How Digital Payment Infrastructure is Transforming Financial Services

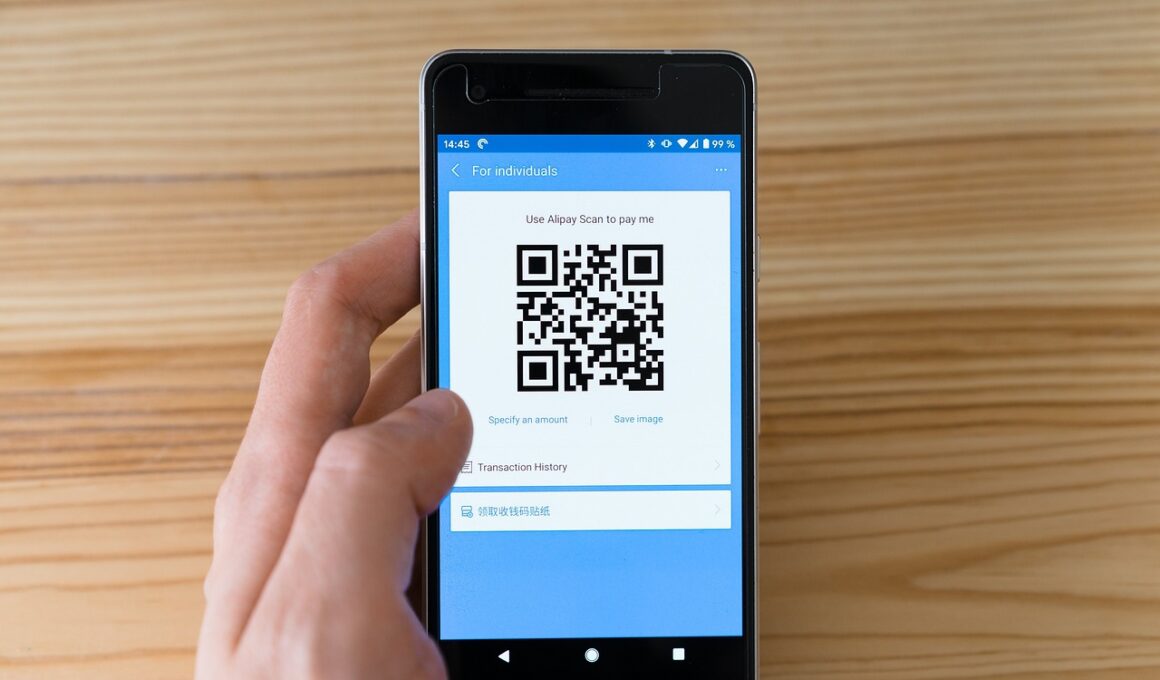

The digital payment infrastructure has revolutionized the financial services industry by providing seamless transactions and enhanced connectivity. In recent years, as the global economy has shifted toward digitization, financial institutions have increasingly adopted innovative technologies to streamline their operations. This transformation enables businesses to offer secure and efficient payment methods that meet customer demands. For instance, innovative payment gateways have expanded merchants’ capabilities to include diverse payment options such as credit card processing, e-wallets, and cryptocurrencies. Customers benefit by enjoying faster transaction speeds and enhanced security features that traditional payment methods often lack. As businesses adapt to the evolving landscape, they can leverage various tools and platforms to create a frictionless payment experience. Furthermore, the rise of mobile payments using smartphones has accelerated the shift to digital infrastructures, enabling consumers to conduct transactions anytime and anywhere. The integration of artificial intelligence and machine learning into payment systems can facilitate real-time fraud detection and risk management, further strengthening the digital payment ecosystem. This transition ultimately fosters trust and drives consumer adoption of digital payment solutions across the globe.

Increased Financial Inclusion

The impact of digital payment infrastructure on financial inclusion cannot be overstated, as it has enabled a larger segment of the population to access banking services. Traditionally underserved communities in remote areas have found newfound opportunities to participate in the global economy. Through mobile wallets and online banking platforms, these individuals can make transactions, save money, and access credit without the need for a physical bank branch. Financial service providers have embraced digital solutions to cater to the needs of these populations, ensuring everyone has access to basic banking functionalities. By lowering the barriers to entry, digital payments have facilitated the growth of small businesses that previously struggled to operate within a cash-dominated economy. Socio-economic disparities are gradually being addressed, leading to improved living standards for millions. Increased access to financial services allows individuals to better manage their finances, invest in education, and create opportunities for future generations. Furthermore, government initiatives have helped promote the adoption of digital infrastructure in rural areas, helping to foster economic growth. These developments highlight the potential of digital payment systems to change lives and improve socioeconomic conditions throughout various communities.

Moreover, the importance of interoperability among digital payment systems is a crucial factor in enhancing their effectiveness. Ensuring that different payment platforms can work together seamlessly allows customers to engage in transactions without barriers or complications. This connectivity fosters a more cohesive payment landscape where businesses can compete effectively and consumers can select services that best suit their needs. As more players enter the digital payment market, standardization becomes essential to guarantee that systems can interact efficiently. For instance, regulatory bodies and industry leaders can collaborate to create frameworks that facilitate smooth transactions while also maintaining consumer protection. Embracing interoperability can lead to greater trust in digital payment systems and encourage wider adoption. As businesses and consumers gain confidence in the infrastructure’s reliability, they will be more likely to utilize these services, driving further innovation. New players are emerging in the industry, leading to an array of alternatives for consumers and businesses alike. As we look to the future, fostering an environment of collaboration among payment providers will enhance the digital payment infrastructure’s growth and sustainability.

