The Role of Blockchain in Securing Biometric Payment Transactions

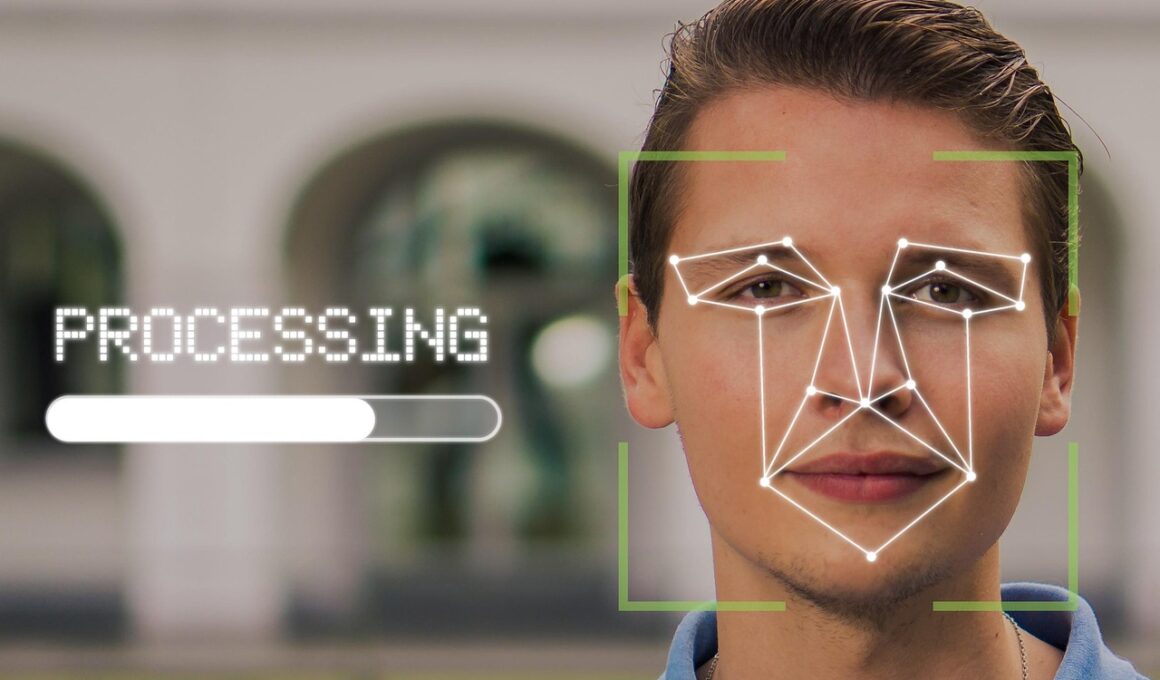

In recent years, the surge in digital payment methods has significantly transformed the way financial transactions occur around the world. Among these methods, biometric payments have emerged as an innovative solution that enhances security and convenience. Biometric payment technology utilizes unique physical characteristics such as fingerprints, facial recognition, or iris scans to authenticate users. This technology significantly minimizes the risk of fraud and identity theft. However, with the rise of biometric systems comes the critical need for robust security measures to protect sensitive biometric data. Here enters blockchain technology, which offers an unparalleled level of confidentiality and integrity for biometric payment transactions. Blockchain acts as a decentralized ledger that securely stores transaction data and user biometric information. This technology allows for secure verification without exposing the actual biometric data to potential risks. Blockchain also improves transparency in biometric payments, assuring users that their personal information remains protected from unauthorized access. By integrating biometric payment systems with blockchain, we can ensure an improved level of trust for consumers, fostering higher adoption rates for usage in everyday transactions. This synergy will shape the future of secure digital payments.

Blockchain technology leverages cryptographic techniques that create strong security measures against hacking or unauthorized access. Each transaction on the blockchain is linked to a previous transaction, forming a chain that is resistant to alterations. In the context of biometric payments, the integration of blockchain ensures that biometric identifiers are converted into encrypted data. This means that even in the case of a data breach, the stolen data cannot be utilized, as the actual biometric markers are never stored directly. Instead, tokens or hashes of these identifiers are used, which enhances security while allowing for quick verification of user identities. Furthermore, the immutability of blockchain records plays a pivotal role in preventing data tampering. Every change to the blockchain is recorded and time-stamped, ensuring accountability. As a result, the biometric payment ecosystem can effectively eliminate potential vulnerabilities associated with centralized storage solutions. Another significant advantage is the decentralized nature of blockchain, which means that no single entity controls the network. This aspect of blockchain mitigates risks of single points of failure, distributing power and protecting data integrity for users across the network.

