An Introduction to Accounting Principles for Financial Statements

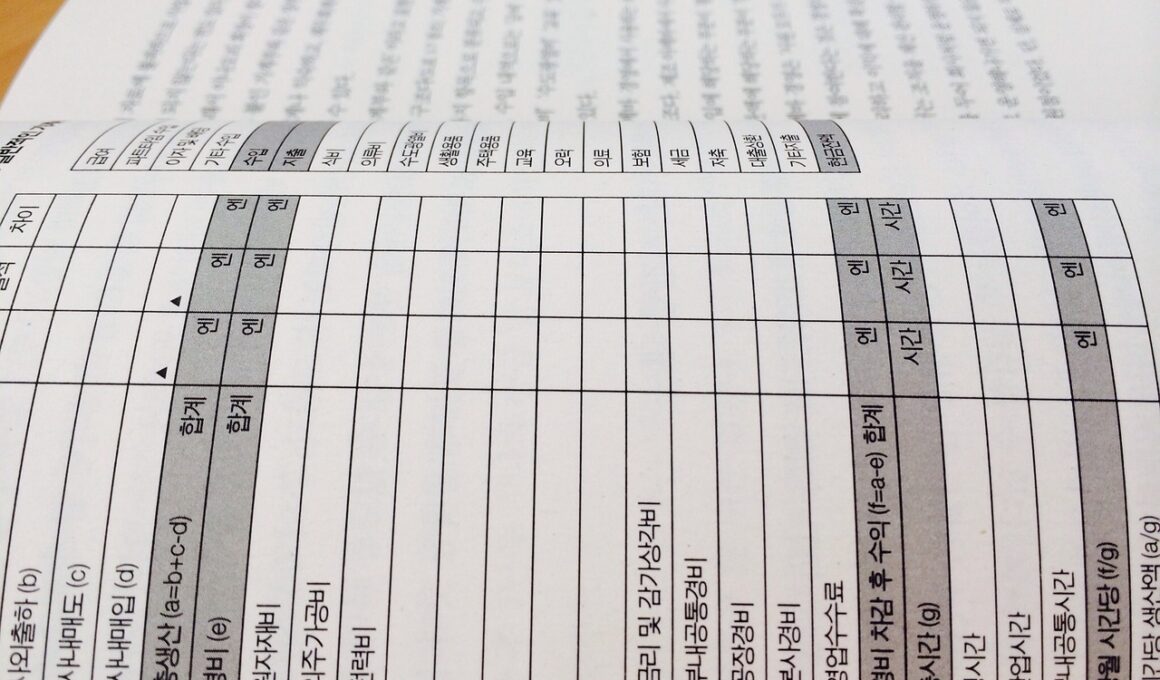

Understanding accounting principles is essential for anyone involved in financial reporting. These principles guide the preparation and presentation of financial statements, ensuring they provide a true and fair view of a company’s financial position. Accounting is governed by numerous standards and regulations that must be adhered to by all businesses. These principles focus on several key areas, including consistency, relevance, and prudence. Financial statements traditionally include the balance sheet, income statement, statement of cash flows, and statement of changes in equity. The balance sheet displays a company’s assets, liabilities, and equity at a specific point in time. Understanding these documents is vital for stakeholders, investors, and creditors as they evaluate a company’s performance. Moreover, adhering to these principles helps maintain transparency and builds trust among users of financial reports. An in-depth knowledge of accounting principles allows business professionals to make informed decisions based on solid data. Companies that follow these principles can ensure accurate financial reporting, ultimately leading to better operational performance and enhanced shareholder confidence.

The income statement provides insight into the company’s financial performance over a specific period. It details revenue, expenses, and profits or losses, allowing stakeholders to gauge operational efficiency. Similar to the income statement, the statement of cash flows highlights cash generated and used during a certain timeframe. This statement is divided into operating, investing, and financing activities. Understanding cash flow is crucial as it affects a company’s liquidity and ability to meet obligations. The statement of changes in equity reflects the movements in equity accounts, showing how profits are retained or distributed. Familiarity with these components is essential for assessing the overall health and sustainability of an organization. Regulatory bodies like the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) play significant roles in establishing accounting standards. Users can significantly benefit from understanding the underlying principles of these documents to draw meaningful conclusions about a firm’s operations and long-term viability. Ensuring compliance with these principles not only meets regulatory requirements but also contributes significantly to a firm’s reputation and credibility in the marketplace.

Key Accounting Principles Governing Financial Statements

Several fundamental accounting principles govern the preparation of financial statements. The going concern principle assumes that a business will continue its operations for the foreseeable future unless there is substantial evidence to the contrary. This principle is crucial when evaluating financial statements as it influences asset valuation and the treatment of liabilities. Another key principle is the accrual basis of accounting, which states that revenues and expenses must be recognized when they occur, regardless of when cash transactions happen. This method provides a more accurate representation of a company’s financial performance. The consistency principle mandates that businesses must apply the same accounting policies year after year unless there is a valid reason for change. This consistency enhances comparability over time. Transparency is another essential principle, encouraging companies to provide clear and full disclosures within their financial statements. Trust is fostered when companies are candid about their financial health. Every industry has unique accounting challenges, and while principles provide a framework, they must be adapted to specific situations. Ultimately, robust adherence to these principles strengthens the integrity of financial reporting.