Security and Compliance Challenges

Even with the benefits of digital payment infrastructure, the industry faces significant security and compliance challenges that must be addressed. As cyber threats evolve, financial institutions must continuously adapt their security measures to protect users’ data and maintain trust in their services. Moreover, compliance with an increasingly complex regulatory landscape is vital, as authorities impose stricter rules to safeguard consumers from fraudulent activities. Companies must invest in state-of-the-art encryption technologies, advanced authentication methods, and comprehensive monitoring systems to deter cybercriminals effectively. Beyond technology, organizations must foster a culture of security awareness among employees and customers to enhance protection against potential threats. Regular training and workshops can help reinforce security principles, enabling users to recognize and report suspicious activities promptly. Additionally, companies must stay informed about industry trends and regulations to ensure compliance and avoid hefty fines. Balancing innovation with security is vital for the growth of digital payment infrastructures, as public trust is essential for widespread adoption. The ultimate goal is to create a robust and secure digital payment ecosystem that promotes growth while protecting consumers’ interests.

Another significant advantage of digital payment infrastructure is the ability to provide data-driven insights to businesses. By implementing analytics, organizations can gather valuable information about consumer spending patterns, preferences, and behaviors. This data enables businesses to refine their marketing strategies, enhance customer experiences, and tailor their product offerings. For instance, understanding customer demographics allows companies to develop targeted campaigns that resonate with their audience. Moreover, businesses can optimize their pricing strategies based on the insights gleaned from transaction data. These informed decisions not only enhance revenue potential but also foster customer loyalty by delivering personalized experiences. Additionally, businesses can leverage this information to identify potential new markets and growth opportunities. Analytics drive innovation by enabling companies to evaluate their performance and make necessary adjustments in real-time. As a result, digital payment infrastructures empower businesses to thrive in a competitive landscape while meeting the ever-changing needs of consumers. The combination of technological advancements and data analysis in digital payment systems leads to smarter, more efficient business operations, ultimately benefiting the entire financial ecosystem.

Future Trends in Digital Payments

Looking ahead, several trends can shape the future of digital payment infrastructures. The integration of cryptocurrencies into mainstream financial services is one such development that may gain traction as consumer acceptance grows. Blockchain technology promises increased security and transparency, making it an appealing option for transactions. Additionally, advancements in artificial intelligence and machine learning are expected to further improve fraud detection capabilities, ultimately leading to safer payment experiences. Furthermore, the rise of contactless payment methods, such as NFC technology, has made payments faster and more convenient for consumers. This method is likely to expand as more merchants adopt compatible systems. The demand for seamless global transactions is also on the rise, as businesses increasingly operate across borders. Enhancing digital payment infrastructures to facilitate this need will be crucial for encouraging international trade. Another emerging trend is the growing emphasis on sustainability in financial services, with more businesses seeking eco-friendly payment options. By staying attuned to these trends, stakeholders can navigate the evolving landscape and capitalize on new opportunities to enhance their offerings.

Finally, the importance of collaborative ecosystems in the digital payment infrastructure cannot be overlooked. As various stakeholders come together, including banks, fintech companies, and payment processors, the collaborative efforts will drive innovation and success. By working together, these entities can create a more inclusive and accessible payment landscape for consumers and businesses alike. Sharing knowledge, resources, and technology can foster a spirit of cooperation that will ultimately benefit all participants. Furthermore, cross-border collaborations can enhance compatibility among different systems, improving the customer experience in international transactions. These partnerships will also enable businesses to leverage each other’s strengths, ultimately improving market competitiveness. As the digital payment landscape continues to evolve, a collaborative mindset will be essential in overcoming challenges and maximizing opportunities. By fostering collaboration among stakeholders, the industry can respond more effectively to changing consumer needs and preferences, ensuring long-term sustainability. Thus, the future of digital payment infrastructure is not only about technology but also about the synergy created through collaboration among diverse entities in the financial ecosystem.

In conclusion, the transformation of the financial services industry through digital payment infrastructure has sparked unprecedented change and growth. As technology continues to advance, the importance of adaptability and innovation will remain paramount for businesses looking to succeed in this dynamic landscape. Digital payment systems facilitate financial inclusion, enhance security, and empower businesses with valuable insights, fostering a more interconnected and efficient financial ecosystem. However, challenges surrounding security and compliance must be addressed to ensure continued trust and reliability in digital payment infrastructures. As trends like cryptocurrencies, contactless payments, and collaborative ecosystems emerge, the industry must embrace these changes to create a seamless payment experience for consumers and businesses alike. Ultimately, the future of digital payment infrastructure holds immense potential for further transforming financial services and enhancing the overall customer experience. By keeping pace with technological advancements and consumer expectations, businesses can become leaders in the digital payment landscape. Through a focus on security, data-driven decision-making, and collaboration, financial institutions can thrive in this rapidly changing environment, ensuring their long-term growth.