Understanding the Role of Supply Chain Finance KPIs in Strategic Sourcing

In today’s highly competitive market, the significance of effective Supply Chain Finance (SCF) cannot be overstated. Companies are increasingly turning to SCF to optimize their operational efficiencies and boost financial results. Among the critical elements in implementing SCF are the metrics and Key Performance Indicators (KPIs) that measure its effectiveness. These metrics provide insights into the functioning of supply chains, enabling organizations to make informed decisions. KPIs in SCF can encompass various areas, including cost savings, efficiency levels, and service quality. Monitoring these indicators helps firms to align their financial objectives with operational goals, ensuring both immediate and long-term gains. For instance, understanding cash conversion cycles aids in managing working capital more effectively. Furthermore, SCF metrics are essential for evaluating supplier performance and identifying potential areas for improvement. Ultimately, having a robust KPI framework in place enhances transparency and reinforces collaboration among supply chain partners. Hence, organizations that actively track and optimize their supply chain finance metrics are better positioned to adapt to market fluctuations and sustain growth over time.

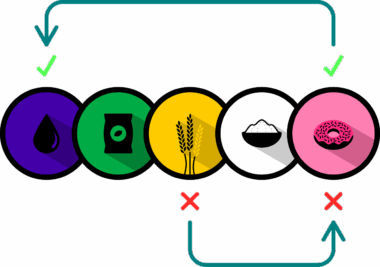

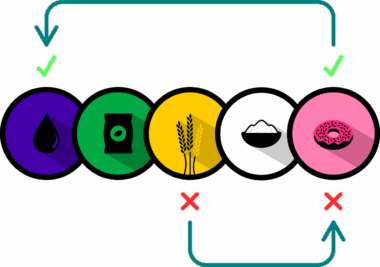

Supply Chain Finance encompasses multiple dimensions, including its metrics and KPIs that are imperative for successful strategic sourcing. Various KPIs serve to provide a snapshot of performance levels across the supply chain finance process. Notable among them are Days Payable Outstanding (DPO), Days Sales Outstanding (DSO), and inventory turnover rates. These metrics allow organizations to assess efficiency and effectiveness in financial dealings with suppliers and customers. Additionally, focusing on metrics such as cash flow visibility can improve decision-making processes significantly. By leveraging these financial indicators, businesses can optimize procurement financing and adjust terms with suppliers to enhance cash flow while minimizing risk. Another critical aspect is monitoring the cost of goods sold (COGS) in relation to sales revenue, which provides crucial insights into operational efficiency. Achieving a stronger grasp on these figures enables better alignment of sourcing strategies with broader organizational objectives. Ultimately, it is clear that integrating SCF KPIs into strategic sourcing provides a comprehensive framework to drive performance improvement and financial success within supply chains.

Importance of Metrics in Strategic Sourcing Decision-Making

The importance of metrics in strategic sourcing decision-making cannot be understated. Metrics empower organizations to measure their supply chain performance accurately and make informed choices based on real data rather than assumptions. In doing so, companies can evaluate the cost-effectiveness of different sourcing strategies and supplier relationships. The strategic sourcing process involves thorough analysis and evaluation of potential suppliers, and KPIs serve as guiding tools in this regard. By assessing supplier performance through specific metrics, organizations can mitigate risks and build stronger partnerships. Furthermore, continuous monitoring of supply chain metrics ensures that organizations can remain agile in their sourcing strategies, adapting to changes in market conditions. Metrics such as total landed costs help businesses understand the financial implications associated with sourcing decisions, while the KPI of lead time assists in managing expectations. Metrics thus enable organizations to enhance their sourcing agility and responsiveness. A clear understanding of these KPIs and their implications can ultimately transform procurement into a strategic asset that contributes positively to the financial health of the organization.

Effective supply chain finance practices hinge upon the establishment of relevant KPIs, which serve as benchmarks for excellence. To develop an effective KPI framework, organizations need to identify key success factors in their sourcing processes. For example, measuring on-time delivery rates is essential for understanding the reliability of suppliers. Furthermore, fostering collaboration among stakeholders can significantly enhance data accuracy and performance outcomes. Establishing communication channels that promote real-time data sharing among supply chain partners can lead to better information flow and collective problem-solving. Organizations may also focus on enhancing not only tangible metrics but also soft metrics, like supplier flexibility. Additionally, performance incentive programs can be designed around KPIs to ensure that suppliers align with strategic goals. Implementing incentives based on financial metrics fosters accountability and prompts suppliers to contribute actively toward achieving business objectives. Consequently, financial KPIs translate into supplier performance, driving incremental improvements in strategic sourcing. Overall, designing a pragmatic KPI framework that reflects company values and operational realities while being adaptable to market shifts can yield substantial competitive advantages.

