How to Implement Sustainable Practices in Supply Chain Finance

Implementing sustainable practices in supply chain finance begins with a clear understanding of the existing financial processes and their impact on the environment. The goal is to create a financing structure that supports sustainability while promoting efficiency throughout the supply chain. Start by assessing current supplier relationships and financing methods. This includes examining the payment terms, financing options, and the sustainability practices of suppliers. It is essential to choose partners who prioritize green initiatives and ethical sourcing. Financing provisions must be aligned with sustainability goals, motivating suppliers to adopt greener practices. Transparency in financial transactions is crucial for accountability. Additionally, businesses should leverage technology to monitor and manage these practices effectively, enhancing traceability. Using advanced analytics can help identify areas for improvement in the supply chain finance process. Creating stronger connections between finance and sustainability ensures better resource utilization and a lower overall carbon footprint. Investing in sustainable supply chain practices can lead to long-term benefits, such as cost savings and improved brand reputation. Embracing these principles not only aids in compliance with regulations but also boosts competitiveness in a rapidly changing market, fostering a more sustainable business environment.

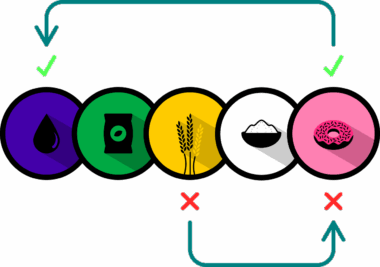

Developing a culture of sustainability throughout the supply chain requires collaboration across departments and stakeholders. Regularly convening cross-functional teams ensures that everyone comprehensively addresses sustainability goals. This can be achieved through workshops, training sessions, and knowledge-sharing platforms. Foster communication between finance teams and sustainability departments to align financial strategies with environmental objectives. Companies should also develop methodologies for evaluating the sustainability performance of suppliers and partners. By incorporating sustainability metrics into procurement and financial policies, organizations can prioritize choosing suppliers committed to environmentally friendly practices. Utilize tools such as lifecycle assessments to ascertain each supplier’s environmental impact, fostering more informed decision-making. Additionally, offering incentives to suppliers for adopting sustainable practices, like discounts for early payments, can encourage further commitment to green initiatives. Creating long-term contracts with suppliers focused on sustainability allows for collaborative, goal-oriented approaches that benefit both parties financially and environmentally. These partnerships often lead to innovation, resulting in improved products and services. Over time, fostering a collaborative ethos leads to enhanced supplier relationships and a more resilient and efficient supply chain, thereby positively impacting the overall business sustainability goals.

Leveraging technology plays a crucial role in implementing sustainable practices in supply chain finance. Digital tools, such as cloud-based platforms, can streamline processes and enhance visibility across the supply chain. With real-time data, businesses can monitor and track sustainability performance metrics efficiently. Blockchain technology enhances transparency and accountability by allowing all parties to access transaction histories securely. This level of transparency significantly improves trust among stakeholders, ensuring sustainable practices are adhered to throughout the supply chain. Additionally, automation within financial operations leads to increased efficiency, reducing the time spent on manual processes. Deploying Artificial Intelligence (AI) can help optimize working capital management, enabling better decisions based on predictive analytics. AI algorithms can analyze historical data to forecast future trends, assisting in proactive financial planning aligned with sustainability goals. Also, adopting e-invoicing and digital payment systems reduces reliance on paper and speeds up transactions, enhancing cash flow. Such tools not only contribute to financial efficiency but also support ecological initiatives. As companies strive for sustainable development, integrating these technological solutions allows for smarter finance management and promotes a cleaner environment.

Evaluating and Monitoring Performance

To effectively implement sustainable practices, it is vital to establish metrics and KPIs (Key Performance Indicators) that align with sustainability goals. These metrics should measure environmental impacts, financial performance, and supplier compliance. Regularly tracking these indicators enables businesses to assess the effectiveness of their sustainability initiatives. Consider expanding the standard KPIs to include sustainability targets, thereby facilitating a more comprehensive performance evaluation. Transparency in reporting progress against these metrics fosters accountability and could reinforce customer confidence in chosen suppliers. Additionally, implementing a continuous improvement framework encourages regular reassessment of sustainability practices, thus identifying areas that require adjustment or enhancement. Utilizing software tools can simplify data collection and reporting, ensuring accurate real-time analysis. Conducting audits on supply chain practices provides insights into compliance levels while highlighting potential risks. Engage stakeholders by sharing sustainability achievements through various communication channels, generating further interest and motivation amongst teams. Ultimately, an organized approach to evaluation fosters trust within the organization and its partners, helping to cultivate a culture dedicated to long-term sustainability success. As the business landscape continually evolves, adapting to new insights ensures the ongoing advancement of sustainable supply chain finance practices.

