Case Studies: Successful SME Financing Using Supply Chain Finance

Many small and medium-sized enterprises (SMEs) face challenges securing funds. Traditional banks often overlook them due to perceived high risk. Supply chain finance (SCF) offers an alternative by connecting SMEs with funding sources. Through SCF, these businesses can access crucial working capital. Additionally, SMEs can improve cash flow, reducing the direct pressure on their operations. The link between suppliers, buyers, and finance providers creates an ecosystem where everyone benefits. SCF harnesses invoices, purchase orders, and receipts to facilitate smooth transactions. This greatly enhances the financial position of SMEs in the supply chain. Drawing on various studies, it’s evident that SCF enables businesses to seize opportunities swiftly. An increased access to funds allows SMEs to take on larger contracts and scale their operations. Companies leveraging SCF effectively report higher growth rates as they can manage their operational costs better. This, in turn, boosts their credibility with suppliers and banks. The lifecycle of SCF is quite fascinating, demonstrating a shift toward collaborative finance strategies. Additionally, technology plays a pivotal role in streamlining these processes, optimizing the relationships within supply chain networks.

Supplier companies are vital for SMEs engaging in a competitive market. Many successful SMEs harness supply chain finance to overcome cash flow challenges. For instance, one manufacturing firm implemented SCF through partnerships with major retailers. By utilizing SCF, they transformed their payment cycles, receiving early payments for their invoices. This provided the manufacturer essential liquidity to cover operational costs, paving the way for growth. Another real-life example involved a small logistics provider capitalizing on SCF to fund advancements in technology. By streamlining operations and expanding their service offerings, they improved customer satisfaction. Investing in state-of-the-art tracking systems became feasible, drastically enhancing service efficiency. Their growth attracted larger clients, generating a positive feedback loop of enhancement. Similarly, an agricultural supplier utilized SCF to invest in high-quality seeds and fertilizers, leading to higher crop yields. Growth was unprecedented as demand surged, enabling them to collaborate with larger distributors. These successes underscore SCF’s role as an enabler for SMEs aiming to optimize their financial management. By understanding the mechanics, SMEs can benefit greatly from innovative financing solutions.

Challenges in Accessing Traditional Financing

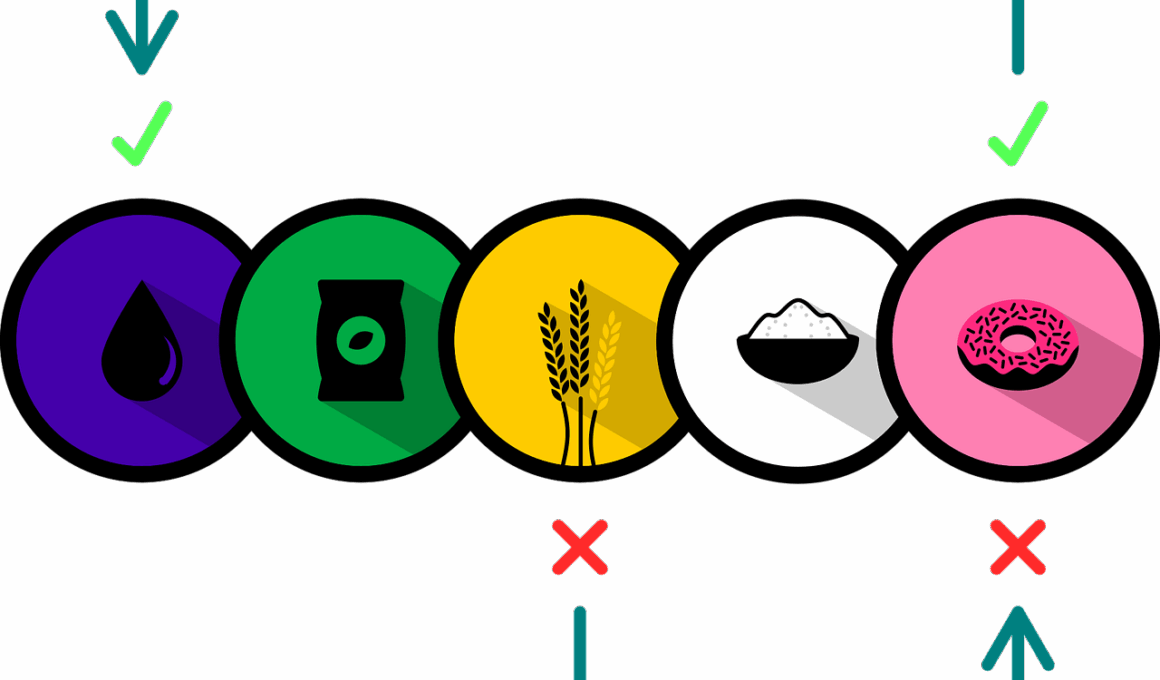

SMEs that rely on traditional financing methods often encounter significant barriers. Higher interest rates, stringent regulations, and lengthy approval processes hamper their growth potential. Many SMEs are deemed high-risk borrowers with limited credit histories or collateral. This often means that creditworthy businesses face rejection from banks or exhaust their capital trying to secure funds. But these barriers highlight the importance of alternative financing mechanisms. By opting for SCF, SMEs tap into resources that acknowledge their position in the supply chain. SCF does not view SMEs merely as borrowers; they are valued participants in a collaborative network. It allows suppliers and buyers to maintain a mutually beneficial relationship, mitigating many challenges faced in traditional financing. One innovative approach is invoice financing, where companies receive immediate funding based on their invoices. This empowers SMEs with cash flow and strengthens their negotiation leverage. On the flip side, financial data generated from transactions provides valuable insights, assisting SMEs in improving their operational efficiency. Overall, understanding SCF challenges can illuminate the path to sustainable business practices.

