Tax Benefits of Charitable Giving: What You Need to Know

Charitable giving plays a vital role in supporting community needs and financial health. Understanding the tax benefits associated with making donations can enhance the positive impact on both the donors and the beneficiaries. Charitable contributions can yield substantial deductions on your income tax returns, lowering your overall tax liability. To qualify, ensure that the charities you support are recognized by the Internal Revenue Service (IRS) as 501(c)(3) organizations. These qualified organizations typically operate for charitable, educational, or religious purposes. Additionally, it is crucial to maintain accurate records, including receipts and bank statements, that document your contributions. By keeping detailed records, you affirm your entitlement to these tax deductions and aid in the claims process should the IRS require proof. Moreover, donors should remain informed about changes in tax laws, as these regulations can affect eligibility for deductions. As tax time approaches, evaluating charitable contributions made throughout the year can prove beneficial. Consider consulting with a tax professional to maximize your tax benefits through charitable giving while ensuring compliance with legal requirements.

When contributing to charitable organizations, understanding the different types of donations can enhance your tax strategy. Cash donations are the most common, easily tracked, and universally accepted by nonprofits. Generally, you can deduct cash contributions up to 60% of your adjusted gross income (AGI). However, other types of donations can also be valuable, such as property or assets. Donating appreciated assets like stocks or real estate allows you to avoid capital gains taxes while providing the full market value as a deduction. Alternatively, donating tangible personal property can also offer significant tax benefits if the items are relevant to the charity’s mission. Furthermore, verifying whether the charity uses the donations for charitable purposes is important to enjoy the deductions. Always appreciate that certain caps apply depending on your AGI and the type of donation made. The IRS provides guidelines outlining these limitations, and reviewing them can be a practical way to plan your contributions. Engaging with tax experts can make an impressive difference in ensuring you take advantage of various options that facilitate charitable giving while optimizing your tax benefits.

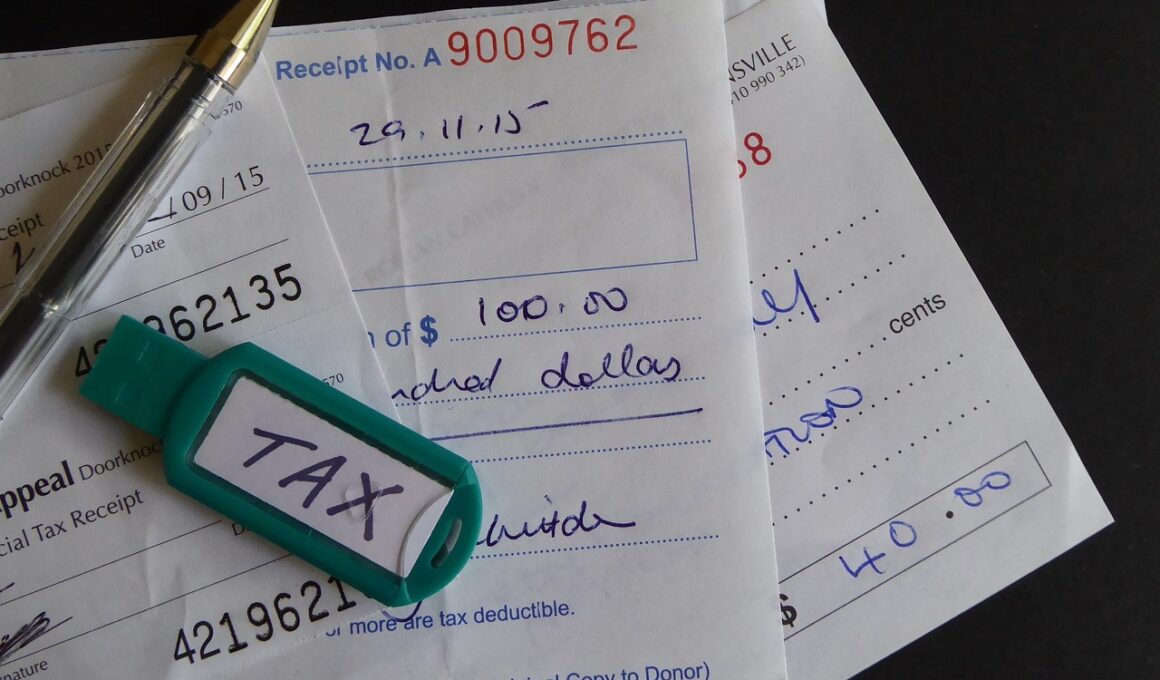

The Importance of Documentation

Documentation is crucial to successfully claim deductions for charitable contributions on your tax return. Maintaining organized and accurate records of your donations provides necessary proof. For cash donations, keep receipts, bank statements, or credit card transaction confirmations. The IRS typically requires a written acknowledgment from charities for contributions exceeding $250. This acknowledgment should detail the donation amount and any goods or services received in return. Such documentation serves as essential evidence of your philanthropy. When donating non-cash items, obtaining a written appraisal can determine the fair market value of the property. Donors must also be informed about rules governing non-cash contributions, including the requirement that items be in good condition or meet minimum valuation thresholds. Keeping these records organized throughout the year will simplify tax preparation and provide peace of mind if audited. Failures in documentation can lead to denied deductions or disputes with tax authorities. Therefore, employing a structured approach to keeping donation records not only benefits charities but also supports generous donors in maximizing available tax benefits.

