Automated Compliance Systems: The Next Frontier in Finance

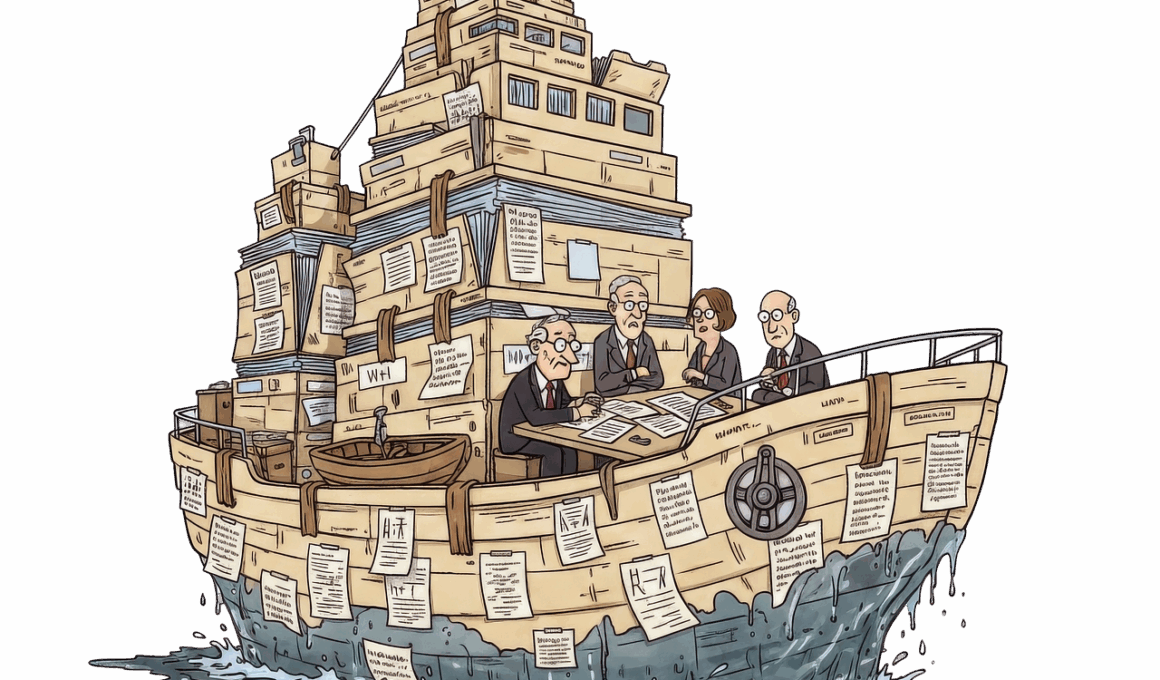

The financial landscape is undergoing substantial transformation, primarily fueled by technological advancements. As financial institutions grapple with increasingly complex regulations, automated compliance systems emerge as a crucial solution. These systems leverage sophisticated algorithms to streamline compliance processes, allowing institutions to effectively manage regulatory requirements. With automation, organizations can reduce human error and enhance efficiency, ensuring that they remain compliant with evolving financial regulations. Furthermore, automated systems offer a significant advantage in real-time monitoring, enabling institutions to respond promptly to regulatory changes. This adaptability is vital in the fast-paced world of finance, where delays can result in costly penalties. Additionally, automated compliance systems can harmonize operations across different jurisdictions, mitigating the risks associated with global transactions. Employing these systems ensures that businesses can navigate the intricate regulatory maze more effectively. As market dynamics shift, the importance of these systems will undoubtedly increase. After all, a proactive approach toward compliance can create competitive advantages and foster trust. These systems not only enhance operational efficiency but also contribute to strategic decision-making within institutions in a compliant manner.

To understand the full potential of automated compliance systems, it’s essential to recognize their components. These systems typically integrate machine learning algorithms, artificial intelligence, and extensive data analytics. By employing these technologies, organizations can automate the gathering and analysis of vast amounts of data related to compliance. For instance, AI can pinpoint potential regulatory breaches by flagging unusual transactions, reducing the strain on compliance teams. Additionally, the use of robust data analytics provides financial institutions with insights into their compliance landscape. These insights facilitate risk assessment, helping institutions identify areas that may require additional focus or resources. Furthermore, the adaptability of these systems means they can evolve alongside regulations, learning from past breaches and adjusting their parameters. Consequently, this dynamic capability enhances compliance posture significantly. Operating in a constantly shifting regulatory environment demands agility, and automated systems afford that agility. They not only ensure adherence to existing regulations, but they also anticipate future changes. Ultimately, automated compliance systems emerge as a vital asset for financial institutions aiming to maintain compliance and mitigate associated risks effectively.

The Benefits of Implementing Automated Compliance

Implementing automated compliance systems yields numerous benefits, particularly for financial organizations striving to keep pace with regulatory demands. One of the primary advantages is the substantial reduction in compliance costs over time. By automating processes that were once labor-intensive, companies can allocate resources more efficiently. Additionally, companies often witness significant improvements in operational efficiency, reducing the time spent on compliance-related tasks. This efficiency translates into increased productivity across the organization, allowing staff to focus on strategic initiatives rather than transactional compliance tasks. Moreover, automated systems improve accuracy in reporting and record-keeping, reducing the risk of human error. Enhanced accuracy can bolster a company’s reputation and strengthen stakeholder confidence. Importantly, these systems enable organizations to adapt quickly to new regulations without extensive overhauls of existing processes. Moreover, they foster a culture of transparency that extends to stakeholders, reflecting a commitment to compliance. This commitment can lead to stronger partnerships and customer loyalty—essential components of sustainable growth. As regulatory environments become ever more complex, automated compliance systems stand out as an indispensable ally for financial institutions.