Real-world examples abound that highlight successful SMEs leveraging supply chain finance. One notable story involves a textile manufacturer focusing on eco-friendly products. Through SCF, they aligned with environmentally conscious retail partners, benefiting from early payments. This funding ensured higher product quality and sustainability practices, setting them apart in a prosperous niche market. Meanwhile, a tech startup that develops software for logistics also adopted SCF to fund rapid scaling. The funds allowed them to fast-track development and enhance customer support, critical for a rapidly evolving industry. Clients reported improved performance, resulting in a broader contract base for the startup. There is ample evidence suggesting SCF enhances relationships along the supply chain. Companies utilizing SCF increase procurement efficiency, fostering cooperation among stakeholders. This enhanced collaboration reduces operational costs and solidifies a reputation for reliability. In various sectors, supply chain finance transforms businesses, offering a lifeline for those stifled by traditional financing constraints. The agility and flexibility gained through SCF empower SMEs to adapt proactively and advance. Hence, learning from these case studies offers crucial insights for other SMEs considering this financing method, making it imperative to assess their potential.

Growing Importance of Technology

As supply chain finance continues to evolve, technology has become a key enabler in its application. Digital platforms streamline the financing process, facilitating seamless interactions between SMEs, banks, and suppliers. With blockchain technology improving transparency, stakeholders can track transactions efficiently. This reduced risk of fraud enhances trust, crucial in building financial relationships in the supply chain. Automation software also furthers the ease of process for SMEs, allowing them to access financing without cumbersome paperwork. Machine learning algorithms help assess risks proactively, facilitating more informed lending. Financial institutions are increasingly incorporating intelligent data analytics, significantly shortening approval times. This tech-centric shift reflects the changing dynamics of SME financing. As businesses adapt to the digital environment, they can leverage these technologies to optimize their funding strategies. Collaborative platforms enable SMEs to network, share insights, and pool resources effectively. The emerging landscape fosters innovation and encourages strategic partnerships among various stakeholders. Better access to technology empowers SMEs to remain competitive and agile. Ultimately, investing in technology enhances businesses significantly, ensuring they can navigate the challenges of modern supply chain financing effectively.

To summarize, supply chain finance greatly impacts SMEs seeking to innovate and grow. It decentralizes the financing process, creating opportunities for a more substantial financial ecosystem. Traditional banking methods often leave many deserving SMEs out in the cold, unable to access essential funds. However, the emergence of SCF breaks down these barriers, enabling businesses to thrive. As evidenced by various success stories, SMEs adopting supply chain finance are experiencing tremendous growth. By enhancing cash flows and providing flexible financing solutions, SCF empowers SMEs to seize market opportunities. It’s evident that strategic planning is crucial for SMEs looking to leverage SCF, ensuring they are well-prepared. Studying successful case histories helps identify best practices and challenges to anticipate. SMEs must actively engage in their supply chains, fostering cooperative relationships with financial partners. Understanding the unique dynamics of their industries allows businesses to create customized financing solutions. Ultimately, this adaptability is vital for future success. As more SMEs embrace supply chain finance, the landscape will continue to evolve, creating countless opportunities for innovation and collaboration. This trend underscores the potential for a thriving SME ecosystem, supported by progressive financing mechanisms.

The future of SME financing holds promise, especially concerning supply chain finance innovations. As technology integrates into everyday operations, it will create fresh avenues for growth. AI-driven analytics will provide valuable insights for risk assessment, guiding informed financial decisions between stakeholders. The importance of financial wellness will only gain momentum, as SMEs emphasize the need for access to timely capital. Moreover, sustainability will become increasingly relevant, influencing how businesses operate. Solutions that promote eco-friendly practices will attract new partnerships and customers eager to invest in responsible companies. The SCF ecosystem must adapt to these evolving demands, aligning financial strategies with market expectations. Efforts to integrate diversity and inclusion within financing models will also benefit SMEs, positioning them for greater success. Flexibility in funding solutions will remain crucial, especially in volatile market conditions. Collaboration between financial institutions and SMEs will lead to sustainable practices, forging a robust foundation for future economies. An increased awareness of SCF benefits is essential, prompting MSMEs to embrace these methodologies proactively. Scaling operations will allow more businesses to innovate and compete on a larger stage. In conclusion, SCF represents an essential pillar in the next chapter of SME growth and success.

In conclusion, SMEs can significantly benefit from supply chain finance by addressing their funding needs innovatively. The key lies in fostering strong relationships within the supply chain, enabling quicker access to capital. As demonstrated through successful case studies, companies adopting SCF strategies can enhance their operational efficiencies while mitigating risks. The importance of understanding one’s industry is paramount, enabling SMEs to tailor SCF approaches effectively. Embracing technology and the digital shift will not only streamline processes but also strengthen ties with stakeholders. The adaptability of SMEs is vital; they must be proactive, embracing new approaches to finance. Emphasizing sustainability throughout supply chains will resonate with environmentally conscious consumers and enhance overall brand value. Collaborative strategies should shape the future of SME financing, ensuring growth and success for all stakeholders involved. The evolution of finance in the supply chain context signals a promising shift for SMEs. By understanding the intricacies of SCF, SMEs can position themselves favorably in competitive markets, ensuring long-term resilience. Furthermore, continuously assessing the dynamics of funding will enable businesses to thrive amidst changing economic environments. Thus, the integration of supply chain finance into SME practices heralds a new era of growth, opportunity, and innovation.