GAAP Guidelines for Reporting Long-term Debt

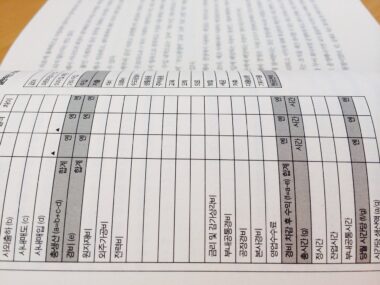

Long-term debt reporting is critical for providing clear financial information to investors and stakeholders. Under Generally Accepted Accounting Principles (GAAP), entities must accurately disclose their long-term debts, including bonds, mortgages, and notes payable. These disclosures help stakeholders assess the company’s liquidity and financial stability. GAAP emphasizes transparency and consistency to ensure that financial statements reflect the true financial position of a company. When reporting long-term debt, it is essential to classify it properly on the balance sheet, separating it from current liabilities. Long-term debt should be reported at its outstanding principal balance, adjusted for any unamortized premiums or discounts. Companies may also be required to disclose interest rates, maturity dates, and any covenants tied to the debt. Failure to comply with these guidelines may lead to misinterpretations of a company’s financial health, potentially impacting investment decisions. Additional reporting requirements, including any debt restructuring or renegotiation, must also be disclosed to provide a comprehensive view of the company’s obligations. Clarity and accuracy in reporting long-term debt are critical for maintaining stakeholder trust.

Another vital guideline under GAAP is the need for regular interest expense recognition related to long-term debt. Interest expenses should be recognized in the periods they are incurred, which aligns with the accrual accounting concept that matches expenses with the relevant revenues. Companies should also report any changes in the carrying amount of long-term debt, which could arise from prepayments or buybacks, reflecting their impact on financial statements. Providing a clear schedule of principal repayments can enhance transparency and allows stakeholders to understand future cash flow obligations. Furthermore, any defaults or breaches of debt covenants must be disclosed, as they could significantly affect the company’s ability to meet its liabilities. Analysts often scrutinize these disclosures to determine credit risk and assess overall financial health. When companies fail to disclose relevant information related to long-term debts, it may lead to significant distortions in their profitability and equity calculations, undermining investor confidence. Companies also need to ensure that their disclosures are presented in a consistent manner, facilitating comparability across different reporting periods and among peer organizations. Consistency in financial reporting under GAAP aids stakeholders in making informed decisions.

Companies engaged in foreign operations must also be aware of how exchange rates impact long-term debt reporting. According to GAAP, when a foreign subsidiary holds long-term debt denominated in a foreign currency, the company must translate the amount into its reporting currency at the current exchange rate. This process helps reflect any potential gains or losses due to fluctuations in exchange rates. Any associated translation adjustments should be recorded in equity under other comprehensive income. This ensures that stakeholders view the actual economic effect of these foreign currency debts and understand potential volatility in the financial statements. Additionally, GAAP permits the use of hedging strategies to mitigate foreign exchange risks associated with long-term debt, which influences how companies report their debt’s fair value. Companies engaging in such strategies must disclose the terms and purpose of any derivatives used to hedge risks. These disclosures provide stakeholders with critical insight into the company’s risk management practices related to foreign debt. Consequently, stakeholders can make better assessments of the company’s financial performance in the context of its overall risk exposure stemming from currency fluctuations.

Debt Covenants and Compliance

Understanding the compliance with debt covenants is crucial for companies seeking to adhere to GAAP regarding long-term debt. Debt covenants are agreements between lenders and borrowers designed to ensure that the borrower maintains certain financial metrics. Companies must regularly review their compliance with these covenants and disclose any violations. If a company is in breach of a debt covenant, it must evaluate the potential ramifications on their long-term financial strategy, including possible debt acceleration. In accordance with GAAP, failure to comply with covenants ultimately impacts an entity’s financial statements. Organizations must disclose both the nature of any violations and the implications on cash flows and future obligations. It’s also essential for companies to disclose any modifications to debt covenants, as these adjustments can significantly affect financial ratios and overall creditworthiness. Investors often rely on such disclosures during their analysis of the company’s financial position, making compliance paramount. Consequently, ensuring transparency around debt covenants supports stakeholder confidence in the management of long-term debts and can facilitate negotiations for improved terms when necessary.

When it comes to reporting purposes, effective communication about long-term debt structure offers insights into a company’s financing strategy. GAAP guidelines encourage companies to categorize long-term debt into various classes based on risk and maturity. This categorization not only enhances the clarity of financial statements but also provides stakeholders with an understanding of the company’s debt profile. Stakeholders can assess the proportion of secured versus unsecured debts, as well as fixed versus floating interest rates. This information is vital as it impacts a company’s risk exposure and fundamentally affects the cost of capital. An extensive debt narrative should accompany the quantitative data, discussing management’s strategies concerning leverage and capital allocation. Furthermore, companies should occasionally provide prospective information concerning future capital-raising initiatives if a significant amount of long-term debt is nearing maturity. Such foresight strengthens investors’ analysis capabilities, leading to more informed decisions about the firm’s financial health and stability. Depicting comprehensive long-term debt information portrays integrity and diligence in adhering to GAAP principles, ultimately benefiting both management and stakeholders through improved trust.

Impact of Regulatory Changes

The evolving landscape of accounting regulations can significantly impact how long-term debt is reported. Changes in GAAP or International Financial Reporting Standards (IFRS) may result in adjustments to the ways companies account for and disclose long-term debt. Entities need to remain vigilant regarding these regulatory updates, as adapting to new standards can require extensive modifications to existing accounting systems and practices. It is crucial for organizations to provide timely disclosures to stakeholders about the implications of such changes on their financial statements and overall business strategy. In doing so, they reinforce their commitment to maintain transparency and accuracy. Any shifts in reporting practices could elicit questions around the comparability of financial information across reporting periods. Therefore, companies should offer detailed explanations of transitions, including how it affects accounting estimates and the financial positions reported. By actively engaging with regulatory changes and clearly communicating these changes, businesses can enhance stakeholder confidence and reduce uncertainty regarding financial reporting. It’s essential for organizations to implement robust internal controls to ensure compliance while managing the complexities arising from shifts in accounting standards.

In summation, adhering to GAAP guidelines for reporting long-term debt is a vital function that promotes transparency and fosters stakeholder trust. By complying with these guidelines, companies enhance their financial reporting, offering investors accurate insights into financial health and risk exposure. Key elements include reliably reporting the balance and nature of long-term debt, recognizing interest expenses timely, and providing comprehensive disclosures about debt covenants and compliance. Organizations also face challenges related to foreign operations and market fluctuations, necessitating effective communication with stakeholders regarding potential impacts. Moreover, understanding and adapting to regulatory changes in financial reporting is essential. Businesses that manage their long-term debts effectively and prepare adequate disclosures are better positioned for sustainable operation and growth. By following the outlined GAAP guidelines, organizations not only enhance their credibility with investors but also facilitate informed investment decisions that are beneficial for long-term financial success. In a competitive business environment, companies prioritizing transparency and accuracy in reporting long-term debt are likely to gain a strategic advantage, contributing positively to overall industry standards while promoting financial integrity.