Financial approaches that consider the environment must also encompass risk management. Traditional models often overlook environmental risks, but incorporating sustainability objectives into risk assessments can enhance overall efficiency and resilience. Begin by identifying potential risks associated with supplier practices, such as sourcing raw materials and transportation emissions. Use risk assessment frameworks that focus on environmental impacts, encouraging serious evaluation of suppliers’ sustainability practices. Additionally, companies should develop contingency plans for supply chain disruptions caused by environmental factors. This foresight not only prepares businesses for unforeseen challenges but encourages them to collaborate with suppliers on solutions aimed at minimizing risks. By supporting sustainable suppliers, companies can mitigate their overall exposure to risks, creating a more robust supply chain network that withstands fluctuations. Furthermore, implementing insurance products geared towards sustainability can safeguard businesses against damages caused by partners’ environmental negligence or failures. Examining the expenses associated with unsustainable supplier practices reveals the potential cost savings achieved through greener alternatives. Ultimately, a comprehensive risk management strategy that partners with sustainable suppliers leads to an adaptive supply chain finance approach that benefits both businesses and the environment.

Engaging stakeholders in sustainable finance initiatives is essential for creating a unified approach to sustainable supply chain practices. This engagement begins with educating stakeholders about the importance of sustainability and its impact on overall business performance. Transparency in sharing the company’s sustainability objectives fosters a sense of ownership among team members, which can drive innovation and collaboration. Regular communication regarding progress and achievements surrounding sustainability goals can motivate all employees and stakeholders to contribute actively. Consider hosting events that bring suppliers and internal teams together to share best practices and collaborate on sustainability initiatives. Innovative approaches, such as roundtable discussions or workshops, can facilitate knowledge exchange and deepen relationships. Additionally, developing a supplier diversity program can broaden the pool of sustainable suppliers, enhancing collaboration. Recognizing and rewarding suppliers for their dedication to sustainability encourages continuous improvement and commitment to these practices. As stakeholders become more integrated within the sustainability strategy, their continued involvement not only strengthens community relations but also creates long-lasting value for the business and the environment.

Conclusion

In conclusion, implementing sustainable practices in supply chain finance entails a comprehensive effort that integrates finance with environmental stewardship. By evaluating current practices, organizations can make informed choices that align with sustainability goals while enhancing efficiency. Leveraging technology, fostering collaboration, and actively engaging stakeholders leads to a successful transformation of supply chain finance. Establishing metrics for evaluating performance ensures progress towards sustainability goals remains accountable and transparent. Moreover, integrating risk management strategies accounts for environmental factors, further enhancing resilience. Ultimately, sustainable practices not only contribute to ethical business but also result in financial benefits such as cost savings and improved reputation. As businesses strive for greater sustainability, these practices will serve as the stepping stones for creating a greener economy. By committing to sustainability in supply chain finance, organizations can position themselves as leaders in their industry, paving the way for future growth and combined success. As the focus on sustainable development intensifies globally, embracing these best practices is not just an option but a necessity for any forward-thinking company. Taking decisive steps now will create a more robust, innovative, and environmentally friendly supply chain finance landscape.

Through these initiatives, companies can substantially impact both their bottom line and the environment, paving the way for an efficient and sustainable future. Promote these practices actively within the community to influence other organizations toward similar goals and foster partnerships that drive industry-wide change towards sustainability in finance. A collective effort can amplify sustainability goals, showcasing the broader impact that traditional supply chain finance can have on the environment. Ultimately, by embedding sustainability deeply within the organization’s financial vision, it sets the stage for influencing behavior in supply chain practices profoundly. The commitment to sustainable supply chain finance becomes part of the corporate ethos, yielding long-lasting benefits for the organization, its stakeholders, and the society at large. As part of a holistic approach, consider how sustainable financial strategies can achieve shared prosperity, linking those to global initiatives such as the United Nations Sustainable Development Goals (SDGs). The journey to sustainability in supply chain finance requires commitment, continuous innovation, and transparent collaboration, presenting an opportunity to showcase responsible stewardship of resources. In this respect, businesses can lead the way toward a collective sustainable future, creating a ripple effect that reaches far beyond their immediate impact.