Strategies for maximizing charitable deductions extend beyond direct contribution amounts. For instance, if you find yourself in a higher tax bracket during certain years, it may be smart to bunch contributions into a single tax year. By doing so, you enhance your deductions for that year and potentially qualify for a lower tax bracket in the following year. Specifically, employing a donor-advised fund also provides flexibility and leverages tax benefits. You make a larger contribution to the fund in one year, sacrificing the immediate distribution to charities, but receive the tax deduction upfront. Like cash donations, contributions of appreciated assets into such funds avoid capital gains tax. Furthermore, evaluating the timing of your charitable contributions with changes in your financial situation can significantly influence your tax outcomes. Engaging with financial advisors enables you to strategize how to maximize contributions while adhering to tax rules. By carefully strategizing the timing and methods of donations, taxpayers can elevate their philanthropy while enjoying substantial financial advantages from the IRS.

Impact of Changes in Tax Laws

Tax laws governing charitable giving are subject to change, profoundly impacting deductions available to taxpayers. For example, the Tax Cuts and Jobs Act significantly altered itemized deductions, raising the standard deduction and limiting itemized claims. As a result, fewer taxpayers may find it beneficial to itemize deductions. You may still benefit from charitable contributions through specific legislative allowances. For instance, the temporary Universal Charitable Deduction provides a deduction for non-itemizers, allowing a $300 deduction for individuals and $600 for married couples. Staying update-to-date on current tax regulations is indispensable, as it enables savvy donors to maximize their available benefits. Even subtle shifts in tax legislation may offer unique opportunities to support charitable causes while minimizing tax liabilities. Engaging with resources such as the IRS website or consulting with tax professionals can aid in understanding these constantly evolving laws. By staying well-informed, you can ensure that your charitable donations yield the most considerable financial benefits in line with tax policy changes. Ultimately, being proactive about tax laws reinforces responsible financial practices while supporting philanthropy.

Estate planning couples the significance of charitable giving with strategic tax advantages. Utilizing charitable remainder trusts (CRTs) allows donors to make substantial donations while securing income for their eventual heirs. A CRT provides valuable income tax deductions upfront while generating income that can benefit donors during their lifetime. This method is especially valuable for high-net-worth individuals looking to minimize estate taxes while supporting causes they care about. Additionally, establishing a charitable lead trust (CLT) offers an alternate strategy. CLTs generate an immediate tax deduction for the based gifts while preserving wealth for heirs over time. By integrating philanthropic goals into estate planning, individuals can create lasting legacies while optimizing tax benefits. Encouraging charitable gifting now or through bequests further emphasizes the lasting social impacts of wealth. Furthermore, engaging with estate planning professionals who understand both philanthropy and tax implications ensures a well-rounded approach. By creating a holistic estate plan that emphasizes charitable giving, donors facilitate significant social change while achieving favorable tax outcomes for family wealth. In this way, charitable giving effectively marries altruism with responsible financial health.

Conclusion: Making the Most of Charitable Giving

In conclusion, understanding tax benefits associated with charitable giving is essential for savvy individuals. Exploring various donation types, keeping detailed documentation, and staying informed about tax law changes can maximize financial advantages. Donors should consider using strategies such as bunching contributions and engaging donor-advised funds to enhance donation efficiency. Furthermore, combining charitable giving with estate planning can create impactful legacies while minimizing taxes. As individuals navigate the intricate landscape of charitable contributions, it remains vital to collaborate with financial and tax professionals. By leveraging their expertise, donors can derive the maximum possible benefit from charitable actions. This enhances their financial health but also influences lasting societal improvements through generosity. Therefore, charitable giving not only serves as a reflection of personal values but also represents a strategic financial decision. As you continue supporting worthy causes, remember the potential tax benefits and long-term impacts of charitable giving. Becoming a knowledgeable contributor empowers individuals to contribute effectively while reaping valuable tax advantages. Ultimately, the intersection of charitable giving and financial literacy supports the overarching goal of making a positive difference in communities around the world.

Direct contributions to charities can pave the way for significant tax deductions, thus providing essential financial support. Charitable giving can yield significant tax deductions. Each dollar donated can significantly impact society’s welfare, emphasizing the charitable spirit’s importance paired with financial literacy strategies.