While the advantages of automated compliance systems are substantial, challenges also exist. One of the primary concerns is the technological barrier to entry, particularly for smaller financial institutions. Implementing these systems often requires a significant upfront investment, which can be daunting. Additionally, organizations need to ensure they have the necessary infrastructure and expertise to leverage these technologies effectively. There is also the risk of over-reliance on automated systems, as human oversight remains crucial in compliance. Without proper human engagement, organizations may overlook anomalies that automated systems may miss. Furthermore, data privacy and cybersecurity issues are paramount when dealing with sensitive financial information. As system integration expands, organizations must implement robust security protocols to protect against potential breaches. Challenges also arise in maintaining these systems, as they often require regular updates and tuning to align with changing regulations. Organizations must strike a balance between automation and human intuition. This balanced approach can maximize the benefits of automated compliance while minimizing potential risks. By addressing these challenges proactively, organizations can successfully harness the full potential of automated compliance systems.

The Role of Artificial Intelligence in Compliance

Artificial intelligence plays a pivotal role in enhancing automated compliance systems, driving efficiency and accuracy in the financial services sector. AI-driven tools can analyze large datasets rapidly, detecting patterns and anomalies that would be challenging for humans to identify. For example, machine learning algorithms can refine their accuracy over time, learning from previous regulatory breaches and adjusting compliance parameters accordingly. This self-learning capability significantly enhances the effectiveness of compliance measures and ensures that AI models evolve with emerging risks. Furthermore, AI integrations allow institutions to develop predictive analytics, proactively identifying potential compliance issues before they escalate into full-blown problems. These predictive capabilities enable organizations to allocate resources efficiently, focusing on areas with higher risk concentrations. Beyond risk mitigation, AI can facilitate the creation of detailed compliance reports, streamlining the documentation process. With real-time insights, compliance teams can make well-informed decisions swiftly, enhancing the organization’s agility in navigating regulatory requirements. The collaborative synergy of AI and automated compliance systems forms a powerful framework, positioning financial institutions as leaders in the compliance landscape. Organizations that embrace this technology are better equipped to face the ever-evolving regulatory world.

In the realm of regulatory compliance, the significance of data cannot be overstated. Automated systems rely heavily on accurate and comprehensive data to function effectively. The quality of data directly influences compliance outcomes, with poor data leading to misinformed decisions. Financial institutions must prioritize data governance, ensuring that the data they rely upon for compliance is of the highest quality possible. Moreover, the integration of diverse data sources enhances the efficacy of automated compliance systems. By combining transaction data, customer information, and external market signals, organizations can achieve a holistic view of their compliance landscape. This comprehensive understanding enables institutions to identify potential vulnerabilities and develop robust compliance strategies. Additionally, data analytics can reveal trends and patterns over time, offering insights into regulatory landscapes. Organizations can leverage these insights to stay ahead of compliance requirements and adapt their strategies accordingly. Building a strong data foundation is essential for maximizing the benefits of automated compliance systems. By investing in data quality and integration, organizations can harness the full potential of automation, paving the way for effective navigation of complex regulatory frameworks in finance.

The Future Landscape of Automated Compliance

The future of automated compliance systems looks promising as advancements in technology continue to shape the financial landscape. Continuous innovation in artificial intelligence and machine learning will likely enhance the efficacy and adaptability of compliance systems. As regulators increasingly adopt technology, automated compliance solutions must keep pace with regulatory changes to remain effective. Furthermore, as financial markets grow more complex, institutions will increasingly rely on these systems to ensure efficient compliance management. The demand for real-time access to compliance data will drive further integration of automated systems into existing infrastructures. As regulatory agencies embrace technology, enhanced collaboration between regulators and financial institutions becomes possible, leading to streamlined compliance processes. Additionally, the rise of decentralized finance presents unique challenges that automated compliance systems must address, requiring more sophisticated capabilities. The focus on maintaining compliance while fostering innovation will drive the development of new technologies. Organizations that invest in upgraded automated compliance systems will not only mitigate risks but also position themselves advantageously in an increasingly competitive marketplace. The ongoing evolution of these systems signifies a new era in efficient, effective financial regulation.

In conclusion, the implementation of automated compliance systems in the financial industry marks a significant evolution. These systems provide invaluable support in navigating the increasingly complex regulatory environment. Institutions harnessing these technologies can achieve operational efficiency, accuracy, and adaptability, enabling them to stay compliant amid changing regulations. By integrating AI and data analytics, organizations enhance their compliance efforts, allowing for proactive risk management. However, embracing these systems also necessitates addressing technological and regulatory challenges. Organizations must prioritize data quality and maintain human oversight to complement technology-driven compliance efforts. As the landscape shifts towards automation and innovation, financial institutions must remain agile to embrace new opportunities. The future holds significant potential for automated compliance systems to redefine how organizations approach regulation. By investing in these technologies, companies can mitigate risks while fostering trust with stakeholders. Automation, accompanied by human insight, will undoubtedly shape the next frontier in financial regulation. Industries embracing this transformation are poised for growth, equipped to meet the challenges of the future. The journey toward automated compliance is not merely a technological shift; it’s a strategic imperative in the evolving financial services landscape.