Challenges in Measuring SCF KPIs

While the benefits of establishing SCF KPIs are clear, organizations often face several challenges in accurately measuring these metrics. One significant challenge is the integration of data from various systems and sources. Many companies rely on disparate systems for finance, inventory, and procurement, making it difficult to obtain a unified view of performance. This fragmented approach can lead to delays in decision-making and distorted results. Furthermore, organizations face difficulty in capturing qualitative aspects of performance, particularly when it comes to supplier relationships. Metrics like supplier communication and collaboration, although critical, are often overlooked or inadequately measured. Ensuring that KPI measurement aligns with business goals requires substantial alignment across departments, which is often easier said than done. Moreover, maintaining the relevancy of KPIs over time is another challenge that organizations need to overcome as market dynamics evolve. Firms must continually reassess their KPIs to ensure they mirror current objectives and challenges. By addressing these challenges head-on, organizations can enhance the effectiveness of their SCF strategies and leverage metrics for continuous improvement.

Successful supply chain finance implementation can significantly influence a firm’s bottom line. As organizations measure and analyze their KPIs, they position themselves for sustained growth in a competitive environment. One key advantage is enhanced visibility throughout the supply chain; providing stakeholders with real-time insights improves collaboration and decision-making. Additionally, effective metrics allow businesses to identify bottlenecks rapidly and allocate resources efficiently. Incorporating SCF metrics into sourcing strategies fosters data-driven cultures, encouraging employees to base their recommendations on historical performance rather than intuition. Another critical element is the identification of high-performing suppliers who can be nurtured for long-term benefits. Companies can refine their supplier bases by leveraging KPIs, focusing on those that contribute positively to margins and sustainability goals. Moreover, aligning SCF KPIs with industry standards can provide competitive insight, allowing organizations to set benchmarks and strive for continuous improvement. In conclusion, integrating SCF metrics offers businesses the opportunity to drive operational excellence and create a framework that supports ongoing innovation and adaptability within their sourcing processes.

Conclusion: The Path Forward for Supply Chain Finance

In conclusion, the role of supply chain finance KPIs in strategic sourcing is essential for enhancing operational efficiency and achieving financial success. Organizations must recognize that effective metrics are more than just numbers; they reflect an organization’s goals and provide direction. By establishing relevant and actionable KPIs, businesses can better align their sourcing strategies with overall objectives. Moreover, providing cross-functional teams with access to these metrics fosters collaboration and innovation. In the constantly changing landscape of supply chains, embracing a KPI-driven approach to strategic sourcing equips organizations to respond promptly to market demands. It also ensures that supply chain decisions contribute positively to financial outcomes. As supply chains continue to evolve, organizations that focus on refining their metric systems will be better positioned to navigate uncertainties and leverage opportunities. Future efforts must prioritize integrating advanced technologies and analytics to provide deeper insights into supply chain performance. Ultimately, successful management of supply chain finance metrics enables companies to build resilience and maintain a competitive edge in their markets.

In today’s highly competitive market, the significance of effective Supply Chain Finance (SCF) cannot be overstated. Companies are increasingly turning to SCF to optimize their operational efficiencies and boost financial results. Among the critical elements in implementing SCF are the metrics and Key Performance Indicators (KPIs) that measure its effectiveness. These metrics provide insights into the functioning of supply chains, enabling organizations to make informed decisions. KPIs in SCF can encompass various areas, including cost savings, efficiency levels, and service quality. Monitoring these indicators helps firms to align their financial objectives with operational goals, ensuring both immediate and long-term gains. For instance, understanding cash conversion cycles aids in managing working capital more effectively. Furthermore, SCF metrics are essential for evaluating supplier performance and identifying potential areas for improvement. Ultimately, having a robust KPI framework in place enhances transparency and reinforces collaboration among supply chain partners. Hence, organizations that actively track and optimize their supply chain finance metrics are better positioned to adapt to market fluctuations and sustain growth over time.