The role of financial statements extends beyond compliance; they are essential for strategic decision-making. Investors, creditors, and other stakeholders rely heavily on financial statements to assess a company’s health, profitability, and risk. Financial analyses derived from these statements inform investment and lending decisions, impacting market dynamics significantly. Additionally, internal management utilizes financial statements for operational assessments. They identify areas where improvements can be made, ensuring resources are allocated effectively. Budgeting and forecasting also rely on accurate financial reporting. Effective budgeting allows companies to set realistic targets and manage cash flow effectively. Furthermore, financial statements can help detect potential issues early on, leading to timely interventions. Businesses that regularly review and analyze their financial statements are better positioned to respond to market changes. Additionally, performance metrics derived from financial statements, such as return on equity (ROE) and return on assets (ROA), help companies evaluate their performance against industry benchmarks. In a rapidly evolving business landscape, understanding and utilizing these documents become essential for sustaining competitive advantages over time.

The Importance of Compliance with Accounting Standards

Compliance with accounting standards supports the accuracy and reliability of financial statements. These standards, developed by authoritative bodies, provide guidelines aimed at promoting transparency and reducing discrepancies in reporting. Organizations that comply with these standards foster trust and confidence among stakeholders, ultimately assisting in attracting investment and securing loans. Noncompliance can lead to discrepancies, misrepresentation, and ultimately, legal repercussions. It can also diminish a company’s reputation and credibility in its respective industry, leading to potential financial loss. Investors often require assurance that financial statements are fair representations of a company’s financial position; thus, adhering to accounting standards is paramount. External audits serve as verification processes that validate compliance with these standards, and auditors assess whether the financial statements conform to prescribed regulations. Consequently, regular audits enhance the confidence of investors and creditors. Maintaining stringent compliance mechanisms ensures effective internal control systems, reducing the likelihood of fraud and financial malpractice. In summary, compliance with accounting standards represents a cornerstone in the creation of reliable, transparent financial statements that uphold stakeholder interests and promote economic stability.

Technological advancements have significantly impacted the accounting profession, reshaping how financial statements are prepared and analyzed. Accounting software and tools automate various processes, increasing efficiency and reducing human error. Advanced algorithms can analyze vast amounts of financial data quickly, providing insights that were previously challenging to obtain. Cloud-based accounting solutions offer real-time access to financial data, enhancing collaboration among stakeholders. This accessibility allows for timely decision-making, enabling companies to adapt swiftly to changes in their financial landscape. Furthermore, technology facilitates deeper analytics, allowing professionals to visualize trends, track key performance indicators, and generate forecasts. Implementing these technological solutions can reduce costs and improve productivity within organizations. However, companies must remain vigilant in ensuring data security and compliance with relevant regulations. Cybersecurity risks are of growing concern as hackers increasingly target financial information systems. Ensuring data protection is essential to maintain trust and confidentiality between organizations and their stakeholders. Additionally, firms must invest in employee training to ensure proper usage of these technological tools. As advancements continue to evolve, companies must strategically embrace technology to remain competitive and positioned for future growth.

Future Trends in Financial Reporting

As the landscape of accounting evolves, several trends are emerging that will significantly impact the future of financial reporting. One notable trend is the increasing emphasis on sustainability and social responsibility in financial statements. Stakeholders increasingly demand transparency regarding environmental, social, and governance (ESG) factors influencing business practices. Companies are now expected to report on their sustainability efforts and overall social impact, leading to the incorporation of non-financial metrics in financial reporting. Additionally, regulatory bodies are placing greater importance on integrated reporting, which combines financial and non-financial information. This approach provides a more comprehensive view of an organization’s performance, aligning with broader societal goals. Innovations in artificial intelligence (AI) and machine learning will also play a major role in transforming financial reporting. As these technologies evolve, they will facilitate predictive analytics, enabling businesses to forecast trends and gain deeper insights into customer behavior and market dynamics. Ultimately, the convergence of technology and accounting practices will enhance decision-making processes and promote greater transparency in financial communications across industries, fostering a more sustainable economic future.

In conclusion, a comprehensive understanding of accounting principles is vital for preparing accurate financial statements. Financial statements serve as essential tools for analyzing a company’s performance from both internal and external perspectives. Adherence to established accounting principles not only enhances reporting integrity but also strengthens stakeholder confidence. As the business environment becomes increasingly complex, understanding these principles is a foundational skillset for financial professionals and business leaders alike. Companies must continuously invest in training and technology to ensure compliance with evolving standards and practices. The integration of sustainability and technology into financial reporting represents an important shift in the accounting profession as well. By embracing these changes, organizations can adapt to new market demands and stakeholder expectations. Ultimately, effective financial reporting illuminates key business insights, drives strategic decision-making, and fosters long-term growth. As we look toward the future, of the accounting profession, the continued emphasis on governance, ethical practices, and data security will likely shape the evolution of financial statements. Investing in understanding these shifts is crucial for ensuring businesses thrive in a dynamic and competitive landscape.