Enhanced User Privacy and Trust

One of the most pressing concerns regarding biometric payments is user privacy. Individuals are often hesitant to adopt biometric technology due to fears about how their biometric data will be stored and used. Blockchain technology addresses these concerns by providing greater transparency and user control. Users can manage their biometric information on the blockchain, determining who can access it and under what circumstances. This gives consumers the power to grant or revoke access at any time, reinforcing trust in the payment system. With blockchain, biometric data does not reside in a single central database that is enticing for hackers; instead, it is distributed across the network. This means that even if one part of the network is compromised, the overall biometric data remains secure elsewhere. Moreover, the use of smart contracts on the blockchain enables automatic, frictionless transactions verified through biometrics. Such automation not only simplifies the process for users but also increases their confidence in the system. As a direct result, enhanced privacy protection fosters broader consumer acceptance of biometric payment methods, paving the way for more innovations in this space.

In addition to enhancing user privacy and fostering trust, blockchain brings scalability to biometric payment systems. As digital payments become more prevalent, the demand for efficient, fast, and secure transactions rises proportionally. Blockchain’s ability to process a high volume of transactions promptly makes it an ideal partner for biometric payment solutions. Transactions can be validated and completed in seconds, significantly reducing the time taken in traditional payment networks. This rapid processing capability enables seamless transactions for users, enhancing overall customer satisfaction. Additionally, the integration of blockchain can further facilitate cross-border payments through biometric verification. Traditional barriers that cause delays in international transactions often stem from multiple intermediaries and complex compliance checks. With blockchain’s decentralized nature, these barriers can be removed, resulting in swift interactions between users globally. As a result, businesses will find it easier to adopt biometric payments given their reduced operational hurdles. Consequently, this advancement empowers users by providing them with an accessible, efficient, and secure method of executing cross-border transactions using biometrics—a significant step toward mainstream acceptance of these revolutionary technologies.

Regulatory Implications of Blockchain in Biometric Payments

While the integration of blockchain with biometric payments brings numerous benefits, it also raises important regulatory questions. How does one ensure compliance with various privacy laws and regulations concerning biometric data? The ability to store, process, and share biometric data carries significant legal responsibilities, particularly regarding consent and data protection. Regulators need to collaborate closely with technology developers to establish guidelines that promote the safe use of biometric payments. This includes ensuring fair treatment, addressing discrimination, and combating misuse of biometric data. Moreover, ongoing discussions about the legality of using biometric identifiers for payments will become crucial for the technology’s mainstream acceptance. Regulatory frameworks should encourage innovation while simultaneously protecting consumer rights. Establishing such balanced policies will foster trust among consumers and corporations alike. A clear legal framework will also give companies clearer guidance in developing biometric payment solutions, ensuring these innovations adhere to compliance and ethical standards. As the industry evolves, staying ahead of regulatory changes will be indispensable to secure both the technology’s growth and consumer protection.

Given the rapid advancements in technology, the future of biometric payments in conjunction with blockchain looks promising. Other emerging technologies, such as Artificial Intelligence (AI) and Internet of Things (IoT), stand to complement this synergy even further. AI could enhance biometric verification by providing adaptive risk assessments based on user behavior. For example, it could analyze transaction patterns to identify anomalies and enhance fraud detection measures. Furthermore, as IoT devices become more integrated into everyday life, they can play a pivotal role in the biometric payment landscape. Smart devices, coupled with blockchain and biometric verification, can streamline transactions and improve user experience. One potential application could involve using a wearable that recognizes a user’s biometrics for making payments in physical stores or online. Such advancements radically change the perception and efficiency of payment systems, leading to a seamless customer journey. As organizations embark on developing these technologies, they will continuously strive to overcome technical challenges. By prioritizing robust security measures combined with consumer-centric approaches, they can build ecosystems where trust and convenience coexist, paving the way for the future of payment solutions.

In conclusion, the amalgamation of blockchain technology and biometric payment methods heralds a new era of digital transactions focused on security, convenience, and user empowerment. As consumers increasingly seek frictionless and secure payment alternatives, blockchain-enhanced biometric systems are poised to satisfy those demands. Blockchain not only secures the underlying biometric data but also enhances trust among users by ensuring privacy and transparency. Regulatory frameworks will be imperative to govern these innovations and uphold the rights of consumers while also allowing for business growth. Looking ahead, the role of emerging technologies in conjunction with blockchain and biometric payments promises a transformative shift in the way we engage with our finances. As we navigate this evolving landscape, stakeholder collaboration across industries will be pivotal in shaping reliable, efficient, and secure payment ecosystems. Embracing technology while fostering consumer trust will ensure that biometric payments lead us into the future of secure digital transactions. Hence, as investments rise in this sector, the collective efforts to innovate responsibly will ultimately define the success and sustainability of biometric payments on a global scale.