or tax refunds directly into retirement accounts. Furthermore, continually educate yourself about financial literacy. Books, podcasts, and blogs can offer valuable insights, guiding you along the path towards responsible financial planning. Engage with platforms that provide calculators for future retirement benefits—these resources help you plan effectively. Consider surrounding yourself with like-minded individuals who are on similar financial journeys. Networking with others might provide motivation and support, essential elements for staying enthusiastic about saving and preparing. Depending on your financial ambitions, you might also seek mentorship from financial experts. Personal finance professionals or retirement planners can provide tailored advice suited to your individual financial landscape, enhancing the likelihood of early retirement success significantly.

Investment Strategies for Retirement

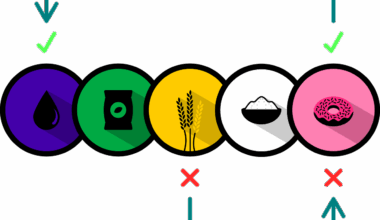

Investment strategies are central to ensuring you have sufficient resources for early retirement. Begin by assessing your risk tolerance; determine how comfortable you are with market fluctuations. Generally, younger individuals might be more aggressive with their investments, unlike those nearing retirement, who may favor conservative options. It’s essential to maintain a diversified portfolio, comprising stocks, bonds, mutual funds, and real estate investments. Diversification helps mitigate risk and balances potential losses in the wake of market downturns. Evaluate your investment returns regularly to ensure they align with your retirement goals. Adjust as necessary based on performance and market conditions. Time horizons should also influence investment choices; the longer your investments are held, the more risk you can afford to take. Engaging a financial advisor can provide enhanced strategy options tailored to your needs. Look for low-cost investment options, such as index funds, which can yield competitive returns without high fees. Remember that retirement portfolios should grow steadily over time. Consider compound interest—the earlier you start investing, the greater the potential growth on your nest egg. Invest smartly, and you may achieve your goal of early retirement sooner than anticipated.

Finally, as you approach retirement, ensure your goals remain realistic and attainable. Ongoing evaluations of your financial situation are essential to ensure you stay aligned with your retirement objectives. Lifestyle changes may need to occur, especially if your savings trajectory is not meeting your expected timeline. Continuous education about the markets and financial instruments will equip you with the necessary tools to adapt to changing circumstances. Engage in regular dialogues with a financial planner; they can help you navigate complex financial landscapes. Remain flexible to account for life’s unpredictable nature—job changes, family needs, or shifts in market conditions may necessitate adjustments to your plans. Monitor your spending continuously; living above your means can severely impact your savings trajectory. Take proactive steps to reduce fixed costs, maximizing your available savings. Lastly, relish the planning journey while keeping your eye on the long-term prize of financial independence. Early retirement is a goal that rewards thorough preparation and perseverance, ultimately leading to a more fulfilling future where you can invest your time in activities that resonate deeply with your passions and values.

In conclusion, early retirement planning is a multifaceted endeavor that necessitates thorough evaluation, disciplined saving, investment strategy, and continual learning. Make it a priority to understand your financial landscape and set achievable goals that align with your aspirations. Financial literacy is an essential component of this endeavor; equip yourself with the knowledge to make informed decisions that will benefit you in the long run. Utilize retirement accounts effectively, paying attention to contribution limits and tax implications to optimize your savings. Consistency is key—establishing a habit of saving and investing will bear fruit over time, leading you closer to your early retirement dream. Along the way, remain flexible and open to adjustments, understanding that life’s unpredictability may necessitate changes in your retirement plan. Surround yourself with a community that encourages and supports your financial goals, with open lines of communication to financial advisors when necessary. Ultimately, the vision of a financially secure retirement can become a tangible reality with diligent effort and planning. Trust in your journey toward financial independence, and embrace the opportunities that an early retirement can bring to your life.